About three months ago, I shared my view on Ascend Wellness (OTCQX:AAWH) as the cheapest MSO, and it has rallied substantially since then. They did report subsequently, but the stock made a new all-time low afterwards, dropping it below $0.50. Now up more than 100% to $1.11, the stock is even cheaper relative to peers than it was when I wrote about it in mid-June. In this follow-up, I discuss the YTD financials and the outlook, assess the chart and analyze the valuation.

2023 Financials

The company reported its Q2 on August 8th. Analysts, according to Sentieo, had been expecting revenue of $116 million with adjusted EBITDA of $21 million. The company actually generated revenue of $123 million, better than expected and up 26% from a year ago. Adjusted EBITDA was in line with expectations at $21.3 million and up 2% from the prior year. AAWH generated $25.4 million from its operations, well ahead of the $8.2 million it spent on capital assets.

In the first half of 2023, the company’s $232.2 million in revenue grew 30% from the first half of 2022. Adjusted EBITDA expanded by 20% to $44.6 million. Cash flow from operations improved dramatically from -$20.5 million in 2022 to +31.2 million.

The company ended Q2 with $68 million in cash. The long-term debt is large at $300.7 million, and there is $9 million in short-term debt. The company also has income tax payable of $47 million. Like many of its peers, AAWH has negative tangible book value at -$103 million.

The Outlook

Ahead of the financial report, analysts were looking for revenue in 2023 to be $477 million, with adjusted EBITDA of $97 million. Now, they expect revenue will increase 22% to $496 million, with adjusted EBITDA growing just slightly to $94 million.

Analysts were expecting revenue in 2024 of $546 million, with adjusted EBITDA of $133 million. They now expect revenue will increase 14% to $565 million with adjusted EBITDA of $124 million, up 33%.

The current market cap of $243 million and the current enterprise value of $484 million are both below the projected 2023 revenue. The other MSOs trade with enterprise value above the projected 2023 revenue.

The Chart

Unlike many of its peers, AAWH has not rallied in 2023, down 3.5%. Trulieve (OTCQX:TCNNF) is down 14.8%, but the other peers are all up.

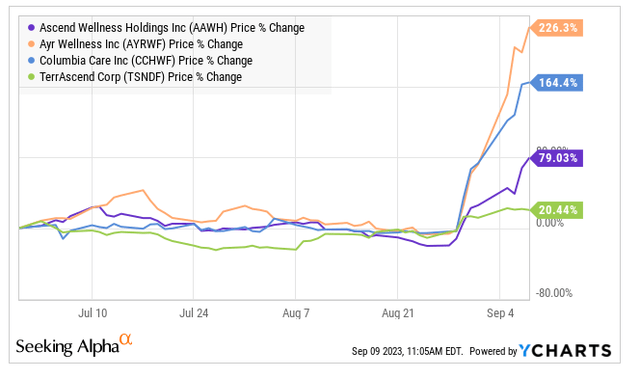

In Q3, the Tier 2 names have soared:

YCharts

Looking at the chart over the past year, AAWH is still down a lot from a year ago:

Charles Schwab

I see some resistance at $1.25 and then $1.65. I think the old bottom in April near $0.85 that then became resistance could provide support, but, below that, I see $0.65 and then $0.50 as being potential support levels.

The Valuation

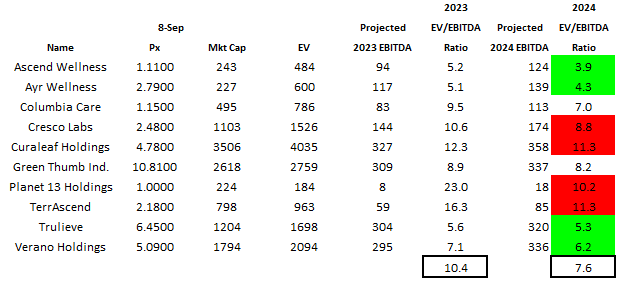

In the last piece, I stated that I thought that Ascend could almost triple by year-end, which would be $2.05. It may! Looking out a year, though, I sense it could go even higher. First, though, let’s look at how AAWH is valued now relative to its peers:

Alan Brochstein using Sentieo

At an enterprise value of just 3.9X projected adjusted EBITDA for 2024, the stock is the cheapest among the Tier 1 and Tier 2 names and below a stock that I really liked a lot more, Planet 13 (OTCQX:PLNHF). I last wrote about PLNHF three weeks ago, but it has rallied a lot since then. I exited the name in my Beat the Global Cannabis Stock Index model portfolio, and I had trimmed it in my Beat the American Cannabis Operator Index model portfolio at $1.10. I just boosted it, though, at $1.01, and it is 26% of that model portfolio. AAWH, which I did reduce a bit, is still the largest at 29.1%.

I have been and remain concerned about Curaleaf (OTCPK:CURLF) and TerrAscend (OTCQX:TSNDF), which are both trading at 11.3X projected 2024 adjusted EBITDA. I still like Trulieve among MSOs. Ascend is cheaper than Ayr Wellness (OTCQX:AYRWF), which has rallied a ton and has more debt than Ascend.

Projecting the price a year from now, I use 2/3 of the 2025 estimate for adjusted EBITDA and 1/3 the 2024 estimate. Two of the 9 analysts have a forecast for 2025 revenue to fall 2% from the 2024 forecast to $552 million. They expect adjusted EBITDA will grow 6% from 2024 to $132 million, a margin of 23.9%. I will use the consensus estimates, which gives a forward adjusted EBITDA of $129 million. I think that the enterprise value a year from now will trade at 6X ($774 million). Adjusting for the net debt, this suggests the stock will be worth $532 million, which is $2.40, up more than 100% from the $1.11 close on 9/8. It currently would not be a 52-week-high, but after December 1st, it would be.

The Risks

While I think that Ascend could double again, it is not without risk. I think that it looks safer than its peers due to its lower valuation and less rapid ascent in price, but the company could fare very poorly if 280E is not eliminated. It has a negative tangible equity of $103 million, which could make it hard to raise funds through debt. The company has a healthier current ratio than peers at 1.7X, but the excess of assets relative to liabilities is solely through inventory 0f $89 million. $286 million of the debt is due in 2025.

Conclusion

I have a lot of concerns about MSOs right now, as this process of rescheduling cannabis could take a long time or might not get rid of the 280E tax if the DEA goes to Schedule 2 or leaves it at Schedule 1. Given the large run-up in prices, there is a lot of downside if investors change their view that it’s a done deal.

In my Beat the American Cannabis Operator Index model portfolio, Ascend is the largest holding, despite it not being in the index. As I stated, it’s the cheapest MSO. I like that AdvisorShares Pure US Cannabis ETF (MSOS) owns no shares. I also own some in my Beat the Global Cannabis Stock Index model portfolio, though it’s not in that index.

I think the stock could keep rallying and that it offers less potential downside than other MSOs.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here