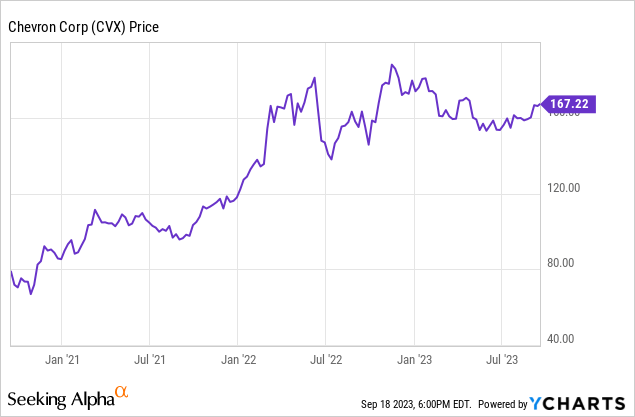

Major multinational energy company Chevron Corporation (NYSE:CVX) is an energy investing staple. The stock price is up 14% from my last review.

The company offers investors a 3.6% dividend coupled with a stock buyback program of up to several billion dollars per year.

Chevron’s low-royalty Permian acreage is a bigger competitive advantage than most realize. However, given today’s US anti-hydrocarbon government policy coupled with overseas needs for both oil and gas, Chevron’s international operations are also an important contributor to earnings.

Although workers are striking against its Australian Wheatstone and Gorgon LNG plants, representing 5% of the world’s LNG supply, the company has not missed any scheduled deliveries and plants are back at full operation. The strike, and talks to resolve it, are expected to continue through mid-October. In a September 18,2023 interview with Bloomberg, Chevron CEO Mike Wirth emphasized the need for LNG—and all the energy Chevron provides — by its global customers. Wirth also spoke about the company’s efforts in low-carbon ventures such as green hydrogen, and new technologies for production, pointing out current methods only recover 10% of the hydrocarbons in place.

Last week, the state of California filed a lawsuit against five large oil and gas companies—Exxon Mobil (XOM), Chevron, ConocoPhillips (COP), BP (BP), and Shell (SHEL)–and the American Petroleum Institute (API) claiming they created climate harms in California. While it is too early to know the outcome, similar attacks on large oil companies are decades-old tropes that these companies have to deal with, not least also in the court of public opinion.

I recommend Chevron to dividend-seeking and growth investors interested in energy. I own shares myself.

Other Macro Issues

Other macro issues for oil prices are Saudi and Russian cuts in production tightening the balance, uncertain Chinese demand, and the historically low US Strategic Petroleum Reserve.

The Biden administration just canceled some Alaska oil leases and generally continues its anti-hydrocarbon policies aimed particularly at discouraging US oil and gas production, and eventually, consumption.

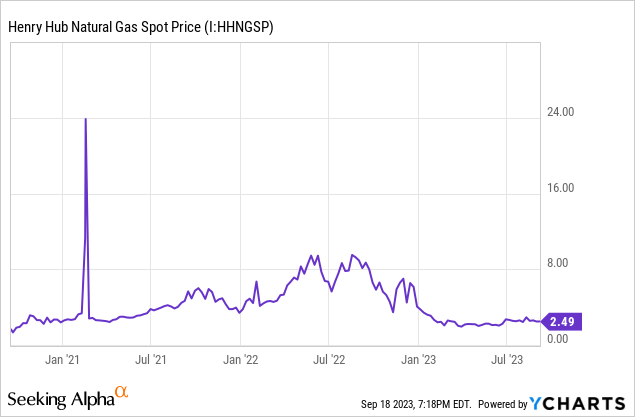

US natural gas demand (and prices) has stayed healthier than expected due not only to steady LNG exports but also to increased demand for electricity generation as coal units are retired and wind energy is a smaller-than-expected contributor.

European gas storage is in a much stronger position going into winter 2023-2024 than a year ago.

Acquisition of PDC Energy Complete

On August 7, 2023, Chevron announced it completed the acquisition of PDC Energy, for which it paid $6.3 billion and assumed another $1.3 billion of the company’s debt. Most of PDC Energy’s reserves (90% by value) are in Colorado’s D-J basin, particularly Weld County, with the remainder in the Permian. The 1.1 billion BOEs of reserves divide as 44% natural gas, 31.5% natural gas liquids, and 24.5% oil. As of December 31, 2022, the future net revenue of the reserves, discounted at a 10%/year rate was $19.0 billion. While Chevron’s all-in acquisition cost of $7.6 billion looks like a considerable bargain, be aware that because of unusually high gas prices in 2022, gas reserve valuations at all companies are likely to be lower at year-end 2023.

Second Quarter 2023 Results

In the second quarter of 2023, Chevron’s earnings were $6.0 billion, or $3.20/share. This compares to $11.6 billion or $5.95/share for 2Q22.

Cash flow from operations was $6.3 billion, compared to $13.8 billion for 2Q22.

