This year was tumultuous for Burford (NYSE:BUR) in a positive sense, with:

- early inflection of speed in the resolving of court cases since an abnormal backlog has amassed during CV-19

- Burford’s disclosure it was working with the SEC to define an industry standard for GAAP valuation of litigation assets: this spooked the market for a few days, until:

- Burford’s – and plaintiffs Petersen and Eton Park – win against Argentina where Argentina (but not YPF!) was found guilty of expropriating YPF in 2012: the range of potential damage to be determined was left uncertain until yesterday

- Burford and SEC successfully conclude review on GAAP valuation of litigation assets

- Damages ruling now suggests a 16 BUSD claim against Argentina. This is based on the judge agreeing 100% with the plaintiffs’ variables on both April 16 as the relevant expropriation date to use (where damages are highest given YPF share price crashed afterwards), and a pre-judgment interest of 8% (Argentina had argued for rates down to 0%). See Burford’s own press release from yesterday.

As a shareholder, I’m excited for this Wednesday (September 13th), as Burford Capital will report its quarterly earnings.

Backdrop: Negativity and skepticism

After an impressive performance since IPO, Burford was a popular name with both UK retail and the buy-side in 2018 and 2019. This caused its valuation to be ‘priced for perfection’, as investor bull theses (buy-side included!) started pondering on what P/E to value Burford. As Burford’s earnings can be lumpy in any given annual period (given the short-term uncertainty in timing of cases resolving, and the binary risks of any small subset of cases resolving), this is a weird framework. It’s as if I were to value a hedge fund like Pershing Square on a P/E basis while it trades and deals in stocks and derivatives.

Carson Block’s Muddy Waters had a good eye for this weakness in market perceptions (and market participants vague understanding of the name) and wrote a highly successful hit-and-run short report. Most of the short report’s points were either factually inaccurate, were making up conspiracies that do not follow from Burford’s reporting (such as faulting Burford for misleading investors with publishing certain KPI metrics, while in reality certain investors were just not taking the time to carefully read the annual reports), or highly cherry-picked case losses.

At the time, I had just finished reviewing all the annual reports and shareholder letters since IPO (which I highly recommend) and was fascinated by this manic depressive mood swing of Mr. Market. I believe Burford’s founders are a (very) rare breed at the intersection of expert lawyers and well-read risk takers. The first is easy to discern from the founders’ CV’s (Professor in law, GC Time Warner). The second can be deducted from reading the shareholder letters, some of the CV (Molot is an academic pioneer in litigation finance theory, while Chris Bogart had founded and run a biotech fund beforehand e.g.). A few years ago, an industry podcast with a Burford employee and electrical engineer by training exposed Burford was using information theory (i.e. Kelly criterion) for determining optimal betting sizes. As opposed to the stock market where applying the Kelly criterion carries with it many unknown uncertainties, as an electrical engineer myself with a love for information theory, I believe Burford’s founders are visionary to apply it to their asset class with better defined parameters.

Covid-19 prolonged the Muddy Waters overhang of skepticism and low price book valuation, as case durations were stretched with delays: to this day, Burford’s vast majority of earnings are determined from cases resolving (and not fair value mark-ups), as evidenced by Burford’s book value ex-YPF today being only marked at around 110% of cost.

This makes Q3 and Q4 all the more interesting, as Burford has noted a true pickup in speed of cases resolving since the beginning of the year.

Burford’s updated valuation

Very little things in life are certain, but betting on a virtually uncorrelated portfolio of outcomes is a nice to have when that company is building an excellent reputation in the industry, a third party capital management business with high performance fees, and simultaneously trades below its liquidation value.

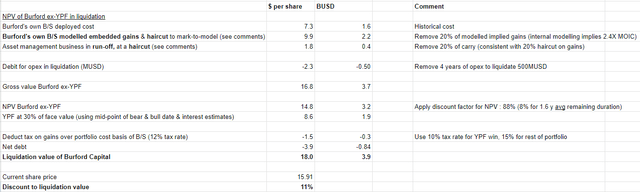

As in my last post, I provided a liquidation value estimate for Burford. This assumes Burford Capital is wound up after its current set of cases, the cases resolve with 20% less gains than Burford’s increasingly accurate internal modelling suggests, Burford has quite some residual opex to wind up, and a 70% haircut on the Argentina claim face value.

I do this again now with YPF damages resolved, to find a lower boundary of what I personally am willing to pay (18$ per share). The conclusion is that I cannot sell a penny of my position at the current market price.

Author’s estimates based on company public filings

YPF outcomes going forward

My liquidation analysis reveals it would be accretive to sell a piece of the claim to third party financial investors and redeploy some cash as soon as possible in the business and / or buybacks. Indeed, Burford’s founders had years to prepare for a day like yesterday.

Burford is not in a position as a business to deploy billions of dollars all at once in cases. Given the time value of money, a lot of balance sheet cash would be suboptimal. Indeed, Burford’s founders have preferred running the business with a small amount of indebtedness (D/E ratios below 0.3). Given Burford’s price today, what I expect will happen is Burford will soon sell a piece of the claim and redeploy in:

- its business

- a special dividend to get back to a 100% sterling reputation with investors after the unfair and lingering Muddy Waters debacle (I feel for them). Having a great reputation with markets is paramount for a business that wishes to deploy third party money in future funds

- a small buyback

It’s also likely that Argentina will settle to pay Burford in tranches. This could be a win-win for both parties. Lastly, crude oil has done well in the last years, and could contribute to Argentina’s ability to pay using a component of perhaps royalties on its oil fields.

In my next post, I will discuss why I believe Burford’s core business is worth much more than liquidation value. I will focus on key bear points (e.g. prospective returns will crater) and why, even if they are correct, are glass half empty half-truths.

Risks

Headline risk: obviously, Argentina has said many times they won’t pay, despite having a track record of eventually settling claims.

Binary risk: markets do not like to value stocks with large binary outcomes. Given the size of the claim, my valuation at 30% of face value could be too high. Investors need to be patient with Argentina resolving with/without third party investors buying out pieces of Burford’s claim.

Read the full article here