Empire building. It is that irresistible itch that needs to be scratched, regardless of the circumstances. Even the ones that promise to stay away from it, ultimately come back to play another round. We saw that over the last two years as Energy Transfer (ET) slowing went and expanded their capex plans and then upped the ante by buying out Crestwood Equity Partners LP. (CEQP). This morning we saw it from Enbridge Inc. (NYSE:ENB), (TSX:ENB:CA), a company that just a few weeks back had committed to not buy anything big.

Robert Kwan

Good morning. So just if I can start with capital allocation. So you pushed back previously on the need for and desire for large sale deals. But just on the tuck-in M&A, and you have executed on that this year. Do you see the tuck-in acquisitions solely being linked to that $3 billion of discretionary annual capital allocation? Or could you see that those tuck-ins in aggregate being at a level that would require external equity?

Greg Ebel

Yes. Well, I guess I’d say I don’t think that’s been our focus to date. Look, we’ve got that $6 billion in investment capital a year and some of which can be used for acquisition. And that gives us a lot of flexibility to do the transactions that we’ve seen to date that meet that low-risk accretive pipeline utility-like deals. I don’t see us doing big corporate-to-corporate deals, but — and I guess we’re always open to things. But that’s — I think the tuck-in route to date has been the right one for us.

Source: Enbridge Q2-2023 Conference Call Transcript

We guess that they were pretty “open” at the point this was said. Maybe Greg Ebel thought $19 CAD billion transaction was a “tuck-in”. Chalk that down along with those “dividend is important” remarks right before the rug pull. But let’s go through the transaction and see if they did buy three lemons or these were irresistible assets at great prices.

The Deal

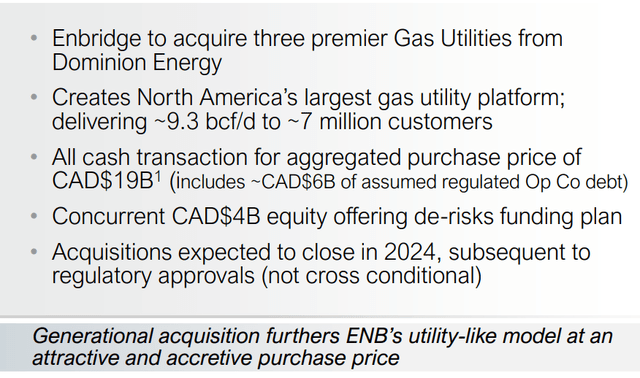

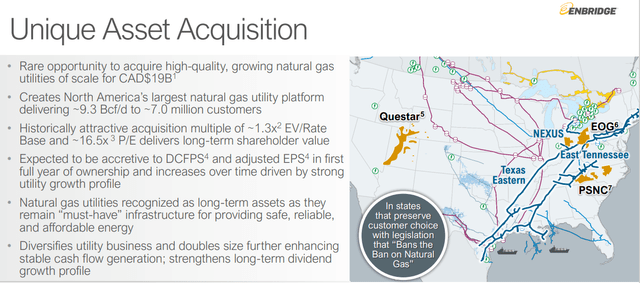

Enbridge is buying 3 gas utilities (East Ohio Gas Company, Public Service Company of North Carolina, and Questar Gas) from Dominion Energy (NYSE:D). The $19 billion CAD transaction comes in at about 16.5X 2024 earnings and multiple and 1.5X base regulated rate.

Enbridge Sep 6 Presentation

Enbridge is pretty large, but that $19 billion CAD size will still move needles on every metric. We agree with the general theme here that was presented that all three of these are good assets.

Enbridge Sep 6 Presentation

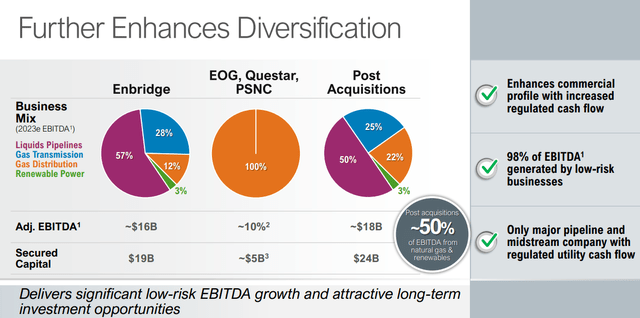

Gas distribution can possibly be considered a lower risk segment of the 4 different areas that Enbridge operates in. But we don’t see the point of enhancing this relative to the rest. In the slide below, Enbridge refers to the 98% of EBITDA being low-risk business and we think that is pretty much been the case for the last decade.

Enbridge Sep 6 Presentation

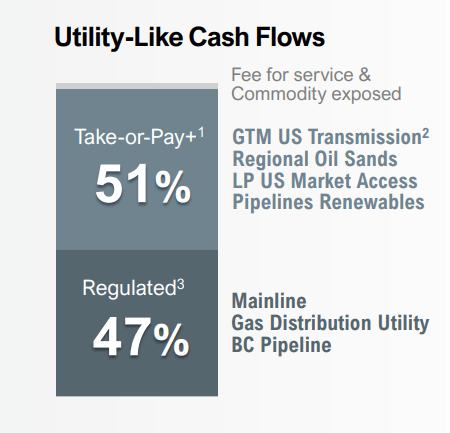

In fact, just prior to this transaction, Enbridge identified almost all of its cash flow as “utility-like”.

