Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of August.

Market Action

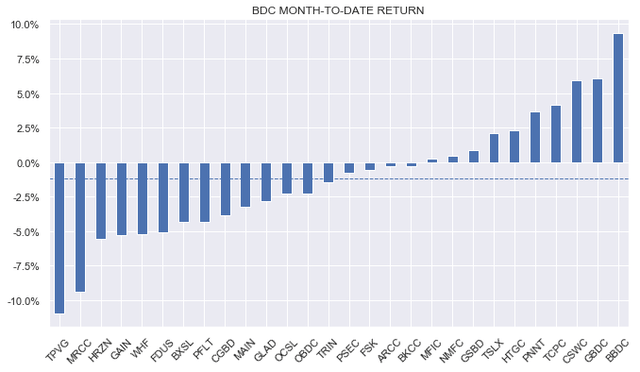

BDCs were slightly down this week along with most other income sectors as the market continued to digest the previous rally in the light of a mixed set of inflation data. Month-to-date the underachiever BBDC caught a bid.

Systematic Income

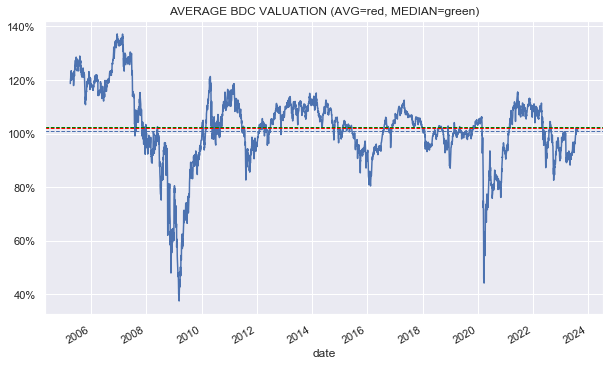

BDC aggregate valuations remain roughly in line with the historic average.

Systematic Income

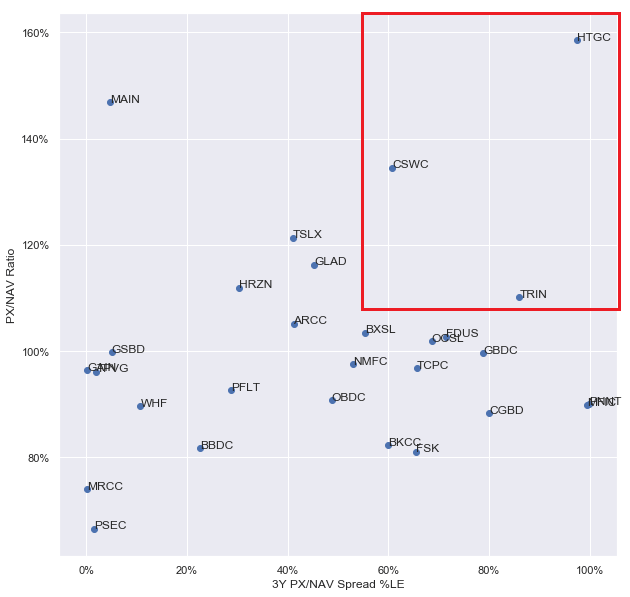

A quick look at the “expensive” BDC quadrant shows that CSWC, TRIN and HTGC look a bit rich both in terms of their high absolute valuations (y-axis) but also their valuation differential to the sector average over the last 3 years. HTGC has almost never been more expensive relative to the sector than it is now.

Systematic Income

Market Themes

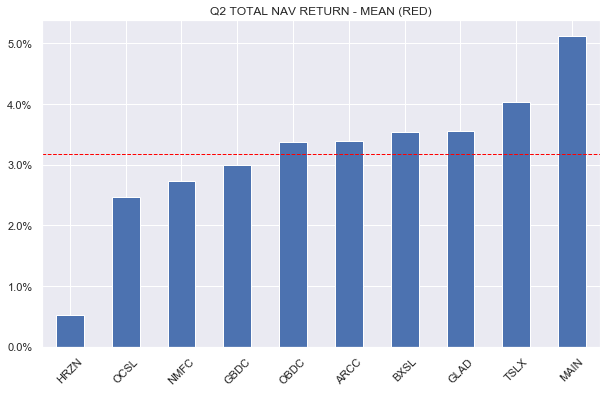

Q2 earnings are rolling in at a quick pace. Of those we have processed on the service, the news is almost universally good. The average total NAV return for the quarter is a touch over 3%.

Systematic Income

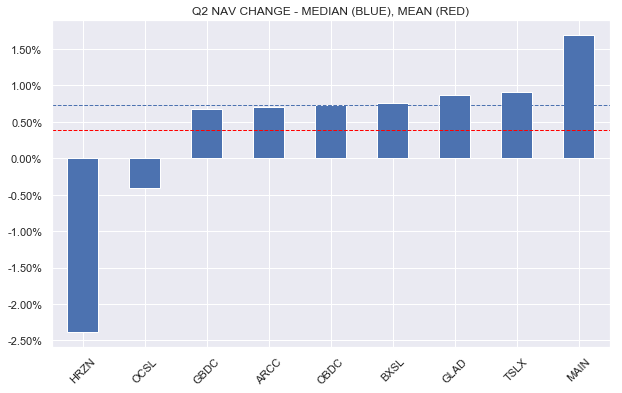

The median NAV change is around +0.7% with the average around +0.45%. This is due to a combination of both unrealized appreciation as well as retained income.

