AST SpaceMobile, Inc. (NASDAQ:ASTS) has embarked on a mission to ameliorate mobile and internet connectivity in regions plagued by inadequate cellular coverage, leveraging a space-based network that interfaces seamlessly with standard mobile phones. Although this endeavor is promising, it remains nascent, necessitating substantial capital infusion, especially given its cash reserve of approximately $135.7 million. Despite such financial constraints, ASTS is on track to propel its inaugural satellite into orbit in early 2024, a strategic move aimed at bolstering global call capacity and potentially unlocking avenues for revenue generation. The firm is amidst a competitive landscape, sharing the arena with formidable players like SpaceX’s Starlink, OneWeb, and Lynk. However, it’s noteworthy that ASTS has forged collaborative ties with SpaceX and partnered with technological behemoths such as AT&T and Vodafone. Financial projections, as elucidated by analysts, paint an optimistic picture, with revenues expected to ascend sharply to $125.13 million by 2024 and further skyrocket to an estimated $531 million by the subsequent year. Diving into a theoretical scenario where these revenue forecasts fructify, my multiples-based valuation analysis reveals a modest 5.5% upside potential for the stock. However, the terrain of space telecommunications is fraught with inherent risks. Coupled with the specter of ongoing stock dilution and a dependency on an aggressive revenue growth trajectory to justify its current valuation, I opine that a more tempered approach towards ASTS is prudent. In my view, assigning a “hold” rating to ASTS adeptly mediates the enthralling technological prospects with the inherent financial perils, thereby fostering a balanced perspective.

Business Overview

AST SpaceMobile, Inc. aims to improve phone and internet coverage by creating a network of satellites in space that can be accessed directly by regular mobile phones. The company targets areas that currently have poor cellular coverage. So, the crux of their service offering is proposing satellite-based mobile broadband to customers, eliminating the necessity for additional equipment, and highlighting its simplicity and innovative approach. In my view, this initiative holds the potential to significantly alter the accessibility of such services for individuals residing in remote areas, as it eradicates common barriers tied to equipment and infrastructure availability. However, ASTS’s technology is still in development, which makes the stock inherently speculative at this stage, akin to investing in a startup.

Their operational costs for 2023, ranging from $36.2 to $38.2 million against a cash reserve of around $135.7 million, indicate a capital requirement. On a bright note for investors, ASTS is investing in its BlueBird satellites to amplify global call capacity. The first satellite is earmarked for a Q1 2024 liftoff, with commercial services initiating later that year, portending potential future revenue influxes.

AST Q2 2023 Earnings Presentation

Moreover, ASTS secured external funding via a SPAC merger, investments from partners like Vodafone and American Tower, and debt financing. However, its financial position is constrained due to high operational expenses and the capital-intensive aspect of satellite deployment. ASTS aims for revenue through agreements with government entities and mobile operators by 2024 and is actively fundraising with strategic partners for the continued development of its space-based network.

