Investment Thesis

People thought high mortgage rates would bring the end of homebuilders as people would not buy homes when rates are this high. This could not be more wrong. Homebuilders are thriving as homeowners are not selling, and the existing demand goes to newly built homes.

However, this doesn’t mean people love spending money. They are buying homes because they have to. They need to move or build a new life and need somewhere to call home. You see these people, mostly young adults, complaining about home prices on the news. They are right, houses have become too unaffordable, and the data shows it.

So, do they give up on buying homes? No. They find cheaper ones. This is where Cavco Industries (NASDAQ:CVCO) comes in. It builds manufactured homes nearly everywhere in the U.S., providing a cheaper alternative.

The company’s sales have been skyrocketing and the issues with home unaffordability will not be solved soon. However, the market applies an unjustified discount to its valuation just because mortgage rates are high. The stock seems undervalued and is getting a “Buy” rating.

Introduction

If you read my article on NVR (NVR), you know that I see big opportunities in the homebuilding space. That article was inspired by Berkshire’s investments in NVR, D.R. Horton (DHI), and Lennar Corporation (LEN).

There are strong long-term drivers for these companies such as low housing supply, despite the short-term headwinds such as mortgage rates being very high and house affordability being very low for the median household in the United States.

Those headwinds got me thinking and inspired me for this idea. There is a space that benefits from both the same long-term drivers and also the expensiveness of houses: low-cost factory-built houses. This is exactly what Cavco Industries does.

It’s a high-quality company that is supplying the demand for affordable houses everywhere in the U.S. Together, we are going to understand its operations, recent performance, long-term drivers, and valuation.

Company Description

Cavco Industries is one of the largest manufactured home producers in the United States and has a history dating back to 1965.

It mostly produces single-story residential homes that contain a living room, kitchen, dining area, up to five bedrooms, and bathrooms. These homes also have heating and water systems, floor coverings, and window treatments. It has everything you expect from a basic home. Maybe one of the best features of these homes is that they are highly customizable. You can add fireplaces, air conditioning, high ceilings, and even another floor if you want.

Other products include park-model RVs that are mostly used for seasonal living or vacations, vacation cabins, and factory-built commercial structures.

Selling these products nationwide and having an optimal cost structure is difficult. Moving manufactured homes is not cheap. However, the company knew exactly how to solve this. Its scale helps immensely with operations.

It sells products through an extensive network of independent and company-owned distributors, community operators, and residential developers. And when I say extensive, I mean it… It works with distributors in 48 states and Canada.

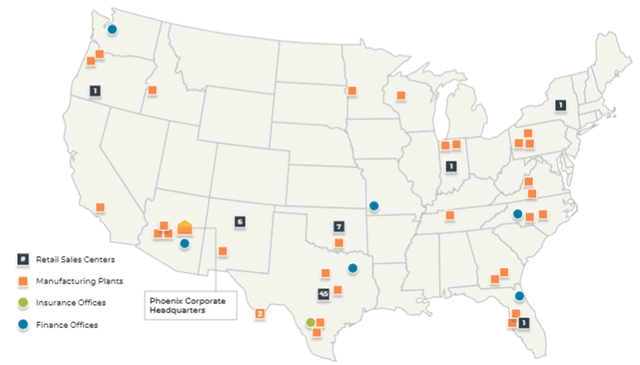

Similar to its distributor network, it has a strong manufacturing footprint all over the U.S. It has 29 homebuilding production lines located throughout the U.S. and two production lines in Mexico. The management shared this map during the investor presentation. Have a look at it for yourself.

Investor Presentation – May 2023

This nationwide footprint allows the company to be a national player who is active in local markets. Each manufacturing facility conducts its own local research and works with local distributors. This is how you become successful in this space.

Because of this “nationwide localization” strategy, the company owns and operates a large number of brands, which you can find below.

