When it comes to dividend stocks, there are a lot of great options out there from low yield, moderate yield, or even high-yield stocks. Low yield dividend stocks like Apple (AAPL) and Microsoft (MSFT) offer some nice growth potential and a little dividend to go along with that growth potential.

Then you have more moderate paying dividend stocks like Johnson & Johnson (JNJ), which offer a 2-4% dividend yield with average growth.

All of those companies are great, and I own all of those companies mentioned, but the stock that is packed with a ton of growth potential for the next decade and beyond is Broadcom (NASDAQ:AVGO).

In today’s piece we are going to:

- Breakdown Broadcom the company

- Look at the company’s growth potential

- Assess the strength of the company’s financial statements

- Understand the safety and reliability of the company’s dividend

- Determine if today’s valuation is worthy of a buy or if we should be patient

Let’s jump into taking a closer look at AVGO.

Company Overview

Broadcom Inc. is a semiconductor company that designs, develops, and supplies various semiconductor chips and devices. Broadcom has roots dating back to 1961 when Hewlett-Packard spun off Agilent Technologies in 1999. In 2005, the semiconductor segment of that business was acquired for $2.6 billion and Avago Technologies was formed, hence where the stock ticker comes from. In 2009, Avago Technologies went IPO.

Fast-forward to May 2015, Avago Technologies announced its acquisition of Broadcom Corp for $37 billion, and at that point the company changed its name to Broadcom Inc.

Broadcom

In 2016, Broadcom actually looked to acquire Qualcomm (QCOM) in a hostile takeover for $117 billion, but it was blocked by the Trump Administration citing national security concerns.

Loaded Growth Potential With AI

Broadcom operates primarily within two operating segments:

- Semiconductor Solutions

- Infrastructure Software

Broadcom has a number of different products, which only increases its reach as well as the company’s investability. Broadcom has products within Wireless, Connectivity, Storage, Data Centers, Software, and cybersecurity just to name a few.

Oh and how could I forget, Artificial Intelligence, or AI.

The bulk of the AI related revenues is found within the semiconductor solutions segment. The semiconductor solutions segment accounts for roughly 80% of total company revenues.

AI has been a big growth driver for the company, which was much needed considering the slowdown the industry has seen when it comes to mobile devices.

However, the AI boost is making up for some of the other sub-segments being slow for the company, but with those areas set to recover and AI continuing to provide a boost, this bodes well for a nice growth trajectory for Broadcom moving forward.

Broadcom management is expecting AI revenues will account for more than 25% of semiconductor solutions revenue in FY ’24. To put the growth in dollars, AVGO AI related sales are expected to reach $3.8 billion this year before rising to more than $7 billion in FY ’24.

In addition to the growth in AI, the company has a pending $69 billion acquisition of VMware (VMW), which would further accelerate its adoption of cloud technologies.

A Closer Look At The Company’s Financials

Next, let’s take a look at some of the company’s latest financial results, beginning with segment revenues.

- Semiconductor Solutions Q3 Revenue: $6.9 billion

- Infrastructure Software Q3 Revenue: $1.9 billion

Total revenues for the quarter were $8.88 billion, which was an increase of 5% from the same period last year. Semiconductor revenues increase 4.8% during the quarter with Infrastructure Software revenues climbing 5.2%.

Revenues are great, but if a company is not operating efficiently, it means nothing. Here are a few other areas the company is performing well.

Adjusted Operating Income for the past 12 months was $21.88 billion, a 14.1% increase over the prior 12 months. Operating margin has increased from 60.5% to 61.7% over that same period.

In addition, AVGO has seen free cash flow, or FCF, increase 13.5% over the past 12 months to $17.37 billion. The FCF margin over that period has increased from 48.3% to 49.0%.

