Investment thesis

Our current investment thesis is:

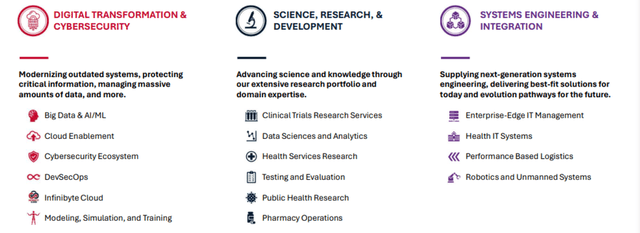

- DLHC’s business model has been incrementally improved over the last few years, with the acquisition of GRSi materially accelerating this. Much of this development has come through its investment in its technological capabilities, allowing the business to provide a vast range of services to several government agencies.

- Despite this, its share price has responded aggressively to its growth slowdown, which appears completely attributable to macro-conditions (and is still good relative to the wider market). We see this as an opportunity to acquire this quality business at a discount to its long-term potential.

Company description

DLH Holdings Corp. (NASDAQ:DLHC) is a leading provider of technology-enabled business process outsourcing and program management solutions in the healthcare, defense, and veterans’ services markets. Headquartered in Atlanta, Georgia, the company serves federal government agencies, state and local governments, and commercial clients.

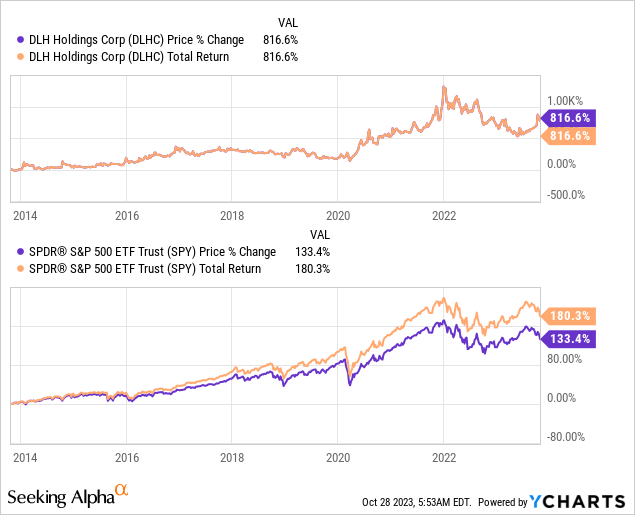

Share price

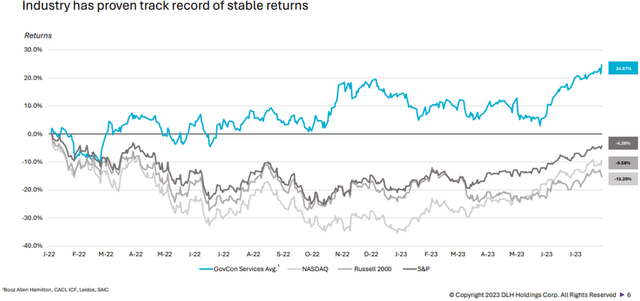

DLHC’s share price performance has been magnificent, returning over 800% (over 10 years) to shareholders and significantly outperforming the S&P 500. This has been driven an impressive development in its financial profile alongside good growth, contributing to an upward assessment of its long-term trajectory.

Financial analysis

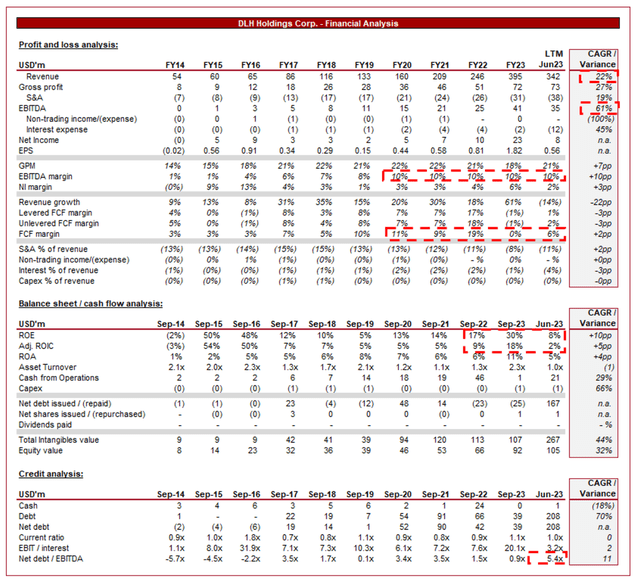

DLHC Financials (Capital IQ)

Presented above are DLHC’s financial results.

