DiDi Regaining Momentum After Regulatory Setbacks

As China’s rideshare leader, DiDi Global (OTCPK:DIDIY) has faced a rollercoaster journey since its 2021 New York IPO and subsequent delisting. But after a bumpy patch, DiDi seems to be regaining momentum.

DiDi once commanded over 90% of China’s rideshare market, peaking at 91% in 2018. However, due to regulatory requirements, the company’s market share declined to approximately 60% following the suspension of new user registrations on its platform in 2021.

Recent results provide optimism. In Q2 2023, revenues jumped 53% year-over-year to RMB 48.8 billion, powered by a 57% surge in its core China Mobility segment to RMB 44.5 billion. Transactions in China reached 2.7 billion for the quarter, up 48% from Q2 2022. After weathering a 19% revenue drop in 2022 amid regulatory headwinds, DiDi’s return to growth in Q2 2023 signals it may be getting back on track. The 53% revenue increase in the latest quarter provides optimism that DiDi is regaining momentum after turbulence.

Maintaining Market Dominance Despite Competition

While DiDi has ceded some market share recently, it remains the dominant leader in China’s ride-hailing industry. DiDi provides nearly 17 million daily rides, more than double the approximately 8 million daily rides facilitated by Amap, Alibaba’s (NYSE:BABA) mobility platform. DiDi’s ride volume also dwarfs Meituan’s (OTCPK:MPNGF) estimated 1 million daily rides.

Matching the unmatched scale of DiDi’s platform, which boasts over 587 million users, will likely prove an extremely difficult task for emerging competitors like T3 and Caocao Chuxing. Beyond just size, DiDi enjoys the key advantages of strong brand awareness built over the past decade and an advanced technological edge in areas like AI and autonomous driving.

These core strengths represent significant barriers to entry for rivals and will help DiDi maintain its leadership position as China’s #1 ride-hailing platform even amidst an evolving competitive landscape. The company’s vast scale and brand equity provide a sturdy foundation to build upon.

To reclaim lost market share, DiDi plans an active second half of 2023, utilizing promotions and diversified and affordable new offerings to recapture users lost during the regulatory freeze. While challenges persist, DiDi can leverage its core strengths in brand, technology, and scale to regain momentum in the Chinese rideshare space, where it has traditionally dominated.

Pursuing Global Expansion

In the near term, profitability may suffer as DiDi ramps up incentives and marketing spending. But reigniting growth now is crucial. DiDi can leverage its pole position to drive sustained dominance in a global Mobility-as-a-Service (MaaS) market worth as much as $358.35 billion by 2025.

This enormous opportunity is why international expansion remains vital to DiDi’s future. As its sole growth engine lately, DiDi’s international segment saw revenues jump 35% in Q2 2023 to RMB 1.9 billion. DiDi now operates in 16 countries across Latin America, Europe, and Asia.

The global addressable market is too vast to ignore. Here, DiDi may have a unique advantage over the Chinese traveller. With Chinese tourist numbers set to hit 400 million annually by 2025, DiDi can harness its brand recognition to gain share abroad.

Beyond rides, DiDi also pushes into areas like autonomous driving, freight, and community group buying. This not only reduces reliance on its core business but also transforms DiDi into a one-stop transportation and delivery platform.

DiDi’s turbulent financial journey

The financials illustrate DiDi’s turbulent journey. In 2021, revenues grew 13% to RMB 173.8 billion. But a cybersecurity probe resulted in the suspension of app registrations, crippling transaction volumes. Consequently, in 2022, revenues declined 19% to RMB 140.8 billion. The China Mobility segment bore the brunt, with revenues falling 22% amid the regulatory freeze.

However, the silver lining was a dramatic narrowing of losses. Despite the 19% revenue decline, DiDi nearly halved its net losses in 2021. Stringent cost control and optimization boosted the bottom line. 2022’s net loss fell more than 50% to RMB 23.8 billion. The Q2 2023 comeback underscores that a recovery may be underway.

Competition is undoubtedly rising, both at home and in DiDi’s overseas forays. But the numbers reveal DiDi’s dominance. In Q3 2022, DiDi accounted for nearly 80% of China’s ride-hailing orders.

The regulatory overhang has eased for now, but unpredictability remains a threat. However, in our opinion, the mobility market’s vast potential and DiDi’s leadership position can help weather any shocks.

Cheap valuation compared to peers

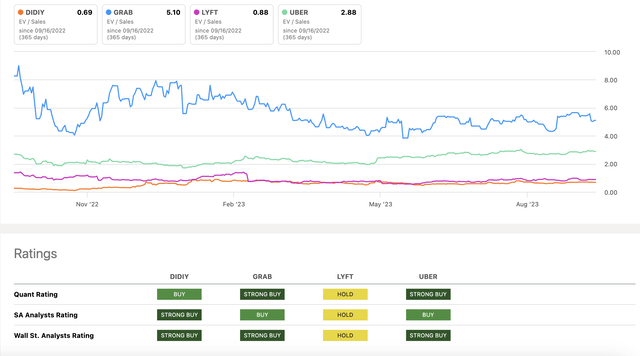

Compared to rideshare peers Grab, Uber, and Lyft, DiDi trades at a sizable valuation discount based on its Enterprise Value to Sales (EV/Sales) multiple. DiDi’s EV/Sales ratio is just 0.69x, much lower than Uber’s 2.88x and Grab’s 5.10x at the time of writing. DiDi’s sales multiple is also below Lyft’s EV/Sales ratio of 0.88x.

SeekingAlpha

This indicates investors are applying a more conservative valuation framework to DiDi compared to other major rideshare operators. DiDi is valued at just a fraction of its peers on a sales basis, likely reflecting regulatory uncertainties in China and market share pressures. However, if DiDi can continue reaccelerating growth, its discounted valuation may offer an attractive entry point for investors.

Key Takeaway

In summary, DiDi Global faces ongoing challenges, but the company retains formidable strengths. Its vast scale, advanced technology, and strong brand leave DiDi well-positioned to maintain domestic leadership. International expansion offers massive potential, leveraging Chinese travelers and brand recognition. While competition rises, DiDi enjoys network effects from its massive user base that are difficult to replicate. If management executes well, DiDi can leverage its pole position in a mobility market with a vast runway for growth. Trading at a sizable discount to global peers, patient investors could be rewarded should DiDi’s recovery momentum continue. The road ahead remains bumpy, but the market opportunity is enormous for China’s dominant rideshare platform.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here