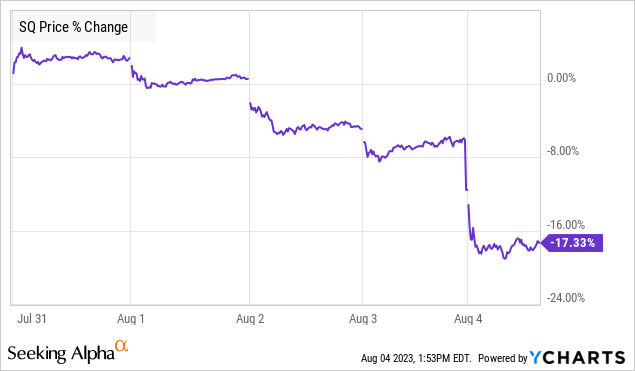

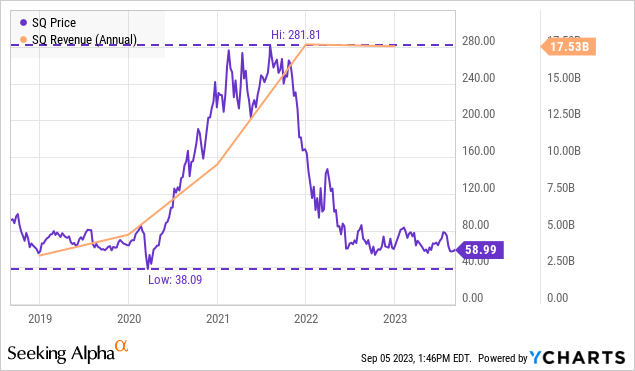

Last month, we shared a bull put spread idea on PayPal (PYPL) (see PayPal: Options Strategy To Generate 17.1% Yield With -27.4% Downside Protection). We’re keeping with the theme on fintech stocks battered by earnings, as Block, Inc. (NYSE:SQ) (formerly Square) disappointed the market with its miss on gross payment volume (GPV), despite continued growth in all segments and a significant boost to its 2023 guidance for adjusted EBIDTA. A closer examination of Square’s strong second-quarter results and improved outlook reveals a compelling opportunity for potential investors.

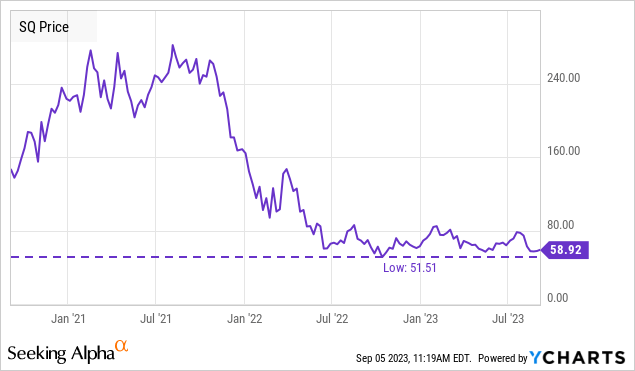

YCharts

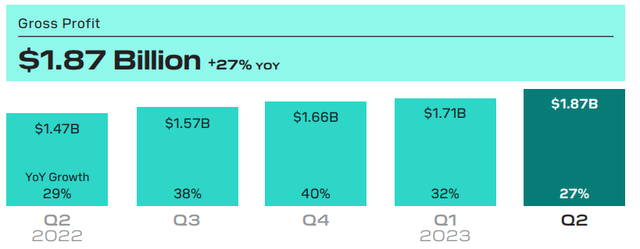

While the market has been preoccupied with PayPal’s challenges, Square delivered an outstanding Q2 report, showcasing impressive growth across its business segments. The company achieved a notable 27% year-over-year increase in total gross profit to $1.87 billion, demonstrating its ability to generate substantial revenue gains.

SQ 2023 Q2 Shareholder Letter

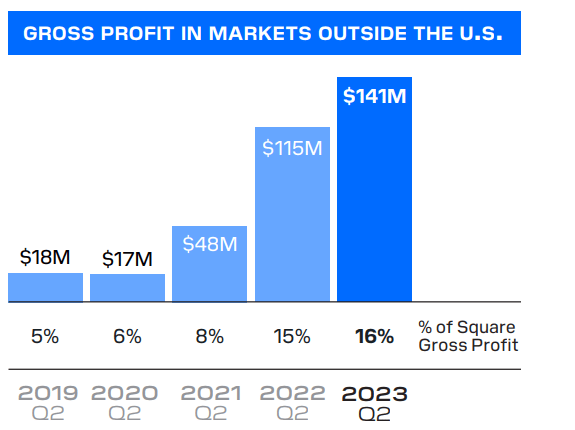

One of the key drivers of Square’s growth is its vertical penetration. By expanding its footprint in various industries, Square is able to capture a larger share of the market and drive significant revenue growth. For example, food and drink GPV and retail GPV were up 17% and 9% year-over-year respectively. Moreover, contributions from international markets continues to rise, with gross profit from markets outside the US up +23% year-on-year to $141 million, representing 16% of the company’s total gross profit. This diversification of revenue streams positions Square for sustained growth and reduced reliance on any single product or market.

SQ 2023 Q2 Shareholder Letter

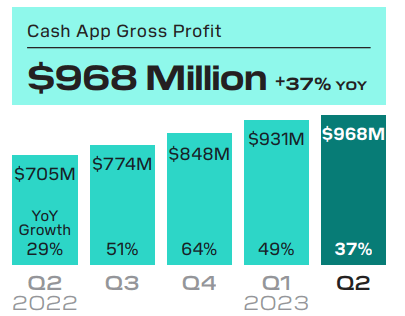

Square’s Cash App, its popular mobile payment service, also played a crucial role in driving growth. Cash App’s gross profit surged by an impressive 37% year-over-year to reach $968 million, indicating strong user adoption and engagement. The number of monthly transacting actives (MTAs) in June was 54 million, which was up 15% year-over-year. This growth in Cash App’s user base, coupled with the expansion of its product offerings, presents a significant opportunity for Square to drive further revenue growth and monetize its large user base.

