Introduction

In December, I wrote a bearish article on SA about telecommunications and electric vehicle (EV) infrastructure solutions provider Charge Enterprises (NASDAQ:CRGE), in which I said that there was little value in the business as revenue growth was coming from low margin voice and data termination services and the tangible book value was negative.

Well, Charge Enterprises released its Q2 2023 financial results on August 14, and I find it encouraging that the backlog of the infrastructure segment has reached $150 million. In my view, the company has a good chance of achieving its goal of reaching positive adjusted EBITDA in Q1 2024. With the market capitalization dipping below $120 million recently, the enterprise value (EV) is now below $100 million, and I’m changing my rating on the stock to neutral. Let’s review.

Overview of the Q2 2023 financial results

If you aren’t familiar with the company or my earlier coverage, here’s a brief description of the business. Charge Enterprises describes itself as an “electrical, broadband and electric vehicle charging infrastructure company that provides clients with end-to-end project management services, from advising, designing, engineering, acquiring and installing equipment, to monitoring, servicing, and maintenance” (see page 37 here). The majority of revenues come from its telecommunications arm PTGi International Carrier Services, which is involved in the provision of routing of voice, data, and Short Message Services (SMS) to carriers and mobile network operators. This company comprises the telecommunications segment of Charge Enterprises, and it has contractual relationships with service providers in more than 45 countries worldwide. The issue here is that this segment focuses on low-margin solutions, and its gross margin is typically less than 1%. The infrastructure segment, in turn, focuses on EV charging, broadband, and electrical contracting services and includes a total of six small companies. It usually has a gross margin of about 20%.

Charge Enterprises

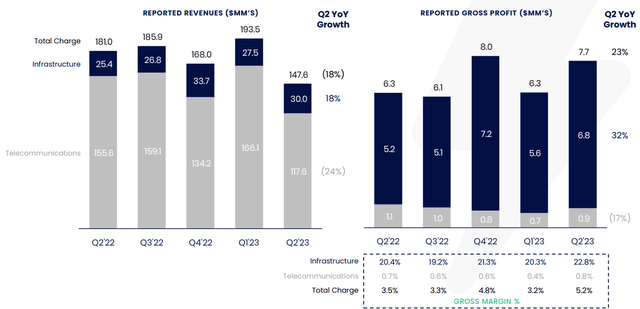

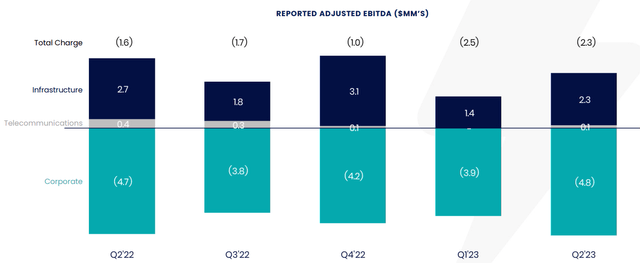

Turning our attention to the Q2 2023 financial results, we can see that revenues decreased by 18.5% year-on-year to $147.6 million and the main reason behind this was a decrease in wholesale traffic volumes in the telecommunications segment. Yet, quarterly revenues in the infrastructure segment reached $30 million for the second time in the company’s history thanks to a higher volume of electrical contracting services and EV charging installations during the period (see page 39 here). Since the infrastructure segment has much higher margins, the total gross margin surpassed 5% during the quarter. Unfortunately, adjusted EBITDA slipped further into the red due to growing salary expenses as Charge Enterprises has been expanding its team to support growth in the infrastructure segment.