Revenue & Commercial Factors

DLHC’s revenue has grown at a CAGR of +22% during the last decade, while EBITDA has materially outperformed this at +61%. This trajectory has been broadly consistent, with an improvement in the latter half of the decade. This said, the business has experienced a sharp drawdown in the LTM period, with revenue down (14)%.

Business Model

DLHC operates as a provider of technology-enabled business process outsourcing and program management solutions in the health and human services market. They serve various government agencies, focusing on health, human services, and public safety sectors. Its focus within these segments has allowed the company to develop deep expertise, contributing to the ability to tailor its services and market its capabilities through successful projects.

DLHC’s services include case management, program monitoring, evaluation, medical review, audits, and data analysis. These services are essential for government agencies managing healthcare programs and ensuring compliance with regulations.

DLHC maintains a highly skilled workforce consisting of healthcare professionals, data analysts, and program managers. These expertise are crucial for responding to complex healthcare regulations and effectively managing programs. Its recruitment has been crucial to the company’s growth in the last decade, allowing for the business to deliver consistent quality while increasing scale.

DLHC utilizes advanced data analytics to underpin its various services, it supports forming a view, efficiently managing large datasets, and responding to complex operational and developmental issues. This data-driven approach has allowed the business to support decision-making, program evaluation, and improving the efficiency of its healthcare services. Although this is a strategy utilized by many of its peers, the outcomes achieved and relationships developed suggest DLHC has strong capabilities. The beauty of a data-driven business model is that it is compounding, with DLHC continually improving from project-to-project. This is not just from a capabilities standpoint but also enables DLHC to advertise its expertise, contributing to new contract wins of greater size.

Coverage (DLHC)

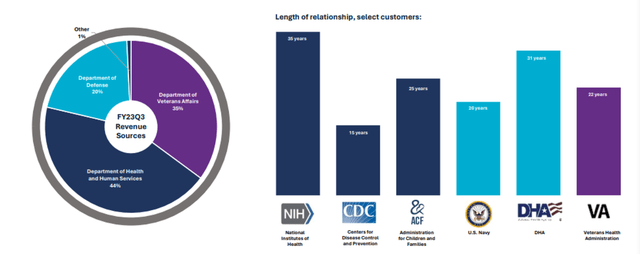

DLHC focuses on securing long-term federal contracts, often securing multi-year agreements with scope for follow-on services and bespoke bolt-ons. The focus on the federal segment, borne out of necessity given its industry focus, should support resilient demand as government funding is unlikely to be cut in these areas. The multi-year contract approach provides income stability and consistent revenue compared to taking a short-term approach that is exposed to pressures around winning contracts. It should be noted that its size means the business is still susceptible to swings based on contracts on/off-boarding.

Contracts (DLHC)

Given the nature of the healthcare sector, DLHC places a strong emphasis on compliance and quality assurance. Adherence to regulations and maintaining high service quality is critical for their reputation and contract renewals. We stress this as a key risk associated with the company’s business model as a single misstep would be destructive to its operations.

Healthcare Outsourcing Industry

The healthcare BPO market is expected to grow at a CAGR of 9.2% into 2032, with key growth regions being North America and Europe. Globe trends, such as technological development, aging western populations, and historical underspending on Government infrastructure are all underpinning this growth trajectory, with a particular focus on operational improvements.

DLHC faces competition from companies such as Maximus (MMS), Leidos Holdings (LDOS), and Perspecta. Although DLHC lacks scale, we consider it a strong market participant that has developed deep expertise. DLHC is in its expansion phase following the development of its brand, with new services within its IT suite showing early success.

In conjunction with these factors, we believe the following will also contribute to a positive growth trajectory in the coming years (and scope for DLHC to outperform):

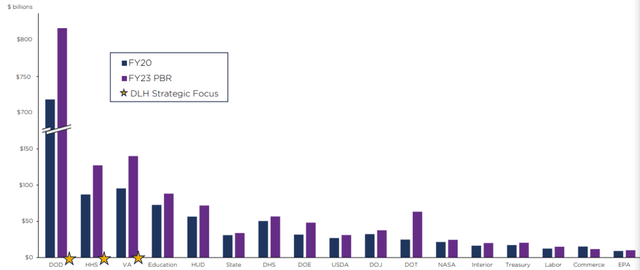

- Government Demand – Increased demand for healthcare and human services by government agencies, driven by changing demographics and healthcare needs, has led to greater federal budget allocation. The expectation is for this to remain robust at a minimum, with scope for improvement. These broader macro/social factors lend well to securing long-term contracts, as government agencies expect support to be required over an extended period.

