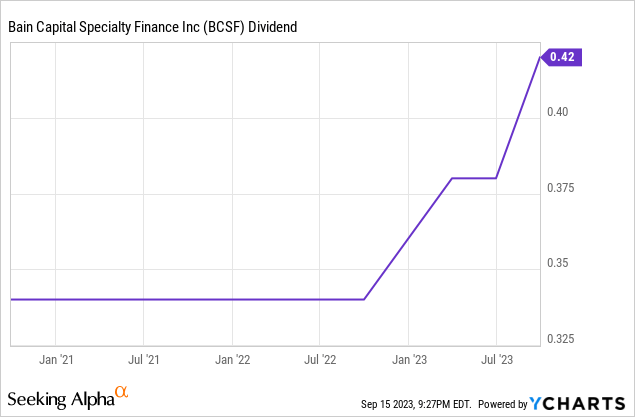

It was clear that Bain Capital Specialty Finance (NYSE:BCSF) was going to hike its quarterly dividend on the back of fiscal 2023 first-quarter earnings that saw huge gains in total and net investment income set within a double-digit discount to net asset value. The business development company last declared a quarterly cash dividend of $0.42 per share, a 10.5% hike from its prior payment for a 10.4% annualized dividend yield. The income is the prize and BCSF’s dividends have staged a dramatic trajectory over the last three years by growing at a 7.3% compound annual growth rate. The double-digit hike is likely not going to be the last in the near term with the current macro environment forming an almost Goldilocks backdrop for the BDC’s floating rate credit portfolio to boom.

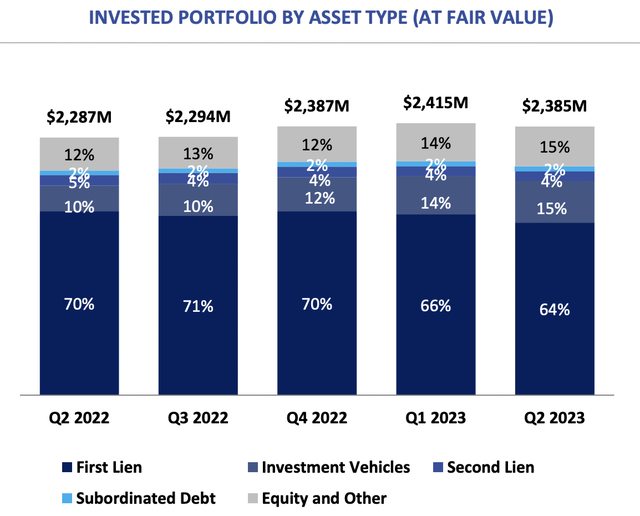

The Fed’s higher for longer mantra means what will come to be seen as the golden era for BDCs will remain sticky. However, we’ve likely reached a peak with hawkishness with the Fed funds rate currently sitting at a 22-year high of 5.25% to 5.50% and with the market widely expecting the Fed to leave rates unchanged at its upcoming FOMC meeting on the 20th of October. BCSF’s investment portfolio as of the end of its recently reported fiscal 2023 second quarter had a fair value of $2.38 billion spread across 142 portfolio companies in 30 different industries.

