Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the third week of October. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

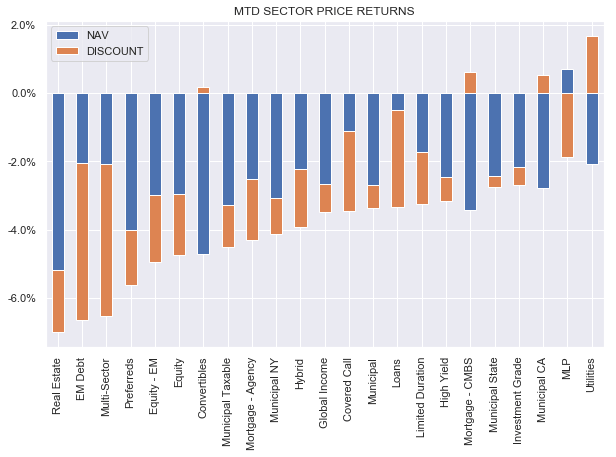

All CEF sectors were down on the week, primarily due to lower NAVs across the board. Only 3 sectors managed to finish with tighter discounts.

Month-to-date, higher beta sectors like REITs and Equities are leading to the downside. Only MLPs have managed an NAV rally over October.

Systematic Income

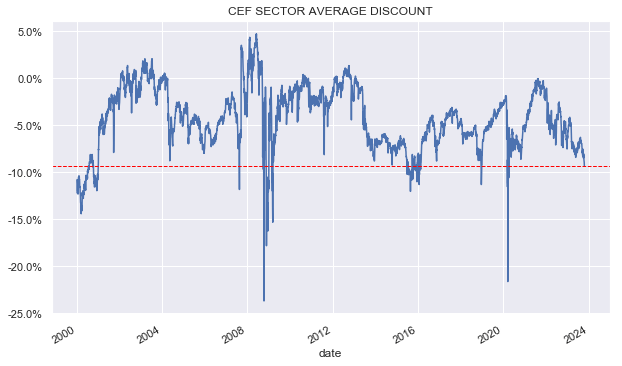

Discounts continued to push wider with the likely catalyst being worse risk sentiment due to higher yields and geopolitical concerns. Interestingly, the recent rise in long-term yields have actually improved net income for fixed-income credit CEFs which should normally result in discount tightening however sentiment has been the overriding factor over the last couple of weeks.

Systematic Income

Market Themes

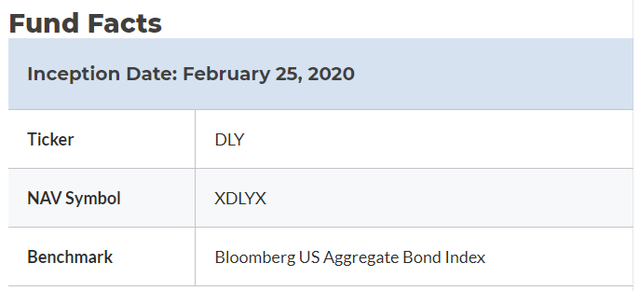

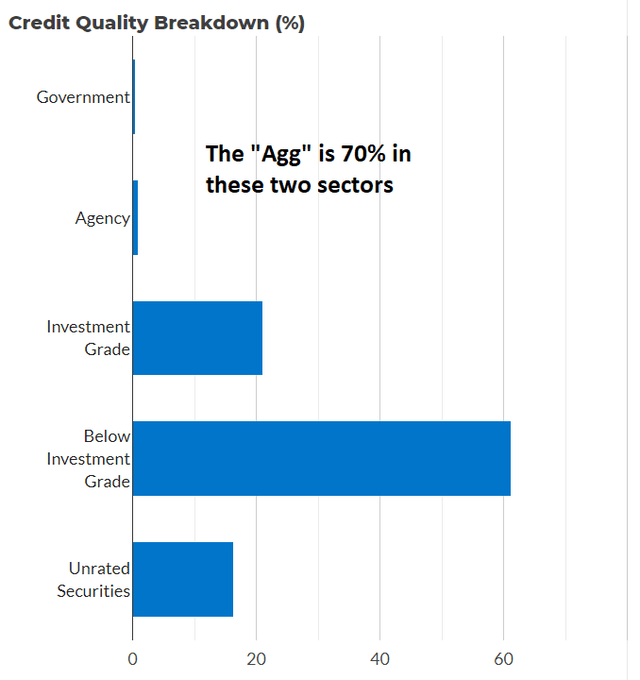

One of the things we like to call out is the ridiculous use of benchmarks by many CEFs. For instance, DoubleLine credit CEFs like to benchmark themselves against the Bloomberg US Aggregate Bond Index despite the fact their portfolios look nothing like the “Agg” which is a high investment-grade (primarily AAA/AA) index given it is allocated primarily to US Treasuries and Agencies with some investment-grade corporate bonds.

