With the market putting a re-emphasis on investing in growth, many tech stocks have seen sharp YTD rebounds, even though macro headwinds are still dealing a blow to their fundamentals. Amid the rebound, it’s important for investors to carefully monitor positions and not assume that a rising tide will lift all boats.

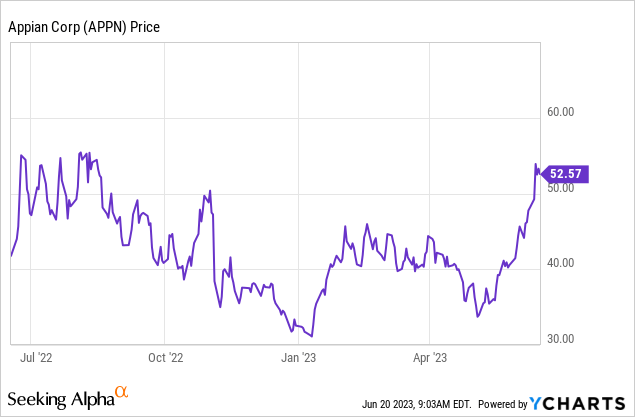

Appian (NASDAQ:APPN), in particular, has seen plenty of recent strength that should raise some eyebrows. The low-code process automation software company has seen its share price jump >60% year to date, with a lot of the gains coming in after the company’s latest Q1 earnings release in May. The question for investors now is: can Appian’s rally be sustained?

I was previously neutral on Appian, but after parsing through the company’s latest quarterly results as well as checking the stock’s current valuation, I’m flipping my call to bearish. I see a lot of red flags with the company at the moment:

- Large transformational projects are being delayed in the current macro climate – Efforts to automate entire business processes are large capital projects, which are being delayed until better times. In the software sector, it’s the products that can generate quick wins and instant ROI that are winning out, and this tilt may hurt Appian, whose integration process may be more involved than other products.

- Still a large chunk of professional services revenue – To Appian’s credit, at the time of its IPO, the company had a roughly 50/50 revenue mix split between professional services and subscriptions, and that has since improved to only a ~25% mix of professional services. The mix shift has improved gross margins, but Appian’s margin profile as well as services mix are poorer than most of its peer software companies.

- Deep losses – In spite of improving gross margins, Appian continues to spend more and more, particularly on sales and marketing. The company doesn’t see a path to breakeven adjusted EBITDA on a full-year basis until FY24.

But the biggest weakness to call out is Appian’s valuation. At current share prices near $52, Appian trades at a market cap of $3.84 billion. After we net off the $254.5 million of cash and $209.1 million of cash on Appian’s most recent balance sheet, the company’s resulting enterprise value is $3.79 billion.

Meanwhile, for the following fiscal year FY24, Wall Street analysts are expecting Appian to generate $620.8 million in revenue, representing 16% y/y growth (data from Yahoo Finance). This puts Appian’s valuation at 6.1x EV/FY24 revenue. In my view, for a company whose growth has decelerated to the mid-teens, with a relatively weaker mid-70s gross margin profile than most software companies in the low 80s, as well as huge adjusted EBITDA losses, there’s not much room for Appian stock to move higher, and they may even be due for a correction.

All in all, in my view, it’s time to lock-in recent gains on Appian and move to the sidelines. At current levels, there’s more risk than there is reward.

Q1 download

Let’s now go through Appian’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Appian Q1 results (Appian Q1 earnings deck)

Appian’s revenue grew 18% y/y in Q1 to $135.2 million, beating Wall Street’s expectations of $131.4 million (+15% y/y) by a three point margin. Growth did, however, decelerate versus 20% y/y growth in Q4.

Cloud subscription revenue grew 30% y/y to $69.7 million, but this was offset by a decline in term licenses. Together, overall subscription revenue of $92.9 million grew only 19% y/y, versus 23% y/y in Q1.

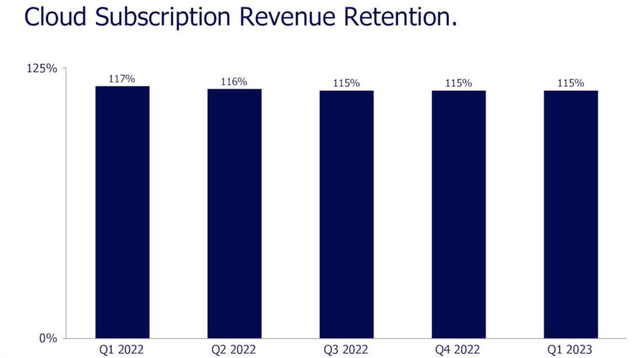

Revenue retention rates in the cloud subscription business, however, remained elevated at 115%: indicating that the average install base customer is expanding its relationship with Appian by ~15% in the following year.

Appian retention rates (Appian Q1 earnings deck)

From a macro perspective, Appian CEO Matt Calkins noted on the Q&A portion of the Q1 earnings call that the company’s sales teams are seeing more scrutiny applied to deals:

We are seeing some deal delays in extra scrutiny, but it’s not much more than last quarter, so it’s just a gradual progression in that. And I wouldn’t say it was overly disruptive to this quarter. As for whether it shines up brighter spotlight on automation, I believe that in the long run having to do more with less in a year of not plenty will encourage the, kind of, creativity that will turn people toward an automation solution and increase the popularity of this industry.”

In my view, though Appian isn’t citing too much disruption from macro headwinds in its current results, I think the company’s target of hitting 14-15% full-year growth in FY23, then hitting consensus expectations of 16% growth in FY24, may be too aggressive considering even current growth rates have slid to just 18% y/y.

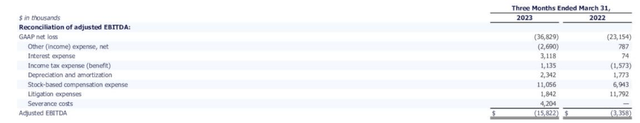

From a profitability perspective, we note that Appian continues to generate massive adjusted EBITDA losses:

Appian adjusted EBITDA (Appian Q1 earnings deck)

Adjusted EBITDA of -$15.8 million were substantially deeper than last year and represented a -12% margin, versus just a -3% in the year-ago Q1. This is in spite of Appian hitting a record-high 75% gross margin in the quarter (versus 74% in the prior quarter), and driven by large cost jumps particularly in sales and marketing. Note as well that Appian’s guidance calls for nominal adjusted EBITDA dollars to worsen in Q2 to -$26 to -$30 million.

Key takeaways

To me, the headlines for Appian are deep losses that don’t have a path to profitability until next year as well as an already-rich valuation. In the current market climate, I think investors should look for stocks that have just the opposite – a near-term profitability story plus an undemanding valuation.

The bottom line here: you’ll do better steering clear of Appian.

Read the full article here