With streaming having disrupted traditional media distribution channels, most of the market’s focus is centered around the players involved in the streaming wars and their path to growth in profitability.

However, I believe not enough attention is being paid to the secular tailwinds that will propel theatrical media releases through the next decade.

Specifically, I believe Cineplex (TSX:CGX:CA) (OTCPK:CPXGF) is the optimal public operator for investors seeking to take advantage of this opportunity.

As this is the company closer to deep-value territory I’ll spend some time also discussing potential sources of momentum that can drive Cineplex’s stock performance in the near term.

Studios Need Theatrical Releases

Decades ago, film and TV production studios could depend on a steady income from multiple content distribution channels including television, theatrical releases, and physical or digital one-time sales.

Today, it is well known that streaming video-on-demand (SVOD) has changed production studios’ earnings potential. Profits generated through traditional distribution methods have dwindled while all SVOD services but Netflix (NFLX) have yet to reach breakeven.

Impossible Economics of Streaming

Studios had an implicit limit on the number of active productions before SVOD services were created. For example, a finite amount of television content would enter production to fill a finite television airing schedule.

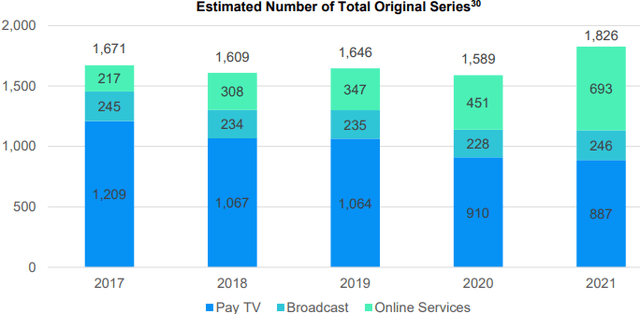

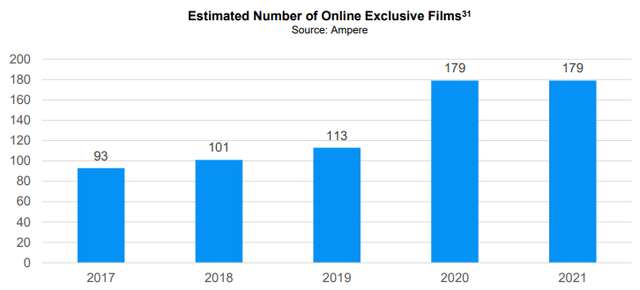

However, since streaming services allow for unlimited and non-linear content consumption, we’ve seen it lead to a boom in active productions to fill libraries of unlimited size:

MPA 2021 THEME Report

MPA 2021 THEME Report

The return on investment of a TV release could be somewhat clearly calculated since all had advertisements, a limited run time, and since new content replaced old ones within the limited airing schedule.

However, new SVOD series releases join a huge catalog of content where their individual retention factor or incremental value generated is harder to discern.

Unfortunately for studios, not releasing new series to SVOD services would be a competitive disadvantage, so they find themselves involved in chasing deteriorating returns.

COVID: Ultimate Theatrical Release Stress Test

While COVID could have catalyzed the fall of theatrical distributors in favor of some non-linear SVOD alternative, the failure of studios’ premium video-on-demand (“PVOD”) experiments confirmed that:

- Consumer interest in theatrical remains strong

- Studios need theatrical releases to make films profitable

A notable PVOD experiment was Disney’s (DIS) 2020 release of Mulan in two stages for streaming: first to customers willing to pay a one-time $30 access fee, then broadly released for no fee to all its Disney+ subscribers.

The returns generated by this strategy were not disclosed but hotly debated. Yet, then-CEO Bob Chapek is said to have been encouraged enough by the film’s performance to continue with more PVOD releases.

Fast forward to a year later, Disney announced their decision to exclusively release their films through exclusive theatrical windows going forward (windowed releases are done at different times for different media like theatrical or streaming).

Disney did not chase consumers to put them in theaters trying to recover what could be lost as has been the case with Pay TV.

Instead, the strong post-COVID box office driven by unwavering consumers made the difference between the returns it had been seeing on PVOD clear, and the decision to miss out on box office revenues inexcusable.

