We forget that Mr. Market is an ingenious sadist, and that he delights in torturing us in different ways.

-Barton Biggs.

There are a lot of angry bears today. I get it. Frankly, I’ve been in their position many times. You are positioned for a data release. The data came out, and your call on it was correct. When you see the print, you get a dopamine rush straight to the brain. A sense of satisfaction washes over you. You were right. And just as you begin mentally preparing your acceptance speech to the Academy, a little fly enters the ointment. You keep waiting for the price to do what you thought it would, but it does the opposite. The satisfaction of being right drains away as you realize you are the poorer for it.

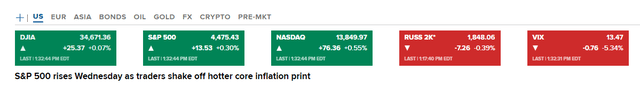

CNBC

Transcendental Meditation is a trendy technique focusing on meditating to a silent mantra. Many well-known folks endorse the technique, including Oprah Winfrey, Clint Eastwood, Gwyneth Paltrow, Deepak Chopra, Arianna Huffington, and Ray Dalio. The mantra is essential. I have a market mantra for you to meditate on if you’ve never tried it: The market is never wrong. If you’d like a more poetic mantra, you could always substitute it with: Listen to Professor Price, Don’t lecture him.

Visual Capitalist

Of course, I’m introducing this concept in a somewhat funny way. However, the thrust of what I’m saying is true. The market is the sum of countless decisions and will always defy the myopic understanding of any single participant over time, no matter how special they seem or feel.

Today’s CPI report came in hot, as many bears expected, but if they positioned for short-term losses, they lost money despite being correct that CPI would come in higher than expected. So why did the market shrug it off? You have to dive into the weeds to find out.

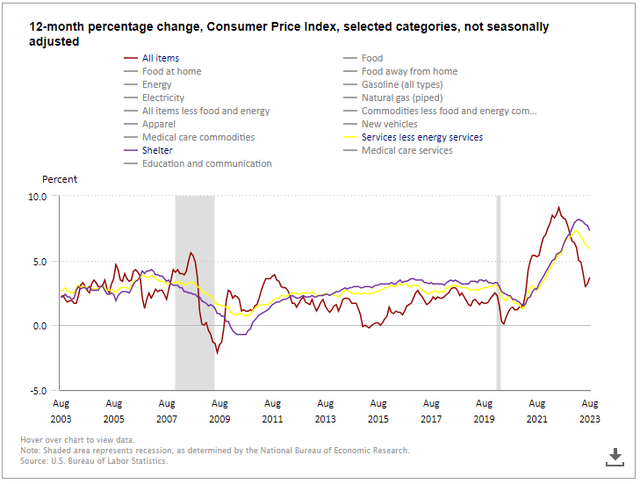

The widely anticipated August CPI Report came in hot after two consecutive downside surprises. Of course, this is the last CPI report before the Fed’s September meeting, giving it added significance. The headline CPI rate rose 0.6% MoM after an increase of 0.2% in July’s report, which aligned with consensus expectations. Core inflation went up 0.2% on a MoM basis, which was also aligned with the consensus.

- Headline inflation rose from 3.2% to 3.7%.

- Core inflation continued to slow and dropped to 4.3% from 4.7%

- Gasoline drove the upside surprise as it had a spicy 10.6% price gain since last month.

- Importantly, Shelter continued decelerating, and other critical areas like Used Cars have shown significant progress.

So, the headline miss is deceptive. Furthermore, although Energy has spiked significantly this month, its decline has been so precipitous that it is still down significantly over the past 12 months. We’ll dive under the hood of the CPI components and, perhaps most importantly, how they are weighted. I am convinced that a nuanced examination of the inflation numbers suggests a soft-landing is occurring and that the Fed will not require further hikes.

