December CPI came out this morning, and while it wasn’t a total disaster, there isn’t a whole lot in the report to suggest that the Fed can take a victory lap on inflation. Areas of inflation that had been previously stubborn are continuing to be problematic, with restaurant prices up 5.2% for the year, overall services up 5.3% (led by eye-popping insurance increases), and transportation services up 9.7% for the year. Over the past couple of months, core inflation has accelerated from its summer 2023 moderation, seriously challenging the idea that the Fed should begin to cut interest rates as soon as March.

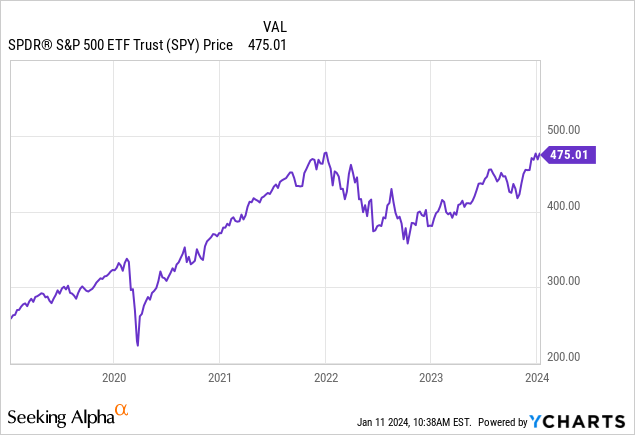

Meanwhile, the corporate earnings boom that Wall Street analysts had expected from ChatGPT, FOMO, and Ozempic is failing to materialize, with Q4 2023 S&P 500 (SPY) earnings estimates at $53.8 and falling. This is roughly the same as Q4 2022’s earnings of $53.2, a potentially toxic combo for stocks. 2023’s rally was largely based on earnings and the economy beating low expectations. But we’re sitting here in 2024 with stock prices 20% higher than this time last year, with overall investor sentiment and earnings expectations sky-high for Corporate America. Since the early numbers coming in aren’t supporting this earnings boom at all (or supporting a quick Fed pivot), investor sentiment could rapidly shift after the massive autumn rally.

The Market’s Fed Math Is Fuzzy

The Fed is widely expected to hold rates steady in January after having signaled that they’d do so, but after that, the betting is wide open. The market currently expects that the Fed will begin to cut in March and then will cut rates at every meeting between now and the election in November.

The Fed is walking a political tightrope with its credibility as it doesn’t want it to look as if it favors one party over the other during the election cycle. Highly visible prices for food, transportation and services in general are going up more slowly but not coming down, so the Fed would be taking a risk by cutting rates without overwhelming evidence that it’s necessary to do so. By cutting interest rates aggressively before the election, the Fed would risk getting its mandate changed by the Republican administration should they end up winning anyway.

I don’t see the Fed methodically cutting interest rates at every meeting before a hotly contested election because it looks bad, and according to the data it probably is bad. Another way to view the market’s pricing of the Fed that might make more sense is that the expected Fed funds rate is an average, not the most likely outcome. In this view, there might be a 50% chance of 250 bps of cuts in a recession and a 50% chance of only cutting rates a couple of times later in the year. This makes more sense to me because the Fed would need to cut rates to stimulate the economy if unemployment starts to rapidly rise. They likely wouldn’t do this 25 bps at a time either but rather would push through cuts of 50 bps or more in response to a rapid tightening in credit and a slowdown in the economy.

Where I definitely don’t agree with the market is with this Goldilocks idea that the Fed will magically cut rates at every meeting this year while corporate profits boom and inflation magically goes away on its own. We could easily go 0/3 here:

- Inflation could stay stubbornly between 3% and 4% due to war in the Middle East disrupting shipping and services inflation continuing at its current pace.

- Inflation in the 3%-4% range would force the Fed to keep interest rates where they are.

- And corporate profits could disappoint massively relative to expectations of huge growth as companies face the headwinds of higher rates and slower consumer spending after the end of nearly 15 years of free money.

I don’t necessarily think all of this will happen, but markets are priced highly optimistically compared to where we are in the business cycle and the corporate profit results that are actually coming in. Data from private vendors are showing that inflation is moderating but somewhat above the Fed’s 2% target. However, if anything crazy happens with Iran, Russia or China then all bets are off on the Fed’s 2% inflation target.

