The regional bank crisis was the main topic of many finance discussions back in March, as several regional banks failed from a combination of unrealized securities losses and deposit flight. Although the problems are not front-page news at the moment, I fear a new regional bank selloff could be brewing as commercial bank deposits are rolling over and unrealized securities losses may be pushing to new highs on elevated interest rates.

I believe investors currently holding the Direxion Daily Regional Banks Bull 3X Shares (NYSEARCA:DPST) should consider selling. DPST is a levered ETF betting on a rise in regional bank shares. If the regional bank crisis flares up again, there could be significant downside to the DPST ETF.

Fund Overview

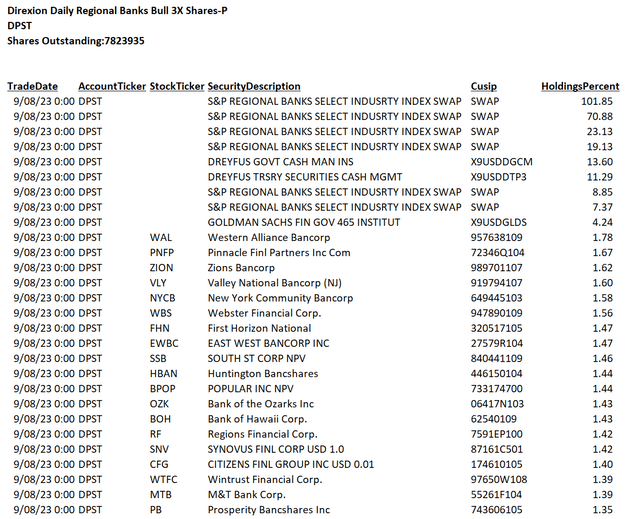

The Direxion Daily Regional Banks Bull 3X Shares is a levered ETF that provides daily returns that is 3x the return of the S&P Regional Banks Select Industry Index (“Regional Bank Index”). The fund achieves its 3x daily return target by holding shares of the underlying banks as well as entering into total return swaps with large investment banks (Figure 1).

Figure 1 – Partial holdings of DPST ETF (Author created with holdings report from DPST)

The DPST ETF is one of the larger levered ETFs on the market with $475 million in assets and charges a 0.93% net expense ratio.

Levered ETFs Are Not Buy & Hold Instruments

Before investors buy levered ETFs like the DPST, they are strongly encouraged to read and understand this disclaimer from Direxion’s website:

Leveraged and inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by investors who understand leverage risk and who actively manage their investments.

In simple terms, what this means is that the DPST ETF is only designed to provide 3x returns of the Regional Bank Index for one day. For any extended holding period, the realized returns will differ materially from the expected returns.

For example, imagine investors bought $100 of DPST. If the underlying index returned 5% on day 1, the investment in DPST will grow to $115 (3 times 1-day return of 5%). If the index returns 5% again on day 2, the investment will grow to $132.25. The 2-day total return is more than 3 times the 2-day compounded return of 10.25% or $130.75. This is due to the ‘positive convexity’ of levered ETFs that magnify returns in the direction of its bet.

On the other hand, if on day 2, the index returned -5%, then the investment in DPST will fall to $97.75, instead of $99.25 that can be expected from 3x the 2-day compounded return of -0.25%. This is due to ‘volatility decay’ of levered ETFs. Although the volatility decay may seem small over 1 day, compounded over many days, volatility decay can cause significant value erosion to levered ETFs like DPST.

Overall, levered ETFs like the DPST should only be used for short-term ‘swing trading’ and are not suitable for buy-and-hold strategies. New investors looking at leveraged ETFs for the first time should read and understand the following warnings from FINRA and the SEC before proceeding.

