By Andrew Prochnow

The dollar milkshake theory is an economic thesis that predicts that the U.S. dollar will prevail against all other currencies, despite the current global economic uncertainties.

Considering the U.S. dollar just closed its 11th consecutive week of positive gains and is now up roughly 5% over the last two months, the milkshake theory seems to be panning out.

Dollar strength has been a theme since June 2021, and the trend continues. Considering recent statements by leaders at the U.S. Federal Reserve, there’s no reason to think the dollar will weaken significantly anytime soon.

At the Fed’s most recent policy meeting on September 20, leaders at the nation’s de facto central bank indicated they weren’t raising rates further, but that they’d likely remain elevated for the foreseeable future. As summarized recently by Citigroup economist Andrew Hollenhorst, “Chair Powell and the Fed sent an unambiguously hawkish higher-for-longer message at today’s FOMC meeting.”

Higher rates are generally bullish for currencies, so higher-for-longer provides a reasonably strong basis to think the dollar could enjoy a “Fed put” for the foreseeable future.

As of Oct. 2, the U.S. Dollar Index (DXY) is trading about 106. The “DXY” peaked in October of last year above 113, and proceeded to slowly retrace through July of this year. Since then, however, the DXY has been steadily climbing higher.

The DXY is up 5% over the last 60 days.

Currencies are somewhat unique because their relative value all depends on what you compare them against. The DXY measures the dollar against a basket of currencies, providing a more balanced view of its value.

To wit, the DXY is calculated using the exchange rates of six major world currencies, including the euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), British pound (GBP), Swedish krona (SEK) and Swiss franc (CHF).

But in the foreign exchange markets (aka forex or FX) most investors monitor and trade individual currency pairs, such as the dollar versus the euro, or the dollar versus the yen using prevailing exchange rates.

Exchange rates are quoted using the format “ABC/DEF,” and are interpreted to mean that the first currency listed is a single unit, while the exchange rate itself represents the amount of the second currency that is required to purchase a single unit of the first currency.

For example, the EUR/USD currency pair reports how many dollars are required to purchase a single euro. As of today, that number is about $1.06. This is referred to as the “exchange rate” between the EUR/USD.

The dollar has been steadily appreciating against the euro for more than a decade, but the euro isn’t the exception-it’s part of the rule. The dollar has made significant gains against many of the world’s major and minor currencies over the last 10 years, as highlighted recently by Charlie Billelo.

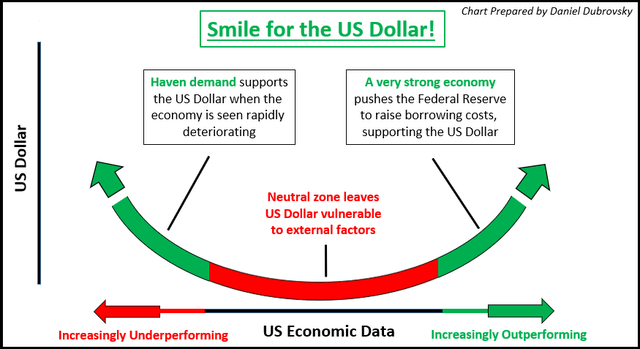

While the dollar derives its resilience (according to the dollar milkshake theory) from the milkshake of central bank liquidity, a theory known as the “dollar smile,” asserts that the greenback can strengthen in both good times and bad, making it a somewhat unique asset in the global markets.

More Background on the Dollar Smile Theory

Twenty years ago a currency analyst named Stephen Jen suggested that the dollar enjoys a unique status because it can appreciate in value amidst a diverse range of circumstances. For example, the dollar can rally when the U.S. economy is going gangbusters, but it can also rally when the world is on fire, due to its safe haven status.

Jen labeled this phenomenon the “dollar smile,” because the graphical illustration of this theory reflects a higher dollar on both ends of the chart, and somewhat weakened in the middle-much like the smile on a person’s face, as highlighted below.

US Dollar Smile Theory: How Does Economic Resilience or Recession Drive USD?

In March 2020, the world saw first-hand what can happen to the dollar when things go awry at the systemic level. Amidst the onset of the COVID-19 pandemic, the DXY spiked by roughly 8.3% between March 9 and March 20.

On the other end of the spectrum, one can see how the dollar has performed since July of last year, when the U.S. economy’s relative strength pushed the dollar higher vis-à-vis most of the world’s other major (and minor) currencies.

Even the Chinese yuan, which remained stubbornly strong against the dollar through March 2022, has since succumbed to the might of the greenback. Over the last 18 months, the Chinese yuan has depreciated by an astounding 15% against the dollar.

These examples help illustrate how the dollar’s future performance is especially unpredictable because the forces that affect the dollar can be so dynamic, as compared to other currencies-not to mention other financial assets.

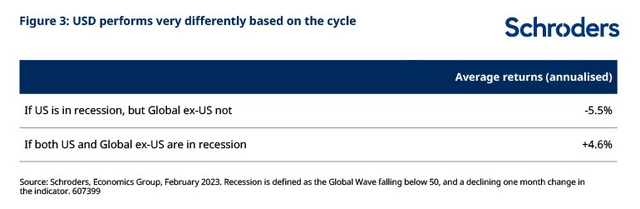

If the U.S. economy slips into recession in 2024-as is widely expected-that won’t necessarily represent a negative for the dollar. It all depends on how the rest of the world’s major economies are performing at that time.

For example, if the rest of the world economy is also contracting, a U.S. recession could actually serve to strengthen the dollar. According to Schroders asset management, amidst a global recession “investors flock to the US dollar as a perceived safe-haven asset, and the demand drives up the value of the dollar,” as illustrated in the historical performance data highlighted below.

Schroders

Dollar as a safe haven

Looking beyond just recessions/depressions, if something unexpected occurs that serves to destabilize the global financial markets, it’s virtually assured that the dollar would also benefit. Historically, the dollar has been a consistent beneficiary when uncertainty strikes the markets, due to its safe haven status.

Safe havens are traditionally defined as niches of the financial markets that retain, or even gain value, during periods of heightened volatility. Market participants typically seek out safe havens in order to help limit losses-or make positive returns-amidst downturns in the stock market.

As underscored previously by Marc Chandler-a managing director at Bannockburn Global Forex-the dollar remains a reliable safe haven because the United States “has the biggest economy, the strongest bonds, and the largest military.”

During the last couple of major financial crises (the Great Recession and the pandemic), investors and traders fled to U.S. government bonds as a place to park their cash. Precious metals such as gold, silver, and platinum have also traditionally been used as safe havens, although arguably less so in recent years.

But at the end of the day, many investors and traders simply elect to hold cash-cash that can be used as an emergency reserve for personal expenses, or for capitalizing upon new investment/trading positions amidst a correction. And for many global institutions, the greenback is the preferred form of cash.

Today, global central banks hold about 60% of their foreign exchange reserves in dollars. And even if the “BRICS” group of emerging economies launches a commodity-backed currency, U.S. dollar hegemony isn’t likely to end anytime soon.

Moreover, the dollar’s ability to thrive in good times and bad-as expressed by the dollar smile theory-probably won’t change, either. Underscoring that outlook, analysts at Schroders recently wrote, “the dollar smile theory remains valid.”

All told, that means the U.S. dollar remains an attractive store of value, and should remain that way for the foreseeable future. It is, after all, the most widely accepted store of value on the planet.

Read the full article here