DHT Holdings, Inc. (NYSE:DHT) is a company that primarily operates VLCCs (very large crude carriers). I think this is currently an interesting segment of the shipping market. The Nov. 1 Fearnleys report shows VLCC rates are (in general) firming up. Keep in mind shipping rates are notoriously volatile and can change direction with a hint of a recession or a missile launched in the Middle East. An interesting tidbit from the report is that there were very few fixes in the Middle East, and this points to a bit of pent-up demand for tankers. In light of today’s news about OPEC cuts, maybe they were just tactically holding back in order to capture lower rates after this announcement.

Historically, tankers are very boom-and-bust. The problem is that once everyone is earning good money, everyone starts ordering more tankers. The industry is beholden to hog cycles. But once VLCCs are on the water, they’re out there for the next 20+ years. Oversupply isn’t easily fixed, and it leads to large overshooting in either direction. There is also some seasonality to the business, and the winter months tend to be stronger up until the Chinese New Year starts.

DHT’s management is doing something that’s so rare I almost never see it; they’re paying out 100% of the earnings to shareholders (which is their current policy). It shouldn’t be so, but this is very, very rare even in shipping where yields are used to attract investors. The consensus dividend estimates essentially double as earnings estimates, and they seem very optimistic.

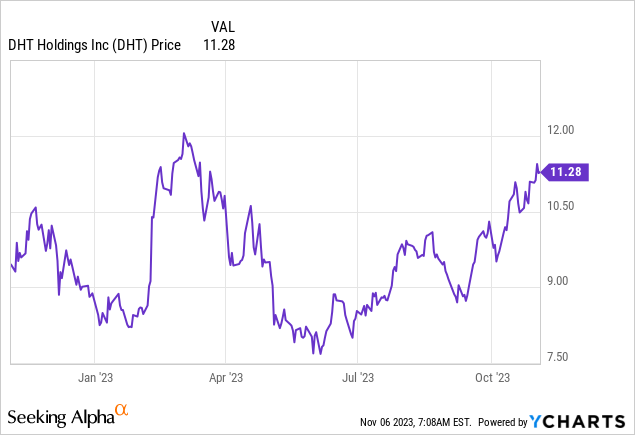

Dividend estimates DHT (Seekingalpha.com)

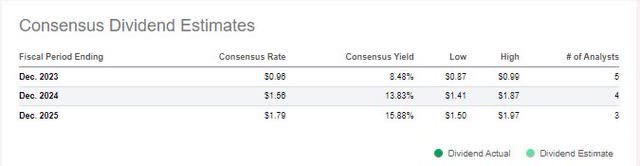

Analysts are penciling in forward yields of 13%-15%. Shipping investors know how fraught this yield is and that it can disappear on short notice. VLCC’s earnings are exceptionally strong compared to a 5-year average (per a DHT presentation):

VLCC earnings (DHT Holdings)

Many factors play a role in the strong VLCC earnings. There is the Russia/Ukraine conflict, which has removed 100-150 VLCCs from the official market. These carry crude outside of the official markets and are unlikely to be allowed to return back to the regular market even if the conflict ends. They are, of course, still carrying crude production, but because they can’t take official cargoes as well, they’re getting loaded much less efficiently. I do imagine older ships are kept on the water longer in this market, though, which adds to supply.

My impression when I review earnings calls, is that operators appear puzzled by the meager order book for new VLCCs. Here’s what the DHT CEO said on the most recent call:

The order book for new VLCCs now stands at 1.9% of the sailing fleet. Insignificant would be an understatement. This level of contracted new supply becomes even more insignificant when compared to 30% of the current fleet being older than 15 years of age and 14% in older than 20 years of age.

To make this fleet development picture even more compelling from a shipowner’s point of view, there are some 90 ships that will turn 20 years of age up to the end of 2025. Year-to-date, 8 vessels have been contracted, consisting of 2 options being declared earlier in the year and 6 new contracts this summer. There are some letters of intent for a few additional ships in place, projects that are subject to financing and employment.

Big oil majors and responsibly operating oil traders generally contract tankers up to 20 years old. In case of extreme price spikes, they may become a bit more flexible. In general, 20 years of age is an age when vessels become noticeably less efficient for operators (as they get booked less reliably).