Destructive Power Of Leveraged ETFs On Full Display In Recent Regional Bank Crisis

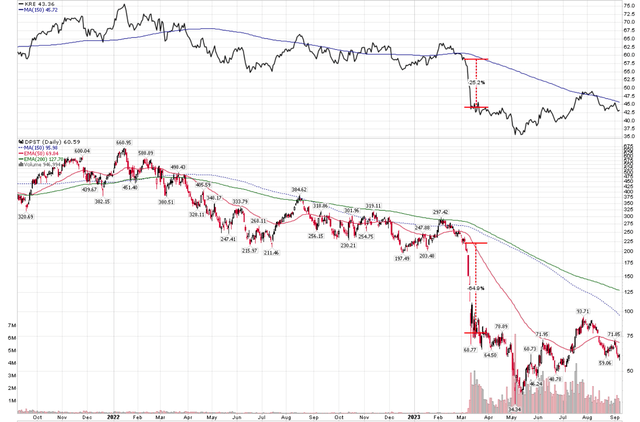

The power of DPST’s leverage was on full display in March. First, as the regional bank crisis developed, the Regional Bank Index, as modeled by the SPDR S&P Regional Banking ETF (KRE, which is based on the same underlying index as the DPST), fell by over 25% in a matter of days. This caused the DPST ETF to lose over 65% of its value over the same timeframe (Figure 2).

Figure 2 – DPST lost over 65% in early days of regional bank crisis (Author created with price chart from stockcharts.com)

Furthermore, in May, regional banks took another tumble, as First Republic Bank experienced a bank run and had to be taken over by the FDIC and sold to JP Morgan in a shotgun marriage. This caused another panic in regional bank shares and induced another large decline in the DPST ETF. Ultimately, from January 3rd to May 11th, 2023, the KRE ETF lost 37.5% of its value while the DPST ETF lost an incredible 81.8% in value (Figure 3).

Figure 3 – DPST lost a cumulative 82% during regional bank crisis (Seeking Alpha)

But Some Use It For Swing Trading

However, leveraged ETFs can also deliver phenomenal returns over short periods of time. For example, measured from the May 11 lows, the DPST rallied by over 120% at one point in August as the KRE ETF rebounded by 37.0% (Figure 4). Even now, the DPST ETF is still 50% higher than its May trading lows.

Figure 4 – DPST rebounded by over 120% from lows in August (Seeking Alpha)

Is The Regional Bank Crisis Really Over?

Although the March to May regional bank crisis was acute, it did not last very long as ultimately, regional banks stopped failing and investors moved on to other investment topics du jour like chasing AI stocks.

Deposits Starting To Flow Out Again

However, for keen observers of the banking industry, risks still remain. For example, if we look at the liability side of commercial bank balance sheets, we can see that commercial bank deposits did not really recover the deposit outflows from March. In fact, in recent weeks, bank deposits have started to trend down again, with total deposits of $17.27 trillion as of August 30, not far above the May nadir of $17.23 trillion (Figure 5). This suggest funding stress may be starting up anew.

Figure 5 – Commercial bank deposits rolling over (St. Louis Fed)

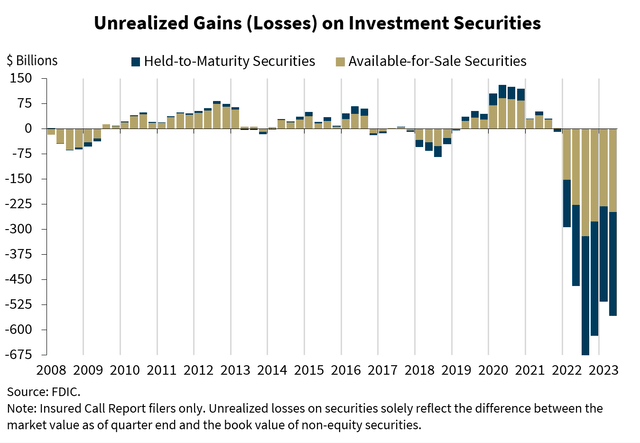

More importantly, on the asset side, the main cause of the regional bank crisis, unrealized losses on investment securities, continue to be a major problem. As of the end of Q2/2023, commercial banks had $558 billion in unrealized losses on their balance sheets, an increase of 8.3% QoQ according to latest data from the FDIC (Figure 6).

Figure 6 – Unrealized losses on bank balance sheets grew QoQ in Q2/2023 (FDIC)

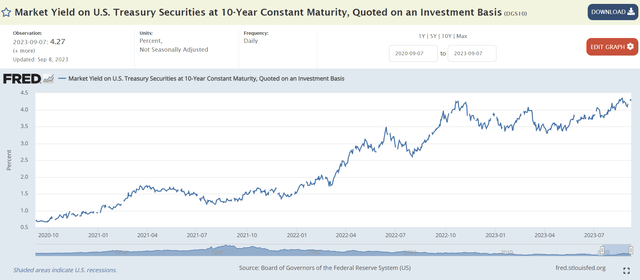

Furthermore, since the end of Q2, long term bond yields have risen significantly, with the 10Yr treasury yield recently touching 4.3%, above their October 2022 peaks (Figure 7). If we were to measure commercial banks’ balance sheets in real time, it is very likely that current unrealized losses would far exceed Q3/2022’s $690 billion, as the 10Yr yield was only 3.8% on September 30, 2022.

