Ecora Resources (OTCQX:ECRAF) (formerly known as Anglo Pacific Group) is a well-established royalty & streaming company. Until now, its cornerstone asset has been the 7-40% Gross Revenue Royalty on the coking coal Kestrel mine in Queensland, Australia. However, as the production at Kestrel is moving out of Ecora’s lands, the company is trying to position itself as a “green” royalty & streaming company, focused mainly on copper, cobalt, and nickel. Over the recent quarters, the transition turned out to be more painful than some investors expected, which resulted in a steep share price decline. But the future prospects of the company remain very good and the recent sell-off presents an attractive investment opportunity.

The Kestrel Royalty

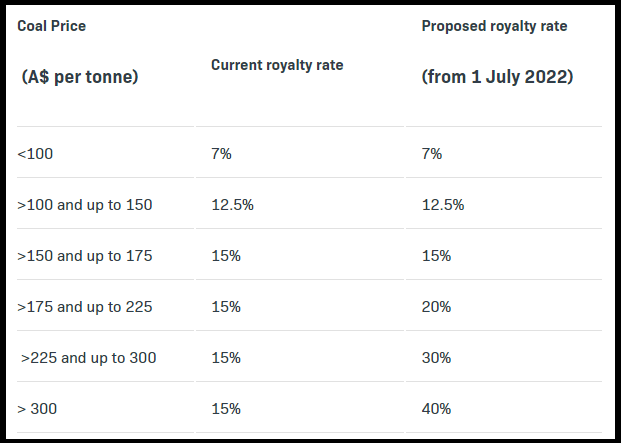

The most important asset of Ecora Resources remains the royalty on the Kestrel coking coal mine. Ecora owns 50% of certain sub-stratum lands which, according to the Queensland laws, entitle it to Gross Revenue Royalty from the coking coal production. Only in June 2022, Queensland introduced new royalty tiers with significantly improved royalty rates (table below). While at coking coal prices below A$100/t, Ecora is entitled to a 7% Gross Revenue Royalty, it grows to 12.5% at a coking coal price of A$100-150/t, 15% at A$150-175/t, etc., up to a 40% royalty at coking coal prices above A$300/t.

Source: Ecora Resources (Anglo Pacific Group)

At the current coking coal price of approximately $250/t (A$395/t), the 40% rate applies. Unfortunately, production at Ecora’s lands is coming to an end (expected in 2026) and the production rates are declining. So are the cash flows attributable to Ecora. However, Kestrel remains Ecora’s most profitable asset and this situation shouldn’t change for the next year or two. In H1 2023, the Kestrel royalty generated revenues of $31.8 million, which represented 71.5% of Ecora’s overall revenues ($44.5 million). However, due to the lower production volumes and lower coking coal prices, in H1 2023, the revenues generated by the Kestrel royalty declined by 55% compared to H1 2022.

The Kestrel Royalty should remain Ecora’s key asset also in the near future, although, its share of the total revenues should keep on declining. The mining at Ecora’s lands is expected to cease in 2026. It means that Ecora has approximately two more years to position itself for the post-Kestrel future.

The Green Transition

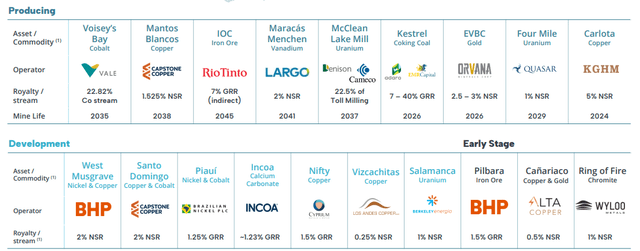

The aim of Ecora’s management is to transform the company into a green one. Therefore, over the recent years, the acquisitions focused on assets dealing with commodities important for green energetics, such as copper, cobalt, or nickel. Moreover, Ecora holds also some interesting vanadium and uranium-focused assets. Besides the Kestrel royalty, Ecora holds another 8 producing assets, 7 development-stage assets, and several early-stage assets.

Source: Ecora Resources

The main of the “green” assets is the 22.82% cobalt stream on Vale’s (VALE) Voisey’s Bay mine. After 16.76 million lb cobalt is delivered, it will be reduced to 11.41%. There are also ongoing payments of 18% of the industry reference cobalt price. In 2022, this stream generated 838,000 lb of cobalt, worth $18.8 million. However, the Voisey’s Bay mine is being expanded right now, and the cobalt production should increase to 5.73 million lb per year, out of which, 1.3 million lb should be attributable to Ecora. At the current cobalt prices, 1.3 million lb cobalt is worth nearly $20 million.

An important asset is also the 1.525% NSR royalty on Capstone Copper’s (OTCPK:CSCCF) Mantos Blancos copper mine. The mine produced 107.6 million lb of copper last year. However, its throughput rate was expanded from 4.2 Mtpa to 7.3 Mtpa, and the new production rate should be more than 130 million lb copper per year. Moreover, further expansion, to 10 Mtpa, is being considered. At an annual production of 130 million lb, Ecora is entitled to nearly 2 million lb, valued at more than $7 million at the current copper price.

