Investment Thesis

DigitalOcean Holdings, Inc. (NYSE:DOCN) delivered investors lowered guidance for 2023. Halfway through the year, a growth company doesn’t lower its revenue guidance unless the outlook becomes particularly dim.

Bulls point to DigitalOcean’s very strong free cash flows. However, I remark that the bulk of the free cash flow is made up of stock-based compensation. And despite management deploying significant sums to repurchase shares and mitigate its stock-based compensation, the total number of shares outstanding continues to climb.

In sum, I find it difficult to turn bullish on DigitalOcean.

Rapid Recap,

In my previous analysis, I said:

The negative consideration is that DigitalOcean’s revenue growth rates appear to be slowing down at a rapid rate. Case in point, last year, DigitalOcean could be counted on for plus 30% CAGR.

[…] DigitalOcean reported its Q1 2023 results, and it didn’t take the opportunity to upwards-revise its full-year outlook. Even though at the time of the results being reported, we are nearly halfway through 2023.

This means that what we see is pretty much all there is, a cloud company’s revenue growth rates of mid-20s% CAGR.

Since I wrote those insights, DigitalOcean has not only failed to raise its revenue outlook for 2023, or even to reiterate its outlook. On the contrary, DigitalOcean has moved to downwards revise its revenue guidance for 2023.

With this background in mind, let’s press ahead.

Why DigitalOcean? Why Now?

DigitalOcean provides cloud computing solutions that enable developers to deploy and manage applications on scalable servers, also known as “droplets,” along with various services for streamlined development. Their platform is designed to empower developers with efficient infrastructure to build, test, and deploy their applications.

DigitalOcean’s value proposition lies in offering developers a user-friendly and cost-effective cloud computing platform to easily deploy and scale applications without the complexities of traditional infrastructure management.

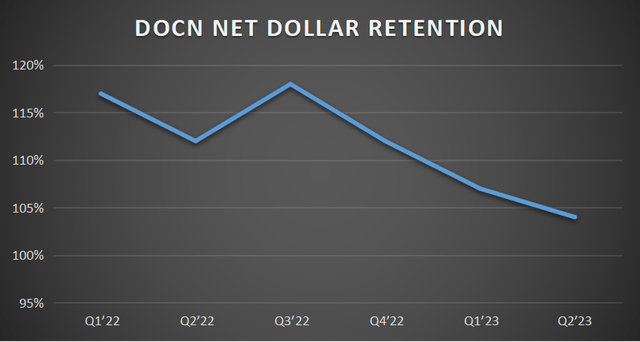

During the earnings call, we heard about DigitalOcean’s newest acquisition, Paperspace. Paperspace adds an AI/ML dimension to the company’s portfolio. And yet, notwithstanding this acquisition, the core portfolio continues to see DigitalOcean’s dollar-based net expansion rates moving in the wrong direction.

DOCN NDR

The trend above demonstrates DigitalOcean’s ability to monetize its user base over time. With that in mind, let’s discuss its outlook.

DigitalOcean’s Outlook Is Uninspiring

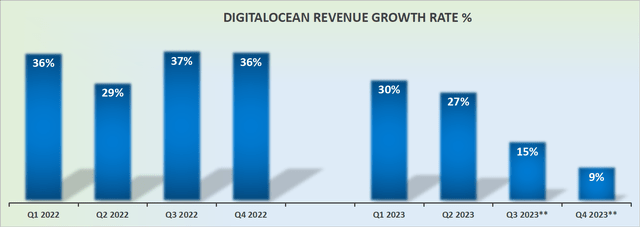

DOCN revenue growth rates

The graphic above forces us to ask uncomfortable questions about 2024. We know that the second half of 2023 will see a significant slowdown versus the start of 2023.

Despite the inclusion of two businesses onto the DigitalOcean platform, it appears that DigitalOcean’s revenue growth rates coming out of Q4 2023 point to about 15% CAGR.

Inherently, this means that the likelihood that DigitalOcean will see a 30% CAGR in 2024 now looks unlikely. Consequently, investors should now start to brace themselves for this growth stock to become ”ex-growth.”

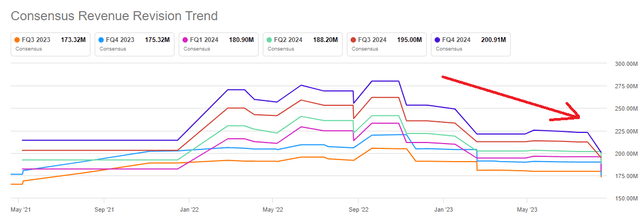

SA Premium

As close followers of mine will know, one should not invest in businesses where analysts following the company are in the process of downwards revising its consensus revenues. Advice? Don’t fight the Street.

Let’s move on and discuss DigitalOcean’s use of capital.

Poor Capital Allocation Efforts

DigitalOcean has deployed approximately $370 million worth of capital toward shares repurchases. This equates to about 12% of its market cap being used to repurchase shares at approximately $35 per share. Has this been a prudent use of capital? I don’t believe so. Why not?

Consider this: DigitalOcean finished Q4 2022 with 96.5 million shares outstanding. And according to its guidance for 2023 as a whole, including its acquisitions of Cloudways and Paperspace, I suspect that Q4 2023 will finish with approximately 105 million shares outstanding.

This means that DigitalOcean’s total number of shares outstanding will have increased by close to 9% y/y, despite management deploying substantial resources towards share buybacks.

Put another way, DigitalOcean this year is expected to report approximately $150 million in free cash flow. Although, slightly more could be possible, reaching $165 million. This means that DigitalOcean has spent more than twice this sum to repurchase shares, while making no meaningful effort to actually decrease the total number of shares.

Consequently, I urge readers to think about DigitalOcean in 2024. DigitalOcean will probably enter next year with approximately $750 million in net debt. Plus given its slowing growth rates, will DigitalOcean be as inclined to aggressively repurchase shares then? I don’t believe so.

That will mean that management’s stock-based compensation will leave DigitalOcean’s total number of shares outstanding in 2024 increasing by somewhere close to 15% CAGR.

Meaning that, even if DigitalOcean grows its revenues next year by around 15%, shareholders receiving a 15% share dilution will be no better off.

The Bottom Line

DigitalOcean Holdings Inc. has downward revised its 2023 revenue projection. This is a notable step for a growth-oriented company, suggesting that the outlook might not be as bright as anticipated.

While some might point to DigitalOcean’s strong free cash flows as a reason for optimism, it’s worth noting that a substantial chunk of these flows is attributed to stock-based compensation.

Additionally, the gradual slowdown in the growth of DigitalOcean’s core cloud business raises questions about the effectiveness of its recent acquisitions like Paperspace.

What adds complexity to the equation is the company’s ongoing share buybacks, which, despite aiming to mitigate stock-based compensation, have led to an increase in the total number of shares. This development casts a shadow on DigitalOcean’s potential for robust future growth and its ability to deliver attractive returns for investors like myself.

Read the full article here