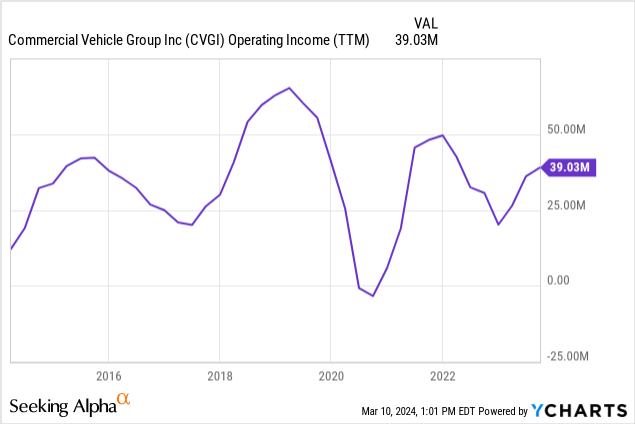

I was previously bullish on Commercial Vehicle Group, Inc. (NASDAQ:CVGI) due to my belief that the market was too bearish on heavy duty and medium duty truck production, and due to management’s longer-term guidance on the growth of the electrical systems segment. My thoughts on truck production have turned out to be correct so far as economic strength and pull forward of orders due to environmental regulation led to higher than expected North American class 8 truck production in 2023 (337,000 vs. an initial prediction of 305,000). Additionally, ACT’s 2024 class 8 truck sales and production forecasts were recently bumped up. Despite continued weakness in the freight market, truck production has remained relatively strong.

However, I was wrong in my belief that CVG would remain on track to hit its longer term financial targets. Management maintained that it would hit its 2027 goal of $1.5bb revenue target with a 9% EBITDA margin after CEO Harold Bevis left the company but new CEO James Ray was much more cautious about this target despite not formally going back on it. Coupled with not benefiting from improved class 8 truck numbers over the course of 2023, this change in confidence in the long-term picture also shook investor confidence. Since my first report on the business, the stock is down 40% while the Russell 2000 is up 5%. A terrible performance given the unexpected economic strength since that time.

From here, I find it difficult to maintain as bullish of a position on the stock, given the poor business performance and my difficulty in trusting the management team. With the stock down so much, I still see some upside from the current price, but I am significantly reducing my 12-month price target to $7.33 based on FY2024E FCF/share of $0.81 and a 9x multiple.

FY2023 Results

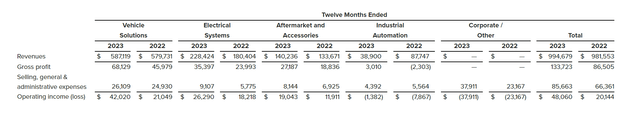

Earnings and revenue growth in the electrical systems segment were offset by declines in other segments. Consolidated revenue was down 4.7% from $981mm to $994mm and consolidated operating income grew to $66mm from $20mm.

In the Vehicle Solutions segment, revenue grew 1.2% from $580mm to $587mm and operating income doubled from $21mm to $42mm. This dynamic was largely a result of lower volume and increased selling prices.

In the Electrical Systems segment, revenue grew 26.7% from $$180mm to $228mm and operating income grew 44.4%. Most of the $150mm in new business wins were concentrated in this segment.

In the Aftermarket segment, revenue grew 4.5% from $134mm to $140mm and operating income grew 5.8% from $12mm to $19mm.

In the industrial automation segment, revenue declined 55% from $88mm to $39mm and operating income grew from a loss of $7.9mm to a loss of $1.4mm.

CVGI FY2023 Financials (CVGI Q4 2023 Press Release)

While these results look like an improvement over the year before, most earnings growth was driven by higher selling prices and was offset by reduced volume. In the context of impressive class 8 truck production, these are disappointing results. This is evident by looking at 2023 North America new truck deliveries for the biggest truck OEMs. Paccar Inc. (PCAR) U.S. and Canada new truck deliveries rose from 95,600 in 2022 to 109,100 in 2023. New truck deliveries in North America for The Volvo Group (OTCPK:VOLAF) grew from 56,535 in 2022 to 60,782 in 2023. Given the decline in volume for CVG’s vehicle solutions segment, it follows that CVG is losing market share.

In addition to the Vehicle Solutions segment, the Aftermarket Parts segment results were very disappointing. Management has touted an ecommerce initiative to grow and gain share, which has been a costly investment that has not provided adequate returns.

