It’s been a positive week for Chinese macro data. GDP growth in Q3 was sequentially up on Q2 numbers, placing the country firmly on track to hit its 5% growth target for the full year. The stronger services and consumer contribution, along with a positive retail sales print, also indicate that the economy is responding to the incremental policy easing in recent months.

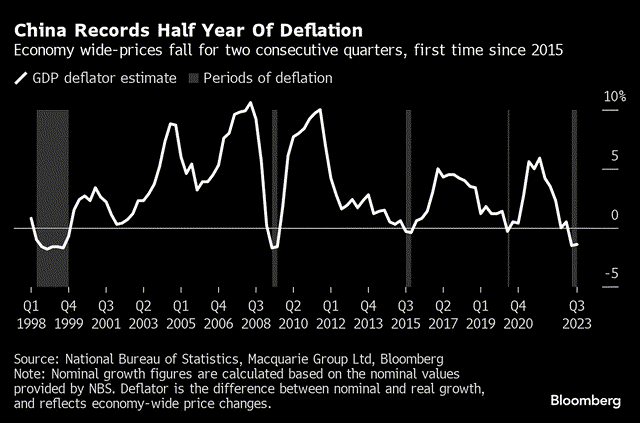

The caveat is the major role that China’s negative GDP deflator has played in driving this growth beat (i.e., nominal GDP growth was lower than real GDP) and the read-through for deflation and domestic demand into next year. Also concerning is the lack of fundamental improvement in property, the major store of wealth for Chinese households, defying the housing policy easing measures implemented in recent months. Until the property issue is solved, households will likely continue to sit on their excess savings hoard, necessitating large-scale easing (unlikely, given fiscal constraints) to break the negative loop.

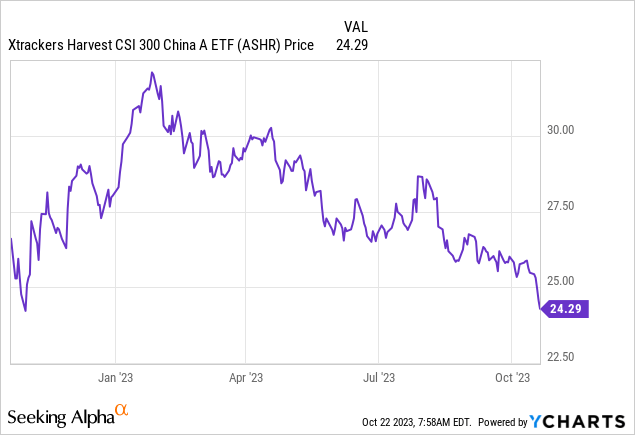

In the interim, support from state funds (i.e., China’s ‘national team’) could cushion Chinese equity performance into year-end. However, the lack of economic momentum doesn’t bode well for earnings into next year. So even with the Xtrackers Harvest CSI 300 China A-Shares ETF (NYSEARCA:ASHR) down to lower valuations since my prior coverage, I wouldn’t move off the sidelines just yet.

Fund Overview – Gain China Exposure via the A-Share Blue Chips

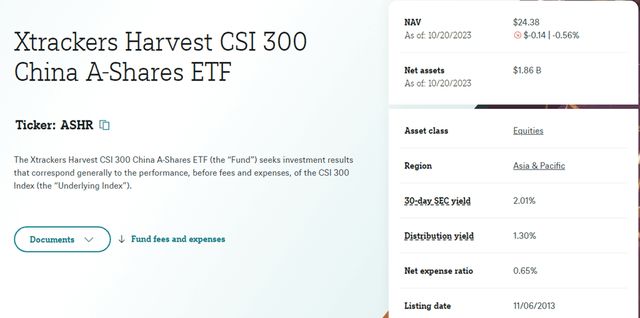

The Xtrackers Harvest CSI 300 China A-Shares ETF tracks the performance of 300 Chinese mainland listed large-caps via the capitalization-weighted CSI 300 Index. As one of the few US-listed funds offering direct A-share exposure (vs. the depositary receipts listed in the US), the ASHR net expense ratio is competitive at ~0.7% net. In comparison, the largest US-listed A-share ETF, the iShares MSCI China A ETF (CNYA), offers a slightly lower net expense ratio at ~0.6% but tracks a broader basket (>550 stocks vs 300 for ASHR) based on eligibility for MSCI Emerging Markets Index inclusion. Like the rest of its A-share comparables, ASHR has maintained its fee structure despite seeing its net asset base decline to $1.9bn amid continued Chinese equity underperformance.

DWS

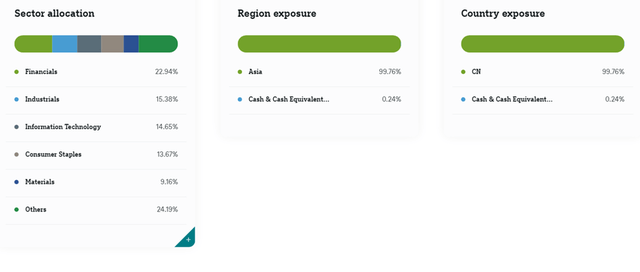

The fund’s sector composition has further skewed toward a relatively resilient financial sector (up to 22.9%), followed by industrials (down to 15.4%) and information technology (14.7%). The fund’s single-stock allocation remains focused on Chinese franchises like spirits leader Kweichow Moutai (the largest holding at 6.0%) and insurer Ping An (OTCPK:PNGAY) at 2.9%. The key change is battery manufacturer CATL’s reduced allocation at 2.8%. Meanwhile, the relative resilience of major banks has seen the likes of China Merchants Bank (OTCPK:CIHKY) and Industrial and Commercial Bank of China (OTCPK:IDCBY) gain portfolio share.

