Dell Technologies (NYSE:DELL) has done quite well over the past couple of years, which might surprise some, given that this is a mature and highly profitable tech company. The bubbly valuations of many stocks in the tech sector may inspire investors to focus on names with GAAP profitability and more reasonable price to earnings multiples, but I am not sure that this is a reason to continue supporting DELL stock here. While the company might see growth return in this upcoming year as per management’s commentary, that shouldn’t be so surprising given that the company is coming off a cyclical trough. The 13x earnings multiple is not obviously expensive, but the opportunity is far from compelling given the leveraged balance sheet and uncertain growth trajectory. Ahead of earnings this week, I am downgrading the stock from “buy” to “hold” as I am closing out my position.

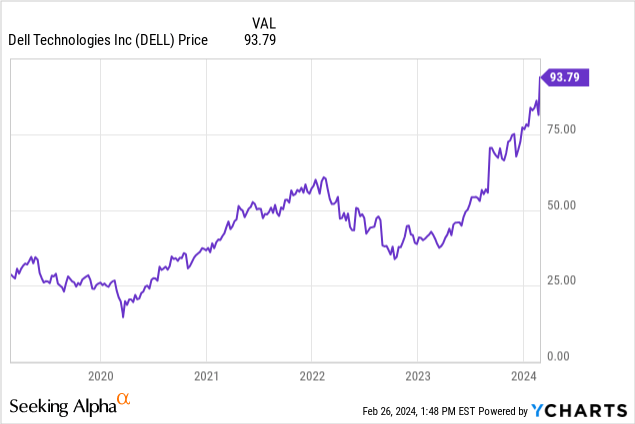

DELL Stock Price

DELL stock has been a winner since coming public in late 2018.

I last covered the name in November, where I rated the stock a buy due to the ultra-conservative valuation. The stock has been a value investor’s dream, as multiple expansion allowed for incredible returns. I think the rally is overdone here and my success has been quite lucky – this is high time to downgrade, especially as the company is set to report earnings on Thursday, February 29.

DELL Stock Key Metrics

In its most recent quarter, DELL saw revenues decline 10% YoY to $22.25 billion, below guidance of $22.5 billion to $23.5 billion. DELL did manage to materially outperform earnings guidance, with EPS coming in at $1.88 versus guidance for $1.45.