FY2024 Outlook

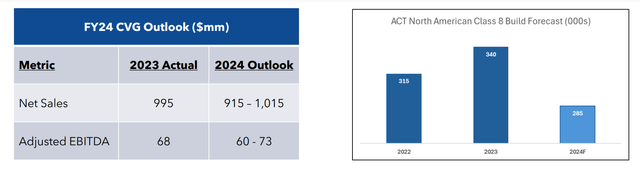

FY2024 Outlook (CVGI Q4 2023 Earnings Presentation)

Management provided FY2024 revenue and EBITDA guidance in the Q4 earnings press release. They are guiding for $915mm to $1015mm in revenue and $60mm to $73mm in adjusted EBITDA, which implies roughly flat revenue and earnings year over year. This guidance is largely driven by ACT’s forecast for 2024 class 8 truck production which calls for a 16% year over year decline. The stock looks optically cheap with this EBITDA guidance (EV/NTM EBITDA of 5), but a deeper look into the market’s assumptions shows that it may be fairly priced given the cyclicality of the business, the uncertainty of economic strength, and given how management has recently made a habit of overpromising and underperforming.

Price Implied Assumptions

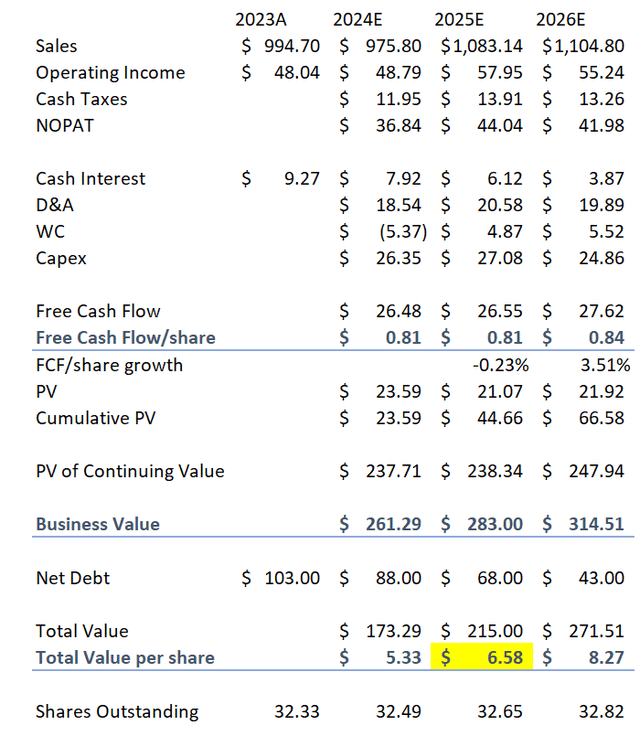

CVGI Reverse DCF (Created by Author)

I am using sell-side estimates and the company’s past financial results to build this model. I am no longer relying on management’s guidance. What’s most illuminating about this is that the market is only expecting CVG to have a competitive advantaged period of about two years. The market clearly does not have any faith in management’s 2027 guidance and given the company’s past cyclicality of earnings, this is not surprising.

The main source of outperformance in a long bet on CVG would be a bet that the company’s competitive advantage period is longer than two years. This would primarily come from successfully growing their Electrical Systems segment which would, in theory, reduce the company’s cyclicality. However, recent comments from the new CEO that indicate the electrical systems segment is mainly tied to construction and agriculture, and markets may mean that the segment will be more cyclical than expected when it’s more mature.

Another source of outperformance would be from betting that short term revenue will be higher than expected. This would stem from higher than expected strength in class 8 truck production. However, given CVG’s inability to gain share in 2023 when truck production did end up being better than expected, there are better ways to make that bet. For example, betting on a higher quality business like Paccar would be better in this scenario as they would almost certainly capture more of the benefits of unexpectedly high truck production whereas CVG may not.

I personally don’t have the confidence to make any of those bets. Management has shown an inability to gain market share and new caution on their long-term guidance makes it difficult to trust them much going forward.

I would also imagine that the complexity of the business, with its multiple and unrelated segments, leads to a lack of focus in business operations. Instead of focusing on being excellent in any one segment, the CVG team is likely spreading its focus out among all of the segments which is leading to underperformance in all of them. This may explain the disappointing results in the Aftermarket Parts ecommerce initiative and the inability to maintain share in the Vehicle Solutions segment.

A plan to spin off or divest any of the segments would lead me to reconsider my views on the stock. But with the current story, I am not confident that the stock will re-rate significantly or that earnings will be significantly higher than expected over the next 12-24 months. Based on these views I have a 12-month price target of $7.33 based on FY2024E FCF/share of $0.81 and a 9x multiple.

Read the full article here