BBCA vs. The Stalwart

The JPMorgan BetaBuilders Canada ETF (BATS:BBCA) offers coverage to over 82 stocks from the broad Canadian market. Despite its relatively young age (BBCA made its listing debut only in August 2018), BBCA has managed to accumulate nearly twice the AUM of the oldest Canadian-focused ETF in the market– The iShares MSCI Canada ETF (EWC), which has been around for roughly 27 years now (AUM of $6bn vs $3.2bn for EWC).

Whilst both portfolios cover a similar number of stocks (80-90 stocks) and are not prone to very much churn (the annual turnover ratio of both ETFs is minuscule at only 5%), BBCA offers a few other structural benefits that may have tilted sentiment towards it.

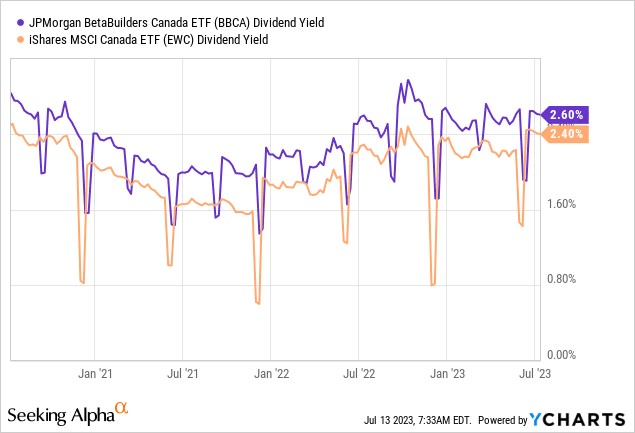

Primarily, it boils down to cost efficiency, and here, BBCA’s significantly lower expense ratio of 0.19% gives it an edge over EWC, which is unfavorably placed, with an expense ratio of 0.5%. Investors, will also likely appreciate the superior yield differential on offer, which has been quite a consistent facet for most periods across the last three years (currently it stands at 20bps).

YCharts

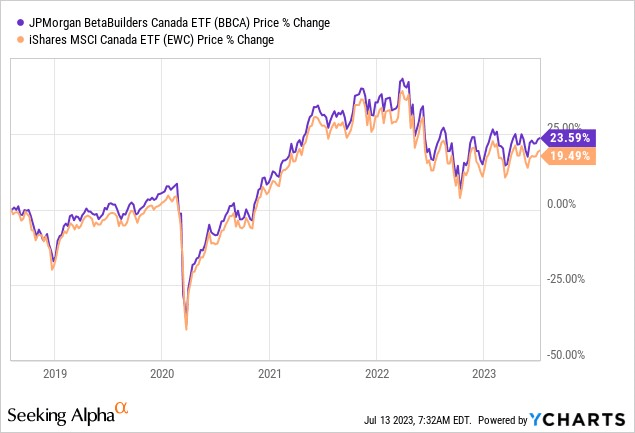

It certainly also helps that BBCA has built a reputation for outperforming EWC since its listing date, delivering aggregate returns of ~24% (EWC’s returns during that time have come in at 19%).

YCharts

Macro Commentary

Hitherto, the Canadian economy has held up quite well, but the wheels could come off in the quarters ahead, particularly considering the central bank’s reluctance to pivot away from rate hikes.

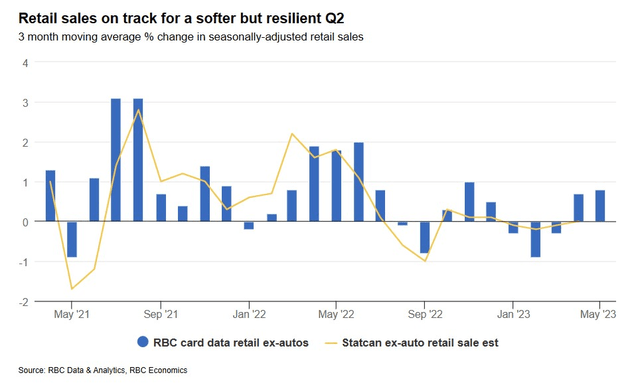

Whilst it has been encouraging to note a decline in headline inflation, the decline hasn’t been broad-based, with quite a few pockets within the CPI basket trending over mid-single-digit levels. Meanwhile, the Canadian labor market also remains relatively resilient, with the recent report highlighting how the economy added 60k jobs, 3x higher than what the street was expecting. Meanwhile, it also looks like consumer spending in Q2 will likely finish on an encouraging note with sequential progress seen across the quarter.

RBC

Relatively sturdy retail spending has been fuelled by sturdy household wealth levels which have been growing for two straight quarters now.