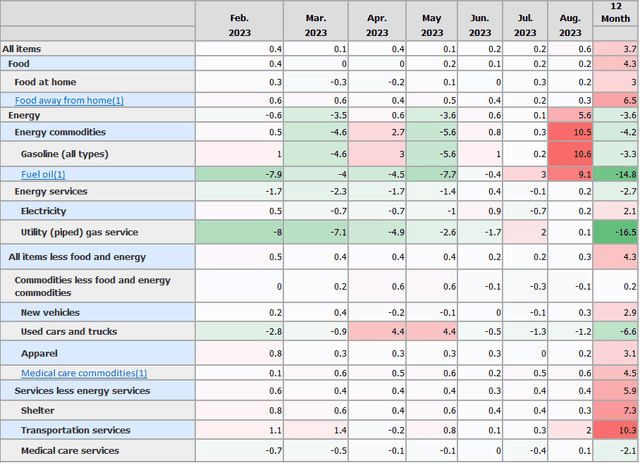

BLS, Author

Despite the upside surprise primarily driven by Energy, most components were less volatile. This is precisely why Core inflation is such an important measure, and underneath the noise caused by Energy, I think the main takeaway for the Fed is that core inflation has shown what looks to be the beginning of a trend. Of course, the rise in Energy prices is concerning, but there is also likely some seasonal relief in the next few months.

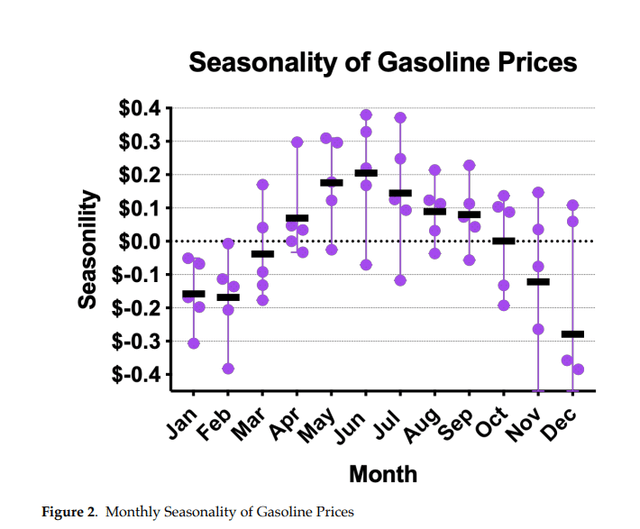

AgManager.Info

There are several reasons why I think the upward pressure on Energy is likely short-lived and that such pressure won’t lead to a reversal of the downward trend in inflation:

- The global composite PMI hit a 7-month low in August. Remember that Energy is a global commodity, and China and Europe are experiencing weakness.

- Seasonal factors suggest that gasoline and Energy prices could decline.

- Production is ramping up in the United States. Total liquid fuel output will reach a record high this year.

- The effect of rising oil prices on the economy is less adverse now that the United States economy has evolved, and the country is a net energy exporter.

- The declining purchasing power of the U.S. consumer suggests that the demand side will be relatively subdued in the coming quarters.

- The labor market has been cooling. There have been three positive reports in a row that suggest wage pressures on prices should ease.

Even if there is continued upward pressure from Energy on next month’s CPI reading, which would align with historic seasonal trends, this effect on the Fed’s battle against persistently high inflation might be counterintuitive. While Energy and inflation are synonymous in the American psyche, how CPI is measured means this historical connection can be misinterpreted. Yes, Energy will cause inflation to rise in the short term, but the Fed is fighting a behavioral inflationary spiral. They are playing a long game. The high gas prices may help lessen price pressures from wages in other areas that help the Fed’s fight.

BLS

When you think about the consumer wallet as a single entity, rising gas prices necessarily mean that other spending must be foregone, given the essential nature of gasoline/energy and the tendency for its purchase to be required for people to continue earning. In this light, gasoline’s strength may help mitigate the persistent stickiness of many of the Services components of inflation. Since consumer confidence is already low, the high gas prices shouldn’t affect them too severely unless they stick around long enough to reignite inflation expectations.

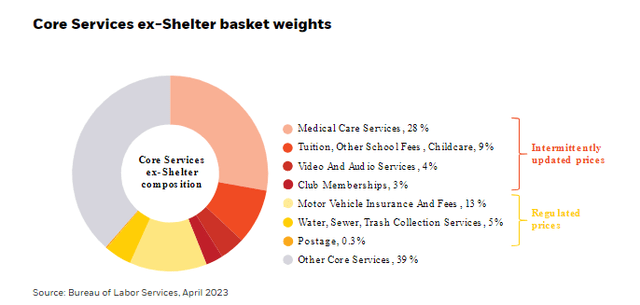

BlackRock

Furthermore, the shelter component is one of the most significant components of CPI that keeps the headline above where the Fed would like it. There has been evidence that Shelter should be declining, but how it is measured in CPI makes it lag. Therefore, the real relief in Shelter may be months away regarding the headline number. Still, for the Fed’s purposes, they probably are comfortable that it won’t reignite for purposes of the rate decision.