Studios are competing on content volume and the ratio of minutes of content to total budget for movies is incredibly lower than for series. Given this, a direct-to-stream movie flop is harder to excuse when a means of “easy” monetization through theaters remains available to them, unlike for television series.

Smooth Sailing Going Forward

2020 and 2021 gave studios a glimpse of what a world without theaters would do to their profitability as PVOD was proven comparatively inadequate.

With post-COVID consumer interest in theatrical remains strong, no studio executive is incentivized to reduce focus on windowed film releases as their shareholders focus on proof of stable and growing profitability.

Warner Bros. CEO David Zaslav has made this observation explicit by remaining committed to maintaining the theatrical window since post-COVID Box Office data proves demand for theatrical exhibitions remains.

Why Theatrical Is Not TV All Over Again

Streaming had an easy upper hand on television: on-demand is broadly superior to linear content distribution:

- No ads

- Lower price

- On-demand content

- Usable across devices

- Available on the go

- Huge content catalog

- Still available to view on television

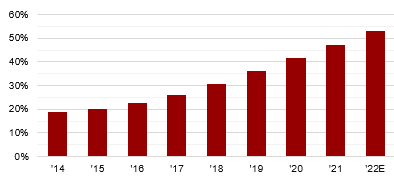

This easy win for streaming has been visible in the fall of television subscriptions:

Share of U.S. Households without PayTV subscription (Statista)

However, with movies de facto being available at the same convenience, the sustained interest in theatrical releases despite an already significant penetration of streaming into households underlines the differences in value proposition between series and movies.

The clearest recent example is the fact that Cineplex recorded their second-highest level of attendance ever on August 28th, 2023.

As long as customers don’t change their preferences, the studios won’t abandon theatrical as the preferred way to monetize their blockbuster movies.

Digital-Age Studios Are Adopting Windowed Theatrical Releases

An even more encouraging trend for Cineplex than older studios remaining committed to theatrical are their digital-age competitors dipping their toes in the space.

Apple and Amazon have both recently announced plans to significantly invest in theatrical releases. For example, Apple’s late 2023 windowed releases of Napoleon and Killers of the Flower Moon, among other titles, show their commitment to the big screen.

For them, these releases are not only a way to monetize their large blockbusters but also serve as marketing for their streaming platforms by getting word-of-mouth publicity during a film’s theatrical run AND before it releases to SVOD.

The fact that new entrants rely on theatrical releases legitimizes the value of this distribution method for both consumers and producers.

Why Theatre Operators Are Best Positioned to Outperform

Any long-term confidence in traditional media producers’ strategy and financial performance depends on their:

- Ability to reach streaming profitability

- Monetization of legacy content

- Content pipeline quality over peers

- Balancing optimal content quality/cost/quantity

Just the first point has been significant enough to, for example, dominate the market’s narrative and spook investors away from investing in Disney, also causing internal C-suite drama.

When or how the dust settles is perhaps a time arbitrage opportunity, but I certainly don’t know enough to play these odds confidently.

If we look instead at movie theatre operators, their results still principally depend on the following:

- Consumer Interest in Theatrical Releases

- Studios’ Interest in Releasing to Theaters

I believe the previous sections should make clear why I believe that both factors of these will remain satisfied going forward.

Of course, other relevant company-specific factors exist, but these are most currently relevant to the market narrative, as are the points regarding production studios.

Given the context of studios’ cash-draining streaming service endeavors, their dependence on theatrical releases for content monetization is underappreciated.

Toll Bridge to Studios’ Profitability

I hope I made clear above why I see studios depending on theatrical to become and remain profitable.

Now if many studios push for more profitability-driving theatrical runs, per-movie economics may become worse, and revenue cannibalization for studios may occur as the release calendar becomes more crowded.

However, Cineplex and other theatrical operators would only find upside in such a situation.

As the toll road to profitability, Cineplex benefits based on the traffic. If more movies are released in theaters, more consumers are likely to be interested in coming to see them during their theatrical runs, driving attendance upward.

Why Cineplex is an Optimal Theatrical Operator

Most of the points or data I’ve presented so far concern the industry in general.

Now, let’s consider Cineplex’s position in all this.

