Introduction

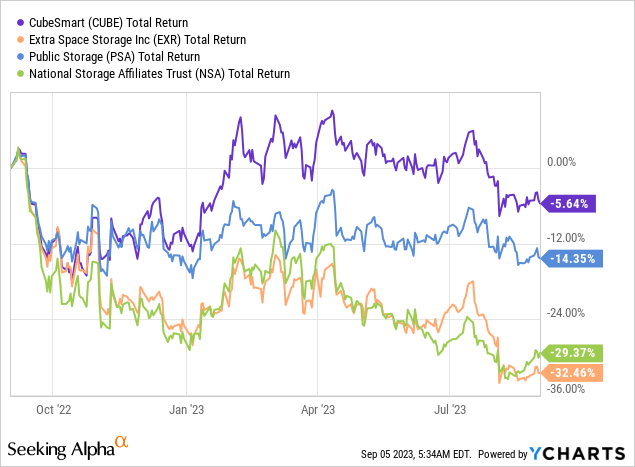

The other day, I wrote an article on Extra Space Storage (EXR), my largest REIT investment. This self-storage leader has turned into a laggard, falling 32% over the past 12 months, including dividends.

Its smaller peer, CubeSmart (NYSE:CUBE), which had an average performance over the past ten years, is now an outperformer, falling less than 6% over the past 12 months. Read my previous coverage on CUBE here.

While the company had to lower its full-year guidance, it remains upbeat about its future, sees solid full-year growth, and has plenty of free cash flow and balance sheet strength to protect its consistently rising dividend.

In this article, we’ll discuss all of this and more.

So, let’s get to it!

Self-Storage Struggles & Opportunities

In the aforementioned article on Extra Space Storage, I started with an assessment of the health of the self-storage industry.

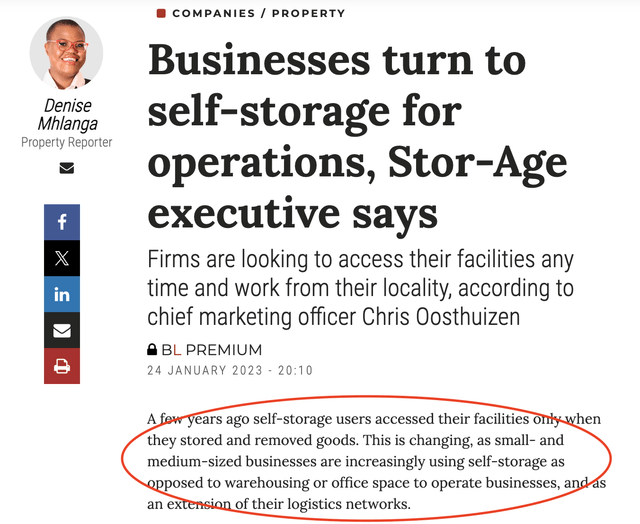

This industry has multiple long-term benefits like overconsumption of goods leading to higher storage needs and secular growth like advanced mini-warehousing solutions and last-mile logistics support.

BusinessDay (Author Annotation)

After all, self-storage operators tend to use top-tier assets close to city centers and consumers. It’s truly A-rated real estate that can be converted into multiple-use assets.

Unfortunately, weak consumer sentiment, persistent inflation, and the related stickiness of elevated interest rates are causing the bull case to weaken.

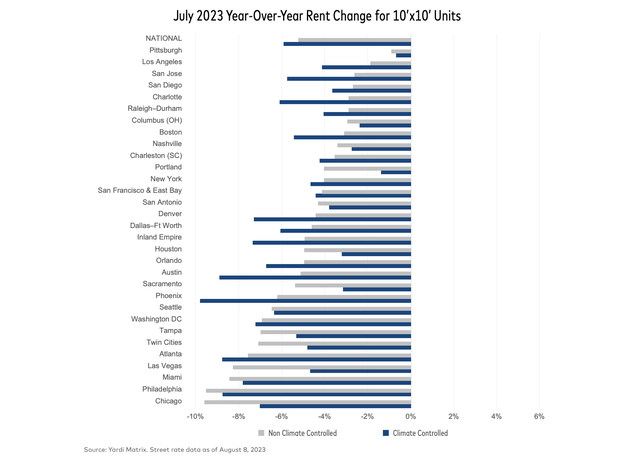

For example, the Yardi Matrix self-storage report for August revealed some weaknesses.

According to the report, the self-storage industry is dealing with economic challenges, causing its growth to slow down from historical levels.

- Street rates for storage units declined in July, and year-over-year growth remains negative as both demand and supply trends soften.

- Nationally, rates for combined climate-controlled and non-climate-controlled 10×10 units fell by $1 to $134 in July.

