In early June this year, I issued an article on CareTrust REIT (NYSE:CTRE) labeling the stock as a buy (see the article here: CareTrust REIT: Opportunistic Capital Structure At The Right Moment).

The key essence of the thesis was CTRE’s financial capacity to accommodate material acquisitions right during a period of tight lending conditions and overall struggles for many sector players to cover their increasing debt service costs. In other words, CTRE’s fortress capital structure and well-structured debt maturity profile warrant favourable conditions to venture into accretive M&A transactions providing a positive boost for the FFO.

Ycharts

Since the publication of the article, CTRE’s share price has moved in line the S&P 500 and outperformed the overall REIT market – i.e., the Vanguard Real Estate Index Fund ETF Shares (NYSEARCA:VNQ). We can see how CTRE’s share price increased in tandem with VNQ up until end of July, and then started to fall at a less pronounced manner. The key reason explaining this divergence is, in my opinion, CTRE’s inelasticity to the changes in the interest rate environment due to favorably structured debt maturities, which impose some refinancing and interest rate risk only in 2026.

Early this month, CTRE circulated its Q2 2023 results. The objective of this article is to assess the recent performance and determine whether there is a sufficient basis of new data points to revise my rating on CTRE.

Synthesis of Q2 results

CTRE managed to deliver stable Q2 results with unchanged normalized FFO relative to the Q1, 2023. On a rental level or top-line, the performance improved by $1.6 million reaching $47.7 million in Q2. The uptick of $1.6 million was mostly explained by incremental revenues stemming from completed investment projects ($1.1 million) and CPI-indexation ($369,000).

On a cash cost front, there were though several immaterial one-off items in conjunction with higher interest costs, which imposed a downward pressure on the FFO result.

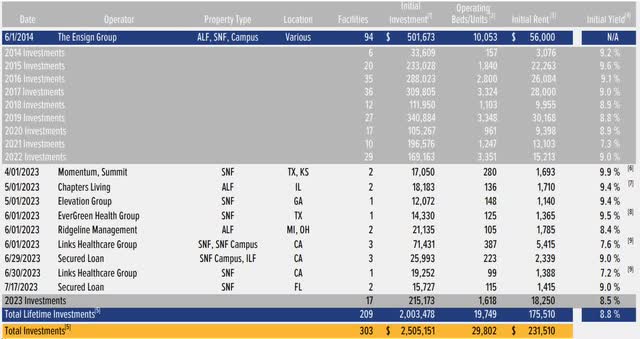

We can see that the key driver for a continued growth for CTRE is (and will be) new cash flows coming from additional investments. Looking at the YTD investment activity, the closed transactions seem to be material accounting for ~ 10% of the total lifetime investments made by CTRE. If we adjust this figure with divestitures, the end-result is still tangible (i.e., ~ 7.5% of the total CapEx spend).

CareTrust

Most importantly, the recently conducted investments have not come at the expense of balance sheet’s quality. CTRE ended the Q2 with strong net debt to normalized EBITDA of 3.8x, which is both below the sector average of 10x and CTRE’s target range of 4 – 5x. In debt to EV terms, the ratio of 26% is also impressive indicating notable financial resiliency.

According to the CEO Bill Wagner in the Q2 earning call, CTRE’s liquidity remains strong:

Our liquidity remains extremely strong with approximately $12 million in cash, $290 million available under our revolver and the $207 million of future ATM proceeds. I expect we will settle this contract during the third quarter and use the proceeds to pay down the line.

The total liquidity reserve is sufficient to cover more than half of the currently outstanding debt.

CareTrust

In terms of the refinancings and the corresponding interest rate risks, CTRE is in a very nice position. The first maturity kicks in only in 2026 and up until the interest rate risk is relatively muted as approximately half of the debt is based on fixed rates. However, I would argue that the debt rollover risk (or rather the consequences of it) is mostly concentrated in 2028 since $200 million in 2026 is not that significant in the context of CTRE’s cash generation.

The remaining half of the debt is subject to floating rates or SOFR. Yet, considering the prevailing interest rate dynamics and what the market has been pricing in, it is extremely unlikely that there would be a notable suffering from further rate hikes. Additional 50 or 100 basis points should not render too negative impact on the CTRE’s FFO.

With all of this being said, the financial outlook of CTRE does not sound seem as promising as the aforementioned analysis might imply.

On the one hand, CTRE has a significant potential to leverage its balance sheet to capture high-yielding opportunities in the market in which currently we can see some signs of weakness (mostly caused by the higher debt service costs). This, in turn, should introduce immediate tailwinds for the underlying FFO. Plus, taking into account the structure of debt and liquidity profile, making sizeable acquisitions would not cause the interest rate and debt refinancing risk to go out of control.

On the other hand, the market does not offer overly attractive opportunities despite the recent surge in the Fed Fund’s rate and the overall fears of deteriorating commercial real estate market.

James Callister – Chief Investment Officer – captured the problem in the Q2 earnings call quite nicely:

And I think that, as some deals slowly start, you know, that we look at to actually become positive cash flowing, you know, then you do look at the per bed, but you also work super closely with your operator to make sure that you are really trying to dial in a stabilized value that will give them a rent stream they can really be successful with, which can be difficult in today’s environment, particularly with labor. I do think, like I said, rates are up in terms of the yield, but cap rates are still pretty much the same as skilled nursing world at around 12.5%.

Also looking back at the investment summary (as outlined above), we can see that the total initial yield of 2023 investments have actually decreased to 8.5%, which is 30 basis points below CTRE’s average. Granted, CTRE has lately been focusing on the higher quality assets with more resilient operators so that could to some extent justify this drop.

However, the fact that CTRE has not been able to find deals yielding above the transactions, which were conducted when the interest rates were zero indicates that it is extremely difficult to find new assets, which could generate juicy spreads from the WACC.

The bottom line

In my opinion, CTRE’s advantage and the potential catalyst that could drive the share price above the benchmark (i.e., VNQ) going forward is the balance sheet in combination with ample liquidity, where there is no need for capital to refinance maturing debt by 2026 (or 2028 that is more material amount).

Nevertheless, the prevailing market environment has not moved in favour of buyers as the cap rates have remained relatively stable, while the actual financing costs have skyrocketed. In such situation, there is no significant value of putting CTRE’s capital at work if the spreads (cap rate – WACC) are less favourable than in the past periods (before the change in the monetary policy).

I still consider CTRE an extremely safe investment with a solid and predictable dividend of 5.6%. Yet, I do not expect alpha performance over the next couple of months and my base case is that Q3 results will not surprise the market to the upside. Once there will be some more tangible signs emerging on the M&A front indicating that cap rates have started to increase, then I would seriously consider going long CTRE.

Read the full article here