It’s not often that a “too big to fail” bank is offering a security with a dividend yield of 9.5%, but that’s just what happened last week when Citi (NYSE:C) did not call its Series J fixed to floating preferred share (C.PR.J) and allowed the dividend rate to float at a rate of three month SOFR plus 430 basis points (including tenor spread adjustment). While a slight call risk currently exists with the security, and many investors believe the shares will be called in December, there are circumstances that may cause the shares to remain issued into 2024.

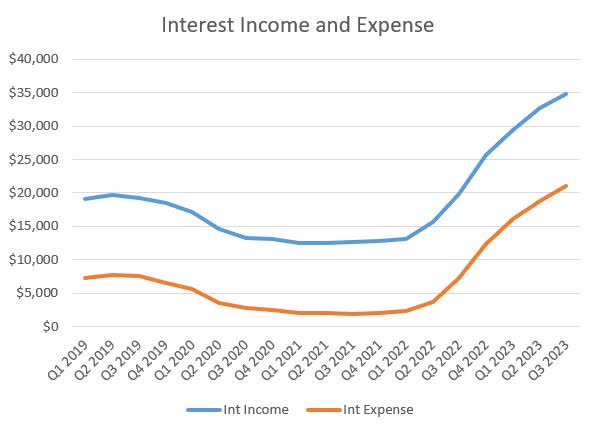

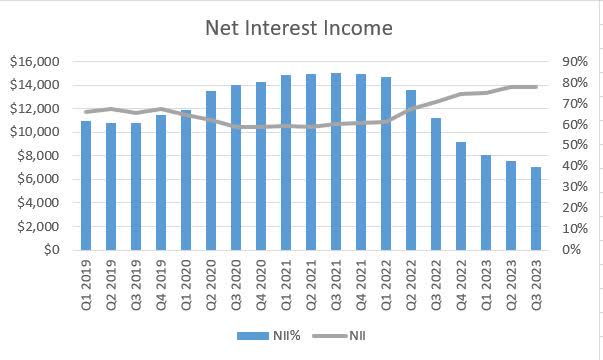

Citi’s decision to not call its Series J shares has nothing to do with whether it has the ability to pay its preferred dividends. Like many banks, rising interest rates have increased both interest income and interest expenses. Fortunately, net interest income (interest income less interest expense) is $2 billion greater on a quarterly basis than it was during the pandemic.

Company Financials Company Financials

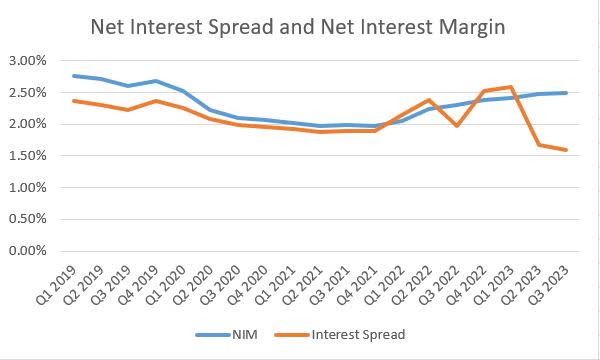

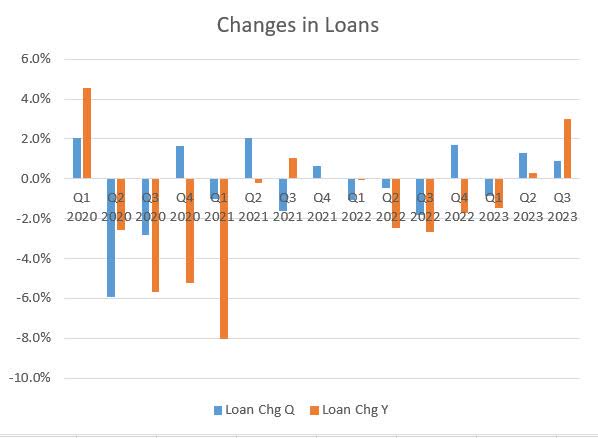

Another positive trend for Citi is the net interest margin, which continues to grow out of the pandemic lows, despite still being 25 basis points below pre-pandemic levels. Net interest margin has held up despite a decrease in the interest rate spread (asset yield less interest-bearing liabilities rate). Net interest margin is up due to the bank deploying more assets into lending, which despite only growing 3% year over year, is at its highest level since the start of the pandemic.

