Applied Digital (NASDAQ:APLD) appears well-positioned for dramatic growth in 2023-2024 through expansion in cryptocurrency mining and new cloud computing services. While the company has taken on additional debt and dilution to fund investments, prudent financing activities provide the necessary capital to scale operations. A detailed analysis of the debt structure, equity issuance, and financial projections highlights Applied Digital’s potential.

Crypto Mining Business Firing on All Cylinders

Applied Digital has rapidly expanded its crypto mining capacity to meet customer demand. The company currently has around 285 megawatts online, up from 185 megawatts at the end of May 2022. This entire capacity is fully contracted out to customers under long-term deals. To further support growth, Applied Digital plans to bring an additional 200 megawatts online in the near future. This added capacity is fully contracted out to customers.

Applied Digital has positioned itself with 485 megawatts of energized crypto mining capacity, either online or planned to be online soon. Multi-year customer deals provide revenue visibility as the company scales up mining operations. Applied Digital continues to see strong demand that enables full capacity utilization while requiring quick expansion of new capacity to support operational needs.

Applied Digital’s revenue jumped from $7.5 million in fiscal Q4 2022 to $22 million in Q4 2023, driven by expanded crypto mining capacity in North Dakota. With facilities in Jamestown and Ellendale ramping up utilisation, the company is poised to grow as 200 additional megawatts come online. Applied Digital’s energized capacity and favorable operating conditions in North Dakota position the company to rapidly scale revenues as demand warrants. The crypto mining expertise and expansion capacity developed in North Dakota provide a launching pad for Applied Digital’s next phase of transformational growth.

Management estimates that crypto mining could produce annual recurring revenue of $300 million at strong 30%+ gross margins at full utilization. This steady cash flow supports growth plans. Multi-year customer deals underpin revenue visibility.

New AI Cloud and HPC datacenter Offering Gaining Traction

Applied Digital is expanding its AI cloud services business and developing next-generation HPC data centers to drive future growth. The company initially launched an AI cloud platform supported by its 9-megawatt HPC facility in Jamestown. Applied Digital announced an agreement with its first AI cloud customer worth up to $180 million over 24 months, with an additional $180 million option for a total potential of $360 million. The company secured a second AI cloud agreement worth up to $460 million over 36 months. To meet AI cloud demand, Applied Digital acquired over 26,000 GPUs to be installed by April 2024.

For HPC data centers, Applied Digital has 300 megawatts of capacity planned, including 200 megawatts in North Dakota and a new Utah facility. By leveraging expertise in HPC infrastructure and customer momentum in its AI cloud business, Applied Digital aims to capitalize on surging growth in AI, ML, and related high-performance computing applications.

Strategic Positioning in Competitive Markets

Applied Digital operates in the rapidly evolving cryptocurrency mining and cloud computing markets. Key competitors in crypto mining include Marathon Digital (MARA), Bitfarms (BITF), etc. The crypto mining industry has seen increasing hashrate difficulty and mining pool consolidation, presenting challenges to smaller players. However, Applied Digital has carved out a strong market position through its North Dakota operations which provide inexpensive, sustainable power. This competitive advantage enabled it to capture market share and expand capacity amidst the crypto downturn in 2022.

In cloud computing, competitors like AWS (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOG) are dominant players. However, Applied Digital is differentiated by its focus on AI/ML and high-performance computing workloads. Its first-mover advantage in offering tailored HPC infrastructure for AI workloads presents an opportunity to establish itself as a leader in this niche segment. Recently, the company announced that it has achieved “Elite Partner” status in the NVIDIA Partner Network (NVDA), reflecting the synergies between Applied Digital’s HPC applications and NVIDIA’s GPUs and Networking. This partnership provides cutting-edge technologies and expertise that will enable customers to increase speed and efficiency, accelerating innovation in AI/ML computing.

Overall, Applied Digital has strategically positioned itself in attractive growth markets, albeit competitive ones. Its execution in maintaining competitive advantages will determine future success.