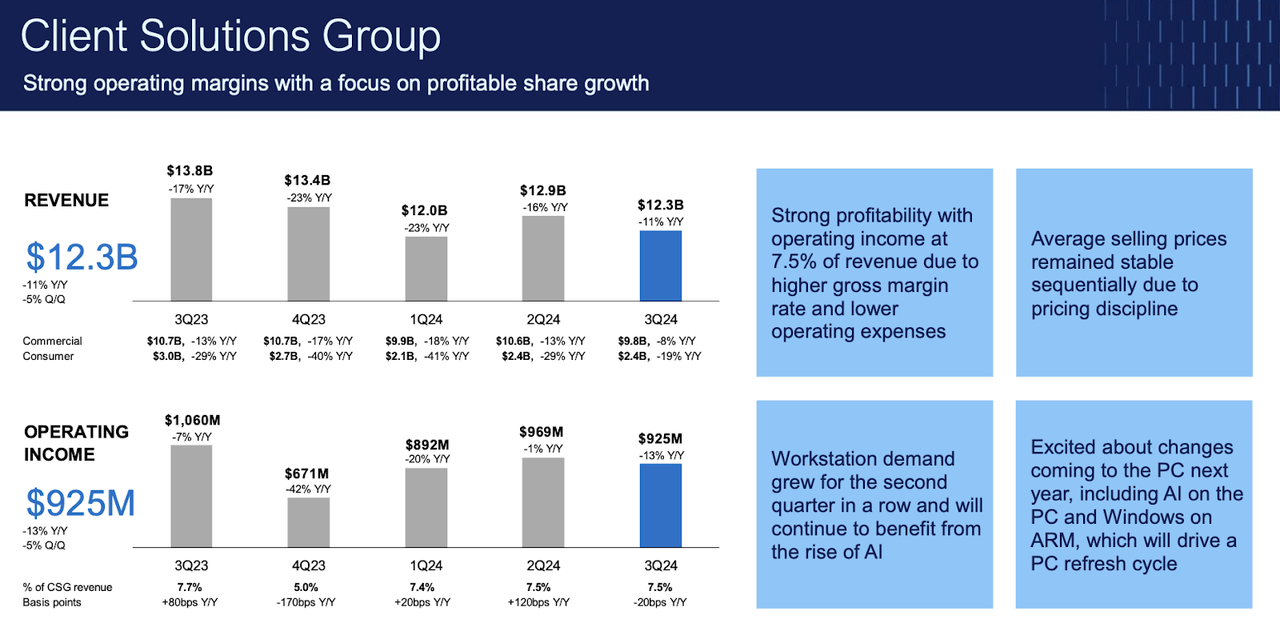

2023 has seen DELL suffer through a down cycle in both servers and the PC markets. The company has strived to maintain pricing power, but a decline in volumes has nonetheless weighed on top-line results.

FY24 Q3 Presentation

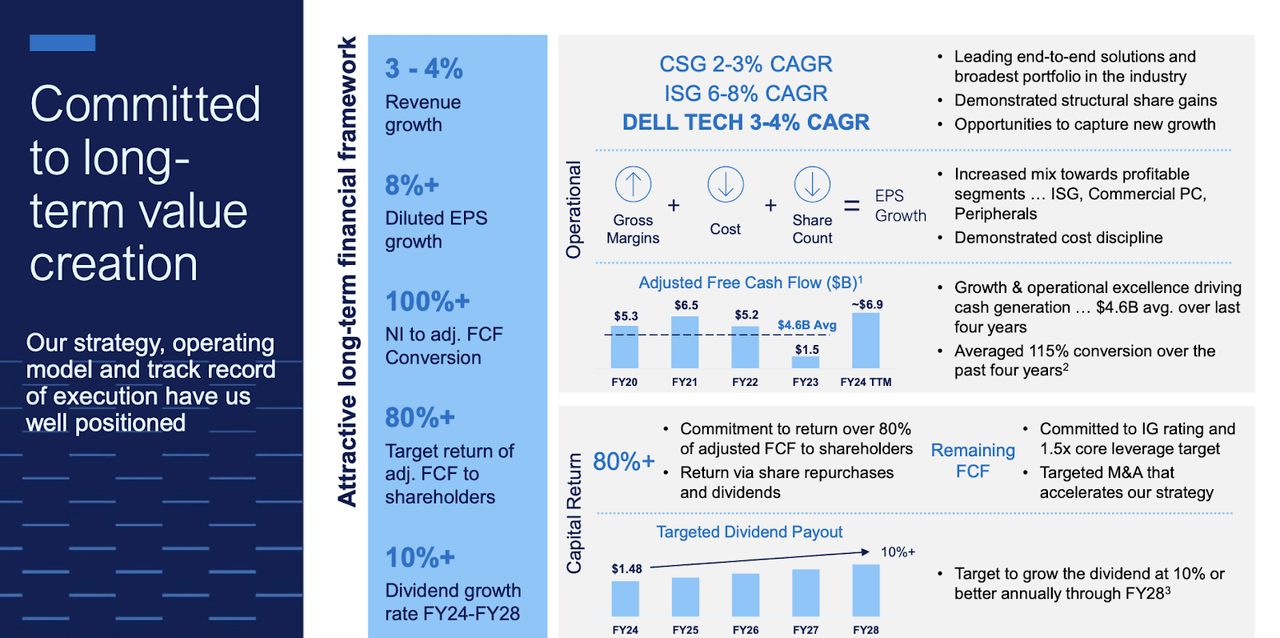

DELL ended the quarter with $16 billion in core debt, representing a 1.6x debt to EBITDA ratio. The company has aggressively reduced leverage since coming public and is close to reaching its 1.5x core leverage target.