Figure 7 – 10Yr treasury yields are at cycle highs (St. Louis Fed)

Ways To Monitor Banking Stress

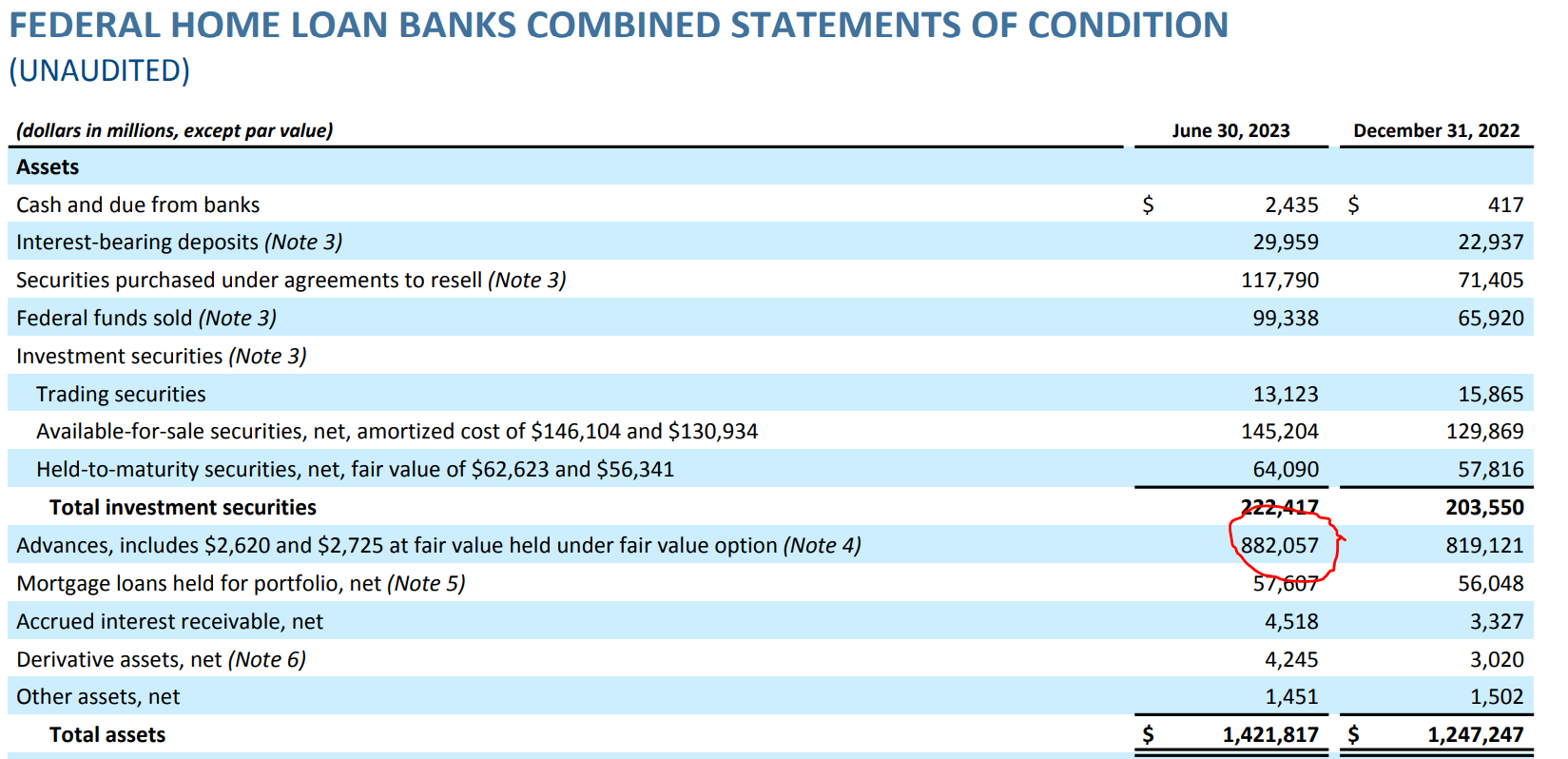

There are several ways to monitor commercial bank stress in near real time. First, investors can track the balance sheet of the Federal Home Loan Bank (“FHLB”), commonly referred to as the ‘lender of next-to-last resort’.