SQ 2023 Q2 Shareholder Letter

Looking ahead, Square’s management demonstrated confidence in the company’s recovery by upgrading its FY23 adjusted EBITDA outlook to $1.5 billion. This upward revision underscores Square’s anticipation of continued growth and profitability. Management expects to achieve profitability on an adjusted operating income basis for the year, inclusive of share-based compensation expenses, and year-over-year margin expansion is expected on both an adjusted EBITDA and adjusted operating income basis.

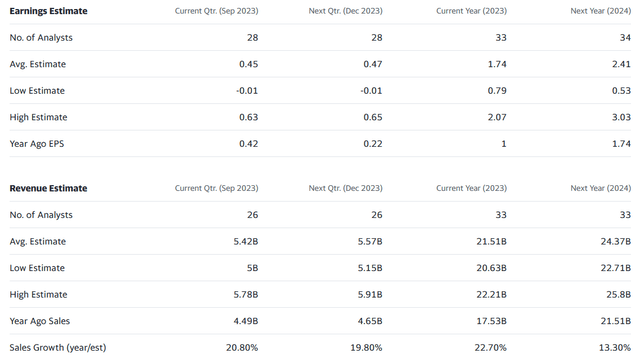

Yahoo Finance

According to Seeking Alpha author The Asian Investor, SQ’s higher valuation than its chief competitor PYPL is justified due to SQ’s stronger growth prospects, particularly in its Cash App ecosystem (see: Block: Buy The Drop):

However, Block is not as expensive as it looks because the FinTech is expected to grow much more rapidly than PayPal. Block is expected to generate 43% EPS growth in FY 2024 compared to PayPal’s 15%. Block’s long-term EPS growth estimates implies that the FinTech could grow almost twice as fast as PayPal going forward.

However, one key risk is that SQ has yet to prove itself to be consistently profitable, and any signs of headwinds on that front would likely be detrimental to SQ’s premium valuation.

In summary, the market’s failure to acknowledge Square’s strong performance and positive guidance creates an attractive opportunity for buyers who missed out on the stock’s previous lows. The recent selloff has brought its forward valuation multiples back to more attractive levels. From a technical analysis perspective, Square’s price chart indicates that the stock could find support at the $50-55 level.

YCharts

SQ is a great growth story, and investors with very high conviction in the company may well wish to simply buy the common stock and participate fully in both the upside (and downside) of the stock from here on out.

We specialize in generating income through selling options or option spreads. This is a great option (no pun intended) for those investors who may wish to participate in limited profit movement in the underlying stock, while protecting their investment with a wide margin of safety.

Although SQ does not pay a dividend, we can generate “yield” from this stock using options. By selling put options on SQ, we are taking a bullish stance because we are committing to buying SQ if it declines below the strike price.

This particular bull put spread idea generates $0.62 per contract in SQ from now until June 21st, 2024, with -40.6% margin of safety. In other words, SQ has to drop -40.6% from today’s prices before any losses are taken.

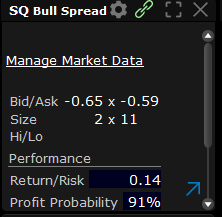

The options trade

(data updated as of September 5, 2023)

The Trade: Block, Inc. (SQ) Bull Put Spread 35/30 expiring June 21st, 2024, stock price at $58.95

- Sold SQ $35 Put for $1.48

- Bought SQ $30 Put for $0.86

Ticker: SQ

Expiration: June 21st, 2024

Type: Sold Bull Put Spread

Upper Strike Price: $35

Price Move Until Upper Strike: -40.6% decrease

Premium Collected: $0.62 or $62 per contract

Days To Expiration: 289 days

Breakeven: $34.38 (Max loss $438 per contract achieved if the stock goes below $30)

Option Volume: Decent, with a $0.65/$0.59 bid-ask spread at the time of writing.

Interactive Brokers

Because of SQ’s premium valuation, I’m going with a wider margin of safety to protect against downside triggers. The upper strike price is $35, which is -40.6% below the current stock price of $58.95 and -31.8% below the 52-week low of $51.34. $35 is also below the March 2020 bear market low of $38.09, when SQ’s revenue was a fraction of its current revenue today.

YCharts

The lower strike price is $30, giving a maximum loss of $5 not counting the premium received.

The put spread expires on June 19th, 2024 which is 289 days (about 9.5 months) from today. The put spread can be sold for $0.62, with a capital at risk of $4.38 (the difference between the two strike prices, minus the premium received). When calculating the potential return of the option spread, remember to also include the interest rate paid on cash (e.g. 4.83% for Interactive Brokers) as the premium from selling the option is received upfront.

An investor writing this put should be comfortable with any of these three scenarios occurring on the expiry date of June 21st, 2024:

- SQ closes above $35: Both options will expire worthless, and the investor pockets the $0.62 premium.

- SQ closes between $35 and $30: The investor will be forced to take assignment of SQ shares at $35, while the lower put will expire worthless. (but you still get to keep the $0.62 option premium, effectively lowering your cost basis to $34.38).

- SQ closes below $30: Both long and short puts will be assigned, and the investor will experience the maximum loss of $4.38.

Remember that each option contract represents 100 shares of the underlying and that anyone trading options should be fully familiar with the risks as set forth here.

Read the full article here