- Lower rates are a result of weak move-in activity and declining occupancy levels.

- The weak home sales market and reduced domestic migration from COVID-19 highs have impacted demand.

Yardi Matrix

During its 2Q23 earnings call, the company acknowledged the inconsistent nature of the market environment this year, describing it as challenging for data science forecasting. Given the many influences on economic growth and demand, I agree with that.

The company mentioned that the occupancy trends have been inconsistent, with variations from month to month and even day to day.

This inconsistency has made it difficult to manage and adapt to market changes.

Competition in pricing and reacting to competitor price cuts have become essential strategies in this environment.

With that in mind, let’s take a deeper look at CUBE.

CUBE And Its New-York Tailwind

With its $9 billion market cap, CUBE is significantly smaller than its peers Public Storage (PSA) and Extra Space Storage.

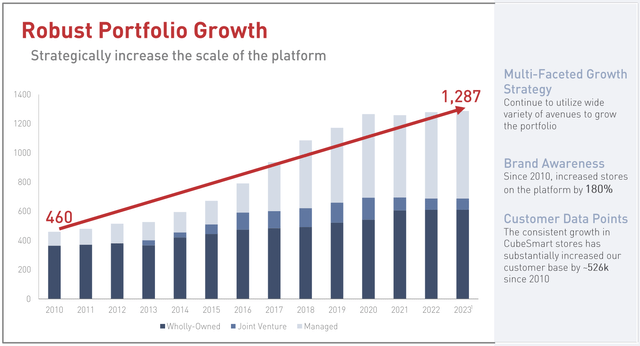

Founded in 2004 as U-Store-It, the company owns close to 1,300 properties after reaching its 1,000th location in 2018.

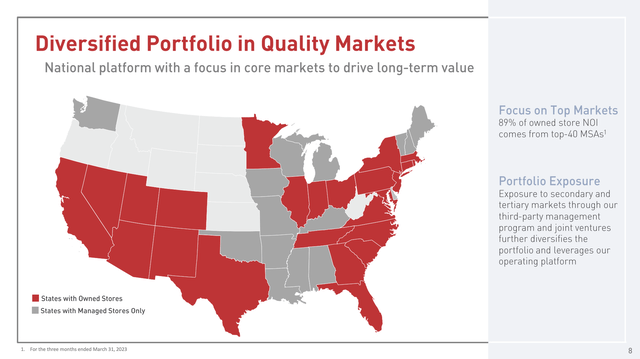

CUBE owns and manages stores in all major real estate markets, except for the Northwest part of the United States (except for Washington State).

CubeSmart

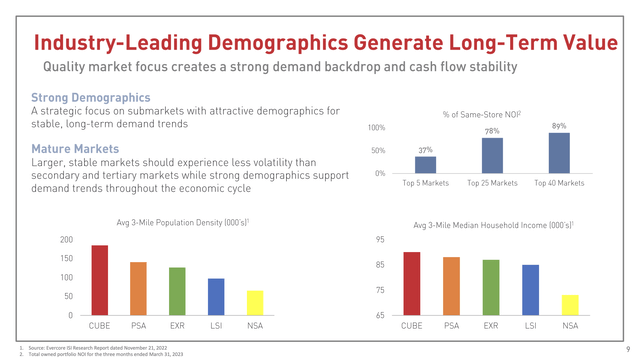

What sets CUBE apart from its peers is the location of its assets. The company is the leader when it comes to owning assets in densely populated areas.

As the overview below shows, the company also enjoys a higher-income target market, although I would make the case that this isn’t necessarily an advantage, as living in a city is more expensive.

CubeSmart

A big driver of growth is third-party management.

CUBE’s expansion into this market remains a significant focus. Over the past six years, they have consistently added more than 130 third-party managed stores annually and are on track to exceed this number in 2023.

In the second quarter alone, CUBE added 58 new stores, bringing the year-to-date total to 83.

This expansion was supported by their conservative balance sheet, which positions them well to pursue attractive opportunities when they arise. More on that in a bit.

CubeSmart

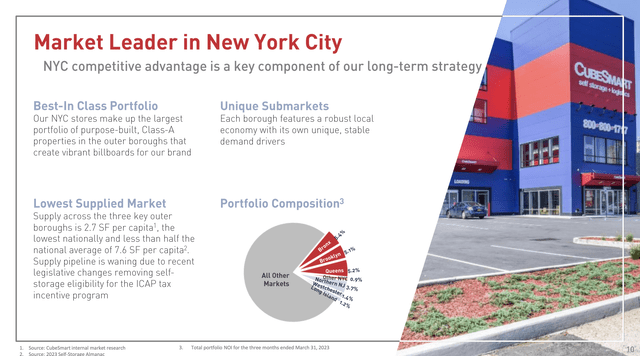

Having said that, one important thing I wanted to highlight is the company’s focus on New York.

