Shares of cortisol concern Corcept Therapeutics Incorporated (NASDAQ:CORT) were initially suppressed after a court found that Teva’s (TEVA) generic would not infringe on its Korlym’s (mifepristone) patents. The shares have acted much better recently, it should be noted. This has prompted a revisit since our last article on this name almost four months ago.

Seeking Alpha

While a decision on the appeal is likely not due until 2025, the company is prepping an NDA for Korlym’s successor, which could be approved for all etiologies of Cushing’s syndrome. With readouts from five clinical trials due in 2024 and a pristine balance sheet against the launch of generic mifepristone in January 2024, this small-cap biopharma merited a deeper dive. An analysis follows below.

Company Overview:

Corcept Therapeutics is a Menlo Park, California-based commercial-stage pharmaceutical concern focused on the development of therapies that treat severe endocrinologic, metabolic, oncologic, and neuromuscular disorders by modulating the effects of the hormone cortisol. It owns one commercial asset, once-daily oral med Korlym, which was approved by the FDA for hyperglycemia secondary to hypercortisolism in adults with endogenous Cushing’s syndrome, who have type II diabetes mellitus or glucose intolerance in 2012. It is also advancing three clinical programs for essentially six indications, with an NDA for relacorilant anticipated to be filed in 2Q24. The company was formed in 1998 and went public in 2004, raising net proceeds of $49.0 million at $12 per share. Its stock trades around $32.00 a share, translating to an approximate market cap of $3.3 billion.

Cortisol

Produced by the adrenal gland, cortisol is a steroid hormone that plays a significant role in the way the body reacts to stressful conditions. It influences metabolism and the immune system, and contributes to emotional stability. In healthy people, cortisol levels follow a diurnal rhythm, peaking upon awakening and decreasing during the day. However, insufficient or excessive cortisol can trigger severe conditions. Hypocortisolism can lead to dehydration, hypotension, shock, chronic fatigue syndrome, and hypoglycemia. Too much cortisol activity (hypercortisolism) can lead to a suppressed immune response, impaired glucose tolerance, diabetes, obesity, fatty liver disease, depressed mood, psychosis, wasting of the arms and legs, edema, fatigue, and hypertension. Cushing’s syndrome (chronic hypercortisolism) is the most common form, which is triggered by continued exposure to glucocorticoids (exogenous) or tumors of adrenal or pituitary gland (endogenous).

As it relates to cancer, excessive cortisol levels may reduce a patient’s immune response to oncogenesis, reduce chemotherapies’ effect on cancer cells, and facilitate the growth of others. As such, Corcept believes regulation of cortisol levels is critical in the treatment of up to 17 diseases.

May 2024 Company Presentation

Product

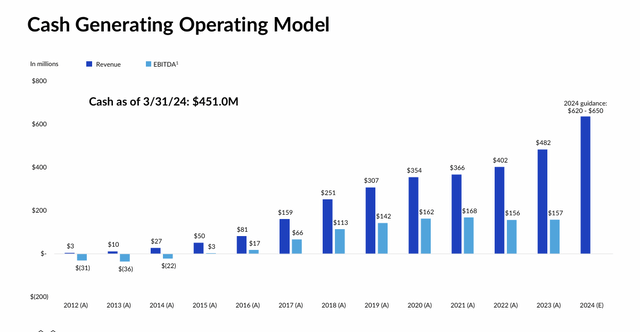

Korlym. That approach was first validated by Korlym, which has made the company a profitable concern since 2016 while financing its additional research efforts. Sales have grown steadily since launch to $482.4 million in 2023.

Much of the R&D spend revolves around improving Korlym, which currently has one major shortcoming. The compound’s active ingredient, mifepristone, is effective because it reduces binding of excess cortisol to the glucocorticoid receptor (GR), effectively regulating the uptake of cortisol. However, it also binds to the progesterone receptor (PR), causing many adverse effects in women such as pregnancy termination, endometrial thickening, and vaginal bleeding. It also induced hypokalemia (low potassium) in 44% of patients in its pivotal trail.

This adverse event profile has held back Korlym, which was the first and is now one of five approved medications for endogenous Cushing’s. Before the approval of Xeris Pharmaceuticals’ (XERS) oral cortisol synthesis inhibitor Recorlev (levoketoconazole) near the end of 2021, there was no therapy that addressed all etiologies of Cushing’s. That said, Recorlev only generated FY23 sales of $29.5 million and ~80% of the 25,000 patients diagnosed with Cushing’s disease elect surgery as a first-line treatment, with ~40% eventually electing pharmaceutical treatment.

Rounding out the competition, Italian concern Recordati (OTCPK:RCDTF) markets pituitary-directed somatostatin analogue injectables Signifor (pasireotide) and Signifor LAR, as well as oral adrenal steroidogenesis inhibitor Isturisa (osilodrostat), the combined sales and adverse event troubles of which are similar to Korlym. Furthermore, Recordati’s franchise is only indicated for Cushing’s disease (CD – pituitary tumor). Antifungal ketoconazole – of which Recorlev is an approved and slightly safer version – and other steroidogenesis inhibitors are prescribed off-label, as is dopamine receptor agonist cabergoline (CD only).

