Prelude

I initially covered Block (NYSE:SQ) in February of 2023 noting that Block has very strong growth prospects with the primary risk of stock-based comp equity dilution.

Management executed well on the growth thesis in 2023 and addressed equity dilution risk with a buyback program which led to my most recent Buy rating in December of 2023.

The recent earnings report strengthened my growth thesis and I am upgrading Block to a Strong Buy in this article.

Revenue came in $63.59m above estimate reaching $5.77b while Non-GAAP EPS missed by $0.12 coming in at $0.45. Although the bottom-line miss isn’t great, there were plenty of positive takeaways from this call.

First and foremost, Block is already below the 12,000 maximum headcount that they mentioned in Q3. This happened far quicker than analysts expected and will be a significant tailwind for 2024 expense reduction.

Next, what I consider Block’s “look-through” revenue, or revenues from just the transaction and subscriptions & services segments, was up 19.5% from $10,254,313 in 2022 to $12,260,143 in 2023. These segments have a much higher gross margin than the overall Block business because the Bitcoin segment carries a very high cost of revenue.

Although the look-through gross margin decreased from 41.2% in 2022 to 38.9% in 2023, there were tailwinds in the cost of transaction and subscription & services cost trends. Transaction costs grew 10%, slower than the 12% GPV growth, because of favorable interchange economics. This is driven by increased use of Cash App Card. However, Cash App Card processing fees drove an increase in subscription & services costs that eroded gross margin here.

Sacrificing some gross margin now for Cash App Card growth is critical to Block’s long-term profitability and something I’ll touch on. Finally, sales and marketing expense decreased as a percentage of gross profit, from 34% in 2022 to 27% in 2023. I expect this trend to continue in 2024 and Financial Services growth, which benefits subscriptions and services, will help increase gross margin back above the 40% benchmark that signals a competitive advantage.

Overall, this report showed overwhelmingly positive progress on Block’s strategic roadmap. By far the most important piece of this report was the strategic redirection of Cash App, from being just a peer-to-peer payments app to becoming a full-suite digital banking app.

Let’s dive in.

Retail Banking: Past and Present

The banking industry is primarily segmented into four divisions: Retail Banking, Investment Banking, Commercial Banking, and Private Banking.

Investment banks help finance IPO underwriting, facilitate mergers and acquisitions, and participate in equity and bond markets. Commercial banks typically deal with large, multinational enterprise bank accounts and private banks are for high-net-worth individuals – typically $1m net worth and above. Some international banks may also have a global banking division that helps with global trade financing and other cross-border transactions.

The remainder of individuals and small-to-medium-sized businesses fall within the retail sphere.

For years, proximity was one of the deciding factors for retail banking relationships. Small regional banks were popular not because of product differentiation or superior economics but because people needed to live close to their bank branches.

Over time, well-managed banks grew and the industry became increasingly consolidated. Scale then became a critical factor to bank profitability – and whichever bank had more brick-and-mortar branches tended to grow the quickest. Again, this is because they had the highest number of physical locations with close proximity to vast swaths of the population.

This is no longer the case.

The rise of digital banks, or the “bank in your pocket”, has led to digital-first (web and mobile) experiences becoming the default for retail customers. Proximity no longer matters – digital banks are ubiquitous. You carry your bank with you everywhere you go.

This changing dynamic led to bloated real estate footprints that many scaled retail banks are now trying to downsize from. While physical reach is still important for many big banks – Chase (JPM), Citi (C), Wells Fargo (WFC), and the like – the digital disruption allowed many Fintechs to make inroads into the legacy banking industry.

At the same time, increasingly strict banking regulations led to the exclusion of many of America’s poorest citizens from traditional banking relationships. Many of these people depended on predatory payday loans and cash to participate in the economy. As the economy became more cashless, many of these people were outright excluded from participating in the economy. These people became known as the ‘unbanked’ population.

An entrepreneur and hacker-extraordinaire by the name of Jack Dorsey had a vision of changing this.

The Foundations of CashApp

CashApp started as a pet project from an internal hackathon held by Square. Jack Dorsey, Block CEO, wanted a seamless way for people to send and receive money without a bank account.

CashApp was born in Atlanta and quickly spread throughout the community. A peer-to-peer (P2P) payments network is acutely dependent on network effects, so CashApp always offered referral bonuses and the “trust-then-verify” onboarding model allowed for seamless customer onboarding.

It was a smash hit in the Atlanta region, so the team brought it nationally. Their strategy was one of product-led acquisition, and by incentivizing current users to refer new users, the CashApp network spread to become one of the largest financial networks in America.