Charge Enterprises

Charge Enterprises

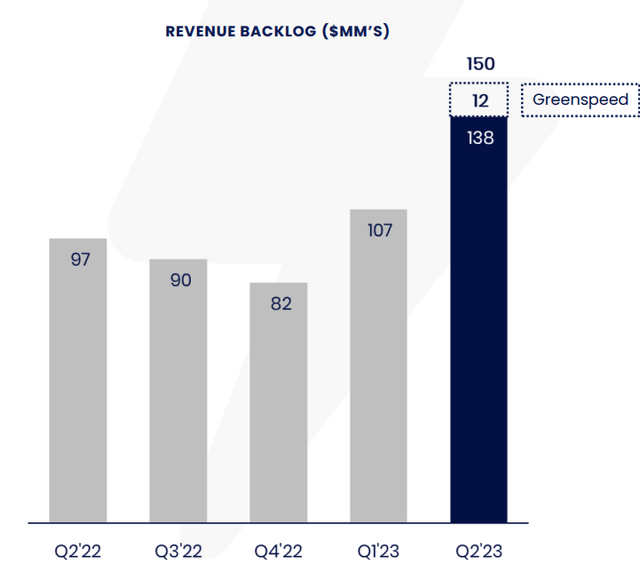

The growth strategy is focused on the EV charging business, and the company aims to engage with 1,000 franchise dealerships by the end of 2025. As of June, this goal has been achieved at about 20% (compared to 15% in March) and this is without including EV infrastructure solutions provider named Greenspeed, which was bought on August 1. In my view, the growth strategy of Charge Enterprises is starting to bear fruit as the order backlog of the infrastructure division grew rapidly during the second quarter of 2023 and reached $138 million. The EV charging infrastructure business accounts for about 28% of that figure and if you include Greenspeed, the total backlog of the segment rises to $150 million.

Charge Enterprises

Overall, I think that the Q2 2023 financial results of Charge Enterprises were mixed, but the growing backlog of the infrastructure segment is a significant positive development, and I’m optimistic that the quarterly revenues of this business could top $40 million by Q4 2023, generating adjusted EBITDA of about $4 million. Charge Enterprises expects to generate positive adjusted EBITDA in Q1 2023, and I think that it has a high chance of achieving this.

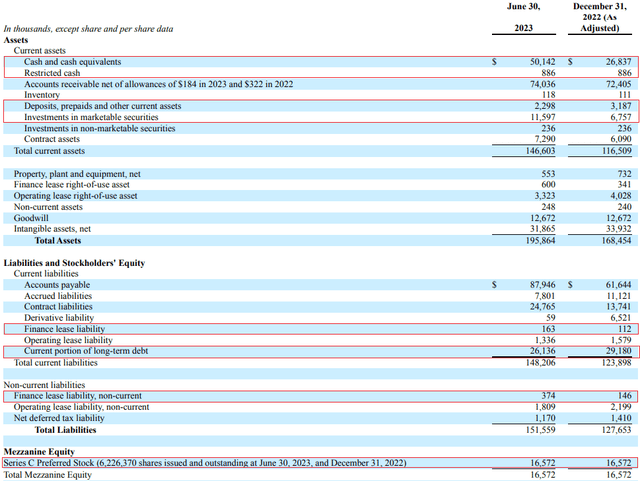

Looking at the balance sheet, I think the situation looks solid as cash, deposits, and investments in marketable securities came in at $64.9 million as of June while debt and mezzanine equity stood at $42.2 million. Series C preferred shares have an annual dividend yield of 6%, so I’ll be counting them as debt.

Charge Enterprises

Free cash flow came in at $25.5 million for the first half of 2023, but it’s worth noting that the main reason the figure was positive was a $26.5 million increase in accounts payable. I expect the latter to return to about $60 million over the coming months.

Looking at the valuation, Charge Enterprises has a market capitalization of $116.3 million as of the time of writing, which puts its EV at just $93.6 million. This figure increases to $120.1 million if we account for the $26.5 million increase in accounts payable, and I think that the company no longer looks overvalued based on fundamentals. While I continue to think that the telecommunications business isn’t worth much considering its TTM adjusted EBITDA is about $0.5 million, the high-margin infrastructure business should book strong growth over the coming quarters thanks to the rapidly increasing backlog. In my view, this segment could be generating an adjusted EBITDA of about $5 million per quarter by Q1 2024.

Investor takeaway

Charge Enterprises booked mixed Q2 2023 financial results, but the backlog of its infrastructure segment is growing fast, and I’m optimistic that adjusted EBITDA could be in the black by Q1 2024. If we assume that the adjusted EBITDA of the infrastructure business surpasses $20 million in 2024, and it should be valued at about 6x EBITDA, this puts the valuation at about $120 million. While the EV of Charge Enterprises is below $100 million at the moment, I expect accounts payable to decrease by over $20 million over the coming months.

Overall, I think the margin of safety isn’t large enough for me to consider opening a position at the moment, and it’s also possible that the backlog could start decreasing over the coming months. That being said, I think that Charge Enterprises is moving in the right direction, and I plan to keep an eye on the stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here