Investor Presentation – May 2023

Finally, as you see with most homebuilders, Cavco has its own financing and insurance subsidiaries, CountryPlace and Standard Casualty. This just makes sense. There are big synergies between these two businesses. While CountryPlace makes sure customers can afford houses and makes products more attractive to them, it is also another source of revenue for Cavco.

Long-Term Drivers

There are huge long-term drivers that the business is going to benefit from in the long term. While some are similar for all homebuilders, there is one theme that significantly changes things for Cavco.

First of all, there is a sizeable shortage of new homes stemming from a long time of under-building in the U.S. Population growth and the rate at which new households are formed is much higher than the newly built homes. This means there is an increasing need for homebuilders. Both producers of manufactured homes and traditional homebuilders benefit from this.

Additionally, as I talked about in the NVR article, as a result of the Fed aggressively hiking interest rates, mortgage rates skyrocketed. This makes homeowners reluctant to sell. If they sold their homes and tried to buy another, they would change their 2% mortgage for a 7% one. Therefore, all the demand from new homebuyers is going to homebuilders. This has been going on for a while, and with high rates sustained, there is a potential this situation will continue.

These are the broad industry trends we see. The significant theme we are interested in for Cavco is house affordability in the U.S.

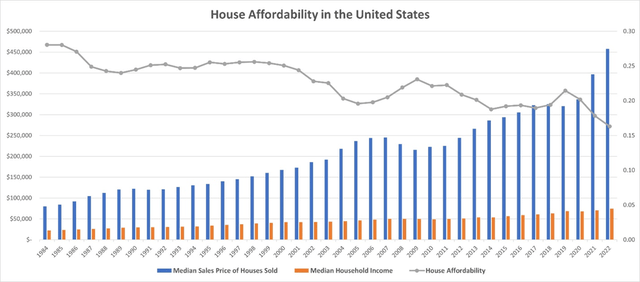

The problem is real. Young adults cannot afford homes. We don’t have to look at the data to see if this is true, just look around. But the data shows how serious this is. I use median household income and median price of houses sold to see how affordability has changed since 1984.

The chart below shows that median house prices have surged much faster than the median household income.

FRED – Federal Reserve Bank of St. Louis

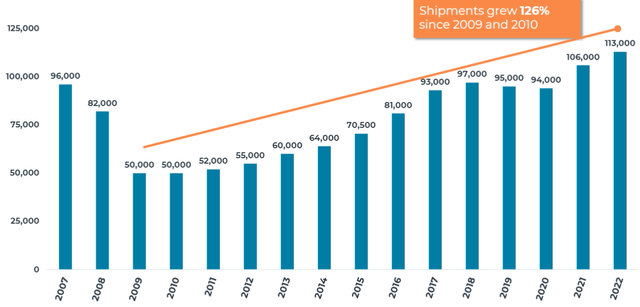

So, what happens if people get married, want to move, and build a life? They look for more affordable homes like the ones Cavco sells. 97% of new homes sold under $200,000 were manufactured housing. This surge in demand is visible if you look at the post-recession growth of the company.

Investor Presentation – May 2023

I don’t know how much more unaffordable houses will get, but the situation is not going to be solved instantly. It will take time. In the meantime, Cavco will benefit.

Valuation

Even though fundamentals look intriguing at the moment, a good business doesn’t always mean a good investment. We will use two methods to understand if the stock trades at a premium, par, or discount.

