Overview

You read that right, a regional bank approaching a near 7% dividend yield!

Today, I am rating none other than Citizens Financial Group (NYSE:CFG) and giving it a buy rating. My rating is in line with the consensus from both Seeking Alpha analysts and Wall Street, but more bullish than the SA quant system rating which gave it a hold rating.

The regional banking segment made headlines in March, perhaps not always in the best light, but this opened the door for buying opportunities in the regionals, and I will show why this one could be considered a value buy while having strong financial fundamentals at the same time.

Its positives include: A dividend yield at 6.5% beating two key peers, capital strength, net interest income growth thanks to the macro environment of high rates, undervaluation on P/E and P/B ratios along with a value buying price opportunity as shown in its price chart.

It’s one negative includes: Not adequate revenue diversification as 75% of revenue is dependent on interest income.

Company Brief

According to its company website, this Providence Rhode Island-based bank serves individual, business, and commercial clients with a variety of banking solutions. Some key metrics include $222.3B in assets and “approximately 1,100 branches in 14 states in the New England, Mid-Atlantic, and Midwest regions.”

A notable item to mention, which shows expansion and growth efforts in the last few years, is that effective February 2022, Citizens had acquired 80 branches on the US east coast region from HSBC Bank USA (HSBC).

According to its investor relations site:

The 80-branch acquisition includes 66 locations in the New York City Metro area, 9 locations in the Mid-Atlantic/Washington D.C. area, and 5 locations in Southeast Florida. The acquired branches have been re-branded as ‘Citizens.’

Rating Methodology

Our rating consists of evaluating 5 areas separately: Dividend yield, valuation, and price chart trends, the company’s revenue diversification and geographic penetration, capital and liquidity strength, and whether the current macro environment helps their business or hurts it. Each category is worth 20 points. A total score of 60 is a hold rating, below 60 is a sell, and above 60 is a buy. A score of 100% would be a strong buy.

Then, I compare my rating vs the consensus rating from SA analysts, Wall Street, and the SA quant system.

A Compelling Dividend Yield

From Seeking Alpha data, this stock currently has a dividend yield of 6.55%.

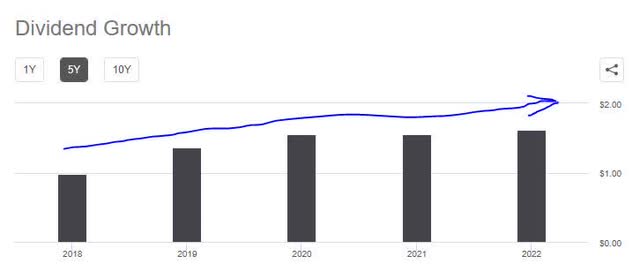

Its dividend is $0.42 per share, with no ex-date coming up soon. Its 5 year dividend growth is positive, going from an annual dividend of $0.98 in 2018 to $1.62 in 2022, a 65% increase over that period:

Citizens Financial – 5-year dividend growth (Seeking Alpha)

In comparison to two of its listed peers, Regions Financial (RF) has a dividend yield of 4.61%, and Huntington Bancshares (HBAN) has a yield of 5.88%.

Citizens beats these two peers on yield, then, and remains highly competitive in that category with a near 7% yield, so I would recommend it to investors looking to add to a dividend-income portfolio of financial stocks.

As a dividend investor myself, I usually look for stocks that have reliable quarterly payments, which is also a sign of capital strength, but also ones with yields over 4%.

Undervalued and Still in Buying Range

From Seeking Alpha data, I am tracking two valuation metrics that are GAAP based: the forward price to earnings (P/E) ratio, and the forward price to book (P/B) ratio. The benchmark I will use is the percentage difference vs the median ratios for its sector.

For this stock, the P/E is 6.19, almost 32% less than its sector median. The P/B is 0.53, over 44% less than its sector median.

This stock is also more undervalued than Huntington Bancshares whose forward P/E is 7.53, as well as Regions whose forward P/E is 7.40. This makes Citizens look more undervalued than its two peers, another plus for a value investor to consider when comparing multiple regional banks considered peers.

Next, let’s look at the price chart after the market open on Thursday June 29th:

Price chart on June 29 (StreetSmart Edge trading platform from Charles Schwab)

As of the writing of this article, the price was trading around $25.87 after market open on Thursday June 29th, and closed at $25.93 that day. This is within my recommended buying range for a value buy, as shown in the yellow highlighted price range I picked of $25-$28 for this stock.

In this chart, which goes from December 2021 to now, I track the 50-day SMA (blue line) vs the 200-day SMA (red line) and circle any death cross or golden cross formations. Currently, the stock is still in a bearish period after the most recent death cross of April 2023, and the price is well below the 200-day average but also below its 50-day average.