Competitive Dominance

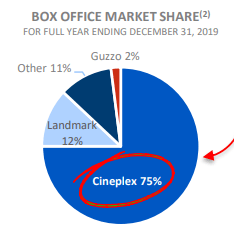

Cineplex’s dominance of its market is such that betting on its success is close to betting on the performance of movie theaters as a whole.

In a chart Cineplex has used in more than one investor presentation they show their ~75% box office market share in Canada as of 2019:

Q2 2023 Investor Presentation

Their market share should not have changed much since then, if not in their favor, since COVID inevitably pushed some smaller competitors out of business.

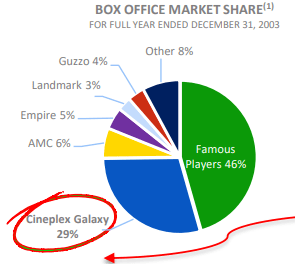

Yet Cineplex has not always been the incumbent movie theater in Canada, as the same slide in Cineplex’s investor presentation shows the 2003 market share profile.

Q2 2023 Investor Presentation

Cineplex’s management has therefore grown into its dominance, and I expect management to continue doing what they have done to bring them to today: innovating and creating value in new ways for all stakeholders.

A History of Pushing To Innovate and Generate Value

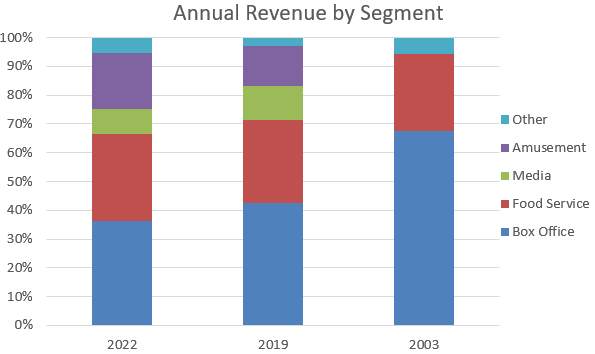

Cineplex’s operations have been materially diversified since 2003:

Company Filings (formatted by author)

The Amusement and Media Business Segments Include: signage and In-theater advertising as well as location-based entertainment and their P1AG amusement solutions business.

Of course, diversification isn’t always positive, but here are some new business ventures that I believe are positive value creators for shareholders. I won’t go into details for each, but all are well described in Cineplex’s filings and press releases.

- CineClub Subscription Membership

- Cineplex Pictures Distribution

- Focus on International Film Showings

- Player One Amusement Group (“P1AG”)

Financials and Valuation Make Sense

Stock returns come from multiple expansion or earnings increases. We’ll take a look at these factors for Cineplex now.

Trading Multiples

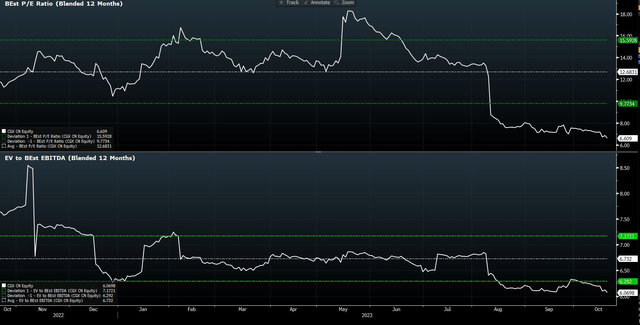

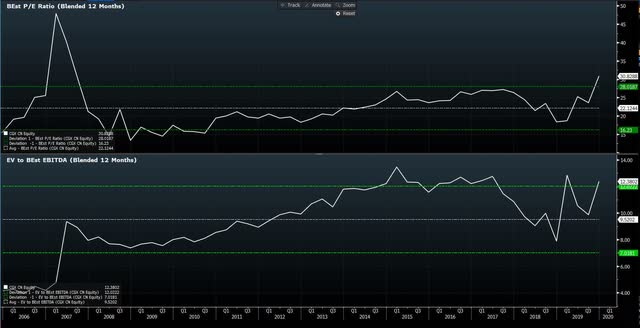

Cineplex’s trading multiples have it in value territory as of now:

