Thesis

My buy rating for Arista Networks (NYSE:ANET) has been working out well so far. Back in February, I had a price target of $171, which is subsequently hit that target in less than a month. Given that my price target is now hit, and the business has done very well – just as I expected – I continue to recommend a buy rating, albeit with a smaller sizing as the upside potential is lesser now relative to February.

Results/Guidance/My Outlook

With revenue exceeding expectations in 1Q23 and guidance for 2Q23, ANET displayed strong operational performance, which I believe is mainly due to the improvement in the supply environment. I believe that ANET will be able to more effectively manage its expanded backlog and realize improved margins (over-time) as a result of these favorable conditions. Additionally, despite the concerns about the tough macro backdrop, I am very encouraged by management comments that there is no issue with demand in 2H23. This is a strong point as it reduces the risk of FY23 guidance, which means consensus that had a more bearish view on the weak macro environment impact on 2H23 will now revise their estimates. However, despite the positives in relation to execution and limited demand headwinds, I do have 2 concern. First is the elevated inventory position. The opportunity to revert to a normalized gross margin is likely to be constrained by the ongoing accumulation of inventory as a result of long-term supply contracts (put in place during the supply crunch). Second is the demand normalization for Cloud Titan. That said, this should not be a major concern in the long-run. Looking ahead in the long run, I continue to expect the growing importance of AI workloads among cloud users, faster production upgrades of datacenter switching products, and increased market share with enterprise customers to result in robust growth.

Gross Margin

Returning to the earlier point about increased inventory putting pressure on gross margin, a key factor in this trend was the company’s massive Purchase Commitments established over the past two years. In the past, when supplies were low, ANET placed numerous orders at artificially inflated prices. Eventually, this increased COGS will be transferred from the balance sheet to the profit and loss statement, as is obvious to anyone with even rudimentary knowledge of accounting. As a result, gross margin is expected to decline. These elevated inventory level not only put strain on ANET’s gross margins, but they also prevent the company from deploying valuable working capital elsewhere. As a result, this is one of the primary causes for concern regarding the potential for near-term margin pressure (I understand management expects sequentially gross margin improvement, but I am not 100% convinced yet).

Cloud Titan

Not only was gross margin pressure something to worry about, but another minor concern I have is that Cloud Titan’s revenue growth is not as strong anymore. I mean, this is not exactly surprising as the lead time was due to the supply chain constraint. Nonetheless, it’s worth noting that ANET’s Cloud Titan customers have less than six months of visibility at this point. What was once a bullish factor for ANET (as it has great visibility into orders and investors can better model financials), has now turned into a potential bearish factor. Firstly, with lesser visibility, investors tend to be more conservative in estimates. Secondly, the fact that lead times are reducing meant that underlying supply chain is indeed improving. In a normalized supply environment, it is less likely for customers to hold more inventories. This might represent a near-term demand headwind for ANET in 2H23/1H24, as it comps against a strong comp due to the supply chain impact.

AI Contribution to Growth

Despite some short-term challenges, I believe that ANET is well-positioned to capitalize on the increasing relevance of AI in the networking sector. I anticipate networking to receive a larger percentage of the Cloud Titan budget as its importance in delivering data to GPUs grows. ANET’s leading position in high-speed networking is a major differentiator that can help the company win over a sizable portion of this market, in my opinion. ANET’s AI switching portfolio, particularly the 7800 series, has begun to see meaningful deployments in production environments in 2023 after undergoing extensive testing and simulation in 2022. As the application of AI develops, I anticipate this trend will accelerate. In fact, management’s expectation of a sizable contribution from AI this year is the best indicator of AI’s impact on ANET.

Valuation

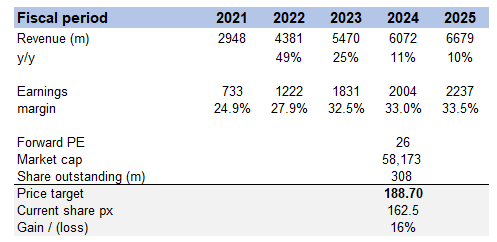

My new model is primarily updated for faster growth in the coming years as a result of improved AI contribution in FY25, which I am quite optimistic about. However, I expect margins to suffer as high-priced inventory hits the P&L in FY23, but margins should gradually improve as things settle down. Another assumption that has been updated is the forward PE at which it should trade. I previously calculated 24x forward PE. Given the management’s balanced demand outlook, I believe the 26x should be supported at least until the end of the year.

Own model

Conclusion

In conclusion, my buy rating for ANET has proven successful thus far, with the stock hitting my price target of $171 within a month. Despite the smaller upside potential compared to February, I continue to recommend a buy rating, albeit with a reduced position size. ANET has demonstrated strong operational performance, surpassing revenue expectations in 1Q23 and providing positive guidance for 2Q23. Although concerns exist regarding elevated inventory levels and potential near-term margin pressure, ANET’s long-term growth prospects remain robust. The growing importance of AI workloads, accelerated deployment of AI switching products, and increased market share with enterprise customers position ANET for future success.

Read the full article here