When SVB Financial faced deposit flight in late 2022, the bank borrowed heavily from FHLB to plug its capital hole. From the latest FHLB balance sheet, we can see banking stress remains elevated, as loans to commercial banks stood at $882 billion at the end of June, a slight improvement from March’s $1.05 trillion but still above December 2022’s levels (Figure 8).

Figure 8 – FHLB loans to commercial banks remain elevated (FHLB)

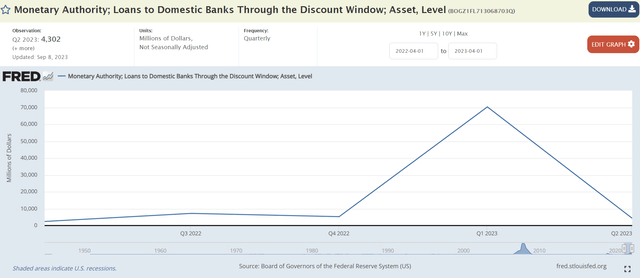

Another way commercial banks can get emergency funding is via the Federal Reserve’s Discount Window, which saw usage spike to $70 billion in March. As of June, usage has receded to only $4 billion (Figure 9).

Figure 9 – Discount window usage has returned to normal as of June (St. Louis Fed)

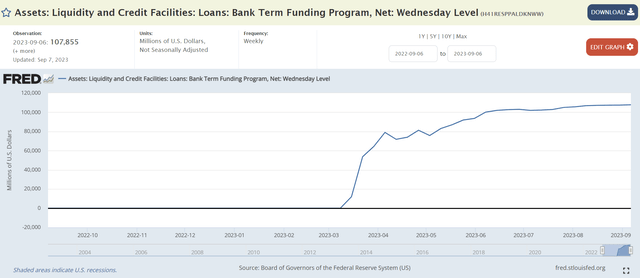

Finally, investors can monitor the Federal Reserve’s Bank Term Funding Program (“BTFP”) which was created in March to help banks weather the crisis. This data series is the most up to date and shows that emergency borrowing ramped up in March and has not let up, with the facility recently recording new usage highs at $108 billion (Figure 10).

Figure 10 – But BTFP usage keeps making new highs (St. Louis Fed)

Technicals Suggest Downside For Banks

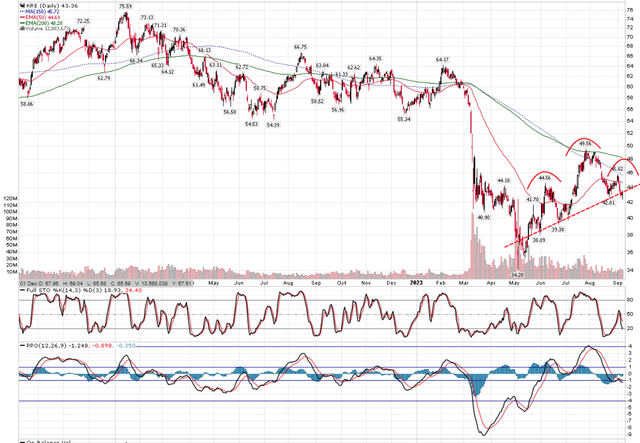

All-in-all, I remain deeply concerned about the banking sector and I fear a replay of the March crisis could occur, as unrealized losses on investment securities grow while deposits exit the banking system.

In fact, in recent days, the KRE ETF is starting to roll over with a negative ‘head and shoulders’ pattern, suggesting more trouble ahead for regional banks (Figure 11).

Figure 11 – KRE ETF has a head and shoulders pattern (Author created with price chart from stockcharts.com)

Conclusion

Investors who played the low in the DPST ETF in May should consider selling now, as funding stress is starting anew in the regional bank sector. Deposits are once again exiting the banking system while unrealized losses may be pushing new record highs as interest rates continue to stay elevated. I rate the DPST ETF a sell.

Read the full article here