DoubleLine

A fund like the DoubleLine Yield Opportunities Fund (DLY) has only a 20% allocation to investment-grade credit with the rest allocated to sub investment-grade and unrated credit. The chart makes it clear that DLY has negligible allocations to the sectors that make up more than 2/3 of the “Agg”.

DoubleLine

There is a clear incentive for credit CEFs to use higher-quality indices because historically higher-quality credit has underperformed lower-quality credit. In other words, selecting a higher-quality benchmark makes it easier for funds to outperform the benchmark.

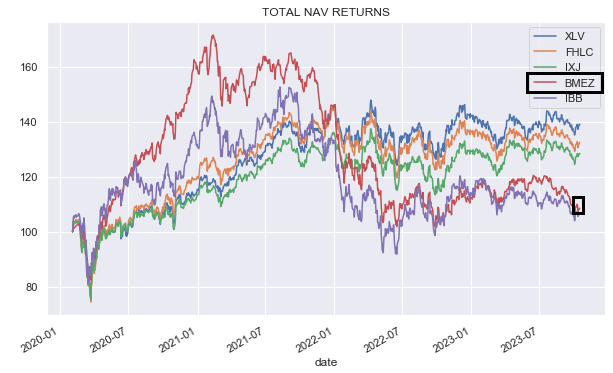

We see something similar in equity CEFs as well. For example, the BlackRock Health Sciences Term Trust (BMEZ) benchmarks itself against both the MSCI ACWI and the MSCI Custom ACWI SMID Growth HC Call Overwrite Index.

The former index is much too broad and clearly inappropriate. The latter index is focused specifically on healthcare stocks within the broader MSCI ACWI SMID Cap Growth Index with a 25% option overlay.

This is certainly a better attempt at finding the right benchmark but even here we see key differences. The MSCI index has a much larger allocation to ex-US stocks, a smaller allocation to Biotech and, likely, an overwrite methodology that is closer to at-the-money strikes as is typical of overwrite indices than the deep out-of-the-money calls sold by BMEZ.

This is probably why while BMEZ shows strong outperformance of the bespoke index, it remains a significant laggard behind the larger healthcare ETFs.

Systematic Income

Overall, it’s important to take CEF benchmarks with a grain of salt, knowing that managers are incentivized to make it easier on themselves to show outperformance. Comparing the key criteria of benchmarks as well as performance of other funds in the sector can give investors a more realistic picture of relative performance.

Market Commentary

Most CLO Equity CEFs updated their NAVs. Eagle Point funds ECC and EIC saw gains while OCCI and CCIF had a drop. The two drops looked to be driven by ex-div dates – OCCI has very large quarterly distributions while CCIF only just increased its distribution and likely did not get to earn it after recently acquiring its assets.

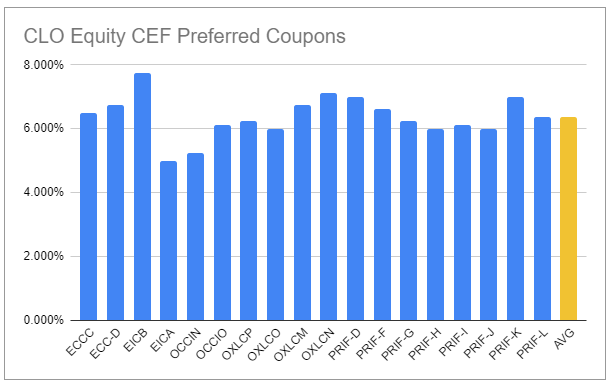

Speaking of CCIF, the fund is issuing a 5-year 8.75% preferred – something we highlighted was likely to happen in due course. Few if any credit CEFs use preferreds for leverage. The reason CLO Equity CEFs do is that preferreds and bonds are much more resilient to a forced deleveraging – very important for a high beta asset class like CLO Equity. Recall that OXLC has been repeatedly blown out of its Nomura facility to the extent that it no longer uses repo or credit facilities at all.

One consequence of this is that CCIF will generate around 2.5% less yield on its leveraged assets, all else equal, given the average preferred coupon in the sector is 6.3%. This should translate into a slightly wider fair-value discount than we see across the sector CEFs.

Systematic Income

Stance and Takeaways

Earlier in the week we pared our allocation to the Muni CEF MFS High Yield Municipal Trust (CMU) in favor of a couple of other Muni and other higher-quality funds. CMU has sharply outperformed the broader sector over the past year before giving back some of the outperformance in the last few days. The fund is undergoing a tender offer and the risk / reward was less compelling in the context of its historical valuation.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here