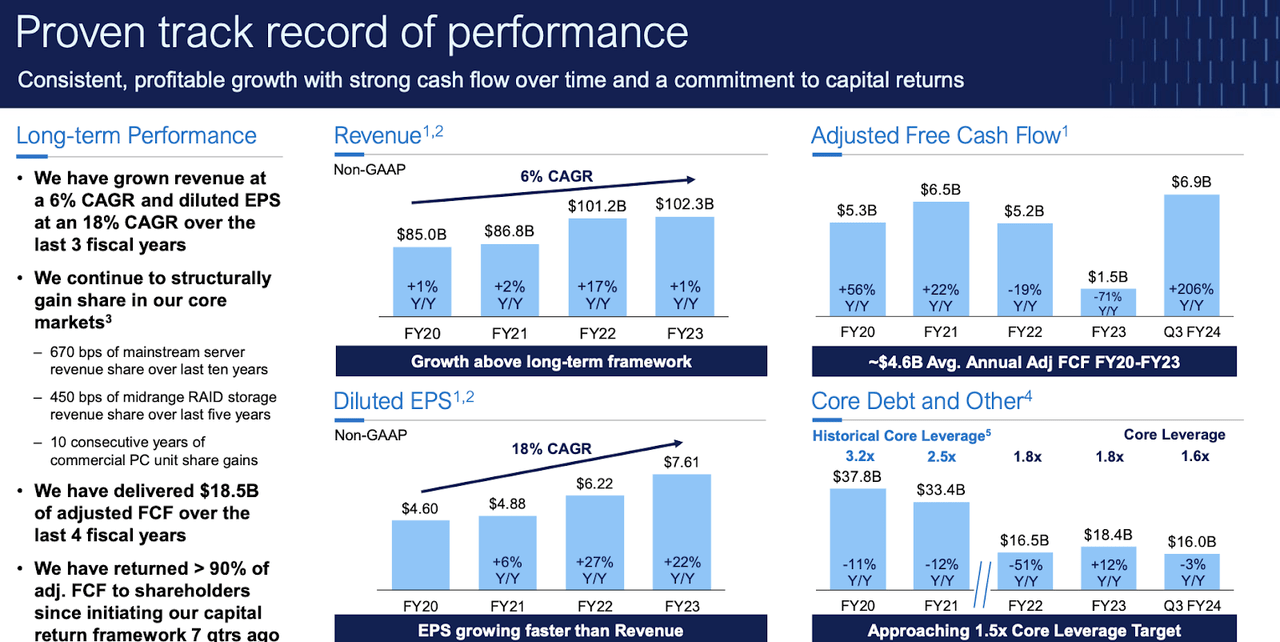

FY24 Q3 Presentation

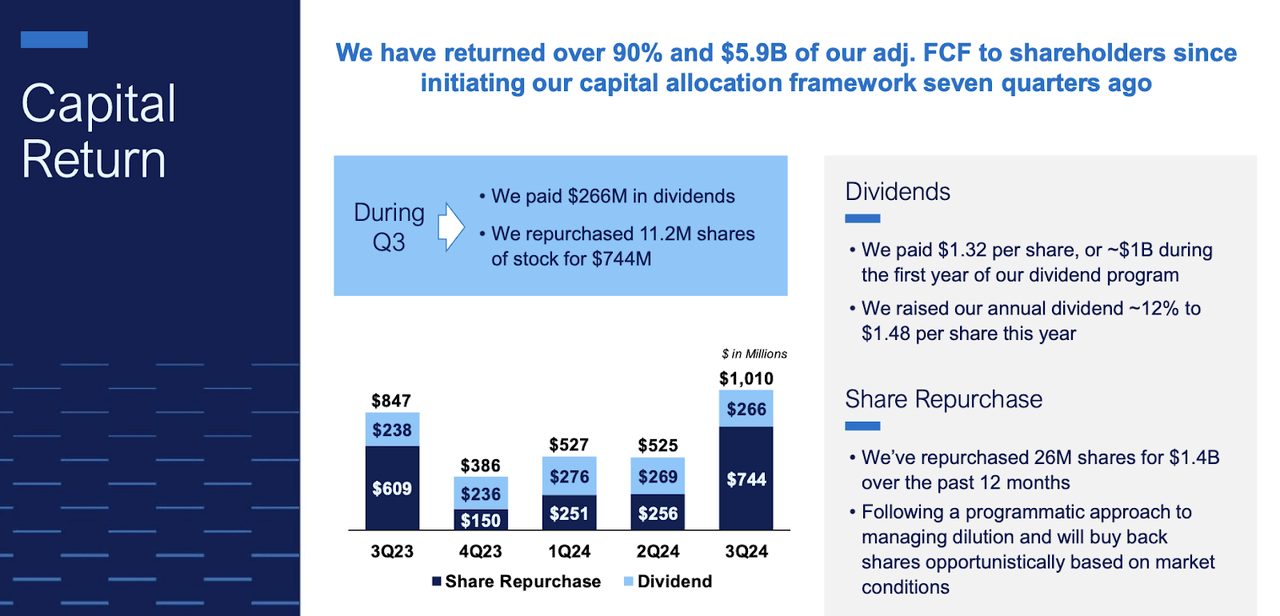

That has enabled the company to aggressively return cash to shareholders. DELL has returned over 90% of adjusted free cash flow over the past seven quarters, including $1 billion between dividends and share repurchases in this past quarter.

