A Quick Take On Backblaze

Backblaze, Inc. (NASDAQ:BLZE) provides organizations with cloud-based storage and recovery software and related services.

I previously wrote about BLZE with a Sell outlook on lower revenue growth and increasing operating losses.

Despite Backblaze, Inc. management’s minor revenue midpoint guidance increase and marginally improved operating losses, its lack of confidence in 2024 industry trends outside of cost ‘optimization’ is concerning.

I reiterate my Bearish [Sell] view on the stock.

Backblaze Overview And Market

California-based Backblaze has developed a cloud-based SaaS storage service suite for businesses and consumers wishing to more conveniently back up and store their critical data.

The firm is led by co-founder, Chairperson and CEO Gleb Budman, who has been with Backblaze since its inception and was previously in various senior positions at SonicWall, MailFrontier and Kendara.

The firm’s primary offerings include:

-

B2 Cloud Storage

-

Computer Backup.

Backblaze obtains new customers mainly through online marketing, social media and word of mouth.

The company operates a self-serve website that enables users to sign up for a free trial and convert to a paid subscription.

According to a 2023 market research report by MarketsAndMarkets, the worldwide market for cloud storage services was an estimated $78.6 billion in 2022 and is forecast to reach $184 billion by 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of 18.5% from 2022 to 2027.

The primary reasons for this expected growth are the increasing demand from businesses for growing amounts of data and a rising number of remote-located employees and contractors needing access to relevant data stores.

Major competitive or other industry participants include:

-

Amazon (AMZN)

-

Alphabet (GOOG) (GOOGL)

-

Microsoft (MSFT)

-

Dell EMC (DELL)

-

iDrive

-

pCloud

-

Dropbox

-

Icedrive

-

NordLocker

-

Others.