DWS

Fund Performance – Down Again in Q3

Following another disappointing quarter, ASHR’s YTD performance now stands at -7.1% in market price terms (-8.6% in NAV terms). In turn, its overall compounding rate since inception is down to +3.8% per annum in market price terms (+3.7% NAV terms). Yet, the fund’s emphasis on the largest cap Chinese stocks has led to outperformance over CNYA (-9.4% YTD), though ASHR has underperformed consumer/tech-focused China funds like the Invesco Golden Dragon China ETF (PGJ) by a wide margin this year.

Still, the manager deserves credit for maintaining a narrow tracking error through the cycles. Another plus is ASHR’s 30-day yield at a solid ~2% – in line with CNYA and well ahead of growth-focused funds like PGJ.

DWS

Q3 Growth Beat Marred by Significant Headwinds

Alongside stronger retail sales data, China’s Q3 headline GDP growth came in at a surprisingly strong +4.9% YoY, implying annualized Q3 growth is back above the government’s 5% target. The report came with some additional good news on the consumption and services side, both of which emerged yet again as the main drivers of growth. Resilient industrial activity was another encouraging development, defying external and geopolitical headwinds.

Yet, China’s below-par nominal GDP growth of 4% for the quarter implied that an outsized ~0.9% point benefit came from deflation (the delta between nominal and real GDP growth) rather than underlying economic activity. Also concerning is that this negative GDP deflator trend has been in place for the second consecutive quarter now, highlighting continued domestic demand weakness and, for the mid to long-term, elevated risk of a deflationary spiral taking hold.

Bloomberg

Another overhang that likely won’t be sufficiently addressed anytime soon is the continued deterioration in property-related activity. The NBS 70-city new home price index was down sequentially again this month, with Tier-2 and Tier-3 prices declining at a faster pace than in Tier-1 cities.

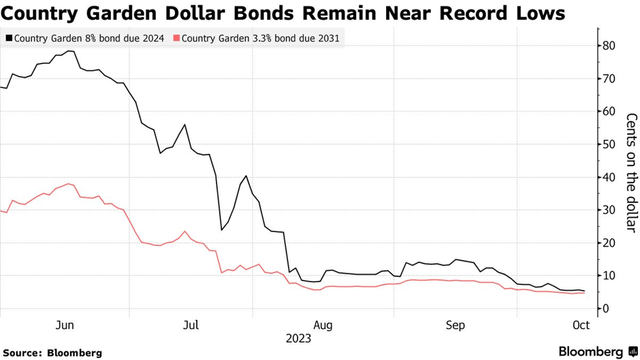

The process of balance sheet repair is only just getting underway as well, with the Evergrande (EGRNF) bankruptcy likely the first of many to come. Other major developers like Country Garden (OTCPK:CTRYY) are in similarly dire straits, which likely means more bond defaults and painful sector-wide restructuring in the pipeline. Given ~70% of Chinese wealth is tied to property, the double whammy of a hit to homebuyer confidence and capital markets shutting off for Chinese property could trigger the negative feedback loop many fear will lead to a Japan-style balance sheet recession.

Bloomberg

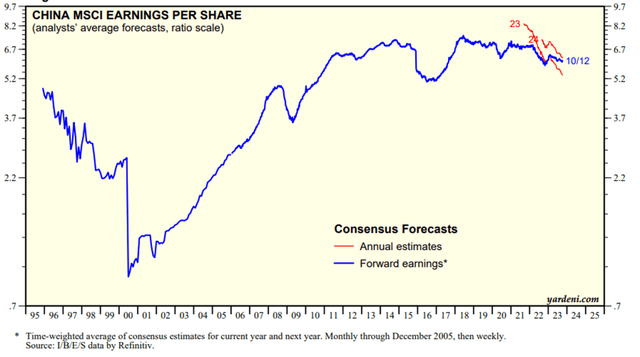

The read-through for equities isn’t great. On the one hand, valuations are cheap relative to current forward earnings estimates (MSCI China trades at ~10x). Yet, the economy is faltering, and no large-scale policy easing measures appear to be coming through from the central government (note that Chinese households are still sitting on a large pile of excess cash accumulated through the pandemic). Thus, my concern remains on the ‘E’ rather than the P/E, as the current Chinese earnings base could well suffer further erosion in the coming months.

All hopes will be pinned on the policy meeting this month, though I fear the Q3 GDP growth beat could prove to be ‘bad news’ in this regard, given it could deter the urgency to unleash aggressive policy stimulus anytime soon.

Yardeni

Caveats to China’s Q3 GDP Outperformance

Chinese equities suffered another torrid week as the market largely looked through the headline GDP growth surprise in Q3 (up QoQ) on property-related spillover concerns. Policy easing isn’t a panacea either, given the consistently negative GDP deflator, a result of demand-led deflation rather than a genuine improvement in economic fundamentals. This points to the need for large-scale rather than incremental measures to prevent the country from descending into a prolonged balance sheet recession a la Japan.

Reviving demand will not be an easy task, though, given the budget constraints at the local government level. In the interim, the central government is doing what it can, including tapping into state support for the Chinese equity market. The sustainability of these measures, though, is questionable, and thus, I am concerned about a reset in consensus earnings numbers from here. As appealing as ASHR might seem at the current high-single-digit earnings multiple, I don’t see a compelling reason to move off the sidelines just yet.

Read the full article here