FY24 Q3 Presentation

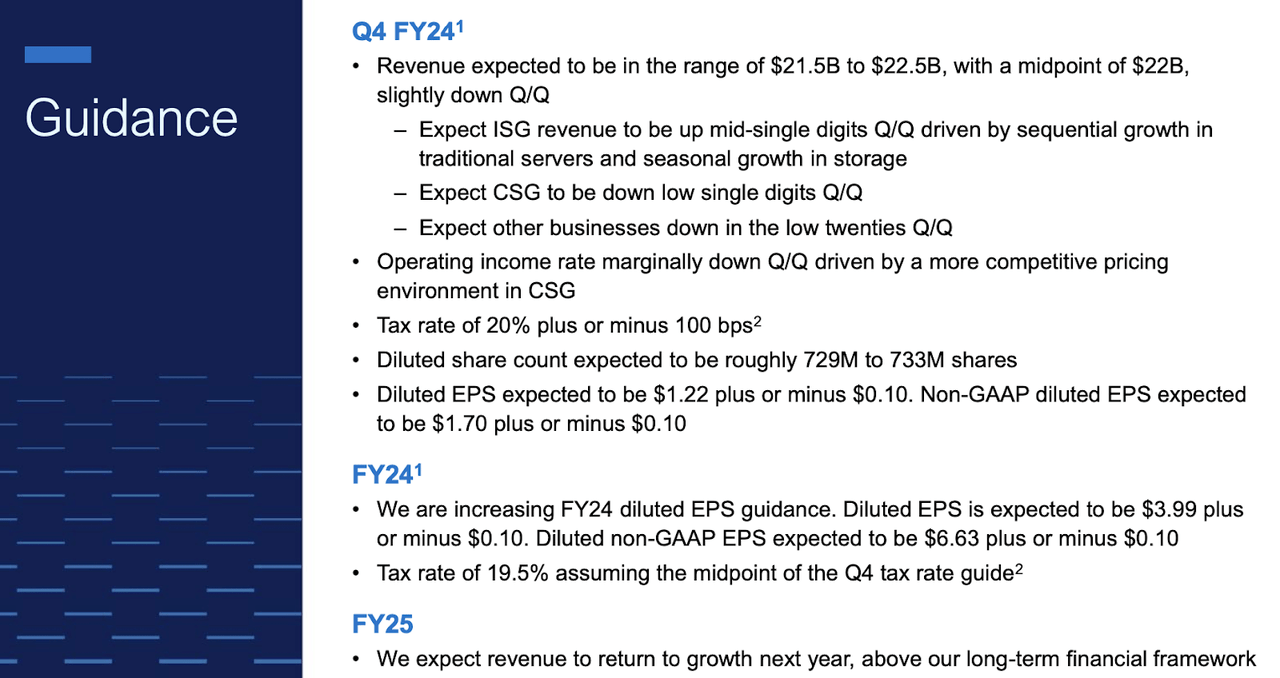

Looking ahead, management has guided for the fourth quarter to see between $21.5 billion and $22.5 billion in revenue, and $1.22 in diluted EPS. Consensus estimates call for the company to generate $22.17 billion in revenue and $1.72 in EPS.