A big part of its assets is located in the greater New York area, including the Bronx, Brooklyn, Queens, Northern New Jersey, Westchester, and Long Island.

CubeSmart

I believe that New York is one of the reasons why CUBE is suddenly outperforming its peers.

In the aforementioned Yardi self-storage report, we got some great data from New York, including supply, demand, and pricing.

New York experienced the largest increase in street rates for 10×10 NON CC and CC units combined, rising 0.8% to $261 month-over-month.

Furthermore (emphasis added):

Storage development in the New York metro has been robust in recent years. However, despite new supply deliveries equal to more than 13% of stock over the past three years, it remains the most undersupplied top 31 metro, with current storage stock equal to 3.8 NRSF per capita. New supply in the New York boroughs is expected to slow significantly in coming years, due to legislative changes, increased barriers to entry—including restrictions to self-storage development in the IBZ industrial zones—and exclusions to storage from eligibility for tax abatements through the ICAP program.

In other words, unless New York were to see a sudden population implosion (I don’t expect that to happen), it remains a great market for self-storage providers with a large existing base. After all, it’s an undersupplied market with increasing pressure on supply. That’s perfect for CUBE!

This is what the company said with regard to its biggest market:

In the boroughs of New York, which is our dominant market, overall demand trends and elongated length of stay should continue to support modestly positive pricing for new customers relative to 2022 levels. This favorable pricing environment, in combination with physical occupancy is remaining slightly above 2022 levels, has helped us drive same-store revenue growth in our most important market.

Supporting these trends is a more favorable supply environment, as the headwinds from stores and lease up, especially in Brooklyn have been less impactful than anticipated. We expect our New York market will continue to benefit from these trends for the balance of the year.

The Dividend & Adjusted Guidance

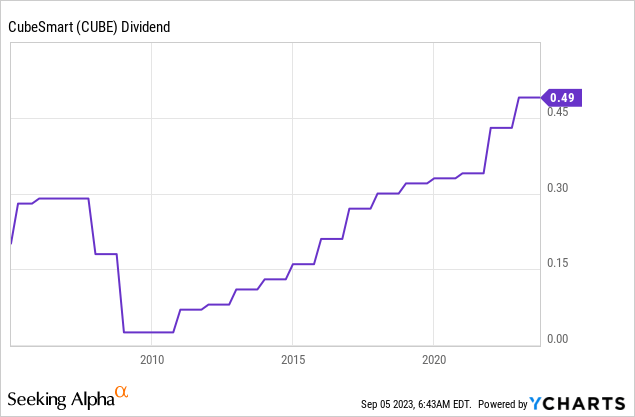

With that in mind, a major benefit of CUBE is its dividend. It currently yields 4.7%. Over the past five years, the average annual dividend growth rate was 10.1%.

During the Great Financial Crisis, the company was forced to cut its dividend. I do not expect that to happen again.

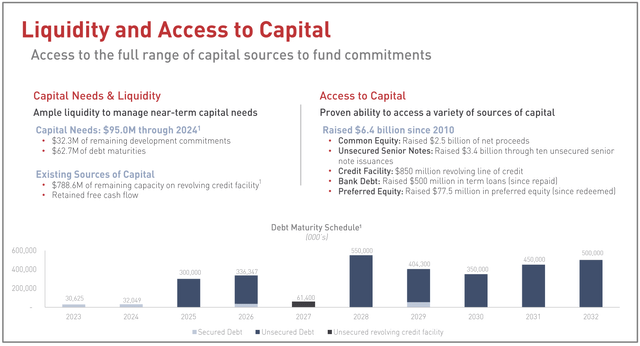

The company has a 73% payout ratio and a balance sheet that protects the company against elevated rates.

The company has a BBB-rated balance sheet with a stable outlook and a net leverage ratio of just 4.3x, which is one of the healthiest numbers in the REIT industry.

CubeSmart

The company also enjoys the benefit of having barely any maturities before 2024, which buys a lot of time in this environment.

Adding to that, the company’s average debt maturity is 5.8 years. 98% of its debt has a fixed rate, which protects the company against rising rates, at least until a point where it needs to refinance maturing debt. But then again, it has no major maturities until 2025, buying the company a lot of valuable time.

Having said that, despite favorable developments in New York, a successful expansion using third-party management, and its healthy balance sheet, the company is not immune to a deteriorating macroeconomic environment.

During its earnings call, the company acknowledged the price-sensitive demand during the rental season and adopted a prudent stance on guidance for the year.