ASTS’s Venture Among Space Tech Giants

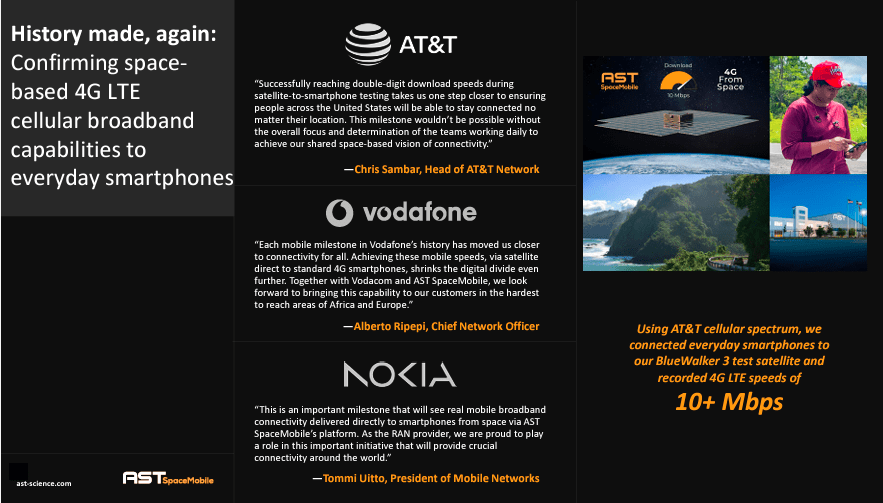

Interestingly, ASTS’s success largely depends on how well they can handle technical, financial, and legal issues. They’ve achieved important things like making a phone call from Hawaii to Spain through a satellite and advancing in space-based 5G mobile internet service. These aren’t just tech achievements; they are early steps towards changing the usual earth-based phone and internet services.

For context, ASTS’s in the space-based connectivity sector span well-established players and emerging entities, including SpaceX’s Starlink, OneWeb, and Lynk. All these companies share a common objective of establishing global connectivity, albeit through different technological and business models. In particular, Elon Musk’s Starlink emerges as a notable competitor with many low earth orbit (LEO) satellites already deployed. The approach of Starlink is straightforward, focusing on providing broadband internet globally, especially in underserved regions, which has drawn considerable attention due to its ambitious plans and an already operational beta service in select areas. When comparing ASTS with Elon Musk’s SpaceX, it’s like comparing a newcomer to a giant. While ASTS is working on connecting mobile phones via space, SpaceX’s Starlink project has already made a big name in space-based connectivity. ASTS working with SpaceX to launch satellites is a smart move, but it also shows that ASTS is still early in its ambitious journey. This partnership could provide strong support for ASTS, but competing with huge companies like SpaceX will be a tough and long journey.

On the other hand, OneWeb is also a significant player with a vision to set up a global broadband network through a constellation of LEO satellites. The progress by OneWeb is notable, with a substantial number of satellites already in orbit and more launches planned for the future. Lynk, albeit smaller in scale compared to Starlink and OneWeb, aligns closely with ASTS’s goal to provide connectivity directly to existing mobile phones without the need for additional hardware. Lynk focuses on technology that could potentially bridge the connectivity gap, especially in remote and underserved areas. These competitors each bring a unique set of strengths, technological innovations, and financial backing.

The competition in this domain highlights the need for ASTS to develop a robust strategy to thrive amidst this rivalry. Collaborative ventures, like the one with SpaceX for satellite launches, offer essential support for ASTS, yet standing strong against competitive forces demands more than just collaborations. The landscape is in a state of continuous evolution with the entry of new players and the formation of new alliances. This dynamic nature of competition implies that the competitive resilience of ASTS is not only about facing the current competitors but also about being ready for the challenges that future competitors and partnerships may bring to the fore.

AST Q2 2023 Earnings Presentation

Consequently, I think ASTS’s success hinges on many factors, including tech advancements where overcoming technological hurdles to deliver space-based mobile connectivity is crucial. Financial stability is another linchpin, ensuring adequate capital to fuel operations, launch satellites, and transition to a revenue-generating phase. Legal approval, too, is a critical aspect, requiring the attainment of necessary permissions across different jurisdictions to ensure smooth operations. Market acceptance is integral, aiming to amass a significant user base by offering reliable, fast connectivity, especially in underserved or unserved regions. Lastly, standing strong against competition is vital, necessitating a robust strategy to hold ground amid rivalry from well-established players and emerging contenders in the space-based connectivity arena.

Working with SpaceX could help, and collaborating with tech giants like AT&T, Vodafone, Rakuten, and Nokia exemplifies ASTS’s potential. Yet, the financial dichotomy could hinder progress. In my opinion, the continuous fundraising efforts are crucial. The competitive resilience of ASTS pivoted on financial infusion and successful commercial agreements, will dictate its market stance amidst the evolving space-based connectivity landscape.

