Note:

I have covered Boxlight Corporation (NASDAQ:BOXL) previously, so investors should view this as an update to my earlier articles on the company.

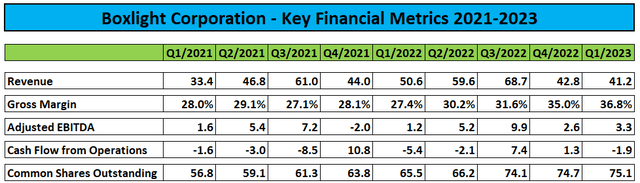

Last month, Boxlight Corporation or “Boxlight” reported slightly better-than-expected first quarter results with both revenues and profitability coming in ahead of management’s muted projections:

Company Press Releases and Regulatory Filings

With container freight rates down by almost 85% from their September 2021 peak, Q1 consolidated gross margin of 36.8% increased to new all-time highs.

Unfortunately, management does not expect the recent margin improvement to take hold, as stated during the questions-and-answers session of the conference call (emphasis added by author):

We don’t believe we can maintain the kind of the higher 34% to 37% margin, I think it’s going to come back down. So we continue to say north of 30%. The reason we’ve come in higher than even what we’ve guided, it’s just because we’ve done a good job of maintaining high pricing.

So we have seen the benefits, as you mentioned, from cost downs and lower cost for transportation, but we’ve also made it a conscious effort across the company to try to maintain this higher pricing. And that’s worked, but we’re going to start seeing a lot more price pressure. We’re starting to see already, particularly in these larger opportunities, in these bigger tender RFP processes, we’re going to have to be slightly more competitive on pricing. And so — we do expect that to come down in the short-term, meaning over the next couple of quarters. Again, we believe north of 30%, but we believe the 37% is probably an anomaly.

In addition, sales were down by close to 20% on a year-over-year basis as the company experienced weak customer demand across all markets:

Despite a challenging first quarter with softer customer demand across the industry, we gained market share in each of our key territories and generated improved profitability, commented Michael Pope, Chairman and Chief Executive Officer. “Our increase in Adjusted EBITDA by $2.1 million over Q1 2022 is attributable to our robust gross profit margin of 36.8%, our highest to date, and our commitment to maintaining conservative operating expense levels.

We remain confident in our outlook for the remainder of 2023 and expect modest growth for the full year.

First quarter order intake of $41.5 million was down 35% as compared to Q1/2022.

For the second quarter, management projected a similar year-over-year sales decline with revenues and Adjusted EBITDA expected to come in at $50 million and $4 million, respectively.

Even with H1 revenues expected to be down significantly from 2022 levels, CEO Michael Pope remained optimistic on achieving year-over-year sales growth:

Our confidence in delivering full-year revenue growth is based on our global sales pipeline and an increase in significant tenders in key global markets.

Negative operating cash flow of $1.9 million represented a markable year-over-year improvement as higher margins more than offset the substantial decline in revenues.

The company ended the quarter with cash and cash equivalents of $11.3 million and outstanding debt principal of $49.3 million under its expensive credit facility with a division of WhiteHawk Capital Partners (“WhiteHawk”).

Subsequent to quarter-end, Boxlight amended the terms of the credit facility (emphasis added by author):

The Third Amendment was entered into for purposes of the Lender funding an additional $3.0 million delayed draw term loan (the “Additional Draw”). The Additional Draw was funded on April 24, 2023, must be repaid on or prior to September 29, 2023, is not subject to any prepayment penalties, and adjusts certain terms to the Credit Agreement, including adding test period end dates and corresponding Senior Leverage Ratios (as defined in the Credit Amendment) and revising the minimum liquidity requirements that the Company must maintain compliance with pertaining to certain Borrowing Base Requirements (as defined in the Credit Agreement), among other adjustments.

In exchange for being provided additional funds and limited covenant relief, the company agreed to terminate the remaining delayed draw term loan commitments.

While management expects liquidity to be sufficient for ongoing working capital needs and debt service requirements, Boxlight will have to address approximately $16 million in outstanding Series B Preferred Stock issued in conjunction with the acquisition of Sahara Presentation Systems (“Sahara”) back in 2020 in the very near future (emphasis added by author):

(…) outstanding shares of our Series B preferred stock are redeemable at the option of the holders at any time or from time to time commencing on January 1, 2024 upon, 30 days prior written notice to the holders, for a redemption price, payable in cash, equal to the sum of (a) ($10.00) multiplied by the number of shares of Series B preferred stock being redeemed (the “Redeemed Shares”), plus (b) all accrued and unpaid dividends, if any, on such Redeemed Shares.

We may be required to seek alternative financing arrangements or restructure the terms of the agreement with the Series B preferred shareholders on terms that are not favorable to us if cash and cash equivalents are not sufficient to fully redeem the Series B preferred shares.

To be fair, I do not expect the former owners of Sahara to force Boxlight into a potential bankruptcy by demanding immediate cash redemption.

On the flip side, it is difficult to envision a potential restructuring of the Series B Preferred Stock at favorable terms to the company.

In any way, with the Series B Preferred Stockholders’ redemption option coming into play in the not-too distant future, a new element of risk has been added to the story.

Despite less-than-stellar liquidity, Boxlight recently announced a $15 million share repurchase program:

As our business matures, we expect growing operating cash flows that we will strategically deploy to drive long-term value to our shareholders, including the repurchase of our stock during times we are trading below our intrinsic value,” commented Michael Pope, CEO and Chairman at Boxlight.

But with debt facilities being maxed out, cash flows from operations under ongoing pressure from elevated interest payments and the requirement to build inventory for the seasonally stronger second and third quarter, I do not expect material share buybacks anytime soon.

Please note also that Boxlight is subject to a $4 million minimum liquidity covenant under its credit facility.

On Tuesday, the company announced the decision to execute on a 1:8 reverse stock split in order to regain compliance with Nasdaq’s $1 minimum bid price requirement:

Boxlight Corporation (…) announced that its Board of Directors has approved a 1-for-8 reverse stock split of Boxlight’s Class A common stock. (…)

The Reverse Stock Split will become effective at 5:01 p.m. Eastern Time on June 14, 2023, and the Class A Common Stock will open for trading on The Nasdaq Stock Exchange on a reverse split-adjusted basis on June 15, 2023 under the existing trading symbol “BOXL”.

Consequently, the number of outstanding common shares will be reduced from 75.1 million at the end of Q1 to approximately 9.4 million.

Bottom Line

Quite frankly, even when considering recent margin improvements and the company’s depressed valuation, it’s difficult to get excited about Boxlight Corporation’s prospects going forward.

For my part, I am taking issue with management’s ambitious year-over-year growth expectations despite ongoing weakness in customer demand.

In addition, renewed pricing pressure is expected to impact gross margins in the near-term.

Lastly, the uncertainty regarding a potential exercise of the redemption option by holders of the company’s Series B Preferred Stock in early 2024 is likely to weigh on the shares going forward.

Given these issues, I would advise investors to remain on the sidelines and wait for management to deliver upon its ambitious second half sales targets and address the Series B Preferred Stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here