Recommendation

Readers may find my previous coverage via this link. My previous rating was a buy as I believed Couchbase (NASDAQ:BASE) will benefit from the strong secular drivers, such as digital transformation and rapid data growth, which should keep the database market expanding at a healthy clip for the foreseeable future.

I am reiterating my buy rating for BASE even though near-term performance might be weak. I expect BASE to continue riding the industry tailwind and prove to the market that it can reach profitability within the next few years.

Business overview

BASE is a database service hosted in the cloud that gives businesses a more adaptable, faster, and scalable option for their application data.

Industry landscape

According to Grand View Research, the global market for cloud databases and database as a service (DBaaS) was worth $15.05 billion in 2022 and is projected to expand at a CAGR of 16.3% from 2023 to 2030.

I agree with both the trajectory and scale of this expansion, as I think cloud computing provides a more affordable and adaptable alternative to on-premises data management solutions for businesses. It allows companies to have access to their information and programs from any location and on any internet-connected device. It’s especially helpful for companies that employ a distributed or mobile workforce, as it facilitates real-time communication and information sharing among workers in different locations. Businesses can scale up their use of DBaaS in the cloud as data volumes and complexity increases.

Comments

Despite my optimism regarding BASE’s future after its recent earnings results release (revenue was above consensus), the stock price has since plummeted. Since competitors like MongoDB (MDB) have recently shown signs of relatively stable demand trends, I believe the market is disappointed by management’s reiteration of FY23 revenue and ARR guidance guide. Additionally, I believe a big negative was the restating of its EBIT margin, guidance at -24%, as this will cause the consensus to model yet another year of losses, delaying profitability into the distant future. As investors seek out profitable companies, I see this as a major overhang on valuation. I expect this overhang should stay in the sky until the market experiences a discernible turn toward profitability.

On a positive note, BASE continues to see momentum in the Capella migrations compared to 1Q22, and the number of Capella customers has reached 15% of the total, indicating growing traction for its cloud-native offering. The company’s NRR has remained above 115%, demonstrating its continued success in retaining clients.

In sum, I believe long-term growth to be robust, but I also recognize that BASE must demonstrate to the market that it is on the road to profitability.

Financials

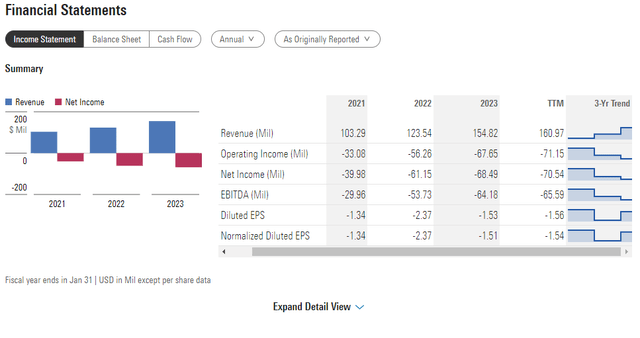

Morningstar

BASE is a fast-growing company that has increased revenue by more than 20% in the last few years, slightly faster than the industry average, implying market share gains. More businesses will use the cloud, which should benefit BASE because of the services it provides. But that doesn’t mean BASE won’t be impacted in the short term, and I expect growth to slow in the coming quarters. Having said that, despite the fact that near-term performance may be poor, I do not see any structural changes in this growth trajectory.

I believe BASE demonstrating to the market that it is on track to profitability is critical to a valuation re-rate. The business was more on track in 4Q23, with an EBITDA margin of -36%, but this was reversed last quarter, with an EBITDA margin of -51%. This is a significant move, and I can see why the market is concerned about the timeline.

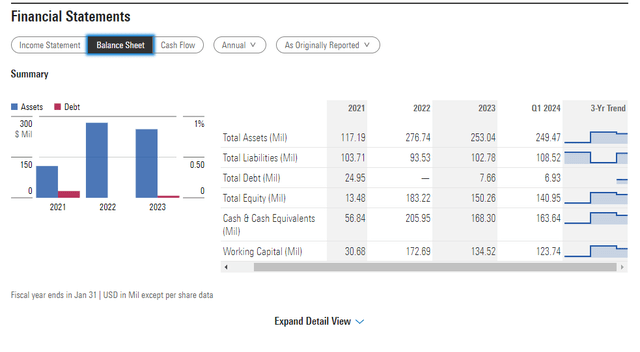

If we look at the balance sheet, we can see that the company only has $163 million in cash, which represents a two-year cash runway if the EBITDA margin does not improve from here. Consensus forecasts total revenue of around $370 million in FY24 and FY25; assuming an EBITDA margin of -50%, the expected EBITDA would be -$180 million, which is greater than the cash balance.

Morningstar

Valuation

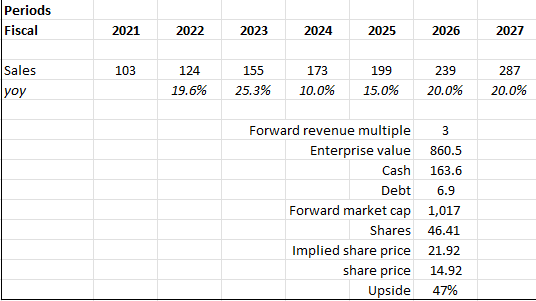

Based on my assessment of the business, BASE should experience a significant slowdown in the near term, with growth of 10% in FY24 and 15% in FY25, followed by a recovery to 20% in FY26 and FY27. My valuation is based on FY27 revenue figures because I believe they are more appropriate and normalized. The best comparable to BASE is MongoDB given the like-for-like offering comparison, which trades at a significant premium to BASE, which makes sense given the higher growth rate and proximity to positive margins. To be conservative, I believe the multiples will remain at the current 2.9x forward revenue until BASE demonstrates profitability and a shift in growth. The stock is potentially worth $21.92 at this multiple.

Based on author’s own math

Risk

The database software industry, which BASE is a part of, is fiercely competitive. Oracle (ORCL), IBM (IBM), and Microsoft (MSFT) are just a few examples of well-known companies with robust customer and channel relationships that help them sell their products more successfully. This is especially true considering that consumers are already familiar with and using these media players. They could more easily upsell their products by bundling them and offering discounts.

Conclusion

I reiterate my buy rating for BASE as I expect growth to recover once the macro situation recovers in due time. That said, I would re-highlight to readers that the near-term revenue slowdown might put further pressure on the stock price, especially if the profit margin worsens from here.

Read the full article here