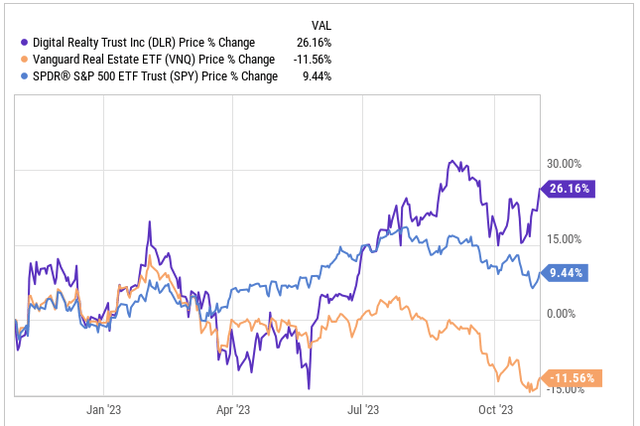

The real estate sector as a whole has been one of the worst performing sectors in 2023 and for much of the past year. As investors and consumers alike have endured rising interest rates, this too has impacted the REIT sector that tends to rely on debt to grow, due to the structure of REITs.

Digital Realty Trust (NYSE:DLR), one of the largest Data Center REITs on the market today, has been one of those REITs that has bucked the overall REIT trend. On the year, DLR shares are up 26% in the past 12 months, far outpacing the REIT sector (VNQ) which is down 11.5% and even outpacing the S&P 500 (SPY) which is up 9% during that same period.

yCharts

In today’s piece we are going to take a closer look at DLR to understand more about the business, its recent earnings release, and look at valuation to determine whether the stock is a buy, hold, or sell.

A Giant In The World of Data Center Properties

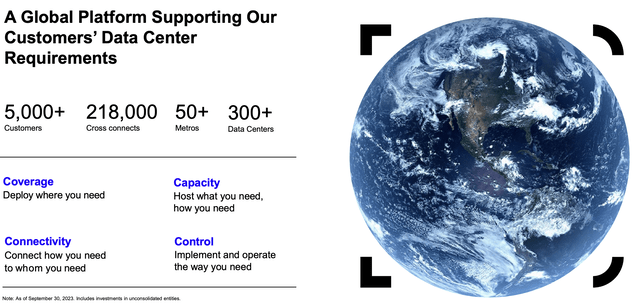

Digital Realty Trust, Inc. is a prominent global Real Estate Investment Trust specializing in data centers, colocation, and interconnection solutions. The REIT was established in 2004, and now has a significant global presence, with 316 data centers strategically located across the world.

DLR Q3 Presentation

Geographically, DLR’s portfolio predominantly spans North America (55%) and Europe (approximately 25%), with a noteworthy addition in Africa through the acquisition of Teraco Data Environments in 2022. This acquisition included seven highly-connected assets in key urban centers across South Africa, contributing to the company’s global footprint.