Backblaze’s Recent Financial Trends

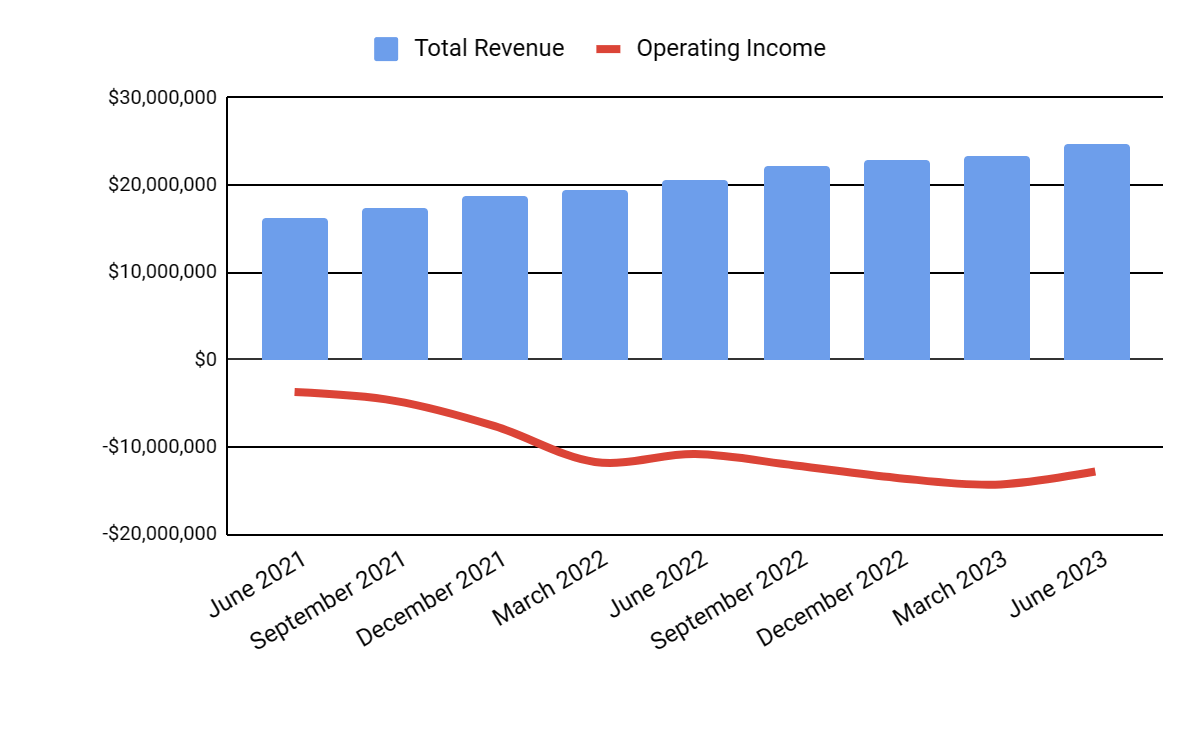

Total revenue by quarter has continued to steadily rise; however, operating income by quarter has continued to worsen further into negative territory:

Seeking Alpha

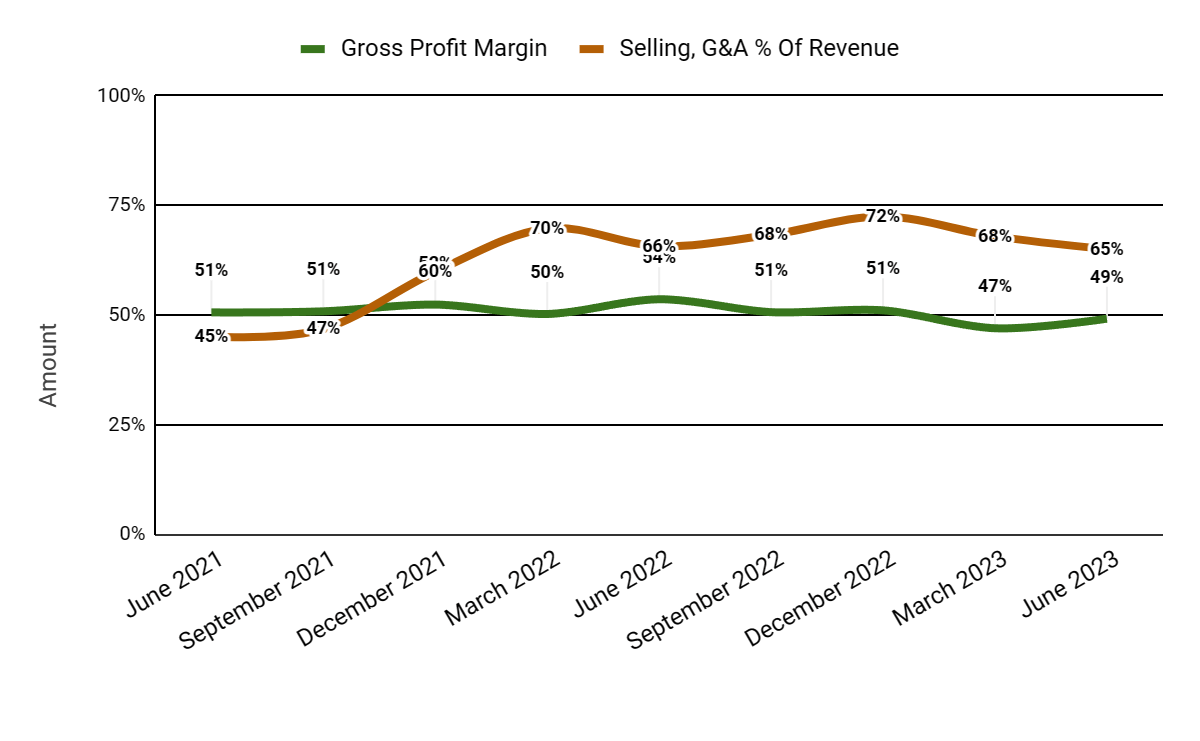

Gross profit margin by quarter has been reduced in recent quarters; Selling and G&A expenses as a percentage of total revenue by quarter have trended higher recently (YoY):