For 2Q23, upstream earnings were $4.9 billion (76.5%) and downstream earnings were $1.5 billion (23.5%).

Production worldwide was 2.8 million barrels of oil equivalent (BOE) per day, 62% of which was liquids and 38% of which was natural gas. Liquids volumes divided about equally between the US and international; however, international gas production was 3x that of the US.

For the downstream, 71% of earnings came from the US; only 29% were international.

Quarterly distributions to shareholders were $7.2 billion, including $2.8 billion in dividends and $4.4 billion of share repurchases.

The company expects to make capital expenditures of $14 billion to $16 billion per year.

Oil and Gas Prices

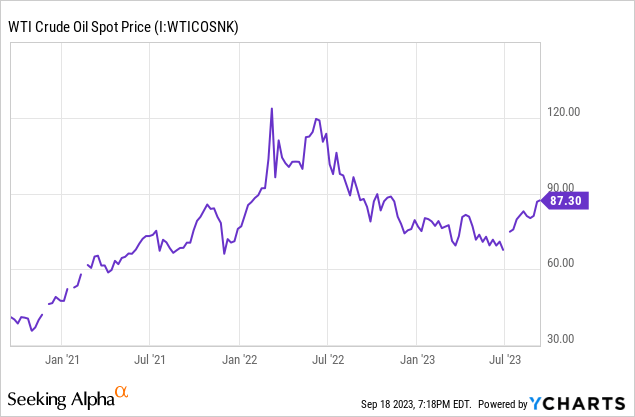

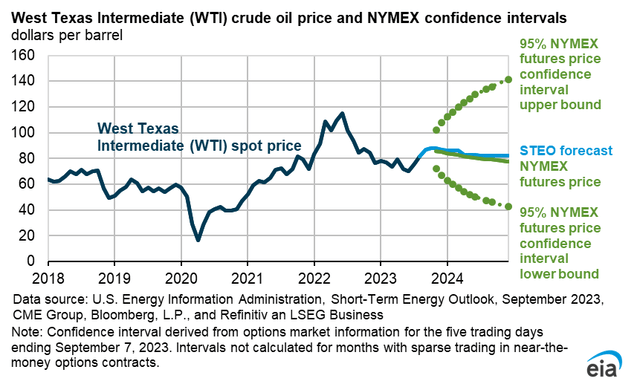

September 18, 2023, NYMEX oil price was $92.31/barrel for October 2023 delivery of West Texas Intermediate (WTI) crude oil. Henry Hub natural gas, also for October 2023 delivery, was $2.73/MMBTU. Dutch Title Transfer LNG for October 2023 delivery was $10.80/MMBTU. Both Henry Hub and TTF prices rise seasonally: TTF tops out at $16.16/MMBTU for delivery in February 2024. Both gas and LNG prices are far lower than last year.

The US Energy Information Agency (EIA) shows a 5-95 confidence interval of $40/barrel to $140/barrel for WTI prices at year-end 2024.

EIA

Chevron’s Reserves Plus PDC Energy

At year-end 2022, Chevron’s SEC PV-10 reserves were $82.5 billion for the US, about double that at $170.5 billion for its consolidated companies (including US at $82.5 billion as well as international consolidated companies), and $211.9 billion for its consolidated and affiliated companies.

This is 64% higher than the 2021 year-end total of $128.9 billion, mainly a benefit of 2022’s higher oil and gas prices as its proved (developed and undeveloped) reserves total 11.2 billion BOE, virtually the same as last year.

Of the total, 44% (5.0 billion barrels), are oil, condensate, and synthetic oil. Roughly 10% or 1.1 billion barrels are natural gas liquids. The remaining 46% is natural gas.

US proved reserves are 4.1 billion BOE, almost exactly half (50.6%) oil and condensate. Another 21.6% is natural gas liquids; the remainder is natural gas.

These do not include PDC Energy’s reserves since the acquisition was completed in August 2023. Per PDC Energy’s 10-K, its future net revenue discounted at 10% at year-end 2022 totaled $19.0 billion: $17.3 billion for Colorado assets and $1.7 billion for Permian assets.

About 90% of the value was attributed to Colorado and 10% to the Permian. Of the reserves, 24.5% are oil, 31.6% are NGLs and 43.9% are natural gas.

As with all companies—including Chevron and PDC Energy—who reported (correctly-calculated) high values for year-end 2022 gas reserves, gas reserve values are likely to be lower at year-end 2023.

Competitors

Chevron operates in the upstream and downstream sectors in the US and internationally. The company is headquartered in San Ramon, California, but has encouraged some California employees to move to Houston, Texas. Indeed, the company just acquired 77 acres in Cypress, thirty-three miles northwest of downtown Houston, potentially for a research and development campus.

Permian competitors are numerous, including small companies, private companies, and other medium, large, and very large public companies like ConocoPhillips, EOG Resources (EOG), Diamondback Energy (FANG), Occidental (OXY), and ExxonMobil.

