Introduction

Some investors may prefer to invest in other sectors like tech or consumer staples because of the capital appreciation those stocks tend to offer. But one sector that has offered investors some capital appreciation in the last few years is the BDC sector (BIZD).

Since I’m constantly building and adding to my dividend portfolio to live off of in the next 5-10 years, BDCs and real estate investment trusts have long been staples in my portfolio. And it’s one of the reasons I typically cover stocks in those sectors here on Seeking Alpha.

And since the recent banking crisis roughly a year ago, I think BDCs will only continue to benefit investors for the long term. I have many that I hold and consider the top BDCs in the sector like Ares Capital (ARCC), Capital Southwest (CSWC), and Blackstone Secured Lending (BXSL). One that I think falls right behind those 3 in terms of quality is Blue Owl Capital (NYSE:OBDC), and in this article I discuss why OBDC is one of the best BDCs your money can currently buy.

Previous Rating

I last covered Blue Owl Capital about 6 months ago back in October in an article titled: When Market Uncertainty Gives You Lemons, Make Dividend Lemonade. With interest rates scaring many investors out of the market into safer, fixed-rate investments like bonds, CD’s, and money markets, I thought OBDC was the perfect investment to park your cash to earn a nice yield.

Additionally, they lend to U.S. middle market companies that have a weighted average EBITDA of $200 million diversified across 29 industries. Their current the second largest BDC by market cap at $5.96 billion.

I liked the BDC because of its strong dividend coverage and their conservative balance sheet. I rated the stock a buy because of its double-digit discount to its NAV price then, and if you’d bought then, you’d be up nearly 15% while also collecting a nice dividend yield. Since then, the BDC has went to to report an additional two quarters to close out 2023. And let’s discuss the company’s financials and see why they are one of the top BDCs if looking for income.

Strong Financials

Since my last buy rating, OBDC reported both Q3 & Q4 earnings to close out the year. And I have to say I was impressed. During its Q4 earnings reported on February 22nd, the BDC beat analysts’ estimates on both net investment and total investment income, growing both quarter-over-quarter.

Nll of $0.51 beat estimates by $0.03, while Tll of $411.23 million beat by an impressive $13.48 million. With the challenging economic backdrop that has not only made it harder to make attractive investments, but also placed downward pressures on borrowers due to higher for longer interest rates, beating on both was something I was impressed with from OBDC.

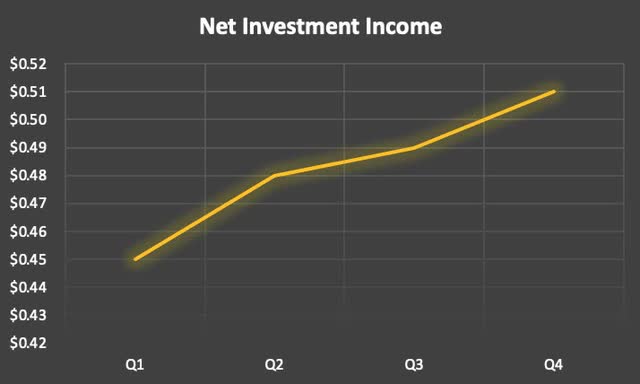

In the chart you can see OBDC’s Nll continued on an upward trajectory. And considering the macro environment, which has plagued some BDCs, this speaks to their management team and credit quality as well.

Author creation

Net investment income also grew year-over-year, up more than 24% from $0.41 in Q4 ’22. Total investment income also grew nicely, up from $399 million in Q3 and from $377.62 million in the first quarter. Moreover, net interest margins also grew from 11.5% to 12.4% year-over-year. So, Blue Owl Capital seems to be firing on all cylinders.

However, the fair value of the portfolio declined to $12.7 billion, down from $12.9 billion at the end of quarter. Moreover, the BDC still made additional investments, growing to 193 portfolio companies at the end of Q4. This is up from 187 in the third quarter and 184 companies at the end of 2022.

And although their first-lien investments declined, they still have a good percentage invested in first-lien loans at 68%. This is lower in comparison to peers, Capital Southwest and Blackstone Secured Lending, whose first-lien/senior-secured loan percentages were 97.4% & 86.5% respectively. But OBDC’s remained higher than ARCC’s 65.1%.

For those unfamiliar with first-lien loans, lenders have priority of payments in comparison to those invested in say, second-lien loans. Therefore these are considered safer and something investors look for when considering investing in the sector. It also makes their financials more stable and less susceptible to economic downturns.

Growing NAV & Dividend

Blue Owl Capital’s NAV growth also grew steadily over the course of the year. This is something investors looking to buy into the sector should pay attention to. This shows not only a growing portfolio, but that the company has comfortably continued to out-earn its dividend.