Funding (DLHC)

- Data-Driven Decision Making – DLH’s focus on data analytics should position the business well as future trends appear to be in the direction of embracing greater technological use. With Government agencies lacking the expertise to utilize these technologies, the demand for external services should improve.

- Reputation and Trust – DLHC’s consistent delivery and adherence to high standards have built trust with government clients. Although we have identified its adherence as a key risk, its perfect track record and continued high-quality deliverables will act as the best form of marketing.

- Specialized Expertise – DLH’s specialized expertise in managing healthcare/military programs and its ability to navigate complex regulations have made it a leading partner for many agencies. We believe this will lead well to expanding its services, either targeting existing clients or broadening its reach. The key within an industry such as this is reputation, expertise, and relationships. DLHC’s financial performance and commercial development clearly illustrate these three characteristics.

- GRSi – GRSi is a specialist in architecture design, infrastructure modernization, software engineering, and multi-tier IT service management solutions. The company’s services are similar to DLH allowing for cross-selling and increased scale while enhancing the wider group through the broadening its offering and the achievement of future synergies.

Margins

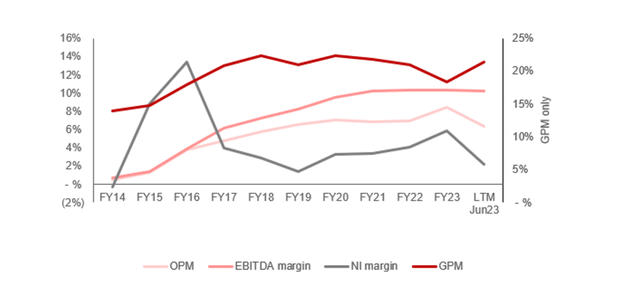

Margins (Capital IQ)

DLHC’s margins were consistently improving in the lead-up to the pandemic, with stagnation following FY20. We suspect improvement is still possible given the company’s scale but the disruptions in recent years have impacted the ability to execute. Margins at this revenue level will be materially impacted by project wins and so forward estimates are difficult.

Quarterly results

DLHC’s quarterly results have materially slowed, primarily due to the impressive comparable periods in FY22 (which was accelerated by a large short-term contract). In its most recent 4 quarters, the company posted top-line growth of +3.1%, (52.4)%, (8.5)%, and 53.9%. Importantly, its QoQ growth has been consistent since Q3’22, suggesting its near-term performance is normalizing.

The stagnation of its financial performance relative to FY21/FY22 (when adjusting for the short-term Alaska contract) is a reflection of macroeconomic conditions, with a reduced quantity of new contract wins and difficulties associated with maintaining momentum. Management has used this period to integrate GRSi and continue the development of its services. This should not be considered a bad performance, however, given many are experiencing a substantial drawdown in profitability.

Growth (Capital IQ)

Key takeaways from its most recent quarter are:

- The company has again passed revenue of $100m, with Management believing this is now its run-rate level. In conjunction with this, margins have sequentially improved, implying the QoQ performance is now translating to YoY, supporting evidence of an improvement in current conditions.

- This said, the contract award environment is still experiencing headwinds, reflected by certain contract protests and extensive procurement cycles.

- DLH had been awarded a contract to expand its role at the National Heart, Lung and Blood Institute, with a 5-year contract worth c.$85m.

- FCF has been primarily invested in debt reduction and integration of GRSi.

Balance sheet & cash flows

DLHC’s balance sheet has become bloated during recent months, with the acquisition of GRSi, financed partially through debt. The business is expected to generate c.$140m in revenue going forward. Management estimates that the normalized debt leverage will be 3.7x FY23 EBITDA. This is the top-end of reasonable in our view, although its growth trajectory means we are not overly concerned currently. This will mean medium-term cash flow is committed to deleveraging, minimizing any hope for distributions.