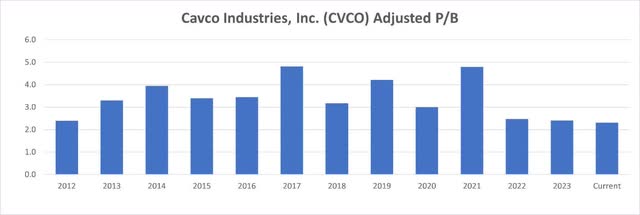

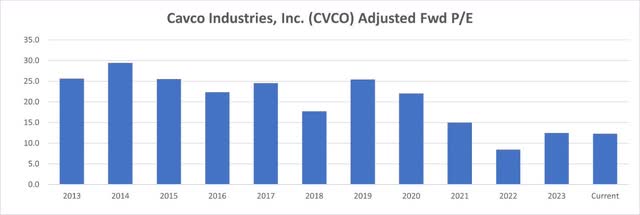

Let’s look at the historical multiples first. Have a look:

S&P Capital IQ

S&P Capital IQ

While shipments grew and revenue skyrocketed, both adjusted price-to-earnings (P/E) and adjusted price-to-book (P/B) declined. The market thinks future prospects are not as good as before, which is not true at all. These adjusted P/E and P/B charts make me believe the stock might be undervalued.

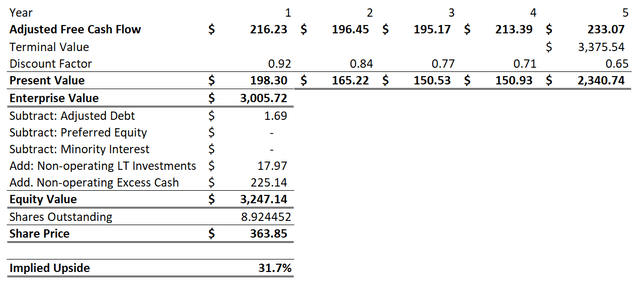

We’ll now use the discounted cash flow (DCF) analysis to see the potential upside.

It is easy for companies to boost earnings or invest heavily in asset growth if the management wants to do so. These numbers are volatile and provide less insight when looking into the future. The one metric that is structurally difficult to improve is the return on assets (ROA).

As you can see below, Cavco has been improving operations since 2014 and making more and more money. The demand has increased thanks to nationwide growth and falling house affordability. The trendline is looking promising.

Similar to the other homebuilders, 2022 and 2023 were exceptionally good years thanks to the demand boost for new houses and higher prices. The ROA jumped from 20% to over 30%. I think these years will stay exceptional, and as the environment normalizes, ROA will fall back to around 20%.

However, as houses get less affordable, I expect a continuation of the trendline and the ROA to continue increasing for 2-3 years.

S&P Capital IQ

This ROA expectation translates to an adjusted free cash flow of $216 million in fiscal year 2024 and $233 million in 2028.

We will use a very conservative terminal growth rate of 2%, in line with long-term inflation targets. The cost of equity is calculated as 9.04% using a long-term risk-free rate of 2%, a market risk premium of 5.7%, and the stock’s 5-year equity beta of 1.24. I ignore the cost of debt as the D/V ratio is lower than 1% and assume E/V is 100%.

Using these numbers, we find an equity value of $3.25 billion, which means a target share price of $363.85. This is a 31.7% upside over the current share price at the time of this article’s writing.

CVCO DCF Analysis

Risks

I see two main risks for this investment thesis.

The first is house affordability. I don’t think it is going to improve soon and I do think it benefits manufactured home producers like Cavco. However, if houses become even less affordable, this may start to hurt Cavco’s sales as well. However, I see this as very unlikely.

Secondly, the annual report shows that the backlog fell from $1.1 billion in 2022 to $244 million in 2023. This is a huge drop and might be showing the declining demand for manufactured homes. However, during the Q1 2024 earnings call, CEO Bill Boor said they see improvements. This needs to be tracked going forward to see how it develops.

Conclusion

Homebuilder space continues to shine with investment opportunities. Even though there are short-term headwinds for some, some turn those headwinds into tailwinds. Cavco Industries is one of those.

The company finds itself in a special position in the industry. As one of the largest manufactured home builders in the U.S., it benefits from the broad industry trends and decreasing home affordability. Its extensive reach in the country is unparalleled and it figured out how to scale up while operating locally.

It is going to be interesting to watch where the company and the stock go in the next few years.

Read the full article here