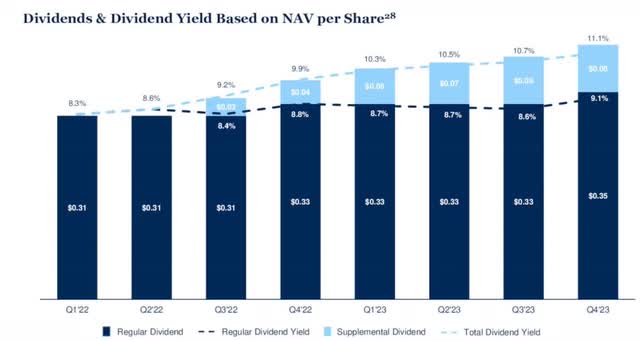

NAV grew from $14.99 to $15.45 year-over-year. This was also up from $15.40 in Q3. With some BDCs paying out extra income in the form of special and supplemental dividends, this can sometimes decrease NAV if coverage is less than 100%.

But even with the supplemental of $0.08 and dividend increase to $0.37, Nll of $0.51 still covered this by more than 100%. OBDC finished the year with $0.30 in spillover income and paid out $1.59 in dividends while earning $1.93 in net investment income.

This is an increase of 37% year-over-year. Additionally, pro forma regular dividend coverage still remains strong at 138%. The beauty of BDCs paying out extra income is that if coverage becomes too tight, management can elect to lower, or just eliminate the special or supplemental all together.

OBDC investor presentation

OBDC also raised the dividend in November by 6.1% to $0.35, rewarding shareholders with dividend increases on top of the supplementals they paid out over 2023. So, while income grew nicely for OBDC because of higher interest rates & in thanks to its predominantly floating-rate portfolio of 97%, the dividend growth has followed as well. This grew from $0.33 at the start of the 2022 and seeing by their growing Nll, I expect to see this increase for the foreseeable future.

Improved Balance Sheet

I was probably most impressed by the fact that OBDC managed to improve its balance sheet. The BDC managed to de-leverage, bringing their debt-to-equity ratio to 1.09x, in management’s target range of 0.90x – 1.25x. This is also down from 1.19x at the end of 2022. For comparison purposes, this is slightly higher than ARCC’s 1.02x at the end of 2023.

And while they do have some debt maturities this month with $400 million, the company had more than enough liquidity available to cover this with $2.1 billion. This also increased from $1.8 billion in Q2.

For next year, the BDC has more than double due with $940 million, but the company raised $600 million in equity from unsecured notes in which some of the proceeds can be used to repay upcoming debt. But again, this is more than manageable as seen by the BDC’s access to capital and investment-grade credit ratings from both Fitch & S&P.

OBDC investor presentation

Risks To Thesis

Although they kept these minimal, Blue Owl Capital did have four companies on non-accrual status at the end of Q4 with one added for the quarter. These accounted for 1.3% & 1.1% at cost and fair value. This is in comparison to popular peers, CSWC & ARCC whose non-accruals accounted for 2.2% and 1.3% respectively.

However, this is much lower than peer, FSK KKR Capital (FSK) whose non-accruals accounted for 5.1% at cost and 2.6% at fair value, staggeringly high and more than I like to see within the sector. And if the economy experiences a sudden downturn like a recession, this number could tick up in the coming months.

OBDC took over one of the four companies on non-accrual status as they had been non-performing for quite some time. As far as updates on the two additional companies, the management team stated they had no update during the latest earnings. And although the current list of non-performing loans is manageable, investors in OBDC should keep a close eye in the coming quarters.

Small Discount To NAV

Despite their share price appreciation over the last few months, OBDC still offers a small discount to its NAV price of $15.45 at a price of $15.28 at the time of writing. However, the current discount is lower than the BDC’s 3-year average of -8.34%, but seeing as how they are up over 24% and strong growth in the past year, getting the BDC at a large discount seems highly unlikely.

Seeking Alpha

Investor Takeaway

Blue Owl Capital showed strong earnings during economic uncertainty with a beat during its most recent quarter. Additionally, they continued to out-earn the regular dividend and supplemental which resulted in some impressive NAV growth over the course of the year.

They also improved their leverage level and increased liquidity, putting themselves in a strong position to take advantage of potential attractive investments with interest rates expected to decline sometime this year. They also increased the regular dividend while managing $0.30 in spillover income.

And while they did add one company in Q4 to non-accrual status, the low percentage is a testament to not only their management team, but portfolio credit quality as well. And while I expect the supplemental dividends to fade away as interest rates decline, OBDC’s strong financials continue to show investors why they are one of the best in the sector for income-focused investors.

Read the full article here