Outlook

Outlook (Capital IQ)

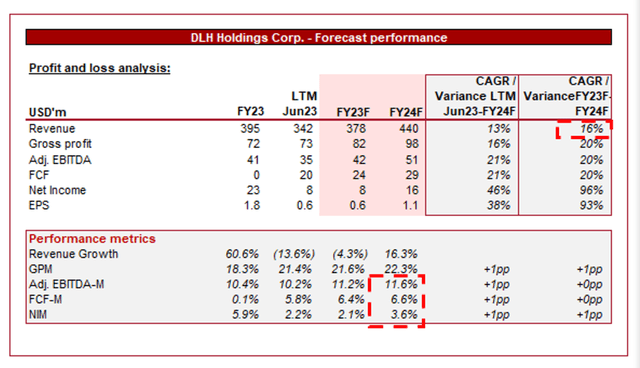

Presented above is Wall Street’s consensus view on the coming 2 years.

Analysts are forecasting a continuation of its strong growth, with a CAGR of +13% into FY24F. In conjunction with this, margins are expected to slightly improve, with an EBITDA-M of 11.6% in FY24F.

These assumptions appear broadly reasonable in our view. The growth in revenue is below its historical average, reflecting its greater scale and a moderate ramp-up in spending from the current depressed levels. Further, the business has shown a track record of margin improvement, with reasonable scope for operating cost leverage.

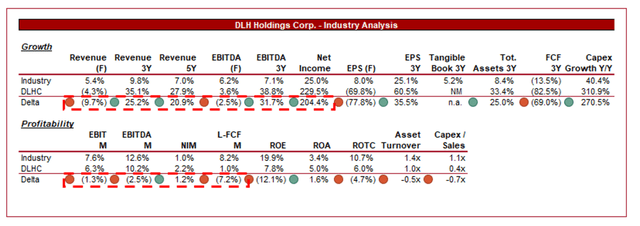

Industry analysis

Human Resource and Employment Services Stocks (Seeking Alpha)

Presented above is a comparison of DLHC’s growth and profitability to the average of its industry, as defined by Seeking Alpha (26 companies).

DLHC performs reasonably well relative to its peers. The company’s growth has been exceptional, significantly outperforming its peers, although this is expected to cease in the forward period. Its growth trajectory is a reflection of DLHC’s smaller size and current trajectory, as well as its aggressive expansion strategy. We do believe DLHC has gained market share through its superior execution.

DLHC’s weakness is attributable to margins. Its peer group is slightly more profitable, with a significantly larger ROE. This is due in part to the company’s scale, benefiting less from economies of scale, but also its aggressive go-to-market strategy. We suspect a shift toward profitability would allow the business to at least reach parity on an EBITDA basis.

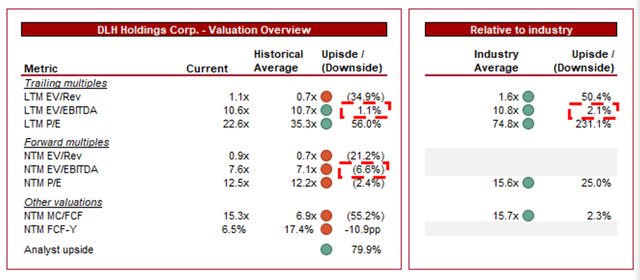

Valuation

Valuation (Capital IQ)

DLHC is currently trading at 11x LTM EBITDA and 8x NTM EBITDA. This is broadly in line with its historical average, with a small discount on an LTM EBITDA basis and a small premium on a NTM EBITDA/NI basis.

The premium to its historical average reflects the rapid deterioration of DLHC’s financial performance, with investors likely weighted toward a reasonable recovery.

Our view is that a premium to its historical average is warranted. DLHC’s business model and commercial position have developed exceptionally during the historical period, positioning the business well for a continuation of strong growth in the years to come. This is compounded when considered in conjunction with positive industry trends.

Further, DLHC is trading at a discount to its peer group. We believe a premium is justifiable, primarily due to the scope for a continuation of above-average growth, as well as the room for margin improvement to the industry average. Given the small delta to its peer group on a margin basis and its current valuation, we see the downside risk as small.

Key risks with our thesis

The risks to our current thesis are:

- Government budget cuts.

- Loss of key contracts.

- Adverse changes to the regulatory environment.

Final thoughts

DLHC is a quality business in our view. The company’s growth trajectory is credited to Management’s ability to scale its expertise and consistently deliver a high-quality service. Through a data-driven approach, the company has positioned its service offering for future developments.

With its focus on federal contracts, we believe DHLC is positioned well to achieve sustainable growth long term, with multi-year contracts alongside consistently improving budget allocations.

Although the company’s performance is not outstanding relative to its peers, we do see a continuation of its above-average growth and sequential margin improvement. When considering this in conjunction with its current valuation, we see an upside at the current share price.

Read the full article here