Introduction

Shares of Duluth Holdings (NASDAQ:DLTH) have fallen 2.3% YTD. Despite the fact that the company’s stock is still valued low by multiples, I believe it’s still not the best time to go long as I don’t see catalysts for the stock going up in the coming quarters.

Investment thesis

In my personal opinion, we may see continued pressure on revenue in the next quarter as consumers continue to face higher food and rental costs despite a possible slowdown in inflation in the second half of 2023. In addition, in line with management’s comments, consumer price sensitivity remains, so the company may continue to invest in prices and discounts, which could have a negative impact on operating margins. For example, pressure on revenues could lead to a continued deleverage effect, as part of operating costs, such as distribution and rentals, are fixed.

Company overview

Duluth Holdings is engaged in the sale of casual wear for men and women, as well as the sale of accessories and workwear. The main sales channels are online and offline. As of the end of Q1 2023, the company operates 62 stores and 3 outlet stores. The company operates in the US market.

1Q 2023 Earnings Review

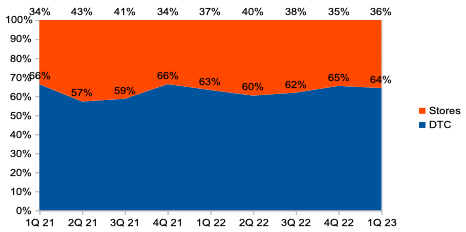

The company reported better than investors expected. According to the results of the 1st quarter of 2023, the company’s revenue grew by 0.7% YoY. The share of the DTC segment (% of revenue) increased from 63% in Q1 2022 to 64% in Q1 2023 due to improved website functionality and an effective marketing campaign, while the share of revenue in the stores segment decreased from 37% in Q1 2022 up to 36% in Q1 2023 due to a decrease in traffic in the chain stores. You can see the details in the chart below.

Revenue by channel (Company’s information)

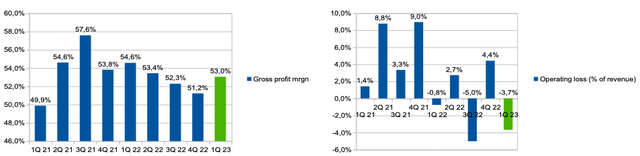

Gross profit margin decreased from 54.6% in Q1 2022 to 53% in Q1 2023 due to the need to invest in prices. The share of SGA expenses (% of revenue) increased from 55.3% in Q1 2022 to 56.7% in Q1 2023 due to an increase in general and administrative expenses and selling expenses due to higher overseas shipping costs. Thus, operating loss (% of revenue) increased from 0.8% in Q1 2022 to 3.7% in Q1 2023. You can see the details in the chart below.

Margin trends (Company’s information)

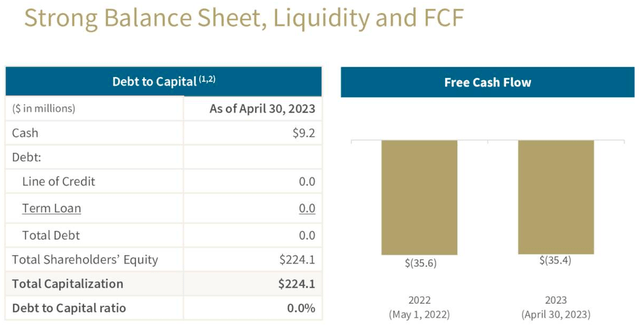

The company is still debt-free, which is good news, as low leverage can provide additional support in times of reduced demand for the company’s products and lower operating margins. In addition, the company confirmed guidance for 2023.

Debt (Company’s information)

My expectations

I believe that if we see a decline in inflation in the second half of 2023, then demand for the company’s products will be delayed because consumers will continue to face high costs for interest payments, rent and groceries. Thus, a decrease in business volumes can lead to pressure on operating margins in terms of reduced economies of scale and deleverage effects, because part of the company’s operating costs is fixed, I mean the costs of distribution, rent and wages.

In addition, in line with management’s comments during the Earnings Call following the release of Q1 2023 results, we can see that management expects leverage to occur only in Q4 2023.

In Q2 2023, according to the company’s CFO comments, sales show a gradual improvement, but pressure on margins remains as the consumer is still price sensitive and companies are forced to discount and invest in prices.

So we had pretty decent April business that brought the full quarter to the slight positive overall top-line. But throughout that period of time, there was continued margin pressure in the customers looking for the deal.

Thus, we can conclude that the pressure on the gross margin will continue in Q2 2023, although we may see some improvement relative to Q1 2023.

So we had pretty decent April business that brought the full quarter to the slight positive overall top-line. But throughout that period of time, there was continued margin pressure in the customers looking for the deal.

Risks

Margin: a decrease in business volumes can lead to pressure on operating margin due to the deleverage effect, since part of operating expenses is fixed (distribution, rent, salaries).

Macro (general risk): high inflation could lead to lower consumer confidence and lower real incomes, which could have a negative impact on consumer spending in the discretionary segment and, consequently, on the company’s revenue.

Valuation

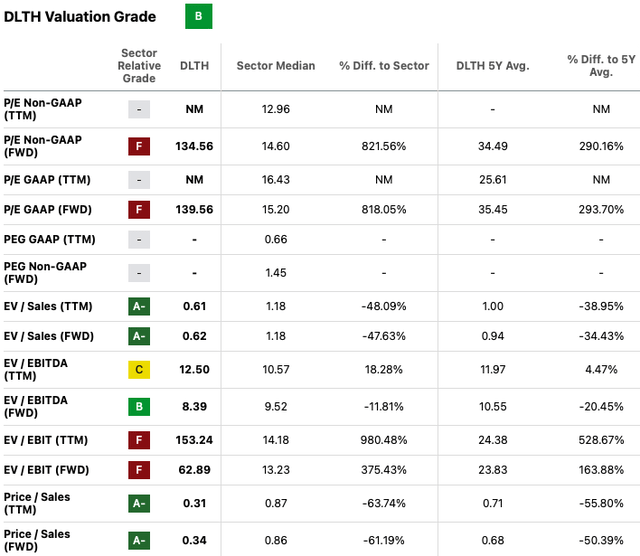

At the moment, in my personal opinion, the company is not expensively valued, in accordance with the multiples. The current Valuation Grade is B. However, it is worth paying attention to the fact that we cannot adequately use the P/E and EV/EBIT multiples, as the net income and EBIT values are abnormally low. Under P/S (FWD) and EV/Sales (FWD) multiples, the company is trading lower than the sector median by 61% and 48%, respectively. However, I believe that now is not the best time to make an investment decision based solely on valuation in accordance with multiples, as a low valuation can remain for a long time if there are no catalysts for growth and improvement in trading trends and, most importantly, the level of operating profitability.

Valuation (SA)

Conclusion

Thus, I believe that now is not the best time to go long, because in the coming quarters, in my personal opinion, we will see continued pressure on revenue due to continued pressure on the consumer from macro headwinds and operating margins in kind of deleverage effect. In my personal opinion, investors need to wait for the next 1-2 quarters of reporting before making a purchase decision. I will continue to closely monitor the company’s financial statements and will change my view if I see improvements in the company’s financial statements in the coming quarters.

Read the full article here