Seeking Alpha

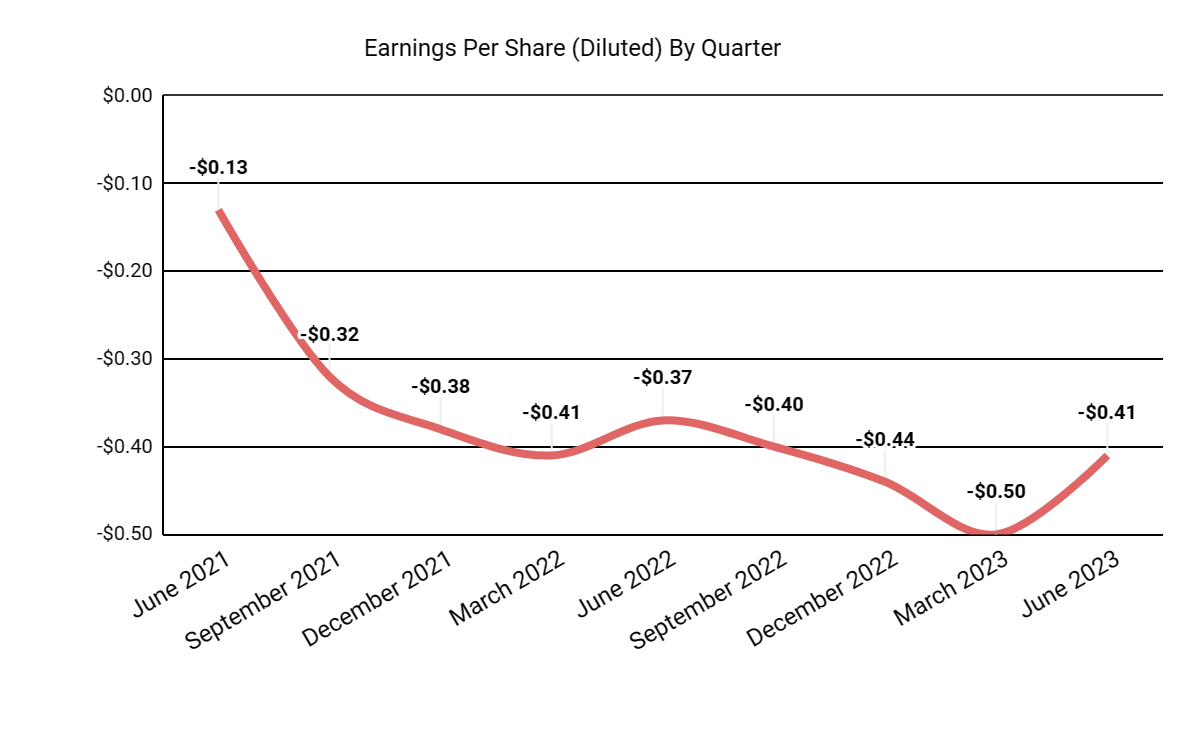

Earnings per share (Diluted) have deteriorated further into negative territory, as the chart shows here:

Seeking Alpha

(All data in the above charts is GAAP.)

