Introduction

Block, Inc. (NYSE:SQ) is reporting its Q3 earnings on November 2, post-market. Given that the company’s stock price has been pressed down to recent lows of around $39, I believe the upcoming quarter will be accompanied by a dramatic price move. If Block delivers a strong report the stock price has the potential to break the recent price decline, however, an equally weak report could bring the share price to new all-time lows. Hence, before the report, it is important to understand the factors that will be pivotal to look at in Q3.

From studying Block Inc. in general for several years and in more detail over the past few quarters, I have found the following factors to play the largest importance with regard to the company’s post-earnings price movements:

- Gross Profit Growth.

- Adjusted Rule of 40.

- Non-Financial Metrics Regarding Business Growth.

- Key Product Milestones.

I will go through each of these factors in detail within this article, explicitly outlining past performance and what to expect in Q3. Given that Block meets performance expectations within each of these areas, I believe that results will be accompanied by a positive post-market price movement – however, given the fragility of the market, a miss in just one of these factors can have a steep adverse effect.

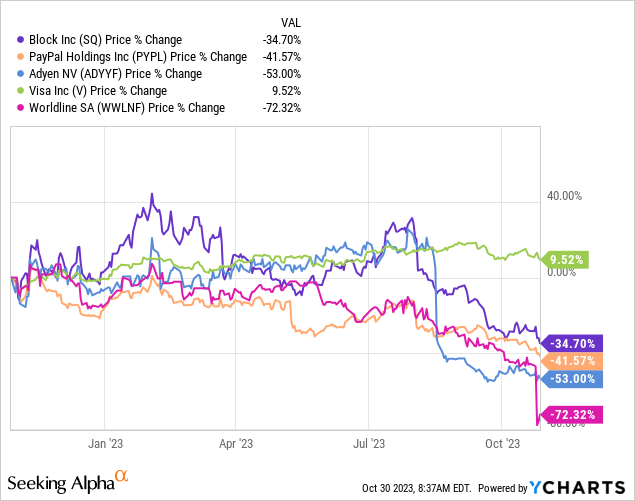

Getting A Feel For The Market

One of the luxuries of Block’s relatively late reporting date is that several notable payment firms have already reported their quarterly results. It is useful to start with earlier reports to get a feel for whether there are tailwinds or not within the payments market. I will outline some notable results below that will help us build an understanding of how Q3 will play out for Block.

Fiserv, Inc. (FI)

Fiserv operates a merchant business with a point-of-sale (“POS”) product called Clover. In their Q3 report on October 24, Fiserv reported that Clover achieved the following

- Revenue growth of 26% YoY.

- Gross payment volume (GPV) growth of 15% YoY.

- Transaction growth 9%.

- Adjusted operating margin 35.9%.

(Fiserv Q3 Presentation)

The strength of the company’s earnings and the rhetoric employed by the CEO, paraphrased by Seeking Alpha – “Although inflation is affecting small businesses, they’re still seeing growth as consumers are still using them”, resulted in a positive post-earnings price movement for Fiserv.

Worldline SA (OTCPK:WWLNF)

Worldline also achieved strong performance within their merchant business during the first half of this year:

- 13.5% organic revenue growth.

- Strong in-store and online payment volume growth.

- Onboarded 40,000 new merchants.

(Worldline H1 Report; Seeking Alpha Earnings Transcript).

Despite the positive news for the first half of the year, Worldline issued guidance that reflected the high probability of a weakening European payments market. This uncertain guidance fueled a sell-off of over 50% on October 25.

Visa Inc. (V)

Visa’s earnings provide a broad overview of consumer spending globally. On top of this, the Cash App debit card is issued by Visa which makes the company’s earnings report especially relevant. The key results were:

- 9% payment volume growth.

- 10% growth in processed transactions.

- Similar growth in credit vs. debit card purchases.

- Lower card-present growth compared to card-not-present growth.

(Visa Q4 Earnings Deck)

Although Visa has experienced some pullback in its share price since earnings, the report shows that payment volumes are growing in general. Furthermore, we can see that card-present growth has been substantially weaker than card-not-present growth.

Implications for Block

Given all of the results, we can see that the merchant business has performed well in general both in the U.S. and globally (as exemplified by Fiserv) and in Europe (as exemplified by Worldline). However, the U.S. seems to be experiencing stronger spending compared to Europe and will likely have a more positive outlook compared to the latter. This is a good sign for Block, which sourced 96% of its revenues, including Bitcoin, from the U.S. in 2022 (2022 10-K). Another point of strength is the fact that general spending is still growing. This is a tailwind for both Square and Cash App.