Multiples-Based Valuation Analysis

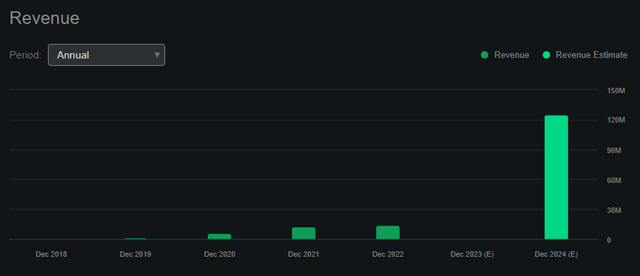

From a numbers perspective, it’s important to realize that ASTS is essentially a satellite-based mobile broadband services company. This means the business is, by definition, going to be capital-intensive and asset-heavy. Financially, the company saw a revenue uptick of 11% in 2022 compared to 2021, elevating earnings from $12.4 million to $13.8 million. However, 2023 witnessed a deviation from this growth trajectory, with revenue plummeting to $4.2 million over the TTM.

ASTS’s revenue is expected to increase sharply in 2024. (Seeking Alpha.)

Furthermore, ASTS financials show substantial R&D expenses and CAPEX to bolster its infrastructural foundation and expedite the deployment of its space-based network. Specifically, the company’s CAPEX for 2021, 2022, and the TTM were $54.8 million, $57.3 million, and $46.7 million, respectively, averaging $52.9 million. Concurrently, R&D expenses were $53.0 million, $99.8 million, and $125.3 million for the same periods, with an average of $92.7 million. Lastly, the average annual SG&A expenses stand at $42.5 million. So, as a whole, ASTS’s OpEx and CAPEX culminate in a yearly burn rate of approximately $188.1 million.

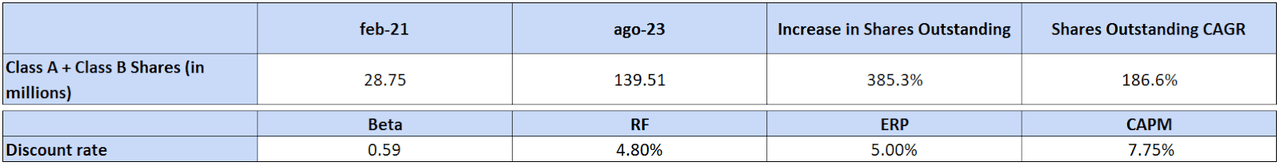

With no significant revenue streams, ASTS has predominantly financed its operations through cash reserves and stock issuance. Since 2021, cash reserves have dwindled from $321.8 million to $190.8 million, indicating a $131 million cash decline. In contrast, the company raised a substantial $165.8 million through stock issuance. The fresh equity influx underscores investor confidence in ASTS’s potential. However, ASTS’s rapid stock dilution, increasing outstanding shares (class A and B) at a 186.6% CAGR since February 2021, poses a notable risk for current shareholders. The combined total of class A and B shares now stands at 139.44 million.

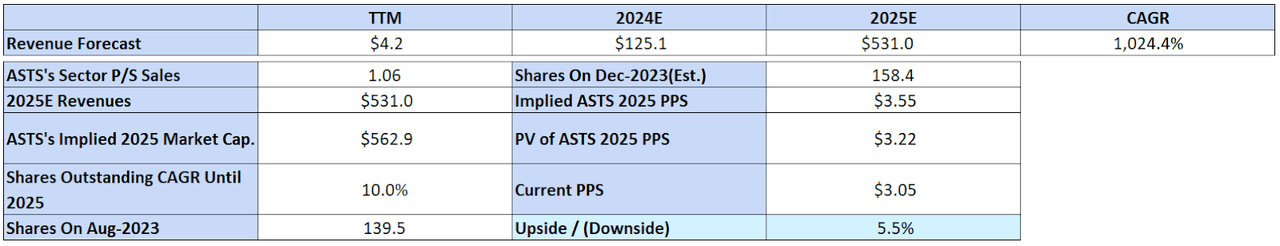

Source: Author’s elaboration.