A Healthy and Growing Dividend

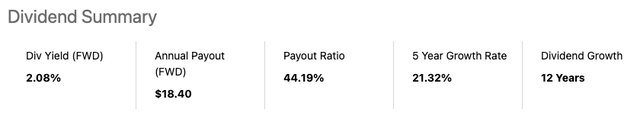

This leads nicely into discussion of the dividend. After all, free cash flow is what makes the dividend grow. On a per share basis, FCF for the company is $40.68. AVGO currently pays a dividend of $18.40 per share, which equates to a FCF payout ratio of 45%, which is extremely healthy. The AVGO dividend currently yields 2.1%.

Seeking Alpha

Broadcom has been increasing their dividend for 12 consecutive years and given the healthy FCF payout ratio, I expect this to continue moving forward. Broadcom has a strong five-year dividend growth rate of 21%.

Time To Buy, Sell, or Hold AVGO Stock

So is now the time to BUY, HOLD, or SELL shares of Broadcom? Well, everything about the company sounds great, for the most part.

Some of the risks and concerns have been around the legacy products and services for the business. If you take away the AI generated revenues, the company would be looking more at flattish growth, so on one end AI is holding up more than its part of the bargain, but a return of growth is also exciting for investors. On the flip side, if AI does not grow into its lofty expectations and the legacy businesses do not turn around soon, AVGO shares could go through a re-rating.

Broadcom has had a tremendous year, a top performing dividend stock in 2023 with the stock up 60% on the year and up 102% over the past 12 months.

Seeking Alpha

When it comes to AI related stocks, AVGO is actually more of an AI value play. Not only do you get a healthy and fast growing dividend, but you are not paying the multiples you find on other semiconductor stocks like Nvidia (NVDA) or Advanced Micro Devices (AMD).

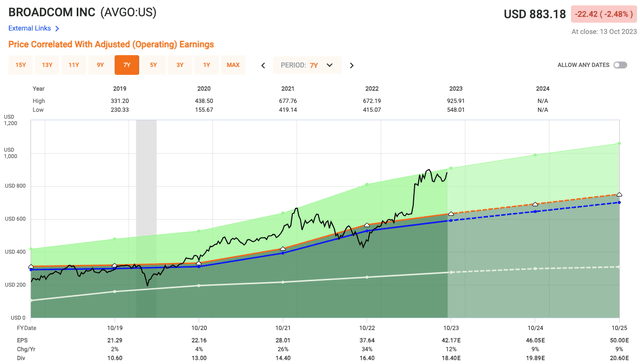

Analysts expect AVGO to generate EPS of $46.05 per share in FY 2024, which would be growth of 9% from what is expected in Q4. This equates to an earnings multiple of 19.2x.

Fast Graphs

For comparable purposes, NVDA shares trade closer to a 30x forward multiple and AMD trading at 26x next years expected earnings.

AVGO trades at a forward multiple of 19.2x, cheaper than other semiconductor plays, but it appears expensive relative to the company’s 10-year average multiple of 15x.

Is the higher multiple warranted given the AI potential and continued growth. One way to decipher that is by utilizing the PEG ratio which takes the earnings growth into account when looking at the P/E multiple.

- Forward P/E Multiple: 19.2x

- 2024 expected EPS growth: 9.2%

- = PEG Ratio of 2.1x

A 2.1 PEG is on the high side, as I generally look for deals below 1.0 and the company’s five year average is 1.13x.

There is a lot to like about Broadcom, both now and moving forward, which is why I believe it will be one of the BEST dividend growth stocks to hold for a number of years. The AI prospects will add to margin and free cash flow, which should justify continued dividend increases in the high teens moving forward.

However, my only complaint right now with Broadcom has to do with valuation. As a disclosure, I currently own shares of Broadcom and have for a while, so at 19.2x and a PEG ratio above 2, along with other metrics like Price to FCF looking inflated, I think it is best for investors to be patient, looking to enter into the name on pullbacks.

I currently rate shares of AVGO as a HOLD.

In the comment section below, let me know your thoughts on shares of AVGO.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Read the full article here