BLS

However, the spike caused by Energy shouldn’t cause folks to fret. As long as the downward trend in Shelter and Services continues, the Fed will likely be able to declare victory on inflation without any further hikes. Though several growing risks could derail this thesis, the primary one starts with the Fed itself.

Risks and Where I Could Be Wrong

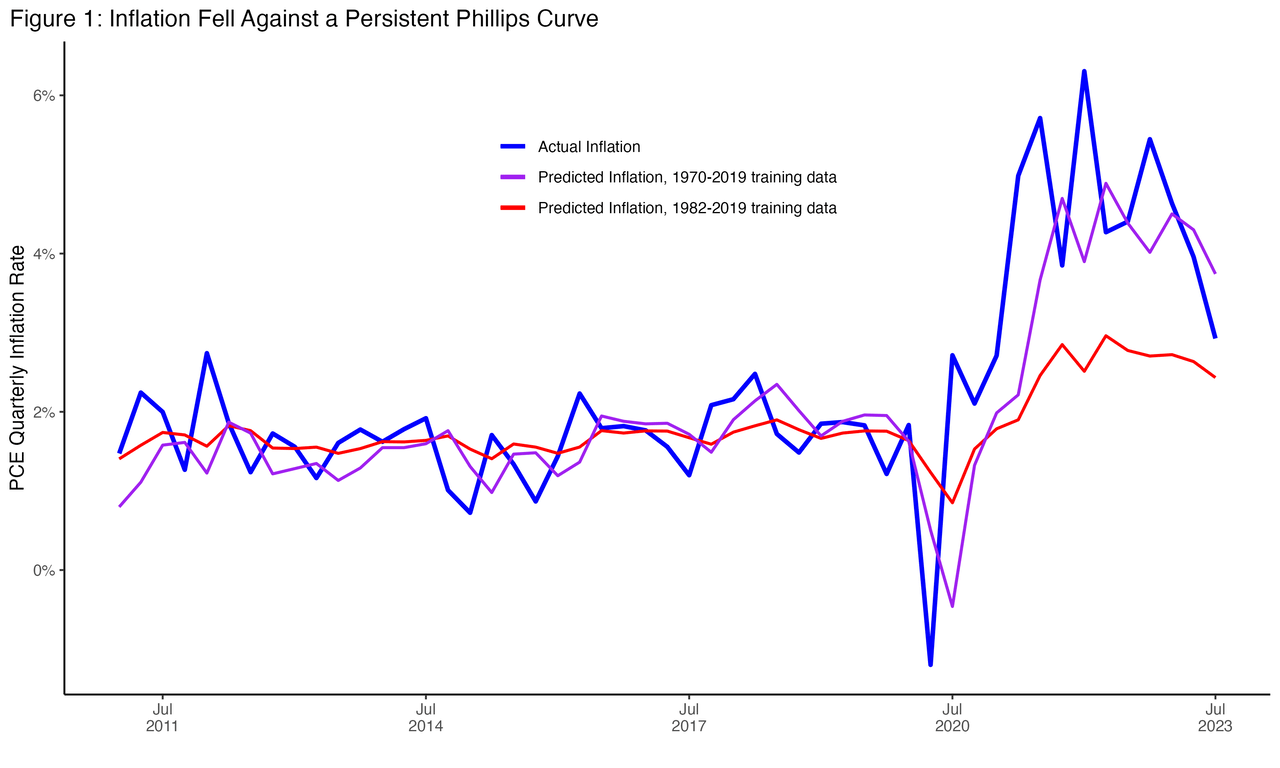

One of the primary risks I see building is that the Fed keeps rates too high for too long. Unfortunately, the Fed seems to orient much of its thinking to not repeating the mistakes of Chairman Arthur Burns. While this is admirable, there’s growing evidence that the primary drivers of inflation are on the supply side. There isn’t anything that the Fed could affect by using monetary policy even if it wanted to.