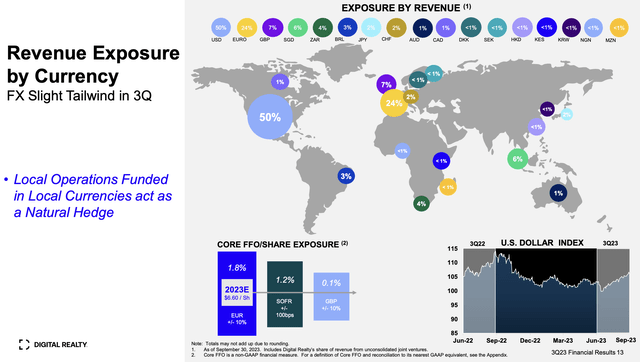

DLR Q3 Presentation

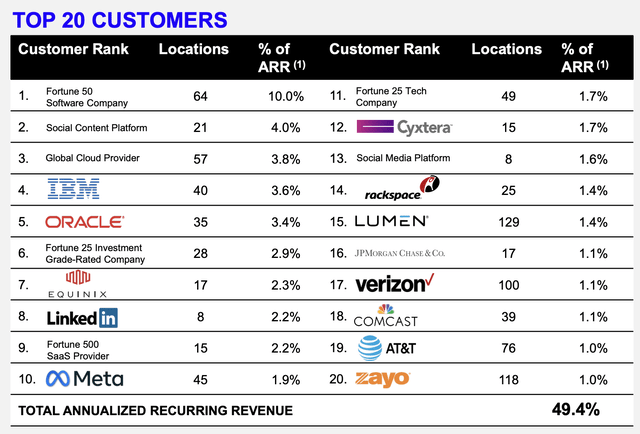

Digital Realty has a diverse tenant base which features tech industry giants like IBM (IBM), Oracle (ORCL), Meta Platforms (META), and LinkedIn, which is owned by Microsoft (MSFT). Roughly half of the REITs revenues are derived from its top 20 tenants. Notably, the largest tenant accounts for just 10% of total revenue, and around half of the tenants boast investment-grade status.

DLR Investor Presentation

This diversity and stability in tenants underline the company’s strong position in rent collection.

Growth moving forward continues to have a tailwind as the digital economy continues to expand itself, driven by technological advancements like IoT, 5G, and AI. All of these things, including more employees working from home has led to increased data generation and processing demands, which all lead back to a need for data centers. DLR’s focus on addressing Data Gravity, along with its global data center platform, positions the company for sustained growth. The company’s data center portfolio, including internet gateway facilities, provides secure and highly connected environments, contributing to its 84.7% occupancy. Furthermore, DRL’s development projects and strategic acquisitions, such as Teraco in South Africa, enhance its global presence, catering to the ever evolving needs of digital enterprises.

Recent Earnings Further The DLR Growth Story

Digital Realty Trust recently reported their Q3 earnings results which were as follows:

- Q3 Funds From Operations (FFO) of $1.62 per share (In-Line)

- Q3 Revenue of $1.4 billion, (BEAT by $0.01 billion)

Revenues beat analyst expectations on the quarter and equated to robust 17.6% year-over-year growth. FFO of $1.62 per share met expectations but it was a decline of 8.4% year over year.

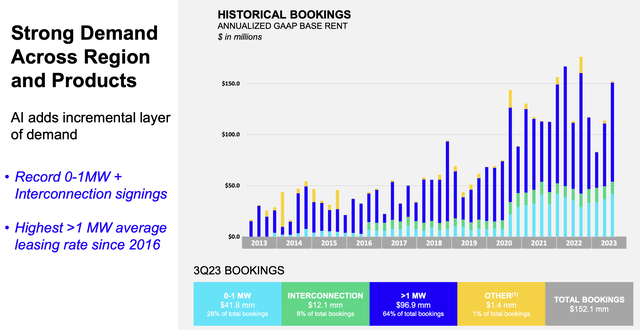

Digital Realty reported robust leasing activity, with bookings in Q3 2023 expected to generate $152 million of annualized GAAP rental revenue. Notably, the 0-1 megawatt category contributed $42 million, and interconnection brought in $12 million of this total.

DLR Q3 Presentation

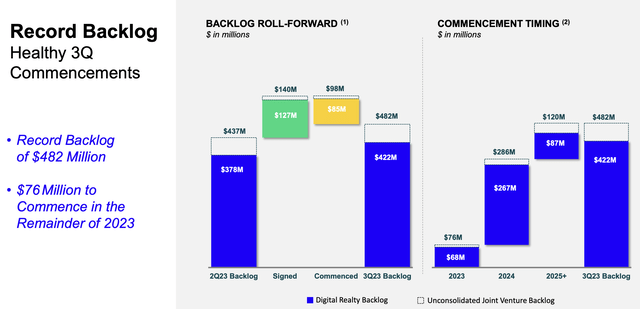

Renewal leasing rates witnessed a strong growth of 7.4% on a cash basis in Q3. Total backlog of signed, yet-to-commence leases reached a new record of $482 million, which shows the demand for data centers.

DLR Q3 Presentation

Interconnection revenue hit a quarterly record of $107 million, marking a 12% increase year-over-year. Pricing power was notably strong, with the highest pricing levels for greater than a megawatt leases since 2016.

In addition, the company’s balance sheet remains in good shape with over $2.6 billion in proceeds from joint ventures, non core asset sales, and settlements. Leverage for the company decreased to 6.3x net debt to EBITDA, as the company moves towards its near 6x leverage goal.