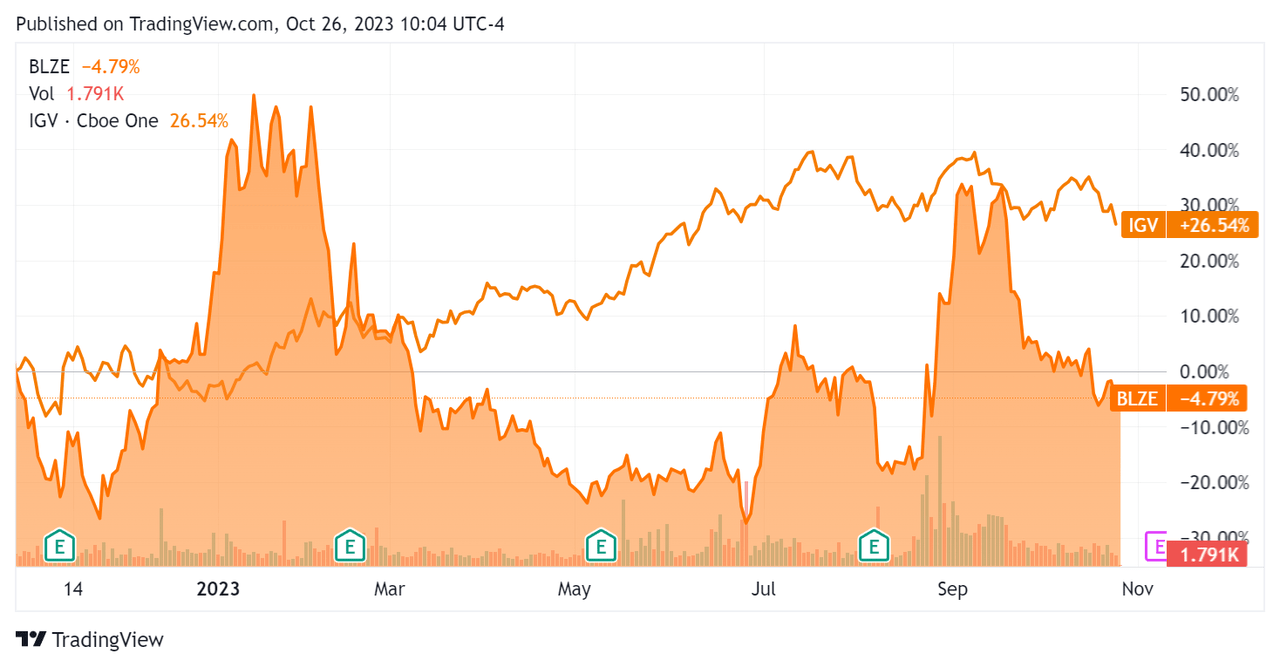

In the past 12 months, BLZE’s stock price has fallen by 4.79% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 26.54%. The stock has also gone through multiple periods of high volatility:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $36.8 million in cash, equivalents and short-term investments and $8.3 million in total debt, of which $0.5 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash used was a hefty ($26.6 million), during which capital expenditures were $10.6 million. The company paid $19.6 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Backblaze

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (Trailing Twelve Months) |

Amount |

|

Enterprise Value / Sales |

2.1 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

1.9 |

|

Revenue Growth Rate |

22.0% |

|

Net Income Margin |

-63.2% |

|

EBITDA % |

-35.4% |

|

Market Capitalization |

$184,600,000 |

|

Enterprise Value |

$194,630,000 |

|

Operating Cash Flow |

-$16,020,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.75 |

|

Forward EPS Estimate |

-$0.89 |

|

Free Cash Flow Per Share |

-$1.18 |

|

SA Quant Score |

Hold – 3.26 |

(Source – Seeking Alpha.)

BLZE’s most recent unadjusted Rule of 40 calculation was negative (30%) as of Q2 2023’s results, so the firm has produced worsening results in this regard, per the table below:

|

Rule of 40 Performance (Unadjusted) |

Q1 2023 |

Q2 2023 |

|

Revenue Growth % |

24.3% |

22.0% |

|

Operating Margin |

-38.6% |

-52.0% |

|

Total |

-14.3% |

-30.0% |

(Source – Seeking Alpha.)

