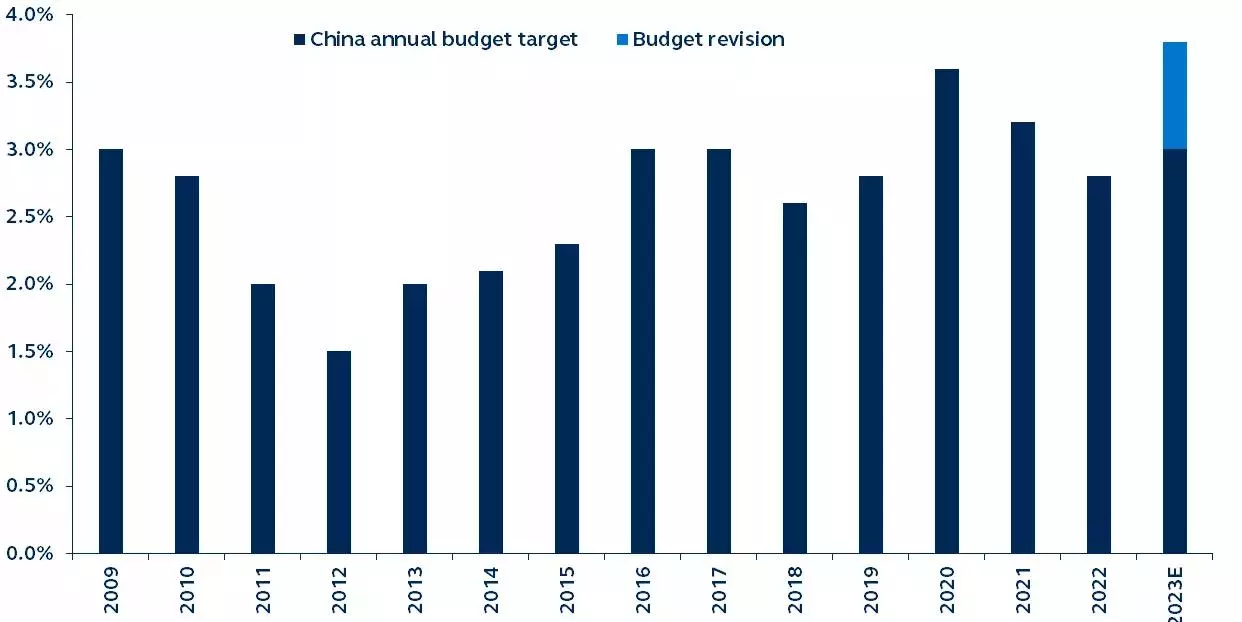

A surprising mid-year budget revision from policymakers in China was recently approved, widening the budget deficit from 3.0% to 3.8%. This occurrence is unusual, as previous revisions mostly resulted from major economic events like earthquakes and financial crises.

The fact that this change is happening during a stabilizing economic backdrop indicates a strong commitment from policymakers to boost growth, and likely improves sentiment for the region.

China annual budget target

% of GDP, 2009–present

Source: Bloomberg, Principal Asset Management. Data as of November 3, 2023.

Recently, China’s legislative body surprised markets with a mid-year budget revision which could widen the budget deficit from 3.0% to 3.8%, surpassing the critical 3.0% threshold that’s only recently been exceeded during the COVID years.

Intra-year budget revisions are historically rare. Similar revisions were announced following both the 1998 Asian Financial Crisis and the 2008 Sichuan earthquake, instances when significant outside forces had impacted China’s economy.

The absence of a catastrophic event this time, and in fact, that China is experiencing a period of economic stability indicates a strong commitment from policymakers to boost growth.

3Q GDP grew 4.9% year-on-year, beating consensus significantly and making China’s 5% growth target likely achievable. Investors had worried that the better-than-expected economic data would trigger an early policy exit, leading to a “good news is bad news” market reaction.

While the fear was justified, considering stimulative policies have previously fallen short of expectations in recent years, the surprise budget revision suggests this time could be different.

Policymakers appear to have recognized that the lingering property rout and indebted local government require meaningful fiscal expansion.

While a bazooka type of stimulus reminiscent of previous cycles is still not the base case, coordinated fiscal and monetary moves will likely continue until the economy is out of the woods – perhaps giving reason for investors to revisit their subdued enthusiasm for the region.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here