Overview

My recommendation for Dynatrace, Inc. (NYSE:DT) is a buy rating, as the 1Q24 results have validated my buy thesis. The additional information related to the strong traction with DPS (Dynatrace Platform Subscription) also reinforced my bull case for the business. As such, I expect growth to remain strong. Any signs of a slowdown this quarter are just a matter of timing.

Note that I previously gave a buy rating to DT back in early July, as I anticipate that DT will maintain strong performance in the upcoming quarters and years due to sustained growth in ARR. This growth would be fueled by increased adoption of DPS and positive momentum from new product launches. As more applications, workloads, and computing requirements emerge, the demand for observability solutions should rise, further benefiting DT.

Recent results & updates

DT’s $332.9 million in reported revenue is up 25% year over year and up 4% quarter over quarter. This was largely due to the 27% year-over-year increase in subscription revenue. Profits from operations increased by 53% year-on-year to $92.1 million on the back of strong revenue growth (operating margin: 27.7%). Financial results aside, annual recurring revenue [ARR] increased by 25% to $1.294 billion in 1Q24, propelled by robust net new logo additions. DT’s net new logo additions grew by 15% year over year, and the company landed several large contracts worth seven figures during the quarter. Gross retention rates for customers remained stable in the mid-90s, and the net retention rate for customers was 116% (management had predicted a rate in the mid-teens).

Looking ahead, management has restated that the net expansion rate will remain in the mid-teens, while the number of new logos will increase by only a small percentage. Although this forecast suggests a slowdown from the prior quarters, I do not believe that this should be extrapolated as a permanent weakness going forward. This is a relatively healthy guide, in my opinion, considering the longer deal cycles DT is experiencing as a result of customers postponing expansions or reducing the size of their deals by dividing them across multiple time periods. Either way, the revenue is simply delayed, which means we could see periods of growth acceleration as this “deferred revenue” comes back to DT.

To me, the launch of the DPS has become a key factor in propelling organic growth. Despite only being live for a quarter, it has already seen tremendous uptake, with deals being closed across a wide range of customers. In addition, a sizeable fraction of the dollar-based pipeline has already shifted to DPS. Importantly, management believes that moving to DPS will increase ARR in the long run because DPS customers grow at a faster rate than non-DPS customers.

In addition, we are seeing strong customer interest for the Dynatrace platform subscription or DPS, having made it generally available to customers in April. (from: 2Q2023 earnings call)

In addition, I believe the recently launched Hypermodal AI offering will serve as a future growth driver. However, I am unable to estimate the potential impact due to a lack of information and an inability to accurately assess the potential competitive advantage due to my lack of technical knowledge. Because of this, I would not incorporate this into my model until the company provided more appropriate KPIs or positive impacts to results.

All in all, the 2Q23 results largely validate my bull thesis. DT was able to maintain its strong performance in all aspects. While there is a slight deceleration, I don’t see any fundamental slowdown in the long-term growth prospect. Management continues to innovate and find ways to monetize the customer base, which has been effective, as seen in the customer additions and ARR growth.

Valuation and risk

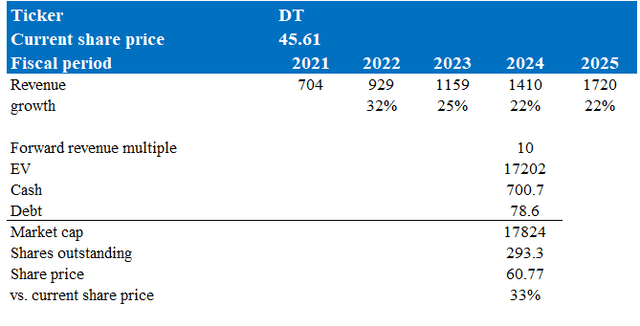

Author’s valuation model

According to my model, DT is valued at $60 in FY24, representing a 33% increase. This target price is based on my growth forecast of less than 20% over the next two years. I expect growth to remain strong at the current pace, as there is no fundamental change to the DT organic growth story. Management’s FY24 guidance also expects a 22% growth rate. As the economy stabilizes, the revenue that got delayed due to the prolonged sales cycle should come back, further supporting near-term growth.

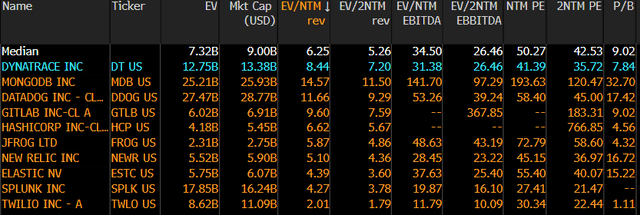

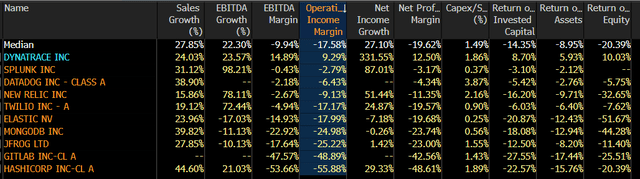

DT is now trading at 8x forward revenue, which I believe will increase as DT continues to grow at this pace. Historically, DT used to trade at 1.9x the multiple peers trade at, and I think DT deserves to trade at a premium because it is the only profitable player within the group and is growing at the same rate. Peers are currently trading 5x forward revenue; at 1.9x, it equates to 10x forward revenue.

Comparing to my previous price target of $77, the key difference between my revised price target today and my previous price target is that I have taken a more realistic approach to multiple re-rating. Previously, I was more bullish that the market would continue to rerate multiples higher within a short time frame (by FY24). While I still believe this is the case, I think the realistic pace is that DT will first reach the average premium vs. peers by FY24.

Bloomberg

Bloomberg

The risk that DT is taking is offering customers a free trial, and then trying to get them to use all six of its modules. The company’s ARR growth rates could be impacted if it is unable to maintain that level of customer expansion. Though I find its execution to be satisfactory thus far, it might not be the case when the economy goes into a steep recession.

Summary

I maintain a buy recommendation for DT. While there might be signs of a temporary slowdown, I view this as a matter of timing rather than a fundamental shift. Anticipated catalysts, such as the robust adoption of DPS and the introduction of Hypermodal AI, are catalyst to bolster organic growth. The DPS adoption has already demonstrated promising uptake, and management’s belief in its potential to enhance ARR growth further underscores its significance. As the economy stabilizes, “deferred revenue” as I mentioned above should contribute to near-term growth.

Read the full article here