Sentiment Analysis

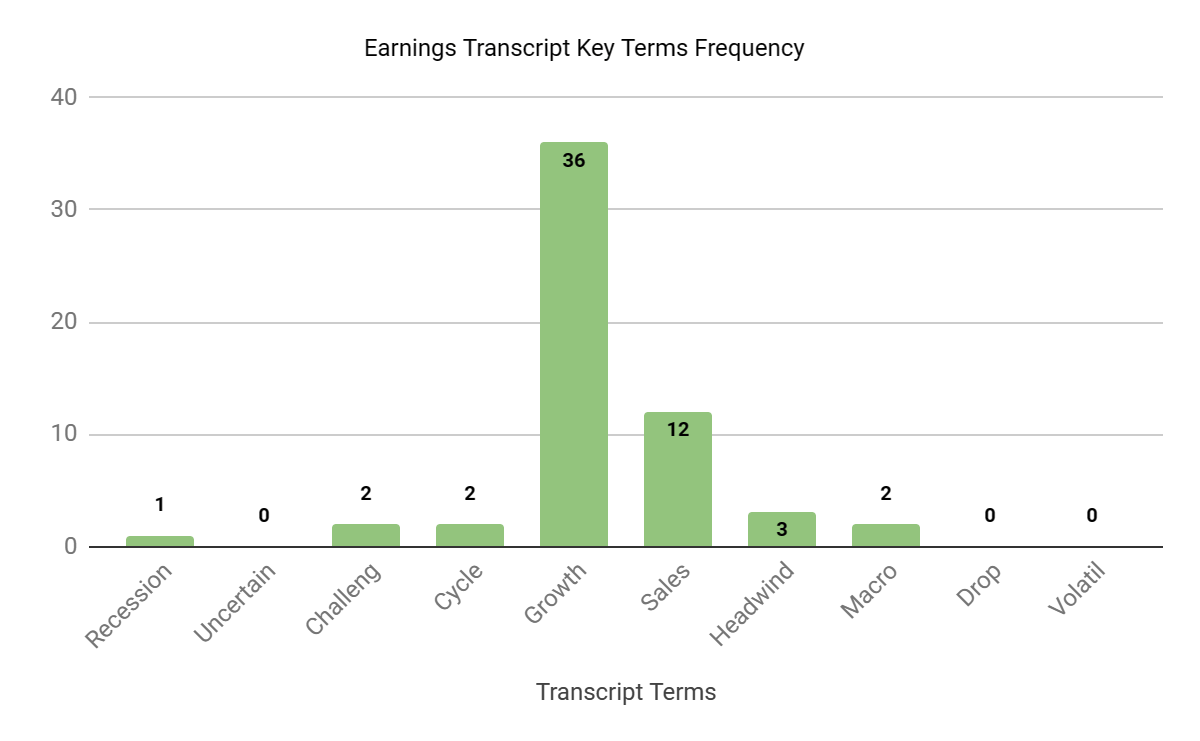

I prepared a chart showing the frequency of certain keywords in the firm’s most recent earnings conference call.

Seeking Alpha

The chart suggests that the company’s clients are facing macroeconomic challenges, but management believes its service offerings can help customers reduce the cost of their infrastructure.

Analysts asked leadership about growth for its B2 Cloud business, the firm’s cost reduction efforts, and its 2024 IT industry spending outlook.

Management replied that its B2 Cloud growth dipped as a result of reduced data growth and some seasonality but that they expect growth to reaccelerate to around 40% in Q4.

As for cost reductions, management has made progress through reduced equipment purchases, lower headcount additions and facilities savings. Non-performing sales and marketing areas have also been pruned.

While leadership didn’t provide any specific guidance for 2024, it said that the current focus on spending on ‘optimization’ will continue. This probably means that demand for projects that are not about reducing spend will continue to be soft.

Commentary On Backblaze

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, management’s prepared remarks highlighted the firm’s “increasing success in moving upmarket.”

The company is seeing an increase in higher-value paying customers and in its sales pipeline.

For its B2 cloud backup product, management is seeking to optimize its self-serve aspects while expanding its sales-assisted efforts with larger customers.

Also, it is pursuing partnerships to produce greater leverage and is “cultivating application storage use cases.”

Total revenue for Q2 2023 rose by 18.8% year-over-year while gross profit margin fell by 0.4%.

The total net retention rate was 110%, which was a sequential drop from 111% in Q1 2023.

Selling and G&A expenses as a percentage of revenue fell by 0.7% YoY, indicating slightly improved efficiency in this regard.

However, operating losses worsened by 18.5% year-over-year, to ($12.8 million) for the quarter.

The company’s financial position is only moderate, with cash greater than its debt, but free cash flow has been substantially negative and unsustainable if continued for very long.

BLZE’s Rule of 40 performance has been poor and deteriorating.

Looking ahead, management raised its full-year 2023 topline revenue outlook by 1% to $101 million, or 18.5% over 2022.

If achieved, this would represent a decline in revenue growth rate versus 2022’s growth rate of 26.2% over 2021.

In the past twelve months, the firm’s EV/Sales valuation multiple has increased by about 37%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include demand increase from customers seeking to reduce their costs.

However, despite management’s minor revenue midpoint guidance increase and slightly improved operating losses, its lack of confidence in 2024 industry trends outside of cost ‘optimization’ is concerning.

I reiterate my Bearish [Sell] view on the stock.

Read the full article here