Korlym’s other competition comes via generics. Three manufacturers – Teva Pharmaceuticals (TEVA); Sun Pharmaceutical; and Hikma Pharmaceuticals plc (OTCPK:HKMPF) – filed ANDAs to manufacture and market generic Korlym. Corcept had settled with Sun and Hikma, protecting the former until 2034 provided it prevailed over Teva. That said, after an early legal triumph over the generic manufacturer, where the company’s ‘214 patent was upheld, Teva filed a motion that claimed its generic would not infringe upon Korlym’s two key patents. In December 2023, a judge ruled in favor of Teva, which launched a generic version in January 2024. Corcept has appealed to the Federal Circuit Court of Appeals, with a decision likely expected in early 2025.

Despite these challenges, owing to an effective awareness campaign that will likely be further buttressed by a Phase 4 study (CATALYST) where ~25% of type II diabetes patients enrolled were found to have hypercortisolism, Korlym generated net revenue of $146.8 million in 1Q24, up 39% from the prior year period – $5.6 million better than Street consensus – compelling management to upwardly revise its FY24 net sales outlook from $615 million to $635 million, based on range midpoints. The final prevalence data and initial treatment results from CATALYST are expected in 2024.

Pipeline

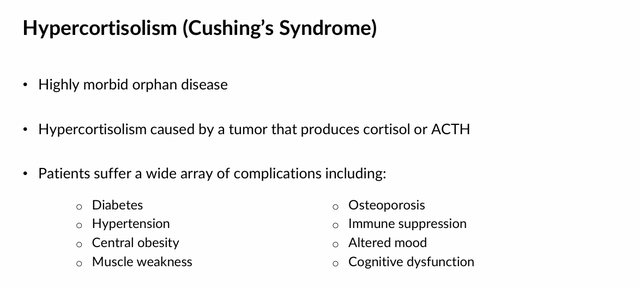

Relacorilant. An easier solution to Korlym’s manifold issues is for Corcept to create a better version of it. To that end, the company has discovered over 1,000 cortisol modulators that bind to GR but have no affinity for PR. From that library, the company selected relacorilant to advance through the clinic, not only as an improvement over Korlym in the treatment of Cushing’s, but also as a therapy for several cancers.

May 2024 Company Presentation

On the Cushing’s front, after demonstrating promise in Phase 2 studies, relacorilant is under investigation in two Phase 3 trials. The first is GRACE, a 130-patient study in which all patients received relacorilant for 22 weeks followed by a 12-week double-blind, randomized withdrawal phase, in which half the patients who exhibited pre-specified improvements in hypertension or glucose metabolism received relacorilant or placebo for an additional 12 weeks. Results from the open-label phase were very encouraging, with relacorilant producing p<0.0001 scores for blood pressure control (primary endpoint), glucose control, body weight, waist circumference, cognition, and quality-of-life score. As important: relacorilant produced none of the side effects (hypokalemia, adrenal insufficiency, or QT prolongation (elongated heart contractions) that plague Korlym. Results from the withdrawal phase, as well as an NDA filing for all etiologies of Cushing’s are expected in 2Q24.

A second 130-patient Phase 3 trial (GRADIENT) is evaluating patients with Cushing’s caused by an adrenal tumor, with data anticipated in 4Q24. For Cushing’s, relacorilant has received Orphan status from both the FDA and the European Commission.

May 2024 Company Presentation

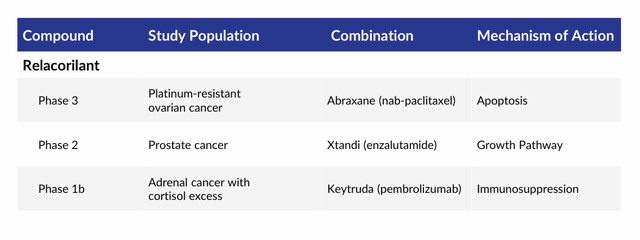

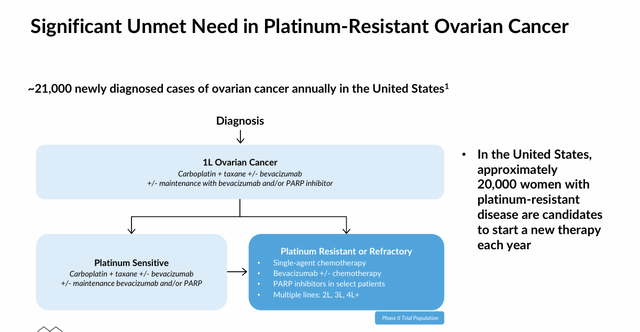

Since cortisol suppresses both apoptosis – a mechanism that chemotherapies are designed to induce – and the immune system, relacorilant is also undergoing assessment in combination with other treatments, including Bristol Myers Squibb’s (BMY) Abraxane (nab-paclitaxel) chemotherapy, Merck’s (MRK) PD-1 monoclonal antibody Keytruda (pembrolizumab), and Pfizer (PFE) and Astellas’ (OTCPK:ALPMF) nonsteroidal antiandrogen Xtandi (enzalutamide) in the treatment of several cancers in which these therapies have demonstrated limited or no effectiveness to date. The most advanced of these indications is platinum-resistant ovarian cancer. After the 150 mg dose produced decent results (p=0.038, median progression free survival) in combination with Abraxane versus Abraxane monotherapy in a Phase 2 study, the duo is undergoing evaluation in a 381-patient Phase 3 trial (ROSELLA) with results anticipated before YE24.