A more immediate problem for investors is earnings. Earnings season starts this week, but few investors have been paying attention with all eyes on the Fed.

Where’s The Earnings Boom?

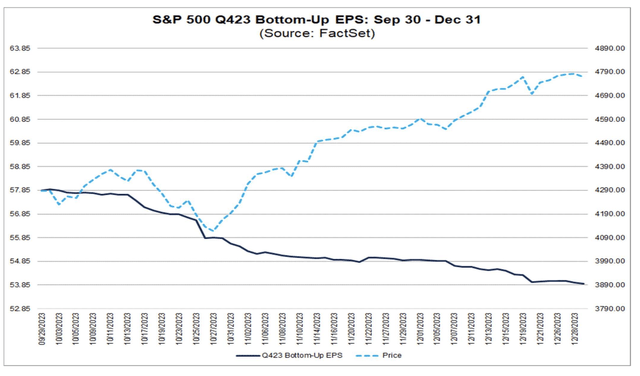

The massive move higher in the S&P 500 has been accompanied by unusual revisions lower in earnings for the current quarter. This is not normal – the market shouldn’t be soaring like this with profits down. It’s common for analysts to mark down earnings estimates throughout the quarter, so companies can “beat” them, but the downward revisions are occurring roughly twice the normal pace.

Q4 2023 S&P 500 Earnings (FactSet)

Of course, earnings being lower than expected shouldn’t be too surprising with student loans kicking back in and already being in the late stages of the credit/business cycle. Savings rates were already near 0% and fiscal stimulus has gone into reverse, so there wasn’t much fuel for earnings to suddenly boom anyway.

The trouble is that analysts are still expecting a spectacular earnings boom for the full year of 2024. For the full year, they’re calling for an 11% increase in earnings that’s back-end-loaded from Q2 onwards. The average analyst Q4 estimate for 2024 is a full 17.6% higher than this year, which would be completely unprecedented.

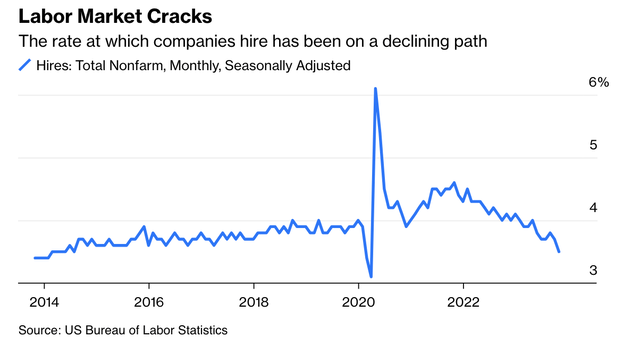

Where’s the money supposed to come from to make this earnings boom happen? The Fed might cut interest rates, but that would actually make corporate profits go down in the short run by taking away interest income from big tech and pharma companies. Fiscal stimulus surely won’t come with Republicans controlling Congress until the election. If AI were causing a massive earnings boom, it should have been happening by now, but we see huge markdowns for Q4 earnings. It’s hard to get more FOMO than half the U.S. populace with a negative savings rate, and every big pharma company having its own weight loss drug means that they can’t all get big market share without competing on price. And can an earnings boom come without a hiring boom? Like most leading economic indicators, hiring has slowed markedly since the beginning of 2022, while quarterly earnings are below their high-water mark in 2022 as well.

U.S. Hiring Rate (Bloomberg)

The logical conclusion here is that the late-cycle earnings boom that analysts are expecting will not happen, and instead, we’re likely to see earnings flat – even without a recession. A recession could bring a Fed pivot, but stocks would likely be much lower in that case. That’s a problem for investors who’ve priced the market for perfection. Stocks are trading for about 22x 2023 earnings, and without an earnings boom in 2024, that’s too expensive. When the pendulum of sentiment inevitably swings the other way, investors are likely to see the autumn rally erased. And if a recession does hit, this autumn’s stock prices could be a distant dream for the next few years.

Bottom Line

The December inflation report wasn’t terrible, but the Fed can’t declare victory. Neither can investors, with valuations sharply higher than they were just a few months ago. The idea that inflation will go away on its own and corporate profits will boom seems to be based on wishful thinking by investors who piled into stocks this fall. I still think investors holding lots of cash are in the best spot, currently earning roughly 5.5% risk-free with the option to pile into stocks cheaply in a bear market and/or recession.

Read the full article here