While the general picture is positive there are two risks for Block based on the facts presented above. First, the Square business could be adversely affected by weakening spending in Europe, which could lead to lower guidance. Second, the Cash App business could be adversely affected by lower growth in card-present transactions. One large source of Cash App’s revenues is from transaction fees gained from debit card transactions. A slowdown here could have a large adverse effect on the group as a whole.

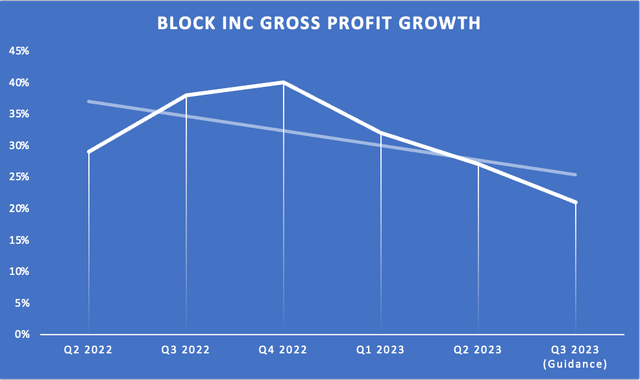

1. Gross Profit Growth

The first line item that I focus on during Block’s earnings is gross profit growth. Block management thinks of their business through a gross profit perspective rather than revenue since it has a cost focus and is more representative of the business due to abnormal (gross) accounting for bitcoin revenue.

Prior Performance

In Q2 gross profit growth amounted to 27% which was a slight slowdown compared to the 32% gross profit growth in Q1. Furthermore, gross profit growth has been in a downward trend since Q4 of 2022 – primarily due to the booming economy at the time, coming off of low COVID comparisons. The slowing growth has weighed down the sentiment for Block. The reason why Block’s share price decreased post-earnings during Q2 was primarily due to the lower-than-expected guidance in Q3 of 21% gross profit growth (Shareholder Letter Q2).

The Author

Updated Guidance

In Q3, we should expect a higher gross margin growth than the guided 21%. The reason for this is the updated terms in the Marqeta (MQ) deal. Marqeta provides card issuance and transaction services for the Cash App debit card. In August the two companies updated the contract terms of their partnership and renewed the contract until the middle of 2027. The updated terms mean that Marqeta will have a lower take rate on Cash App volume:

“Looking ahead to Q3 and Q4 of 2023, we expect the gross profit take rate we earn on Cash App volume to be approximately 40% lower as a result of the renewal.”

(Seeking Alpha Transcript).

The 40% reduction in price that Cash App has negotiated will boost margins for years to come and will definitely be reflected in the Q3 earnings report. Block has even issued the following update on X:

Block Inc X Account

Takeaway

Block Investor Relations decided not to update its guidance even though they expect the deal terms to increase growth profit, Adj. “EBITDA”, and Adj. Operating Income. The company does not give any indication of how much of an improvement they will experience in these factors, which makes it difficult to forecast. However, the bottom line is that we should expect both a higher gross profit growth in Q3 than 21% and a higher guidance for gross profit going forward.

Adjusted Rule of 40

Prior Performance

Block began indicating earlier this year that it expects to measure its ecosystem business units against the sum of its gross profit growth and adjusted operating income margin.

During Q2 Block achieved a gross margin growth plus adjusted operating income of 28%, as stated in their shareholder letter. Although this is short of the company’s 40% goal, it should be noted that this goal is a long-term effort. In my previous article on Block’s Q1 earnings, “Block: What To Look For And What To Disregard In Q1”, I noted that it was too early to judge the company based upon the Adjusted Rule of 40 in Q1 and Q2. However, for the upcoming quarters and years, I believe this metric will become increasingly important considering the potential further slowdown in gross profit growth.