I think operators are underestimating the effect of interest rates on the attractiveness of financing tankers. It is just becoming much less attractive. At the same time, environmental regulations are 1) introducing a lot of uncertainty with regards to what kind of tankers (think fuel propulsion) will remain competitive over their lifetimes. 2) introducing uncertainty on how crude production will develop. Is crude production really going to peak. If it peaks around 2030 like IEA models, that means you only have a solid market for 3 more years if you order a ship now.

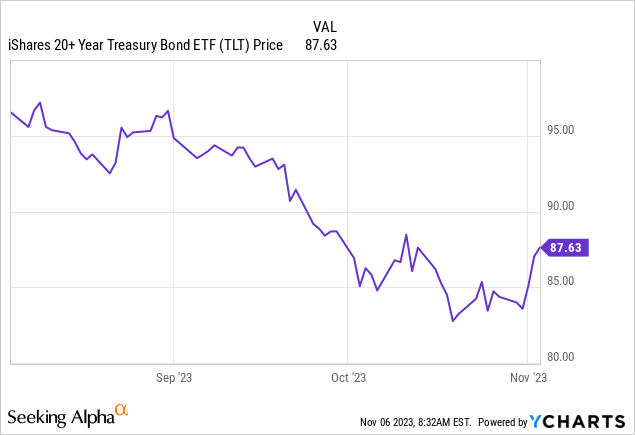

Lately, the longer rates have jumped significantly and I don’t think that’s going to help tanker supply one bit. The graph below shows the dominant 20-year bond ETF (TLT). A lower price means yields went up:

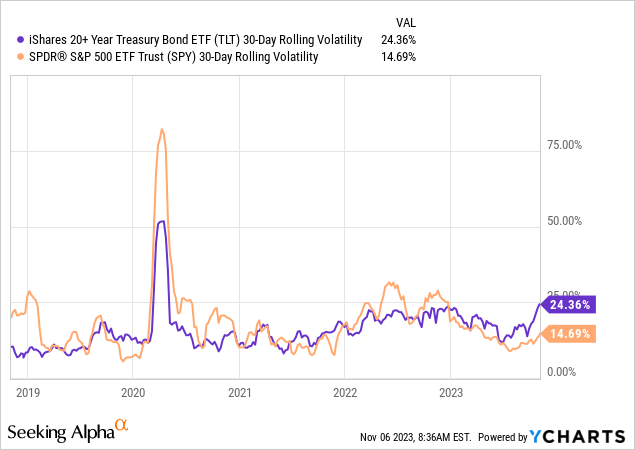

It’s not just that yields are high. Yields are extremely volatile as well. Recently the 20-year volatility went above the S&P 500 volatility which is not very common:

That makes it harder to provide long-term financing and if rates stay volatile, the compensation required should trend upwards, irrespective of the level of the rates.

From the 2nd to last earnings call, I learned DHT entered a new credit facility and ended its interest rate swaps.

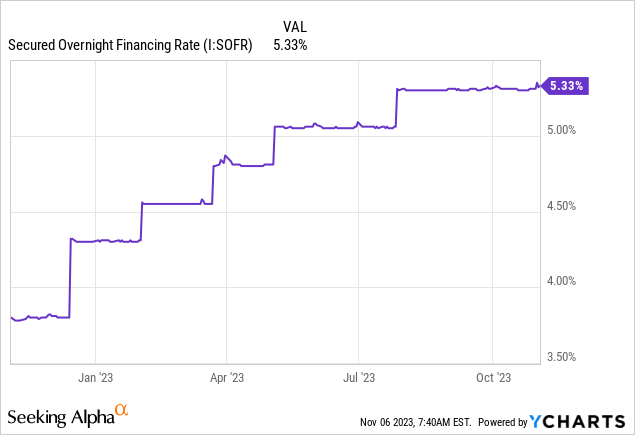

In January, we entered into $405 million secured credit facility, including $100 million accordion. This refinanced the outstanding amount on the ABN AMRO facility and is secured by 10 of the company’s vessels. That is payable in quarterly installments of $6.25 million, equal to 625,000 per vessel, with maturity in January 2029. The new loan bear interest at a rate equal to SOFR+ 1.9%, which is equivalent to LIBOR+ 1.64%.

The mentioned refinancing is in line with DHT-style financing, which includes of 20-year repayment profile and a fixed year tenure. In connection with the refinancing, and as mentioned on the previous slide, we terminated seven interest rate swaps that would have matured in the second and third quarter of 2023. We received 3.3 million in cash in connection with the termination.