FY24 Q3 Presentation

On the conference call, management repeatedly emphasized their commitment to returning capital to shareholders. This emphasis makes sense given that the company lacks the same secular top-line growth rates of typical tech peers. Management guided for growth “above long term guidance” in the upcoming fiscal year, but faced pushback on that commentary from analysts. The issue is that growth should be expected given that the touch of cyclicality experienced in 2023 should allow for easier comparables moving forward. Analysts also appeared confused about the change in tone, as management had stated that “the demand environment improved at a faster rate than we anticipated” just 90 days earlier in the second quarter. Yet in this past call, management was optimistic about the potential for AI to lead to an acceleration in growth (perhaps due to an upgrade cycle), with the caveat that it may take some time for the growth to show itself. Management clarified that their previous commentary was simply to indicate “what we saw through August” but glossing over the exact verbiage, I can understand the confusion. Yet, this is the kind of market in which investors appear to be more forgiving of such things. Readers are best advised to avoid complacency amidst a richly valued market.

Is DELL Stock A Buy, Sell, or Hold?

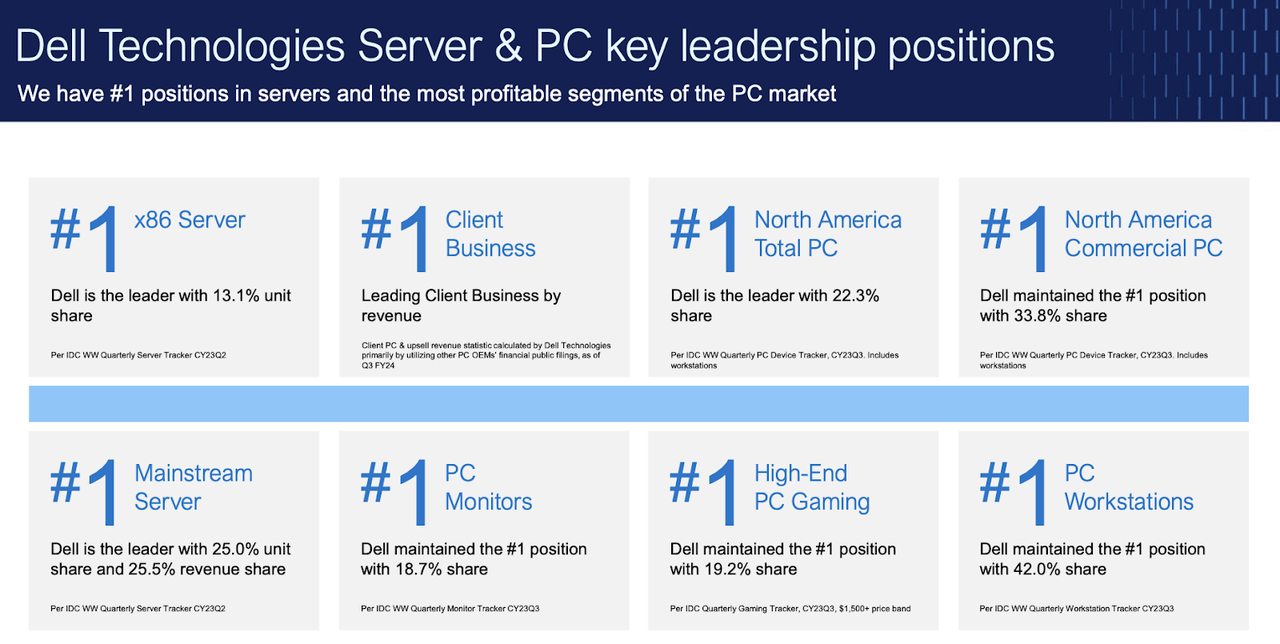

DELL is a mature tech company with market leadership across server and PC markets.