The combination of undervaluation on P/E and P/B ratios, which I have shown already, as well as the current price trading where it is, makes this a recommended value buy at this time, in my opinion.

Strong Regional Penetration but Needs Better Revenue Diversification

As mentioned earlier, this firm is essentially a regional bank and not in the same category as a Morgan Stanley (MS) who typically has global penetration, or a Wells Fargo (WFC) with national market penetration. Just as Regions Financial (RF) has a solid footprint in the American southeast, Citizens seems to be primarily concentrated in the northeast and mid-Atlantic, and also growing after the (HSBC) branch acquisitions mentioned earlier.

I would like to see Citizens make a greater effort to penetrate the southeast market which is a major growth area of the US. They should consider that another regional bank I covered recently, Fifth Third Bank (FITB) has already recognized the opportunity to penetrate other high-growth regions beyond its native Ohio, particularly the southeast US.

According to my analysis on that bank, Fifth Third “is continuing its now four-year-old push into the Southeast, with plans to open 30 to 35 branches throughout the Carolinas, Georgia, Florida, and Tennessee in 2023.”

Although Citizens is a strong regional player, where it does need room for improvement, I think, is in growing non-interest income, to increase revenue diversification.

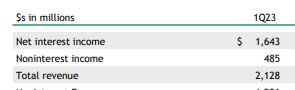

Revenue info shown is taken from the official company Q1 results on its website, and/or its financials on Seeking Alpha. First, let’s look at the breakdown of interest vs non-interest revenue at this firm:

Citizens Financial – Q1 Presentation (Citizens Financial)

The breakdown of total revenue is about 77% coming from interest and about 23% coming from non-interest income. This is roughly 3/4ths and 1/4ths, so it appears to think their revenue is very dependent on interest income, being over 75% of total revenue.

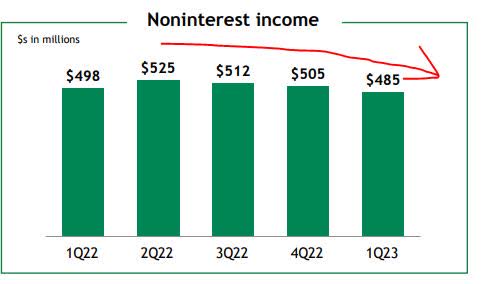

Next, let’s look at the non-interest income segment. Consider that their non-interest income has been in steady decline since 1Q22:

Citizens Financial – Non-interest income (Citizens Financial – Quarterly Presentation)

In their recent Q1 results, notable items they mentioned that were driving declines are “capital markets fees decreasing $10MM, and mortgage banking fees decreasing $12MM, driven by lower production volumes.”

Some of their other non-interest income comes from things like service charges, trust fees, and card fees, for example. However, from a larger view, I don’t think they are diversified enough when comparing interest to non-interest income. Eventually, when rates start going down again at some point, my question would be what impact will it have on their interest-driven revenue?

So, at the moment although it has geographic diversification across multiple states in the US within one large region, I am not convinced that Citizens is highly competitive in terms of revenue diversification due to over 74% of revenue coming from interest income.

Capital & Liquidity Strength is Healthy

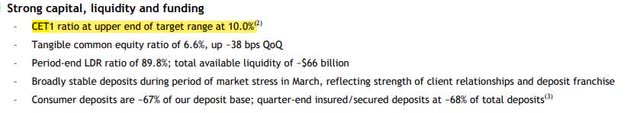

The company’s CEO Bruce Van Saun set a positive outlook in his Q1 commentary. According to van Saun, “our capital, liquidity, and funding position remains strong, and our deposits were broadly stable over the month of March.”

Additionally, in researching their Q1 results, I see that their CET1 ratio is the upper end of 10%, which is well above Basel III standards. This is also slightly higher than the 9.8% CET1 ratio of Regions Financial, for comparison purposes.

Additionally, one notable item to mention, especially after the March failures of banks exposed to a large amount of uninsured deposits, such as Silicon Valley Bank, is that at Citizens the “insured” deposits are 68% of total, or well over half:

Citizens Financial – Capital (Citizens Financial – Q1 Presentation)

The company’s balance sheet has shown positive equity for several years in a row, and their cash flow statement shows a positive free cash flow per share for the last three quarters. These are some metrics I look at in assessing this firm’s financial fundamentals.

On the basis of these metrics above, I would recommend this stock.

Macro Environment of High Interest Rates is Favorable

As I talked about in prior articles covering both banking & insurance, the larger macro environment of elevated interest rates driven by Fed decisions has specifically benefited these types of businesses that make a lot of money from interest-bearing assets.

Let’s see how that applies to Citizens Financial, which I already showed has over 75% of its revenue coming from interest income.