CashApp now touts one of the industry’s largest customer bases, but P2P payments are difficult to monetize. As a result, Jack and team have shifted CashApp’s strategy from one of scaling the network to deepening the product suite. Thus, CashApp the digital bank was born.

Deepening The Suite

Now that CashApp is one of the most popular finance apps, Block management will focus on monetization efforts. They expanded CashApp offerings into investments, Bitcoin, direct deposit, debit cards, tax filing services, savings accounts, and buy-now-pay-later (BNPL).

Today, CashApp offers a product suite that is equivalent to or more robust than all major banking institutions. In the Q4 2024 shareholder letter, Jack said they are pivoting CashApp’s strategy to a banking model. This allows for further enrichment of the Block ecosystem, better monetization of CashApp, and will pave the way for sustainable profit growth.

To achieve this, management is focusing on two things: Primacy and Relationship Deepening.

Primacy refers to the primary financial institution of a consumer. Your primary bank is the one which you use most often. The two leading factors of primacy are debit cards and direct deposit.

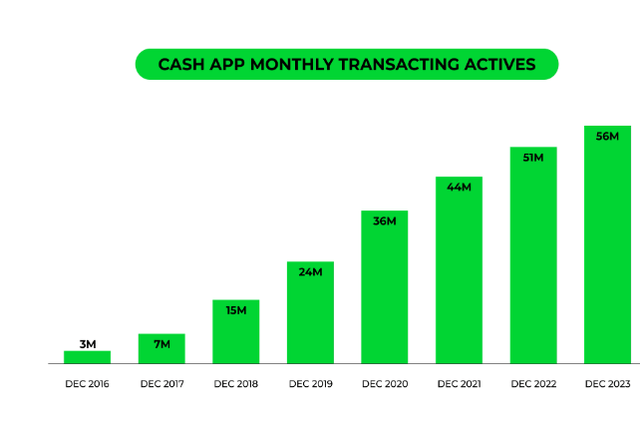

CashApp card, the debit card linked directly to a CashApp account, has grown to 23 million users as of this writing. Meanwhile, only 3% of CashApp’s 56 million monthly actives have direct deposit setup or roughly 1.68 million customers. Transacting actives are rapidly growing, so Block now needs to increase the rate of direct deposit users:

Block 2023 10K

To achieve this, Block recently began offering 4.50% APY on its savings account, earning the title of a high-yield savings account. Meanwhile, CashApp card customers can earn 1.50% on their savings.

This strategy will work but it will take time. Many CashApp users are unbanked, so they don’t have access to many high-yield savings accounts. By setting up direct deposit they can access this account and also open a debit card for day-to-day transactions.

However, this yield and the availability of other financial services like overdraft coverage, P2P payments, and check deposits make CashApp’s banking proposition more compelling for the middle class as well. Jack Dorsey is targeting consumers earning between $100,000-$150,000. These customers offer much more monetizable value than unbanked consumers.

I firmly believe this strategy will work and that it will deliver immense shareholder value over time. The CashApp network is very scaled and further monetizing this network is the right strategic decision.

While shareholders should applaud the strategic direction of CashApp, this pivot to digital banking is important and very positive for another reason.

Square: The Full-Stack Commerce Platform

Square resembles a retail business bank in many ways. It offers business bank accounts, loans, and debit cards. But Square is much more than this – it is a full-stack SMB (small-to-medium-sized business) commerce platform.

Square offers software solutions for customer relationship management (emails and SMS to customers), enterprise resource management (critical to growing a business and managing inventory), website building, transaction reporting and analytics, one-click buy from wholesalers, appointment booking, and AI-enhanced features like menu generation and product descriptions.

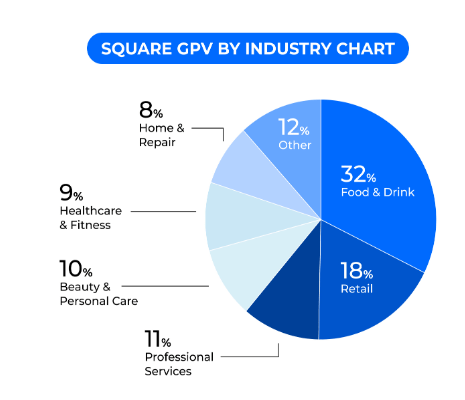

These software solutions sit atop the payment terminal hardware solution and are differentiated for numerous industry verticals:

Block 2023 10K

As Block (Square at the time) was growing the Square network, most revenues came from hardware sales. Simply from buying the Square dongle or the payment terminals. Once a business purchased the hardware, Square became a ‘merchant acquirer’ within the context of the payments ecosystem.