Considering all these developments, it was no surprise to see the Bank of Canada lift policy rates yet again by 25bps, taking it to 22-year highs (it had lifted rates by a similar figure last month, after a 5-month pause in between). Passive observers may now be prone to think that this would be the last of the rate hikes, but we certainly wouldn’t bet on it. Why so?

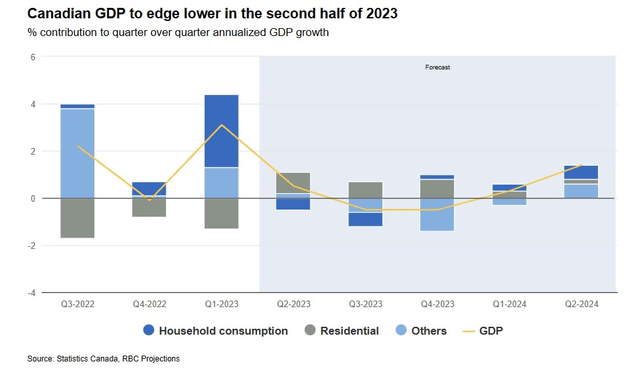

Well, the Bank of Canada had hoped to close FY25 with inflation below their 2% target, but because of the stickiness of certain components, they’ve been forced to extend their target by another six months to mid-FY25 (Also note that inflation in FY24 will likely be around the 3% annualized levels). With further rate hikes on the cards, risks to the GDP growth trajectory in H2-23 looks to have grown.

RBC

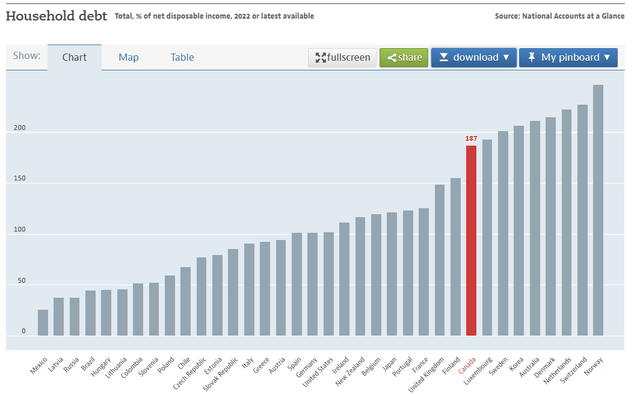

The more pressing issue also revolves around how higher interest rates could asphyxiate the debt-servicing capabilities of Canadian households. Even before these hikes, Canadian households represented one of the most indebted pockets across the world (with household debt to disposable income of 187% last year).

OECD

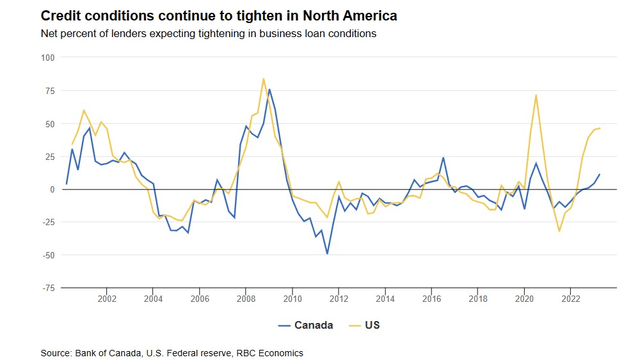

A higher threshold of policy rates in the face of an excessively levered household base will certainly not be conducive for the prospects of Canadian banks (which incidentally dominate BBCA’s portfolio with an aggregate weight of 35%). These banks have been tightening their standards in recent periods, but it is still not quite at the same threshold as their US counterparts

RBC

Also consider the challenges associated with refinancing of their mortgage portfolio, with over $250bn worth of mortgages due to be renewed next year at much higher rates (for context, the floating rate mortgages are now pricier by 70% vs levels seen in October 2021 when rates were at record lows).

Whilst it is encouraging to note that the Canadian banking regulator intends to implement more stringent capital norms to mitigate the risks associated with the mortgage portfolio of these banks, developments like this will only dampen the prospects of higher shareholder distributions, which may prompt some investors to look away from Canadian financials.

Closing Thoughts

As far as the valuation backdrop is concerned, Canadian equities don’t appear to be attractively priced. For context, BBCA’s constituents are currently priced at a forward P/E of 13.6x, which translates to an 8% premium over the corresponding multiple of the Vanguard FTSE Developed Markets ETF (VEA).

Would BBCA come across as an attractive rotation play within the developed market space? Well, that chart below suggests there’s no great incentive to rotate into BBCA at this point as its relative strength ratio versus VEA is bang in line with the mid-point of its trading range.

Stockcharts

Read the full article here