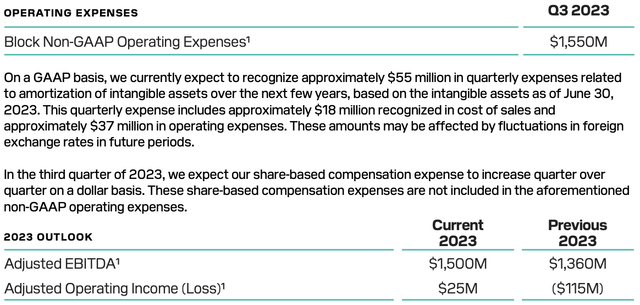

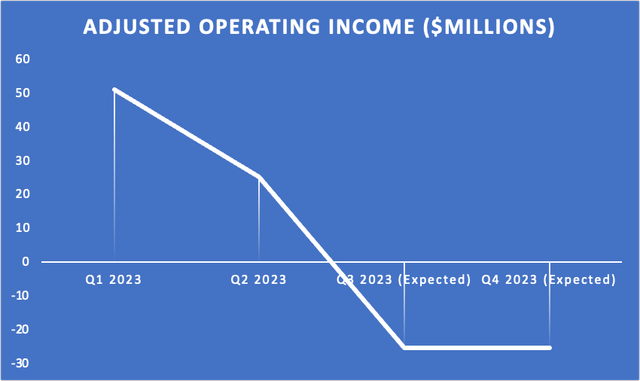

Guidance

Block Inc

Excluding the updated guidance from the Marqeta deal, Block previously guided for an adjusted operating income for 2023 to be $25 million. This represents a margin much lower than 1%, which means that it will not contribute meaningfully to the Rule of 40. Furthermore, since the adjusted operating income has been $72 million this year so far, the guidance implies that adjusted operating income will be an average of -$25.5 in the two upcoming quarters.

The Author

Takeaway

Block has updated its guidance in a positive direction with regard to profitability in Q1 and Q2, which implies that it will give an updated outlook for 2023 in Q3 as well. In the prior quarter, Block projected that their adjusted operating income would turn out to be $140 million better for the full year compared to the guidance in Q1. This reflects the fact that the company is cutting down on costs, including hiring slowdowns and investing in more proven marketing channels. Given that gross profit growth will likely be in the range of 21-23%, it is likely that Block will miss its Rule of 40 target by a long shot. Although the Rule of 40 is important, it is key to remember that this is a long-term goal that should not be overemphasized in the short term.

Furthermore, in Q3 we can expect a further increase in the profitability guidance, which would contribute to a positive sentiment for the stock price. However, there is a large risk profitability is weighed down by a bloated headcount. Although Block COO, Amrita, stated during the Q2 earnings call that they expect a head count increase of less than 10% in 2023, Block has yet to conduct any mass layoffs similar to what other big tech peers such as Shopify (SHOP) and Alphabet (GOOG) (GOOGL) have done. This could further stifle profitability efforts as well as positive stock market sentiment.

3. Non-Financial Metrics Regarding Business Growth

There are three important non-financial metrics to look at in the upcoming quarter:

- Cash App inflows framework.

- Square gross payment volume (GPV).

- Square upmarket growth.

1. Cash App inflows framework

Cash App has three drivers of success which are monthly active users, inflows per active user, and the monetization rate. In June monthly active users amounted to 54 million, representing a 15% YoY growth. In Q3, we should be looking for this number to continue increasing. In general new monthly activities may not grow significantly QoQ due to the company’s decreased marketing spend, however, given that Cash App has as much traction as Block says it does then there should be no reason for stagnation here.

Inflows per active is a measure of how much money each active brings into Cash App on a monthly basis on average. In Q2 the average inflow was $1,134, representing an 8% YoY increase and a flat QoQ change. Cash App has recently expanded its discount offerings to a wide array of merchants during the quarter which could help draw more money into the ecosystem. Therefore, I expect inflows to slightly increase QoQ. One factor that might work against this however is the fact that Cash App does not offer any interest-bearing savings accounts. In this high interest rate environment customers want to earn interest on money sitting in their account, which is something that traditional banks as well as the neobank SoFi Technologies (SOFI) offer.

Finally, the monetization rate on Cash App is likely to stay flat. Amrita stated the following in Q2.

“Monetization rate, which excludes gross profit contributions from our BNPL platform was 1.44%. Monetization was up 16 basis points year-over-year, driven primarily by pricing changes over the past year, and up 3 basis points quarter-over-quarter, driven primarily by the timing of strong first quarter inflows during the tax season.”

(Seeking Alpha Transcript)

Furthermore, it was noted that the company recently made price increases which means that the monetization rate is likely to stay around 1.44%.

2. Square GPV

GPV is a measure of the payment volumes that flow through Square. Last quarter Square had a GPV of $54.2 billion, representing a 12% YoY growth. For Q3 and Q4, Amrita offered explicit guidance:

“Square GPV is expected to be up 12% year-over-year, consistent with the second quarter as we’ve seen stability in GPV growth over the past three months from May through July. For the fourth quarter, we expect gross profit and GPV growth to improve slightly compared to the third quarter as Square benefits from more favorable comparisons.”

Hence, we should expect GPV to grow by 12% and a growth rate under this may be an indication of a further weakening macro environment. This type of growth is likely doable given Fiserv’s GPV growth of 15% YoY.