Bain Capital Specialty Finance Fiscal 2023 Second Quarter Presentation

8% Discount To NAV, 10.4% Dividend Yield, Strong Coverage

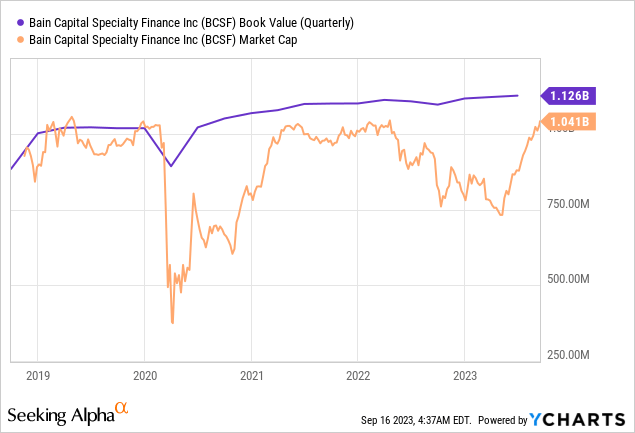

The portfolio drove a net asset value of $1.126 billion, around $17.44 per share, and growth sequentially from $17.37 per share in the first quarter. Second quarter NAV was also an expansion from NAV of $17.15 per share in the year-ago quarter with BCSF’s debt to NAV ratio coming in at 1.32x as of the end of the second quarter. Whilst up from 1.12x a year ago, this leverage ratio is still within a prudent range and compares favorably to its peer group. Net debt-to-equity came in lower at 1.13x and was also down sequentially from 1.16x in the first quarter. This figure considers principal debt outstanding alongside cash and equivalents and net receivables.

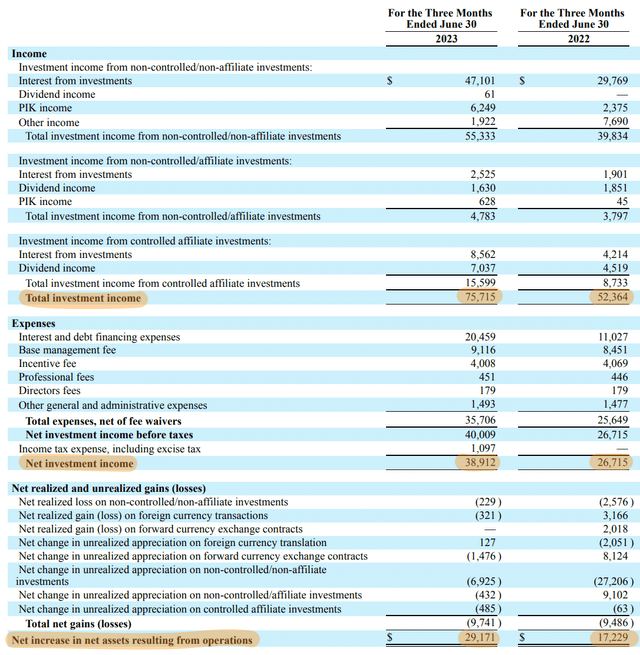

I’d like to see the ratio stay within this range going into 2024 even against broader forecasts that the US should stage a soft landing. Critically, the BDC is now swapping hands at an 8% discount to NAV, a dramatic reduction from a 28% discount when I last covered it. Total investment income came in at $75.7 million, a 44.6% increase from $52.36 million in the year-ago quarter with net investment income coming in at $38.9 million, around $0.60 per share. This formed an annualized NII yield on book value of 13.9% and was growth from NII of $0.41 per share in the year-ago comp.

Bain Capital Specialty Finance Fiscal 2023 Second Quarter Form 10-Q

Critically, NII covered the second quarter dividend by 143% to form a material level of safety and heighten the chances of a year-end special dividend. The company stated during its second-quarter earnings call that its spillover income stood at $0.66 per share and that its board will evaluate the potential for any additional distributions as 2023 closes out.

Golden Moment For Private Credit

I like that the BDC only had two portfolio companies on non-accrual status as of the end of the quarter, this was around 2.1% and 0% of its total investment portfolio at amortized cost and fair value, respectively. Further, 94.1% of BCSF’s debt investments at fair value were in floating-rate securities with its broader investment portfolio pushing a 13% weighted average yield. BCSF will likely declare a special year-end dividend payout but I don’t see any further hikes until next year even with the strong coverage level. The BDC essentially has to tip-toe between NAV stability going into the end of interest rate hikes and maintaining an appropriate level of dividend payouts.

Higher for longer will support elevated investment income for BDCs but eventually the Fed funds rate will have to come back down. We’ve likely reached a crescendo with the market currently pricing in a 98% chance that the Fed will maintain rates at their current level at its next FOMC meeting. Private credit, or non-bank lending, is set to occupy an increasingly important role in the US economy as large banks get ready for higher capital requirements from the incoming Basel III Endgame and as regulators move to respond to the March banking crisis. I hold a substantial position in BCSF with a view for the BDC to eventually trade in line with NAV. This implies further upside with a special year-end dividend or the implementation of a supplemental payout program being likely.

Read the full article here