A merchant acquirer is a company that facilitates payments from consumers to businesses. Since most Square users were very small, Square’s Gross Payment Volume (GPV), was very small – and Square earns only ~1% of GPV as revenue.

Merchant acquirers charge a percentage of each transaction processed on their hardware, which is the ‘transaction fee’ that businesses pay. On average, this fee sits around 3%, but Block doesn’t get the whole 3%. A slice of this fee goes to card issuers like Visa (V) and Mastercard (MA), while the bulk – nearly 2/3rds – goes to the sending and receiving banks in the form of interchange fees. Square will get roughly 30% of the fee or 1% of each transaction processed through a Square terminal. This is Square’s “take rate” of their GPV.

Using this context, let’s discuss why CashApp’s pivot to a digital bank is overwhelmingly positive for shareholders.

Growing “On Us” Transactions

Growing Square GPV is good for Block since its revenues will increase alongside it. However, for sustainable earnings growth and gross margin expansion, we need a strong competitive advantage. Block’s competitive advantage, while still taking shape, is becoming clear: process a growing number of “on us” transactions.

An “on us” transaction in this context is one from a CashApp user to a Square seller. In this instance, Block will not need to pay interchange fees as they are not pulling money from or sending money to other banks. It is staying within the Block ecosystem. This will be very margin accretive because interchange fees are a material percentage of Block’s cost of revenue, so it will boost gross margin in a meaningful way.

The Afterpay acquisition was Block’s first move toward boosting the volume of “on us” transactions since Afterpay had a strong network of in-app marketing. Participating merchants are displayed within the Afterpay app, so Afterpay users can buy right from them. The BNPL product will be incorporated into CashApp in the coming months, and with it, this internal marketing strength.

Further, Block will have the capacity to decrease merchant transaction fees for CashApp transactions, thus incentivizing them to push CashApp in their business. They can do this while still growing gross margin because interchange fees are so high. Although Block hasn’t yet stated they will do this, it’s a lever they have at their disposal.

The Ecosystem of Ecosystems

All of this ties back into the recent rebranding from ‘Square’ to ‘Block’. In this rebranding, management described the company as an ‘ecosystem of ecosystems’. The goal was to integrate the ecosystems to sustainably grow profit, and management is pursuing this goal through Square’s full-stack commerce offering and CashApp’s pivot to digital banking.

No one is doing what Block is doing.

I expect the ecosystem model to work wonderfully over time, and accordingly believe Block is an attractive investment.

Valuation and Risks

My estimated fair value price of Block is $140-$160 per share, or a market cap of ~$92b at the midpoint. My model assumes a ten-year CAGR of 14% from Block’s $1.15b adjusted operating income guidance in 2024. Finally, I assumed a multiple of 21 for price-to-adjusted operating income, which is materially below the current forward multiple.

The primary difference between my updated valuation model and the previous one is that I’m using adjusted operating income guidance here. Previously, I estimated on 15% growth for adjusted operating income in 2024, but the guidance provided in the call was much more ambitious. Therefore, I’m being somewhat more aggressive in my estimate, but Block has a proven track record of execution at scale and I believe this will continue.

From the strong growth story to the compelling valuation, I believe Block’s current price represents an extremely attractive long-term investment opportunity.

The primary risk to this thesis, aside from a wider macroeconomic slowdown, is equity dilution.

Although Block announced a $1b stock buyback program in 2023 Q3, they used only $156m of it in Q4. This was not enough to stem the dilution of stock-based comp, which is still a significant headwind for the stock’s performance. I’ll be looking for Block to use significantly more of the buyback program and either announce an expansion of it or reduce stock-based comp expense in 2024.

On a more optimistic note, the 12,000 maximum headcount that Jack set is a promising sign for less dilution in the future. Fewer employees simply means fewer equity rewards; however, this headcount cap alone won’t stem the flow. Existing shareholders were still diluted in Q4 despite buybacks, and thus the risk persists.

Conclusion

I am very bullish on the Block business and stock and am upgrading it to a Strong Buy. I believe in the growth story, see a very compelling valuation, and trust the management team to continue executing at scale.

The Q4 report gave investors plenty of reason to be optimistic on the future of Block, and I believe investors will be richly rewarded for buying and holding this stock long-term.

Read the full article here