Company Financials Company Financials

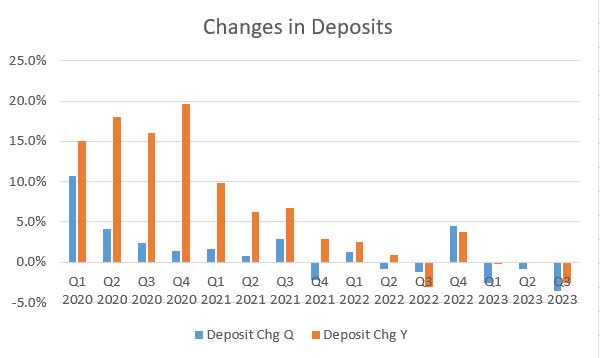

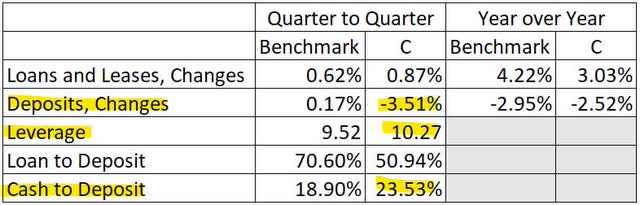

Citi is not without its share of struggles. Like the banking industry, Citi is losing deposits. In fact, while deposits stabilized industrywide in the third quarter, Citi saw the greatest decline in deposits thus far and deposits have declined in six of the last eight quarters. This bucks the myth of deposits growing amongst “too big to fail” banks due to the regional banking crisis.

Company Financials

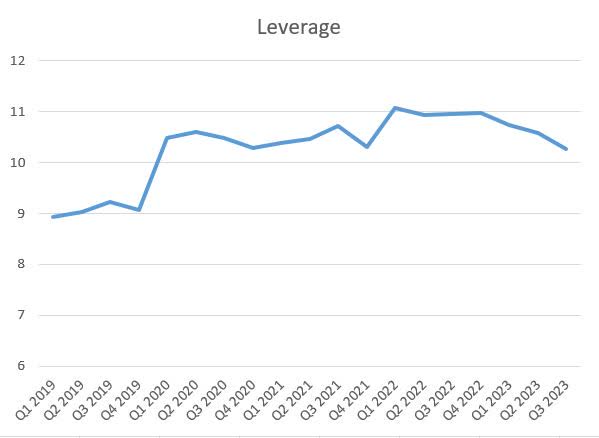

Leverage is also another area investors need to be mindful of. While the bank has deleveraged from a ratio of 11 to 1 down to 10.25 to 1 in the past few quarters, this ratio remains above the industry benchmark. Despite the leverage issue, Citi has a large amount of cash, enough to cover nearly a quarter of deposits and nearly half of its loans. Cumulatively, the capital structure of the bank is quite conservative.

Company Financials Company Financials & Federal Reserve

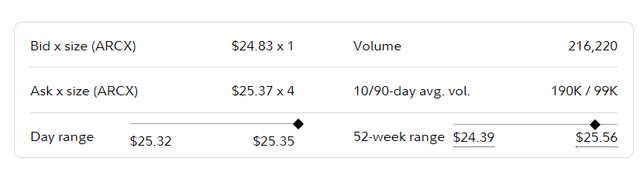

The Series J shares do have a slight call risk as they are trading between 1 and 2% over their call price, but a quarterly dividend of over 60 cents (or 2.5% of the call price), has already been declared for payment in December. If investors pick up the shares prior to the ex-dividend date, a December call would net $25.60 per share, above the current price.

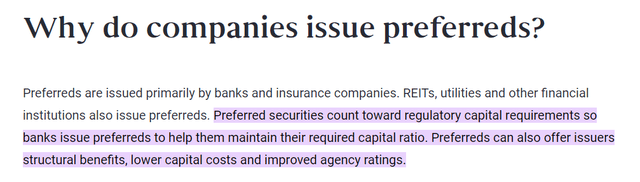

A December call is not a given for the Series J shares, and this is not an oversight. Citi did call its Series K shares for just under $1.5 billion earlier last week. Having preferred shares on the balance sheet do benefit banks as they help support capital ratios. Citi needs to be careful with how it proceeds because calling in more preferred shares or engaging in common share buybacks can create problems with capital ratios, an issue that was mentioned on the earnings call.

Pimco Earnings Call Transcript

Investors interested in purchasing Series J preferred shares are cautioned to do so by issuing limit orders. The Series J preferred shares, like many preferred equities, have wide bid/ask spreads and can be subject to low volumes. Investors can get pricing below the ask price with limit orders and a little patience. Market orders can increase the probability of the order filling immediately, but at a higher price.

Fidelity

I’m holding the Series J preferred shares and will be fine if I get my investment back plus a small premium if the shares are called in December. If the shares are not called due to capital concerns, the dividends will continue to float at a premium to market rates. For Citi to eliminate its preferred dividend, it would need to eliminate its common dividend first and be under much more stress than now, as it was in February 2009 when it opted to suspend preferred dividends. Based on current financial data, the bank’s performance is nowhere near approaching these levels.

Read the full article here