Receive free Semiconductors updates

We’ll send you a myFT Daily Digest email rounding up the latest Semiconductors news every morning.

It is hard to overstate the importance of chip design company Arm’s stock market debut for other tech companies hoping to list their shares. After a dearth of public offerings since the start of 2022, the IPO, which could come as soon as September, will be a barometer of the market’s revived interest in tech this year.

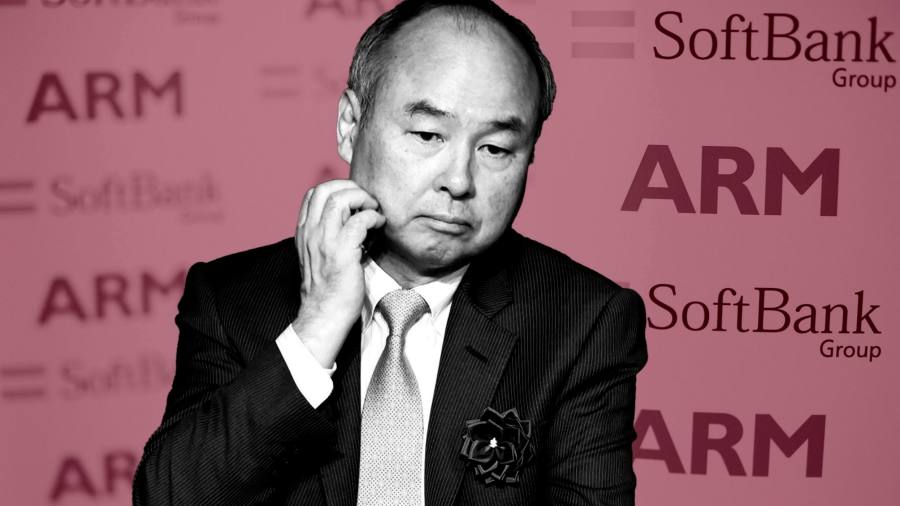

Yet it is also hard to overstate the difficulty that SoftBank, Arm’s owner, faces in getting the premium valuation it needs to help repair its own, battered image as a tech investor. It is taking Arm public at a time when the chip company’s core market has run out of growth, its business model is in transition and it is ensnared in a legal battle with one of its biggest customers.

The chip sector, like much of the tech world, is also in the throes of a valuation shift as investors try to identify which companies will benefit from the much-anticipated generative AI boom, and which will be left by the wayside. Any of these issues would complicate an IPO but taken together they make for a particularly challenging share sale.

No wonder SoftBank is trying to land a group of deep-pocketed anchor investors to put a floor under the offering price. It emerged this week that while Amazon has been in discussions about taking a stake in Arm, behind the scenes SoftBank has been courting a number of Arm customers that rely on its technology in their own chip designs.

Arm’s difficulties begin with the maturing of the smartphone market, where its designs for low-power processors are the standard. Apart from some successes in data centres and cars, SoftBank’s hopes of taking Arm’s technology to new markets have not panned out and its revenue fell 11 per cent in its most recent last quarter because of weak demand for smartphones — never a good look just before an IPO.

With its technology used to make CPUs — general purpose chips needed for the range of tasks undertaken by devices such as smartphones — Arm is also only on the fringes of the AI boom. The huge data processing demands of machine learning have brought a surge in sales of things like GPUs and networking chips that can accelerate the processing and transfer of data. Chips using Arm’s technology play only an auxiliary role in managing these functions.

SoftBank has already had a painful lesson in the cost of missing the hot trends in chip investing. Six years ago it bought $3bn worth of shares in Nvidia, the AI market leader. Had it held on rather than selling out for a short-term profit, that stake would now be worth $50bn — probably more than the whole of Arm will be worth when it goes public.

Arm’s business model is also at something of a crossroads. Arm made an average of 9 cents for each of the more than 30bn computing devices containing its technology that were shipped last year. To claim a bigger slice of the pie, it has floated the idea of charging device makers directly, rather than only looking to chipmakers for its licensing fees and royalties. As it prepares to go public, however, there is no indication that this plan will succeed.

At the same time, the company is under pressure as some of its own customers take on more of the work that goes into creating chips based on its designs. Along with selling blueprints of its technology, Arm sells computing “cores”, the basic building blocks of chips.

Apple, for one, has turned to making its own cores, meaning that it only needs to pay Arm for a basic, or “architectural”, licence. Qualcomm, one of Arm’s biggest customers, is moving in the same direction after buying a start-up called Nuvia which designs its own chips based on Arm technology.

According to some estimates, buying only an architectural licence could cut the amount that a customer pays in half. The threat is heightened by the fact that Arm is heavily reliant on a small number of big customers.

Arm’s willingness to take Qualcomm to court shows how much is at stake here. In what looks like a fight over licensing fees, the company filed a lawsuit arguing that Qualcomm’s Arm licence does not allow it to use the Nuvia technology, prompting a countersuit.

All of this adds to the significance of SoftBank’s attempt to bring in some of Arm’s big customers as investors. Besides helping to stabilise the price, such a move would act as powerful validation for Arm’s business at an uncertain time. But despite reports about the talks that have circulated for weeks, there is no sign yet that it can seal the deal.

Read the full article here