The Roosevelt Institute

Evidence suggests that the decline in inflation has occurred much faster than would be predicted by a historical Phillips Curve relationship. If inflation remains volatile or is influenced by another shock and the Fed thinks it can get it to come down with monetary policy, it runs the risk of needlessly bashing the rest of the economy while having little or no effect on the underlying drivers of inflation. For example, the Fed would be better off negotiating with OPEC to increase production than hiking.

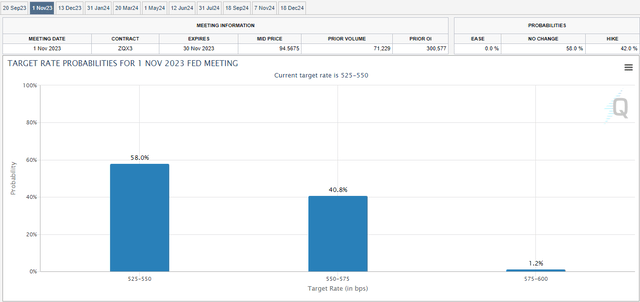

CME

There are components of the CPI Report that are measured in autumn that are adjusted only intermittently and, therefore, can cause nasty surprises. If one of these nasty surprises occurs on the heels of continuing Energy strength, it may pressure the Fed to raise in November. Then, of course, any of the following risks could cause severe problems that could result in a stagflationary environment in the wrong set of circumstances:

- Escalation in Ukraine or Taiwan.

- Fed Policy Error.

- Banking Issues Worsen.

- Return of Inflation.

- CRE meltdown.

- Write-downs of Private Assets.

Overall, I’m very confident that the trend in inflation will continue toward the Fed’s target unless an unforeseen shock occurs. I continue to believe that inflation was primarily driven by the twin shocks of the pandemic and war and that the Fed’s tools will ultimately have limited effectiveness in removing upward price pressure on the remaining drivers.

Conclusion

We are all just human beings, and when we try to predict what the market will do, and it does it, we should never make the mistake of thinking we were right. The market was right, as it always is, and you were lucky enough to be along for the ride. Inflation is one of the most pernicious risks that can affect financial assets. And given that we have limited experience in the past four decades, many of us, like Powell, find ourselves “navigating by the stars under cloudy skies.”

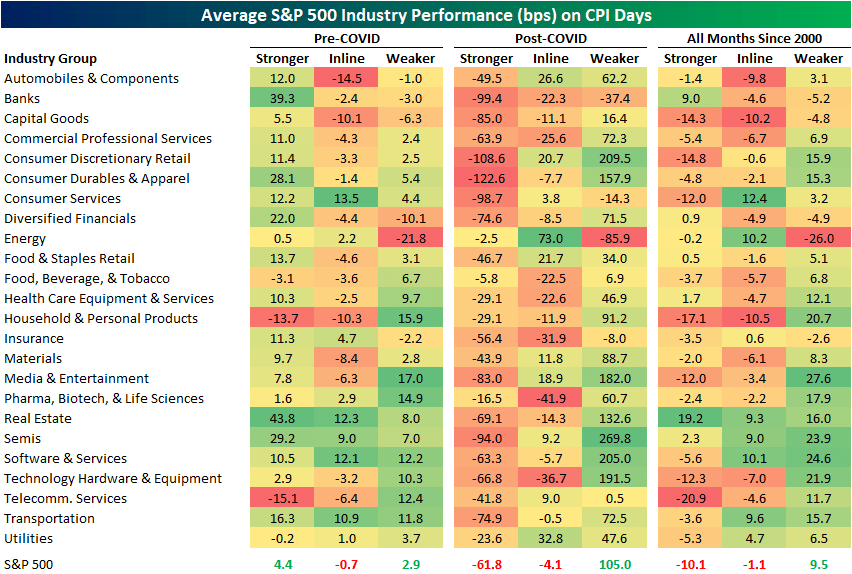

Bespoke Investment Group

However, today’s reaction to a hot CPI report shouldn’t infuriate you. It should make you curious. Always check the historical performance of the market concerning catalysts. The performance compared to the heuristics you’ve taken to arrive at what you think that performance will be might differ.

It should make you question why so many market participants were comfortably buying today. I have outlined why I think they were, but I could be wrong like any other participant. One thing seems clear after this market reaction to an unfavorable reading: perhaps the market is becoming more convinced the general inflation trend is down, and the likeliest outcome is that the Fed will not hike again in 2023.

Read the full article here