Blended Forward P/E and EV/EBITDA (Bloomberg)

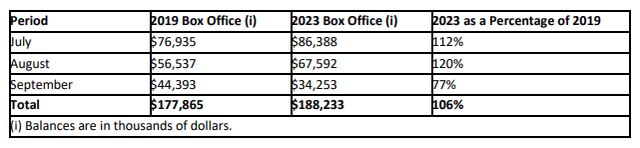

As we can see, the current trading multiples are well below one standard deviation away from the mean. The market seems to be more pessimistic as Cineplex remains stuck in a trading range despite, among other positive factors, some of the most positive attendance figures for Q3 2023:

Q3 2023 Cineplex Attendance (Press Release)

The difference in valuation levels is even sharper in contrast to the 2006-2019 range, which had an average ~22x BF P/E and ~ ~9.5x BF EV/EBITDA:

2006-2019 Cineplex Valuation (Bloomberg)

Relative to those average multiples, the current P/E Cineplex trades at a -42.7% difference and the EV/EBITDA a -36% difference.

Of course, I’m not arguing that those multiples are the fair ones Cineplex should trade at today, but rather I want to highlight both the near-term and long-term depressed multiples Cineplex can be bought at today.

This return potential does not consider the return to or surpassing of 2019’s box office results and beyond.

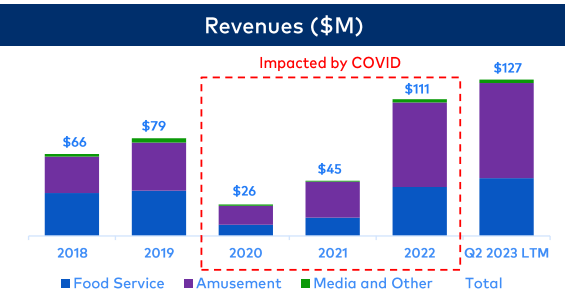

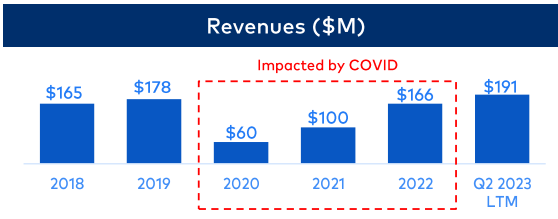

Cineplex’s other non-core business lines alone have shown significant growth potential and stand to be drivers of growth and profitability going forward:

Location Based Entertainment (LBE) Revenue (Q2 2023 Investor Presentation)

P1AG Segment Revenues (Q2 2023 Investor Presentation)

Otherwise, as discussed in depth earlier, I believe theatrical showings will generate as much if not more interest from both consumers and studios in the coming years. This will catalyze earnings growth which, coupled with multiple expansion, generate significant returns to investors.

What Will Catalyze Momentum Recovery

The Hollywood Writers’ and Actors’ strikes have been a drag on Cineplex’s stock performance, limiting the positive impact of the strong summer 2023 Box Office.

The significant downward pressure the strikes have been exerting was confirmed once the writers’ was announced to have been resolved on September 28th and Cineplex shares rose by more than 7% on that day.

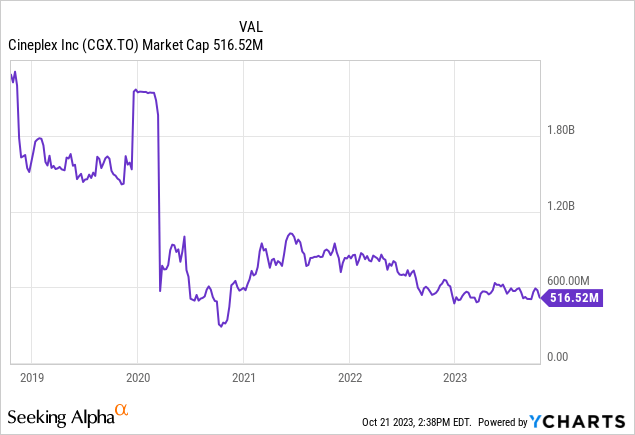

Also, it’s worth noting that significantly shrunken market capitalization relative to its historical range restricts institutional holders, many of whom sold in 2020, to buy back in given most have minimum trading volume or capitalization limits above Cineplex’s.

