Investment Thesis

In simple terms, Dynatrace, Inc. (NYSE:DT) detects issues, optimizes performance, and minimizes downtime for applications.

The bull case points to the fact that Dynatrace is highly profitable with 5% of its market cap made up of cash and no debt.

However, the bear case here points to the fact that its valuation isn’t providing enough margin of safety. Having to pay around 31x forward non-GAAP operating profits is already pricing in a lot of very high expectations from Dynatrace next year.

Therefore, I’ve downgraded my DT rating to a hold.

Rapid Recap

Back in December, I concluded my bullish article, by saying,

Given its stability and predictability, I argue that investors are not paying a significant premium, and with a projected increase in free cash flows for fiscal 2025, Dynatrace presents a reasonable entry point for potential investors.

Author’s work on DT

In hindsight, I made a bad call on this stock, as it has underperformed the S&P 500 (SP500) by a wide stretch. Simply put, I was projecting an increase in free cash flows for fiscal 2025. But I can see now that my estimates were too high and didn’t live up to Dynatrace’s underlying reality. Hence, this is why I’m now downgrading this stock to a hold.

Dynatrace’s Near-Term Prospects

Dynatrace provides software solutions that help businesses monitor and optimize their digital operations. Essentially, they offer tools that allow companies to keep an eye on how their applications are performing. Dynatrace’s platform uses advanced analytics to detect issues, and identify areas for improvement, to keep everything running smoothly.

With a robust pipeline and increasing interest in larger strategic deals, Dynatrace anticipates capitalizing on opportunities presented by the growing demand for automated observability and application security solutions.

The company’s investment in targeted go-to-market areas and R&D innovation, including recent acquisitions like Runecast, describes why its underlying profitability guidance isn’t as strong as many would like (to be discussed in more detail soon).

The introduction of new solutions such as Dynatrace AI Observability and Dynatrace OpenPipeline further enhances the platform’s capabilities, offering customers insights into AI-powered applications and empowering them with full control of data management.

Despite its promising prospects, Dynatrace is having to rethink how it balances growth with profitability, particularly its go-to-market investments.

Given this background, let’s delve into its financials.

Upcoming Fiscal Year to Grow at 22% CAGR

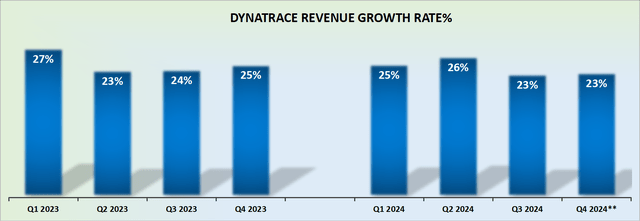

DT revenue growth rates

When Dynatrace reported its fiscal Q3 2024 results and guidance, it did not significantly raise its fiscal Q4 guidance. However, as is the practice with most high-quality companies, Dynatrace would most likely be lowballing its guidance by a couple of percentage points, to allow for a slight beat at the time of reporting. Along these lines, see below how previous recent quarters have faired.

SA Premium

Given this consideration, I have increased management’s guidance beyond the high-end of their guidance by 3%, to 23% growth in fiscal Q4.

Thus, when it comes to forming a few of fiscal 2025 (starting next calendar month), I’ve presumed that Dynatrace will grow next year by approximately 20%. It may end up growing a couple of percentage points faster than this, but given its current ARR is growing at 21% y/y in constant currency, I find it difficult to envision its growth being dramatically different from approximately 20%-22%. Therefore, I’ve worked off the assumption that 22% CAGR will be on the cards for Dynatrace next year.

Next, we’ll discuss its valuation.

DT Stock Valuation — 31x Forward Non-GAAP Operating Profits

For the trailing 9 months of fiscal 2024, Dynatrace delivered 29% non-GAAP operating margins.

But then, for fiscal Q4 2024, Dynatrace guides for its non-GAAP operating margins to be around 23% to 24%. Even if we presume that management is being conservative to allow for an easy beat when it actually reports its fiscal Q4 results, and its non-GAAP operating margin actually reaches 25%, that would still put Dynatrace on a path towards a compression relative to the trailing 9 nine months of the year.

And on top of that, if we compare with Dynatrace’s prior year, it also reported 25% non-GAAP operating margins. Consequently, I believe that all the hard work that Dynatrace had been putting in to improve its underlying profitability may have already maxed out and been picked over.

Given this context, as we look ahead to fiscal 2025, let’s say that Dynatrace expands its underlying profitability by a further 200 basis points relative to this current fiscal year. This would put Dynatrace on a path towards 27% non-GAAP operating margins, which means that in the near term, that’s as profitable as Dynatrace is capable of being operated at.

Therefore, approximately $460 million of non-GAAP operating profits is as good as it’s going to get in the coming year. Hence, all the upside that investors are going to be likely to get in the coming year is about a 10% to 15% increase in underlying profitability.

Given this backdrop of a 15% increase in underlying profitability, does it really make sense to pay 31x forward non-GAAP operating profits?

Even if I’m wrong, and Dynatrace’s profitability profile comes in stronger and closer to $490 million of non-GAAP operating profits, this would put Dynatrace at 29x forward non-GAAP. And while this latter valuation is clearly more palatable than the former, that would mean that investors would have to expect a very rosy scenario simply to match the priced in expectations. All in all, I’m simply not that bullish.

The Bottom Line

In conclusion, when I look at Dynatrace, Inc.’s near-term prospects, I see a challenge in its valuation.

Case in point, its underlying profitability guidance isn’t as robust as many investors would prefer. Despite a solid pipeline and strategic investments in R&D, Dynatrace faces the challenge of striking the right balance between growth and profitability.

Examining its financials, the upcoming fiscal year is anticipated to grow at a 22% CAGR. Yet, with a valuation of 31x forward non-GAAP operating profits, I find the margin of safety to be insufficient. As I navigate this landscape, I must weigh the potential upside against the already priced-in expectations, leading me to adopt a more cautious stance on Dynatrace’s near-term outlook.

Read the full article here