Sizeable cash contributions are delivering also the 22.5% toll milling revenue royalty on Cameco’s (CCJ) McClean Lake mill ($5 million in 2022) and the 2% NSR royalty on Largo Resources’ (LGO) Maracas Menchen vanadium mine ($3.6 million in 2022).

There are also several highly prospective development-stage assets. BHP Billiton’s (BHP) West Musgrave copper-nickel project is expected to be producing around 60 million lb nickel and 90 million lb copper per year, over a 24-year mine life. Production should start in 2026. Ecora owns 2% NSR royalty on West Musgrave. It means that Ecora should be entitled to approximately 1.2 million lb nickel and 1.8 million lb copper per year. At the current metals prices, the annual revenues should be around $16 million.

Also Capstone Copper’s Santo Domingo project offers significant potential. It should be able to produce 140 million lb copper and 10.4 million lb cobalt per year. The mine life is projected at 18 years. A feasibility study should be completed in H1 2024, so if everything goes well, production could start around 2027 or 2028. Ecora holds a 2% NSR royalty which means that it should be receiving around 2.8 million lb copper and 208,000 lb cobalt per year, valued at approximately $13 million at the current metals prices.

Brazilian Nickel’s Piaui nickel-cobalt project is technically in production, but only in a small-scale one. The small-scale plant produces approximately 3 million lb nickel and 77,000 lb cobalt per year. However, according to the feasibility study, the full-scale operation, once completed, should be able to produce 55 million lb nickel and 2 million lb cobalt per year. Ecora owns a 1.25% GRR royalty on Piaui, however, it has the right to increase it to 4.25% by investing further $70 million. It means that after Piaui reaches full production, Ecora should be entitled to 687,500 lb nickel and 25,000 lb cobalt (at the current royalty rate), or 2.34 million lb nickel and 85,000 lb cobalt per year. At the current metals prices, the annual revenues should amount to $5.88 million or $20 million respectively.

And highly prospective is also the newly added 0.25% NSR royalty on Los Andes Copper’s (OTCQX:LSANF) Vizcachitas copper project. The mine should be able to produce nearly 340 million lb copper per year on average, over the projected 26-year mine life. The mine should get in production by 2029. Ecora should be entitled to 850,000 lb copper per year, valued at $3.1 million at the current copper prices.

Risks and Opportunities

As shown by the abovementioned numbers, the upside potential is really high. The currently producing assets, even after Kestrel is excluded, should be able to generate revenues of approximately $35-40 million per year (after the Voisey’s Bay mine expansion is completed). West Musgrave, Santo Domingo, Piaui, and Vizcachitas have the potential to add further $50 million. And there are also other development-stage, as well as early-stage assets. It means that if the current metals prices prevail, in 4-5 years, Ecora has the potential to generate revenues of around $100 million per year, even without Kestrel.

Right now, Ecora’s market capitalization equals $280 million, and enterprise value is $320 million. Last month, the price-to-revenues ratio of 16 precious metals royalty & streaming companies ranged between 7 and 69, with an average value of 20.5. Other mature industrial metals royalty & streaming companies, like Altius Minerals (OTCPK:ATUSF), Labrador Iron Ore Royalty (OTCPK:LIFZF) or Deterra Royalties (OTCPK:DETRF) had price-to-revenues ratios of 11.9, 9.78, and 10.5 respectively. At revenues of $100 million, and a price-to-revenues ratio of 10, Ecora should have a market capitalization of $1 billion, which means an approximately 250% upside.

Of course, there are also risks. First of all, there is no warranty that the metal prices will remain at the current levels over the coming years. Their decline would reduce also the projected revenues and resulting valuation of the company. There is also no warranty that all of the projects will be completed on time and they will reach the projected production rates. However, this risk is slightly reduced by the fact that the abovementioned valuation doesn’t include all of the assets included in the portfolio, and it doesn’t take into account potential new acquisitions. If one of the projects surprises negatively and fails, there is a chance that it will be replaced by another one that surprises positively.

And there is also the financing risk, although, in my opinion, this one is pretty limited. The company held cash of only $6.3 million as of the end of Q2, which is not too much. Especially if the management decides to make a new acquisition. However, the company has a debt of only $50 million, so it shouldn’t be a problem to secure additional debt financing if needed, and avoid share dilution.

Conclusion

Over the recent quarters, Ecora’s share price declined by 50%. The main reason is worsened financial results due to the declining Kestrel royalty contributions, as well as temporarily lower production at the Voisey’s Bay mine. The recent lows touched the $1 level. And although the share price bounced back up above $1.1, it is hard to say whether the bearish trend is over, as the technical indicators don’t indicate any trend reversal. The $1 level may be re-tested again soon. On the other hand, if the share price starts growing, the next more meaningful resistance should be met only in the $1.6 area.

Source: YahooFinance

Although the end of the Kestrel royalty contributions and the whole transition to green assets may cause some near-term pain, the long-term prospects of the company are very good, due to the quality assets included in its portfolio. Even after the Kestrel royalty stops generating cash flows (probably in 2026), Ecora has the potential to reach annual revenues of around $100 million over the next 4-5 years. Of course, if the current metals prices prevail, and there are no major negative surprises, especially at the development-stage assets. At revenues of $100 million, it is reasonable to expect Ecora’s market capitalization to approach the $1 billion level. It means a nearly 250% upside at the current share count.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here