Another potential reason is the pause of its dividend payout program, removing the possibility for institutional holders to possess shares if their mandates required companies with a long-standing track record of dividend payments and growth, as had been Cineplex pre-COVID.

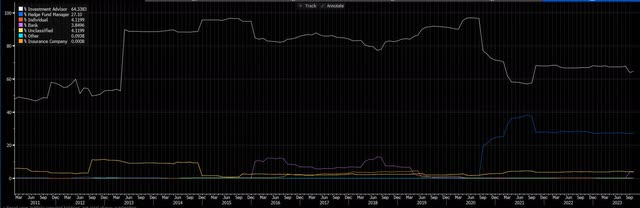

For these reasons or others, we’ve seen Cineplex’s institutional shareholder base has yet to recover, indicating that positive momentum could be intensified by them joining in the buying.

Cineplex Shareholder Composition 2011-Today (Bloomberg)

The market narrative underlying Cineplex’s stock performance seems to be pessimistic regarding or at least unconvinced by the long-term prospect of movie theater economics.

The significant positive reactions to the July Box Office results or even the ticket sales performance of Taylor Swift’s theater experience imply that further good news could push Cineplex’s stock upward, especially if the gloomy cloud of SAG-AFTRA’s strike goes away.

Further, as discussed earlier, I believe that even if the market remains unconvinced by the long-term promise of the currently sustained consumer interest in theatrical (see Q3 2023 attendance levels higher than Q3 2019), once media producers, especially the streaming-first new age studios, commit to theatrical releases, it will be harder for the market to ignore the value proposition strength of theatrical operators.

To conclude, here is a short list of some high-potential momentum drivers.

- Hollywood Strike Conclusion

- Sustained & Increasing Consumer Interest

- Studios continuing explicit commitment to windowed theatrical releases

- New-Age studios pushing toward more theatrical releases

- More Event Theatrical Releases

- Dividend Reinstated

Resilience Through Recessions

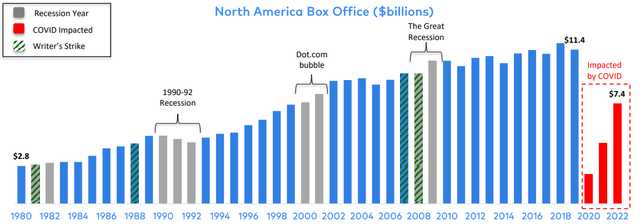

Cineplex’s Q2 2023 earnings presentation deck featured key data for our current economic environment:

Investor Presentation

Of course, no economic slump is like the next, and the addition of streaming to the mix as well as a recession potentially coinciding with a diminished release slate due to Hollywood strikes could all play against theatrical players.

However, the past two decades have demonstrated the resilience of the box office in North America.

Going forward, I wouldn’t be certain that revenues wouldn’t fall if a recession began. The unique factors of every economic environment don’t allow us this confidence.

However, what I am confident in is that theatrical will remain key to studios’ distribution plans, that consumers will remain interested in seeing movies in theaters, and that the release slate will continue improving.

Short-term disruptions to these trends could occur due to economic variability, but I don’t expect any impact on the long-term trends above, even if the historical resilience of the North American box office doesn’t hold this time around.

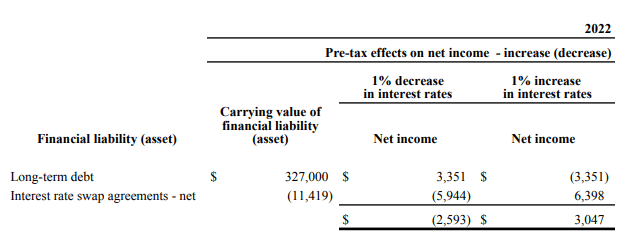

Interest Rate Sensitivity

Regarding Cineplex’s Financial vulnerability to changes in interest rates, a relevant analysis is presented in their 2022 annual report.