May 2024 Company Presentation

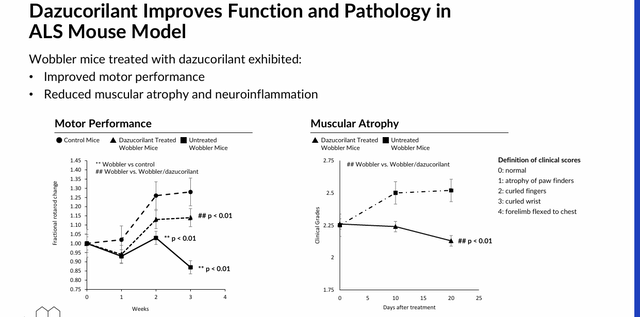

Dazucorliant. Another selective GR binding candidate to keep an eye on is the highly brain-penetrant cortisol modulator dazucorilant, which is undergoing assessment in the treatment of devastating neuromuscular disorder ALS (Lou Gehrig’s disease). After delivering improved motor performance, as well as reduced neuroinflammation and muscle atrophy in Wobbler mice in the preclinic, dazucorilant is being investigated in a 249-patient Phase 2 trial (DAZALS) where participants are being randomized 1:1:1 to receive either one of two doses of therapy or placebo. Data are expected by YE24.

May 2024 Company Presentation

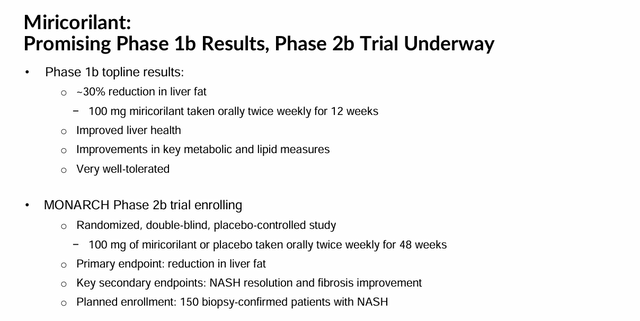

Miricorilant. Rounding out the current clinical selective GR binding portfolio is miricorilant, which is undergoing Phase 2b (MONARCH) evaluation for the treatment of metabolic dysfunction-associated steatohepatitis. An initial Phase 2 study showed promise with patients exhibiting substantial reductions (38.5% to 73.8%) in liver fat after receiving miricorilant for just four to six weeks, but it had to be suspended due to elevated liver enzymes in four of the first five patients who were on miricorilant for at least four weeks. Once off treatment, the elevated liver enzymes resolved. Armed with a milder dosage that demonstrated ~30% liver fat reduction in a subsequent Phase 1 study, MONARCH was initiated in October 2023 with 150 patients randomized 2:1 to receive either 100 mg miricorilant twice-weekly or placebo for 48 weeks. The primary endpoint is liver fat reduction. Enrollment is ongoing.

May 2024 Company Presentation

Balance Sheet & Analyst Commentary:

Owing to Korlym’s steadily rising sales, self-funding Corcept held cash and marketable securities of $451 million and no debt on March 31, 2024. The company has repurchased shares in the past and its board authorized another $200 million buyback program in January 2024, although no meaningful progress on that authorization has been made to date.

May 2024 Company Presentation

With plenty of catalysts on the horizon, the Street is unanimously bullish on Corcept Therapeutics Incorporated stock. Since Q1 results posted in early May, five analyst firms, including Truist Financial and Piper Sandler have reissued or assigned Buy ratings to the stock. Price targets proffered range from $35 to $70 a share. They expect Korlym to generate net sales of $632 million in FY24, followed by $715 million in FY25. Corcept made nearly a buck a share of profit in FY2023 and is on track to do so again in FY2024.

Verdict:

Those sales estimates assume an impact from Teva. Shares of CORT plunged 26% on January 2, 2024, the trading session after the judgement that gave Teva’s generic the green light. Management is confident that it will win on appeal, but that is anyone’s guess. If Corcept prevails, Teva can’t come back to market until 2037.

However, with excellent open-label results from relacorilant in GRACE portending solid placebo-controlled results and an NDA filing for all etiologies of Cushing’s in a few weeks, Corcept has a solid backup plan. Factor in 4Q24 results expected from GRADIENT, CATALYST, ROSELLA, and DAZALS, there are plenty of catalysts to move the needle. Therefore, given CORT’s favorable risk/reward profile, a small to decent sized position appears warranted. In other words, Corcept Therapeutics Incorporated stock merits an “accumulate” rating.

Read the full article here