FY24 Q3 Presentation

Management has guided for 3% to 4% long term revenue growth which may translate to around 8% EPS growth (which is inclusive of share repurchases).

FY24 Q3 Presentation

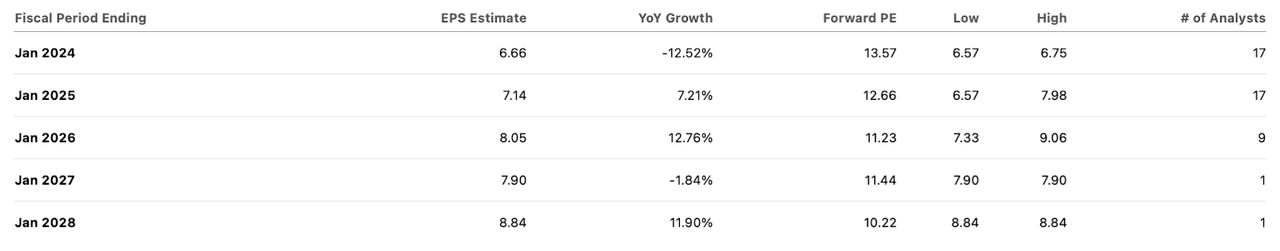

That kind of growth profile would have been more than enough the last time I wrote about the stock, when it was trading at just around 6x earnings. After a doubling of the stock price, the stock is now trading at 13x earnings, and things have changed.

Seeking Alpha

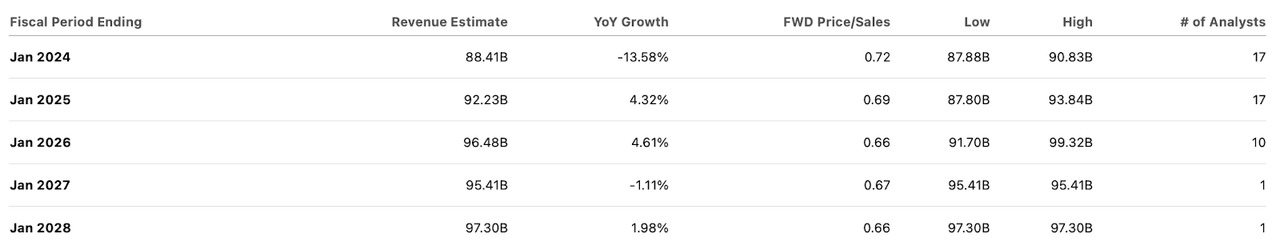

Consensus estimates continue to call for low single-digit top-line growth from here.

Seeking Alpha

Given the company’s leveraged balance sheet, the 13x earnings multiple looks rather lofty, especially when compared against the muted growth backdrop. Yes, if management can deliver on its 3% to 4% top-line growth target, then the 13x earnings multiple might lead to around 10% annual returns from here. However, the company is coming off a year in which revenues declined double-digits, making it difficult to predict a return to consistent top-line growth (at least for yours truly). Even if the company does see growth return to the targeted range, there remains the possibility that the stock experiences a valuation re-rating downwards – consider that a name like HP Inc (HPQ) is trading at 8x earnings (albeit not a perfect comparable). I find it unlikely that generative AI will lead to a “supercycle” for the stock given the flat YoY growth in remaining performance obligations, and as an analyst pointed out on the call, there is also the possibility that the newer AI-driven businesses might end up cannibalizing the legacy compute businesses. While DELL stock might not look obviously expensive, I am of the view that the current valuation is more reflective of the richness of the broader market than of the potential for accelerating growth. I am downgrading the stock as I see little reason to own DELL over the broader market index.

Read the full article here