It shows that at fiscal year-end 2022, a 1% increase in interest rates would only decrease its net income by about $2.5mm:

Interest Rate Sensitivity (2022 Annual Report)

Main Risks

Strikes Drag On

Of course, no movie slate will be as disrupted as it was during COVID, where no one could even sit in Cineplex’s theaters.

While the writers’ strike being resolved reduces the magnitude of the risk to box-office results, the impacts of the actors’ strike dragging on are non-negligible.

It’s hard to know the magnitude of delays given that most delays are impacting movies that have not completed or not even started filming, such that release dates are rarely announced.

One avenue protecting Cineplex includes its international film slate, CineClub membership, and amusement services.

Nonetheless, this will not compensate for the lost revenue, and seeing as the strikes have already been a material downward pressure on Cineplex shares so far, we should expect that its dragging on will continue to limit performance.

The flip side is that once resolved, I expect the market to be forward-looking despite a temporarily slower release schedule as worries of a year-long strike will have had time to pass.

Worse-Than-Anticipated Recession

It could also be the case that the historical resilience of the North American Box Office through recessions does not hold this time around.

Perhaps due to the new competition for consumers’ spending with streaming services or the significant magnitude of the economic slump in Canada’s economy, it could be that Cineplex’s earnings underperform.

However, while this development’s impact on Cineplex would certainly be negative but of unknown magnitude, I would remain confident that the positive long-term drivers I discussed above will remain unchanged.

Dilution

Cineplex issued in July 2020 $316mm of convertible debentures maturing on September 30th, 2025, with a conversion price of $10.94.

The total principal being converted to shares at this conversion price would represent an increase of 28.9mm shares. As of the latest quarterly earnings release, Cineplex had ~63.4mm shares outstanding, so this would represent a 46% increase in the share count.

It is worth noting that if one of or both of the previous risks discussed occurs, it could be that Cineplex’s stock price remains depressed below the conversion price, preventing any dilution.

Based on the market’s general pessimism, for Cineplex to reach 11$ would imply a better outlook or perception by the market regarding its business, which isn’t all negative and could sustain momentum through conversion issuance.

For perspective, even while I tend to not take sell-side analysts’ opinions as wholly reliable, they are going against the stock’s trend and show some non-negligible conviction in this name:

Sell-Side Analyst Cineplex Rankings (Bloomberg)

Therefore, I do expect Cineplex to reach the conversion price before expiry and subsequent conversion of the debentures.

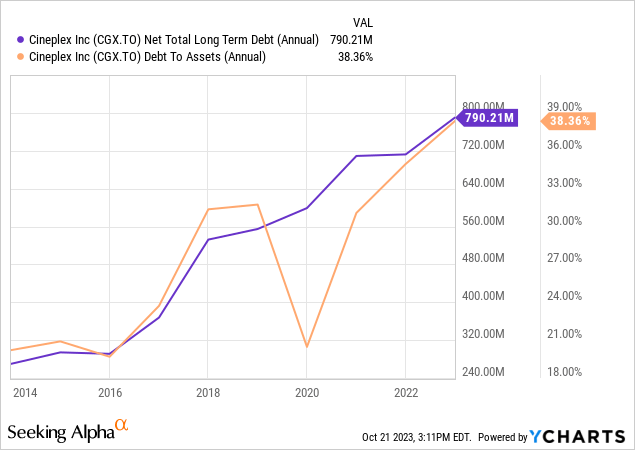

I do not see the danger here as this potential one-time conversion. The real risk would be lenders’ unwillingness to finance their debt fueling more financings of convertibles or high-rate debt. This will remain to be monitored, especially given Cineplex’s historically elevated leverage.

Conclusion

Theatrical releases have come out of COVID as a proven value-added for film production companies.

With Apple Studios and Amazon joining established studios in committing to windowed theatrical releases for their films, I believe the industry will live through the next decade and beyond.

Driven by unrelenting consumer engagement, theaters will remain a key part of producers’ content strategy, and Cineplex’s dominant market position in Canada will allow it to reap the associated profits.

While the market has adopted a wait-and-see position with Cineplex, I encourage you to buy, as its valuation remains cheap, the value of its service has been proven to consumers and studios, and momentum is temporarily depressed by the Hollywood strikes.

In due time, momentum will recover and the market will once again appreciate Cineplex’s value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here