From a valuation standpoint, assuming an optimistic scenario where revenues burgeon as speculated by some analysts, ASTS’s revenues are projected to touch $125.13 million in 2024, with some forecasts suggesting a quadrupling to $531 million by 2025. Given the sector’s current P/S ratio of 1.06, this would peg ASTS’s valuation at roughly $563 million by 2025. However, it’s pivotal to factor in the 186.6% CAGR in shares outstanding over a similar previous timeframe (February 2021 to August 2023). Optimistically, assuming only a 10% CAGR for the shares outstanding this time due to increased revenues offsetting ASTS’s yearly cash burn of $188.1 million, the total economic shares would rise to 158.4 million by 2025. This would imply a per-share price for ASTS by 2025 projected at $3.75. Discounting this value back 1.33 years using the CAPM with ASTS’s beta of 0.59, a risk-free rate of 4.8%, and an equity risk premium of 5% yields a CAPM rate of 7.75% and a current share price of $3.42 in Q4 2023. Compared to ASTS’s current PPS of $3.22, this presents an implied upside of around 5.5%.

Source: Author’s elaboration.

However, this analysis places significant emphasis on a hypothetical scenario with a rapid escalation in revenue from $4.2 million in TTM revenues to an ambitious $531 million by 2025 within a relatively short period of 1.33 years. This trajectory translates to a revenue CAGR of 1024.4%, which carries a high degree of uncertainty due to its speculative nature. In my view, adopting a more conservative stance is advisable, given the speculative assumptions underpinning this revenue growth projection. This perspective leads me to recommend a “hold” rating for the stock. The rationale behind this rating stems from the stock’s technological potential, coupled with ASTS’s seemingly negligible undervaluation with a slight upside, which presents a compelling case.

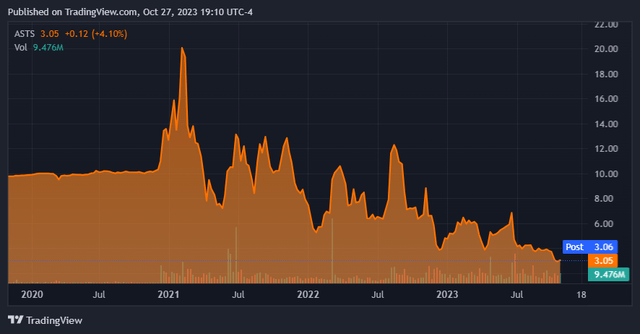

ASTS’s stock is not without its risks. (TradingView.)

However, this is counterbalanced by notable downside risks, predominantly arising from AST SpaceMobile, Inc.’s capital-intensive operations and the potential dilution that could adversely impact the stock’s value. The “hold” rating, in my opinion, represents a balanced approach, tempering the optimism from the technological potential with a cautious acknowledgment of the financial risks involved.

Conclusion

ASTS is actively working to enhance mobile connectivity in underserved regions, with an inaugural satellite launch slated for early 2024. The company’s ambitious roadmap includes the deployment of 5 satellites in Q1 2024, followed by an additional 20 satellites later in the year. By forming alliances with key global mobile network operators, ASTS aims to serve markets encompassing over 2 billion subscribers initially. These upcoming satellite launches are crucial for validating ASTS’s commercial viability on a broader scale, with revenue generation anticipated from FY2024, contingent upon the timely deployment of these satellites. However, financial hurdles pose significant challenges, notably ASTS’s history of high stock dilution. Although collaborations with notable entities like SpaceX, AT&T, and Vodafone are encouraging, ASTS’s prospects remain uncertain. Hence, despite the strategic partnerships, ASTS’s capital-intensive nature, coupled with its high stock dilution, could act as a deterrent to potential investors. My valuation analysis posits a modest 5.5% upside potential at the current levels, leading me to rate ASTS as a “hold” due to its promising technological venture and the substantial subscriber market, juxtaposed with its significant potential dilution and highly speculative nature.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here