Credit and equity markets rallied over Q2 and this allowed BDCs to marginally write up their portfolios. Most BDCs are also running high coverage levels for fear of having to cut the dividend if the Fed cuts rates sharply. This excess income tops up the NAV. And while a number of BDCs have experienced realized losses, they have not been large enough so far to offset these two NAV tailwinds.

Systematic Income

Median net income rose by over 5% on-the-quarter. As we suggested last quarter, double-digit net income gains were going to dissipate to a still healthy single-digit rise and this is what we are seeing this quarter.

Non-accruals have increased on average once again. This is to be expected as the broader economy is still slowing down. However, this has not yet translated into significant return headwinds.

Overall, Q2 is shaping up to be a very good quarter for the BDC sector. While we are no longer in the Goldilocks period of stable asset quality and double-digit net income gains, there is little reason for BDC investors to complain. If there is a small complaint, it’s that BDC valuations have run ahead in the last few months, leaving less margin of safety on offer.

Market Commentary

Trinity Capital (TRIN) is doing a $75m share offering at $14.45. That pushed its price significantly lower to $14.12 more than erasing the gains from its earnings release.

The credit environment remains friendly to lenders so the equity issuance makes sense particularly when prepayments are running at a low pace, meaning recycling repaid capital into new loans is not working as fast as it normally would.

The use of proceeds mentions a repayment of a credit facility which also makes sense given the high cost of floating-rate debt. We tend to see a lot of stock offerings after earnings releases which may be disappointing given the terrible price action. However, the price drop is usually temporary.

The Blackstone Secured Lending Fund (BXSL) reported good results with a rise in the NAV and a double-digit net income gain. Non-accruals remained exceptionally low and leverage moved lower – all good to see in this environment. BXSL fell sharply as it’s also doing a stock offering. A good time to pick up the stock for those who were waiting.

Systematic Income BDC Tool

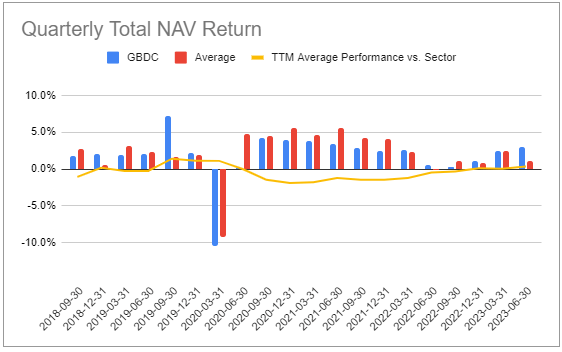

Golub Capital (GBDC) reported very good results with a rise in both net income and the NAV. Total NAV return for the quarter was 3% – a touch below the average reported so far.

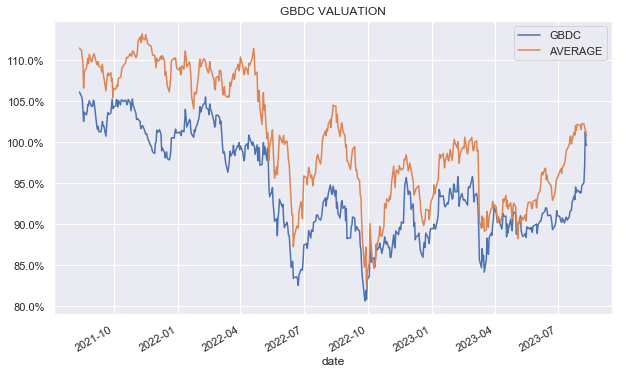

GBDC is not one that’s going to blow it out of the water, particularly in “good times” given its low equity allocation and relatively conservative underwriting stance. That said, this relatively boring approach does get results. Total NAV return over the past year is ahead of the sector median level. This is all particularly compelling as the valuation has tended to trade well below the sector average which obviously boosts return even further above the sector for each dollar invested.

Systematic Income BDC Tool

More good news for the quarter was the 12% regular distribution hike and another boost from a supplemental dividend. The stock has rallied nicely recently with the valuation nearly converging with the sector. The management fee was also reduced, resulting in the best fee structure in the sector.

Stance and Takeaways

We took advantage of some of the volatility in the BDC space this week to make a couple of rotations.

GBDC has been our largest allocation in the sector owing to its higher-quality profile and cheap valuation. Its good quarterly results, 24% dividend hike and a management fee cut drove a sharp rally in the stock this week so that its valuation has now nearly converged with the broader sector. We took this opportunity to pare down our allocation.

Systematic Income

Readers may recall that we recently partly moved our BXSL allocation to ARCC when the BXSL valuation was more than 5% above that of ARCC. Now that ARCC is ahead by around 2.5% we are moving back to BXSL for a round trip of more than 7.5%. It’s fairly likely we see an offering from ARCC soon enough which would make a better entry point.

Systematic Income

Read the full article here