SOFR has moved against them through the year, so I think that’s going to be a bit, but the debt level isn’t so high that I think it is a concern (as long as rates are solid-good):

DHT isn’t immediately leveraged to higher VLCC prices as it last reported it had quite a few contracts on at 35k and a lot of days at 43k per day:

We will now go to the third quarter outlook. We expect 530 days to be covered by our term contracts at an average rate of 3,500 per day. We expect to have 1,560 spot days for the quarter, of which about 1,090 days, equal to about 70% have been booked at an average rate of $46,300 per day. As of today, this suggests combined bookings of 78% of the total days for the quarter at weighted average earnings of 42,800 per day.

You can compare these stop booking numbers with our estimated spot P&L breakeven of 25,000 per day for the third quarter, allowing you to model a net income contribution based on your own assumptions for the unfixed spot base — the market thus far this quarter exceeds the general idea of what the weak third quarter period should look like.

But contracted days will be rolling off and with higher rates, the forward bookings should generally happen at higher prices. Rate development really looks quite healthy going into the winter:

Tanker rates (Fearnleys Weekly Report)

What I like a lot is the very high rates for the smaller ships. These can theoretically pass the Suez Canal, but that’s becoming a lot more difficult due to an ongoing drought. Panama is limiting pass-throughs, and this is expected to continue. If you can’t go through the canal, you might as well book a VLCC. The high rates for the smaller vessels also mean they don’t limit the upside of VLCC rates easily. A smaller vessel becomes an economical substitute, even on longer routes, once the VLCC rates go high enough. But with rates in the small market already very high, that substitution isn’t readily available.

The valuations among the large VLCC companies appear to be roughly in line with each other. All trade far above book value. In bad times, they can trade far under. They trade at relatively modest earnings multiples, which also reflects the market’s belief earnings mean-revert over time. The more you believe in the idea that demand for miles remains up while supply remains constrained, the better it is to go long DHT Holdings, Inc. at these prices.

valuations VLCC market (Seekingalpha.com)

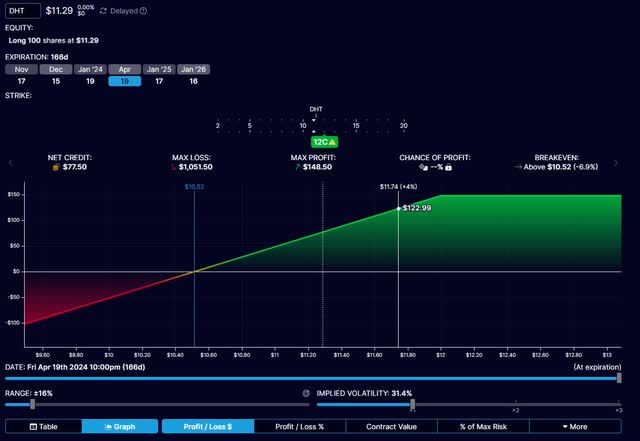

One risky trade idea I may have considered, if I were long DHT holdings to begin with, is to sell a covered call-out until January or April. April appears best to me because it captures 2 ex-dividend dates and the Chinese New Year starts on February 10th. Festivities last around 16 days. The frontloading of cargoes ahead of that time is hard to avoid.

covered call payoff profile (optionstrat)

The downside of this tactic is that it’s very risky, in that tanker stocks can unexpectedly surge tremendously due to the operating leverage and volatility of rates. If that happens, you lose all upside beyond $12 in this example. That’s assuming the

At the same time, selling a call at $0.77 at $12 results in a 6.8% return if it doesn’t end up over $12. It also leaves 6.4% upside to $12 from the current stock price. Together that adds up to a 13.4% return in 166 days BEFORE the 2 dividend payments on the stock portion of the position. Because DHT pays out 100% of earnings, this is a flexible and hard-to-predict amount. However, if we take the prior 2 payments as a guide, it could be another $0.60. The 100% payout policy is a pull on the stock price and should make it harder to go over $12. The more the market starts believing in higher VLCC rates for longer, the higher the odds it will go over $12. The call selling severely limits the maximum upside, but it only modestly helps on the downside. If the stock dives (for example, if a recession materializes) the $0.77 premium compensates for some losses. I wouldn’t do this systematically, but it looks like covered call-selling could be interesting over this particular time period.

Read the full article here