Debt Profile Supports Growth While Managing Risks

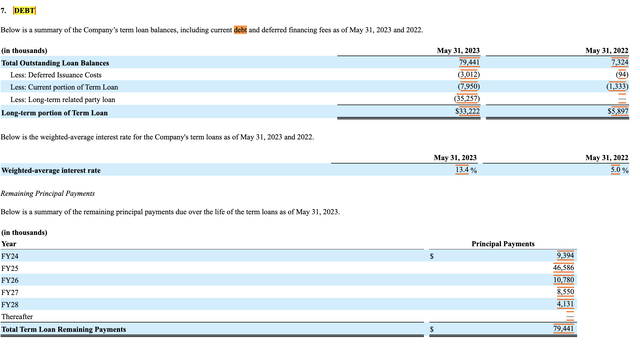

Applied Digital has expanded its debt capacity through prudent financing to fund its growth investments. The company’s total long-term loan balances have risen substantially, from $7.3 million to over $79.4 million within 12 months. This higher debt load has also increased the weighted average interest rate on the loans from 5% to 13.4%.

10-K filing

According to Applied Digital’s latest 10-K filing, the repayment schedule on these more significant debt balances is spread over time rather than concentrated in the near term. More than 50% of the total debt will be due for repayment by 2025. However, the remaining balances have longer maturities, staggered from 2024 to 2028. This staggered maturity schedule helps avoid major repayment cliffs and smooths the debt profile over time.

The debt financing was necessary to support significant growth projects, such as new data centers, that require capital investment upfront but generate revenues over multi-year periods. By aligning debt terms with project timelines, Applied Digital maintains liquidity while benefiting from expansion.

Equity Issuance Dilutive But Increases Flexibility

In addition to prudent debt expansion, Applied Digital initiated an at-the-market (ATM) equity sale program of up to $125 million to bolster cash reserves. The company has already raised $64 million through this ATM issuance.

The expanded share count is dilutive, with over 25 million new shares representing a 25% dilution to existing shareholders. However, the equity sale was critical to funding growth while limiting debt risks.

It provides Applied Digital with a substantial liquidity buffer, increasing cash reserves from just $29 million to nearly $94 million pro forma for the $65 million ATM raise. This flexibility helps the company pursue its growth objectives.

Financial Projections Support Growth Strategy

Applied Digital’s financing activities appear to align with supporting management’s financial projections for the mining and cloud computing businesses. The company is targeting $200 million in EBITDA by 2024. Based on the median EV/EBITDA multiple of 6.7x for the company over the past twelve months, this level of EBITDA could potentially drive an enterprise value for Applied Digital of $1.34 billion. Factoring in the diluted share count from an ongoing $125 million share issuance, which expanded from nearly 99 million to 124 million shares, the implied market capitalization supports a share price approaching $11. This represents over 100% upside from current levels around $5.

Key Takeaways

Applied Digital has made prudent financing decisions to fund aggressive growth plans in crypto mining and cloud computing services. Although debt and dilution present risks, the flexibility of the balance sheet gives Applied Digital the capacity to scale operations amid surging demand. If management can execute on bringing new capacity online to capitalize on crypto and AI/ML tailwinds, the company is positioned to deliver tremendous shareholder value. Despite challenges, Applied Digital’s strategic expansions in mining, AI cloud, and HPC data centers underscore its potential to unlock transformational growth. Backed by prudent financing, execution now holds the key to realizing Applied Digital’s ambitious vision.

In my opinion, Applied Digital represents an intriguing growth story in two high-potential markets: crypto mining and cloud computing services. While risks remain in executing their ambitious expansion plans, prudent financing activities provide the capacity and flexibility to scale up operations. For investors with a high risk tolerance looking for exposure to crypto and AI tailwinds, Applied Digital warrants consideration. Starting with a small position to manage risks would be a reasonable approach. Continued strong execution and capacity utilization will be key indicators to watch moving forward.

Read the full article here