Different from its competitors, Chevron has considerable legacy, low-royalty-cost Permian production and acreage.

International competitors include BP, Equinor (EQNR), ExxonMobil, Shell, plus all non-OPEC and OPEC+ (such as Saudi Aramco and Gazprom) national oil and gas companies.

Governance

At September 1, 2023, Institutional Shareholder Services ranked Chevron’s overall governance as a stellar 1, with sub-scores of audit (3), board (4), shareholder rights (1), and compensation (3). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk. This is a significantly lower risk level than last year’s 7, reflecting better governance scores for audit, board, and compensation.

On August 31, 2023, shorts are 0.81% of floated shares. Insiders own only 0.04% of shares.

The company’s beta is 1.17, higher than one might expect for a giant multinational with both upstream and downstream operations.

As of June 29, 2023, the four largest institutional stockholders, some of which represent index fund investments that match the overall market, are Vanguard (8.65%), BlackRock (6.7%), Berkshire Hathaway (BRK.B) (6.6%), and State Street (6.5%).

There are two points of interest. First, Berkshire Hathaway’s holdings of Chevron, along with its significant position in Occidental, suggests a Berkshire/Buffett assessment that both companies are undervalued.

Second, Blackrock and State Street are signatories to the Net Zero Asset Managers’ initiative, a group that, as of June 30, 2023, manages $59 trillion in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Financial and Stock Highlights

Chevron’s market capitalization is $319 billion at a September 18, 2023, stock closing price of $167.22/share.

Trailing twelve months’ EPS is $15.77/share for a price/earnings ratio of 10.6. Analysts’ average estimates for 2023 and 2024 EPS are $13.49 and $14.27, respectively, for a forward price-earnings ratio range of 11.7 to 12.4.

With a 52-week price range of $140.46-$189.68 per share, the September 18, 2023, closing price is 88% of its one-year high. The company’s one-year target price is $187.21/share putting its closing price at 89% of that level.

Trailing twelve-month (TTM) returns on assets and equity are 8.9% and 19.3%, respectively.

TTM operating cash flow is $41.3 billion and leveraged cash flow is $23.4 billion.

At June 30, 2023, the company had $92.5 billion in liabilities and $251.8 billion in assets giving Chevron a liability-to-asset ratio of 37%. Of the liabilities, debt totals $21.5 billion ($20.2 billion of which is long-term debt), or just 8.5% of assets.

The company’s ratio of debt to market capitalization is a very small 6.7%. The debt-to-EBITDA ratio is quite comfortable at 0.42.

Chevron’s dividend of $6.04/share represents a 3.6% yield at its current price. As noted, the company plans to repurchase several billion dollars’ worth of stock. It repurchased over 27 million shares during 2Q22 and nearly 50 million shares through July 28, 2023.

The mean analyst rating is 2.1, or “buy,” from the 24 analysts who follow it.

Notes on Valuation

Book value per share at $84.79 is well below market price, implying positive investor sentiment. Its ratio of enterprise value to EBITDA is in the bargain (sub-10.0) range at 6.4.

Chevron’s current market capitalization is $319 billion. SEC PV-10 reserve value at year-end 2022 was $211.9 billion, which does not include PDC Energy’s $19.0 billion. As of June 30, 2023, assets were $251.8 billion, and liabilities were $92.5 billion for balance-sheet equity of $159.3 billion.

Market capitalization/flowing BOE is $114,000 and market capitalization/flowing barrel of liquids is $183,000.

Positive and Negative Risks

Investors should consider their oil and natural gas price expectations as the factor most likely to affect Chevron’s operations.

Although it does not appear that either the Australian strikes or the California climate lawsuit will materially affect Chevron, that could change. What does appear certain vis-a-vis California is that legal issues will continue.

International operations in the eastern Mediterranean, Australia, and elsewhere carry country-specific risks, but so do operations in the US given the anti-hydrocarbon stance federally and in many states. The company’s international diversification is a significant benefit layered atop its low-royalty advantage in the Permian basin.

Recommendations for Chevron

I recommend Chevron somewhat to dividend hunters with its 3.6% dividend and more fully to those looking for capital appreciation since the company also offers a hefty share buyback program.

The company has a 14% upside to one-year target and continues its steady growth in natural gas, oil, and new energy technologies.

Sector-wide, gas prices have steadied at a more normalized level and oil prices are very constructive for the near future. LNG has proven itself to be a reasonable and necessary energy backstop.

Chevron has operational flexibility via its balance sheet with a relatively small debt percentage and an attractive enterprise value-to-EBITDA ratio of 6.4.

Those who follow value-oriented Warren Buffett’s Berkshire Hathaway will have noted Berkshire’s 6.6% ownership of Chevron equity.

Other favorable factors for long-term investors include Chevron’s low-cost Permian position, globally diversified operations, and good cash flow.

chevron.com

Read the full article here