During the quarter, management narrowed its 2023 Core FFO per share outlook range to $6.58 – $6.62. Full-year revenue guidance was adjusted slightly to reflect lower passthrough tenant utility reimbursements. Key takeaways included strong leasing, improved fundamental metrics, and diversification of the balance sheet. The company expects to continue executing asset sales and development ventures.

Is DLR A BUY, SELL, or HOLD?

DLR emerges from its Q3 2023 results as a strong player in the real estate investment trust sector. With a focus on data center, colocation, and interconnection solutions, DLR has proven to be a resilient and attractive option for investors. The company’s presence in over 50 metros across 27 countries positions it as a key player in the data center space.

DLR’s core business benefits from its ability to facilitate the growth of AI and cloud computing. Furthermore, the company enjoys sticky customer relationships, particularly among clients utilizing high storage capacity, which accounts for a significant portion of DLR’s bookings.

However, there are potential headwinds, such as higher interest expenses that are weighing in on DLR’s FFO/share. The higher interest rate environment, driven by the Federal Reserve’s actions to combat inflation, may continue to affect DLR’s bottom line in the coming quarters. AT the same time, high interest rates are nothing new for the past 12-18 months and the company has still found a way to outperform.

One notable aspect of DLR’s strategy is its commitment to deleveraging its balance sheet, aiming to achieve a long-term net debt to EBITDA ratio of 6x. This prudent financial approach, combined with a strong fixed charge coverage ratio and a BBB credit rating, provides DLR with lower-cost access to capital and financial stability.

So with all that being said, is DLR a BUY, SELL or HOLD?

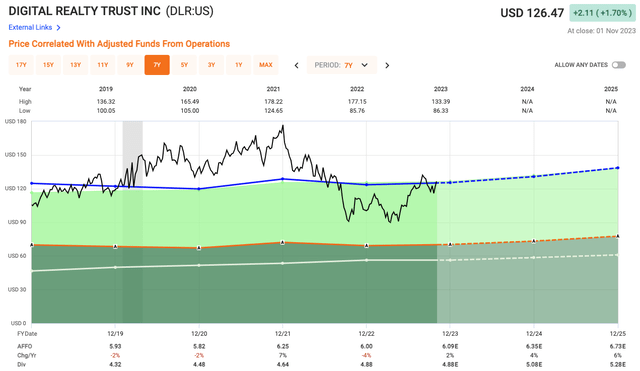

In terms of valuation, analysts are looking for 2024 AFFO of $6.35 per share, which would imply 6% AFFO growth over 2023. This puts shares of DLR at a forward AFFO multiple of 19.9x. Over the past five years, shares have traded at an average AFFO multiple of 20.5x and over the last decade closer to 19.5x. This puts shares as being “Fairly Valued” based on this metric alone, as a lot of the growth seems to have already been priced into the stock.

Fast Graphs

Among the 18 analysts actively covering Digital Realty Trust on Wall Street, 10 have a ‘Buy’ rating on it, 7 have a ‘Hold’ rating, and only 1 has a ‘Sell’ rating. Their consensus 12-month price target is $127.94, implying shares are again fairly valued.

Given the run the stock has had, I rate the stock a HOLD at current levels.

Investor Takeaway

One notable aspect of DLR’s strategy is its commitment to deleveraging its balance sheet, aiming to achieve a long-term net debt to EBITDA ratio of 6x. This prudent financial approach, combined with a strong fixed charge coverage ratio and a BBB credit rating, provides DLR with lower-cost access to capital and financial stability.

Management is utilizing its strong results over the past year to deleverage and strengthen its balance sheet, which is a positive from an investor standpoint.

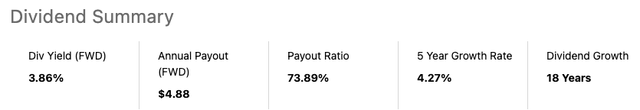

In terms of the dividend, shares of DLR yield 3.9%, and it is a dividend that has been increased for 18 consecutive years with a five-year dividend growth rate of 4.3%.

Seeking Alpha

Valuation is not all that intriguing at current levels, which is why I rated the stock a HOLD at the moment in my opinion.

Read the full article here