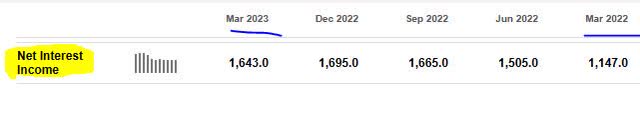

For starters, we see a steady increase in NII since the same quarter a year ago:

Citizens Financial – NII (Seeking Alpha)

Also, to deep dive on this further, the company reported the following in its Q1 release in discussing YoY performance:

Net interest income of $1.6 billion increased 43%, reflecting higher net interest margin and 20% growth in average interest earning assets, including the impact of the HSBC and ISBC transactions.

Net interest margin of 3.30% increased 55 basis points, reflecting higher interest-earning-asset yields given higher market interest rates and interest-earning asset growth, partially offset by increased funding costs.

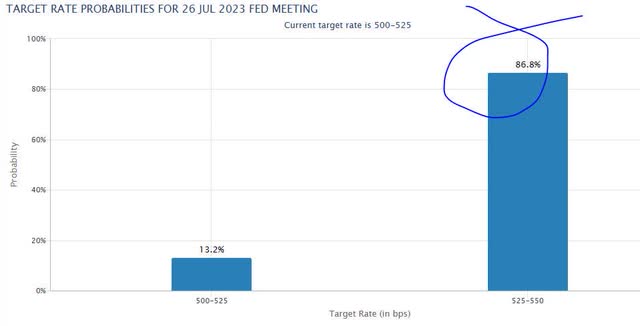

From a forward-looking perspective considering the rest of 2023, I think this positive trend will continue because there is no sign that rates will fall soon.

This is supported by the CME Fedwatch survey of rate traders which shows an 86% probability of rate hikes again after the next Fed meeting in July:

Probability of Rate hikes (CME Fedwatch)

Further, a June 28th article in Bloomberg said the following after Fed Chair Powell attended a panel discussion in Portugal:

Federal Reserve Chair Jerome Powell signaled policymakers could potentially raise interest rates in July and September to curb persistent price pressures and cool a surprisingly resilient US labor market.

So, when it comes to benefiting from this macro environment we are in, Citizens Financial would be a company I recommend.

Risks to My Outlook

A risk to my bullish outlook would be this firm’s exposure to commercial real estate, and more specifically office property.

This has come up as a discussion point lately, and as an example, it was reported by Axios on June 5th that:

The office space market is in a tough spot thanks to the double-whammy of remote work and high-interest rates. More employers are either downsizing their footprint or letting leases go entirely. Demand for space is down.

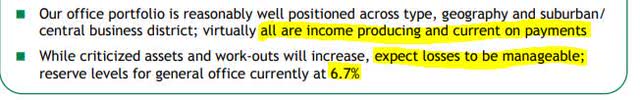

However, in its last Q1 presentation Citizens has addressed the issue of office space in a positive light:

Citizens Financial – Office exposure (Citizens Financial – Quarterly Presentation)

So, while the risk of office property exposure is a real concern for many, this specific bank seems to be managing this risk adequately for now.

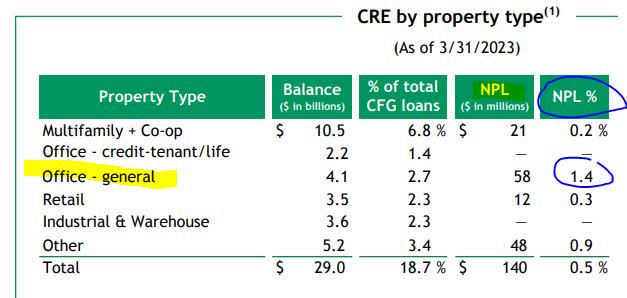

Consider that office non-performing loans amount to just 1.4% of total general office loans in their commercial real estate portfolio:

Citizens Financial – Office NPLs (Citizens Financial – Q1 Presentation)

Therefore, I will continue to track these trends, especially in their upcoming Q2 results, but for now, the risk seems manageable for a firm like this.

Conclusion

In conclusion, I reiterate my buy rating for this stock, which scored 80% out of 100 in my own rating methodology. My rating is in line with SA analysts and Wall Street consensus which gave a buy rating, but is more bullish than the Seeking Alpha quant system that rated Hold:

Ratings consensus (Seeking Alpha)

Its positives are close to 7% dividend yield, favorable interest rate environment, capital strength that is proven, and undervaluation on P/E and P/B metrics along with a price trading well below its 200-day SMA.

Its one negative for now keeping it from a rating of strong buy, in my opinion, is a need for more growth of non-interest income in its revenue mix.

While some this spring may have thought it was the end of the regional banks, the rest of us were, and are continuing, to find value buying opportunities in some of them, particularly ones like Citizens and others who have generally strong financial fundamentals and prudent risk management in place.

This is still a golden opportunity, I believe, to add some of the regionals to a portfolio, before the bearish price trends stage a rebound.

Read the full article here