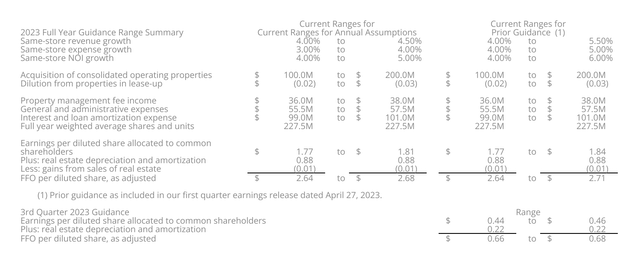

As we can see in the overview below, the company still sees growth – just less than it initially expected. Same-store net operating income growth this year is expected to be between 4.0% and 5.0%, down from the prior 4.0% to 6.0% range.

It now sees funds from operations per diluted share of $2.66 (midpoint). That’s slightly down from $2.675.

CubeSmart

Looking ahead to 2024, the company sees positive signs in a stabilized mortgage rate environment, continued household formation, relief in supply chains, and declining new self-storage facility openings.

CubeSmart believes its portfolio and platform are well-equipped to navigate dynamic market conditions.

Valuation

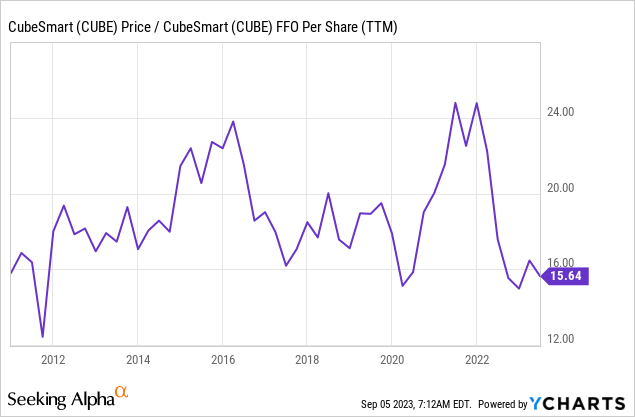

Using the new guidance midrange, CUBE shares are trading at 15.6x 2023E FFO.

Just like most self-storage REITs, the company is trading at one of the lowest multiples since the Great Financial Crisis.

This market adjustment is partially warranted due to the change in the low-rate, low-inflation environment.

Before 2022, the stock often traded close to 19-20x FFO.

The median sector multiple is 12.6x, which gives CUBE a slight premium.

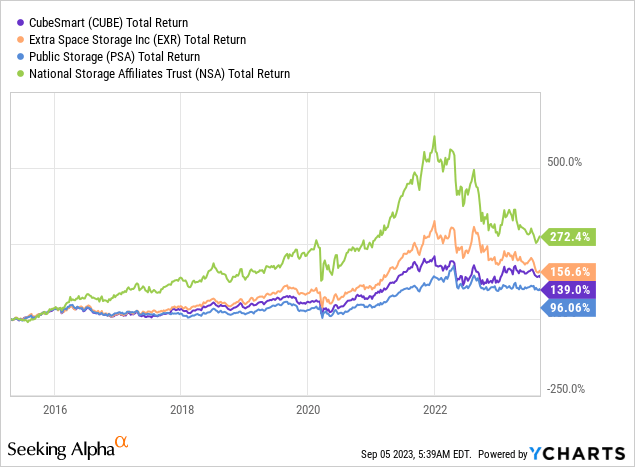

I believe this premium is warranted. CUBE has (sustainably) raised its dividend by 16.6% per year over the past ten years. The median sector compounding growth rate was just 2.4%. Adjusted FFO has grown by 9.7% per year over the past five years. The sector median was just 1.9%.

The stock has a $48 consensus price target, which is 16% above the current price.

I will give the stock a Buy rating. However, I do not believe that the stock will take off within the next two quarters. Inflation is re-accelerating, and sticky rates could keep a lid on yield-sensitive stocks for a while.

Needless to say, I’m accumulating high-quality stocks at fair valuations.

The only reason I am not buying is my investments in PSA and EXR. I am not looking to own three self-storage companies in a portfolio of fewer than 25 single stocks.

Takeaway

The self-storage industry is facing challenges, but CubeSmart stands out as a promising player. With a focus on densely populated areas, particularly in New York, CUBE is capitalizing on undersupplied markets, which bodes well for its growth.

The company’s strong balance sheet, healthy dividend yield, and prudent management make it an attractive choice for income-focused investors.

Although CUBE has adjusted its guidance due to market uncertainties, it remains a resilient player in the REIT sector.

While the short-term outlook may be influenced by inflation and interest rates, accumulating high-quality stocks like CUBE at fair valuations is a wise strategy for long-term investors.

Overall, CubeSmart presents a compelling opportunity for those seeking stability and income in their investment portfolios.

Read the full article here