3. Square Upmarket Growth

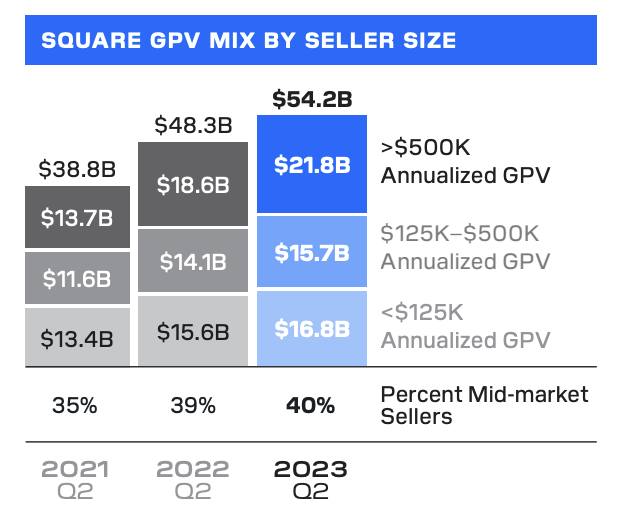

Finally, Square has made great initiatives to grow from serving small sellers to serving medium and large-size sellers. In Q2, 40% of the company’s GPV came from mid-market sellers, representing a substantial improvement from Q2 in 2021.

Block Inc

The growth to bigger sellers implies that Square will be placed in more durable chains that have more complex software needs. This creates GPV growth for Square as well as margin improvements as the company can sell more software services to these types of sellers. In Q1 of 2023, this rate was at 38% hence the recent improvement is likely attributed to the company’s new go-to-market strategy. Square is now focused on selling in specific upmarket verticals such as large stadiums, large restaurant chains, etc. They have done this by specializing in the sales force and also updating the website view to cater to the new strategy. For these reasons, I expect to see a slight uptick from 40% next quarter.

4. Key Product Milestones

There is one key product milestone that Block enthusiasts like myself have been waiting for: the integration of Square and Cash App. Jack Dorsey has said, at JPMorgan’s 51st Annual Conference:

“And within the app, we have this new area, which is super clunky right now called Discover that people right now are just using to find the people they previously paid or the people that they want to pay in their address book, but eventually will be the merchants around them, mostly Square merchants around them.”

The company is working on reinforcing the two ecosystems by having local offerings on the app, where Square merchants can be discovered and Cash App consumers can find great deals. This model has the potential to be really strong which is likely why the company is taking its time to get this right.

Recent job postings suggest that this initiative is a high priority within the company. A recent job description began with the following:

“We’re looking for a Product Manager to lead a new, 0 to 1 initiative of bringing a global consumer rewards program to market for Square. Reporting to the Product Lead for Customer Experience, you will increase discovery for our Sellers, help them attract new customers, and boost sales. Our vision is to connect Block’s Seller and Buyer networks to build an industry-leading cash back rewards program for local businesses, making every Square purchase rewarding.”

Creating this type of incentive that “make[s] every Square purchase rewarding” will create an incredible reinforcement effect on the company’s current operating model.

Takeaway

This merging of ecosystems has been in process ever since Block acquired Afterpay in August of 2021. Hence, it is likely that the roll-out of this integration will happen soon. However, there has been no clear indication of when this may happen which has dampened investor beliefs of it happening at all. Although it is highly uncertain when this will take place I believe that when it does happen it will drive strong momentum for the business as well as the stock price.

Summary: Catalysts and Risks

In all, this is what to expect going into Q3:

- Gross profit growth > 21% (previously guided).

- Higher gross profit guidance for Q4.

- Adjusted operating income > $25 million for 2023 (previously guided).

- Growth in Cash App monthly actives and inflows per active, with a steady monetization rate of 1.44%.

- Square GPV growth of 12% YoY.

- Square mid-market penetration of slightly greater than 40%.

- Update on the Cash App and Square Integration.

Given that all of these factors are upfilled I believe that we could see a positive post-earnings price action. Based on earlier earnings results of Fiserv and Visa, there seem to still be tailwinds in overall consumer spending in the U.S. which could support these catalysts above. However, Worldline’s negative outlook on the European market where Block is also active suggests that headwinds are also imminent. Since the market is extremely sensitive to bad news right now, it is likely that if Block misses on any of the key expectations above the share price will fall post-earnings. Given the information I presented above, I hope that you can make a judgment on whether Block is likely to meet these expectations or not.

I believe that Block will be able to meet the expectations it has set out for itself, including the updated guidance after the Marqeta deal. However, as a long-term shareholder, I am not going to stress any quarterly results. In the long term, I rate the company a strong buy due to the substantial pullback the share price has experienced. Furthermore, the key catalysts named above, if met, can lead to a price increase in the short term as well.

Read the full article here