Enbridge Q2-2023 Presentation

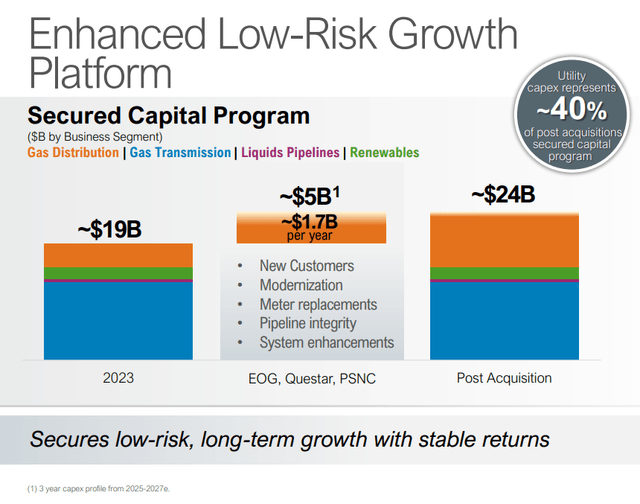

Not only will be Enbridge buying these assets at a good price tag, it will also now become committed to a large amount of additional capex.

Enbridge Sep 6 Presentation

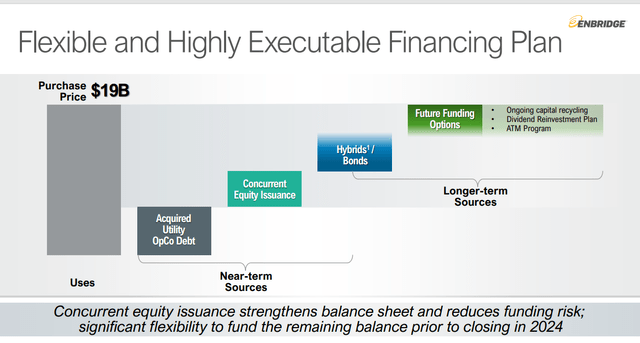

Worse yet for shareholders, Enbridge will once again go on issuance mode rather than entering that elusive timeframe where management actually buys back shares. Instead, we started off by issuing $4.0 billion CAD of shares right at 52 week lows.

Enbridge Sep 6 Presentation

For context, they also bought back $125 million CAD worth of shares at a higher price in Q2-2023.

Outlook

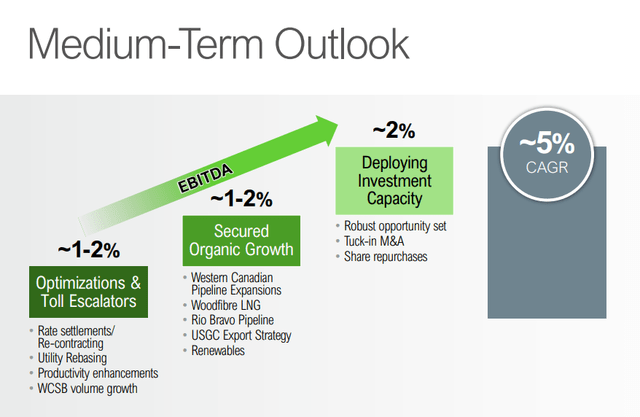

Buying three defensive utility assets could be seen as a way to derisk the business even further. But with cost of capital on the rise across the board and Enbridge issuing expensive equity right at floor prices, one has to be skeptical that management was thinking straight. The funny aspect is that Enbridge promised 5% medium term growth at the Q2-2023 results.

Enbridge Q2-2023 Presentation

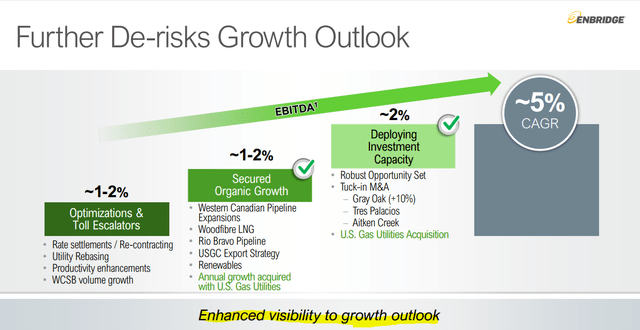

After spending $19 billion CAD, guess where we are at?

Enbridge Sep 6 Presentation

Yeah, same amount of growth but the new and improved slide come with an “enhanced visibility to growth outlook”.

So an expensive transaction that will not change the growth profile but perhaps reduce the business risk, slightly. We don’t like it. But let’s not forget the billions in assets that Enbridge had in place before this.

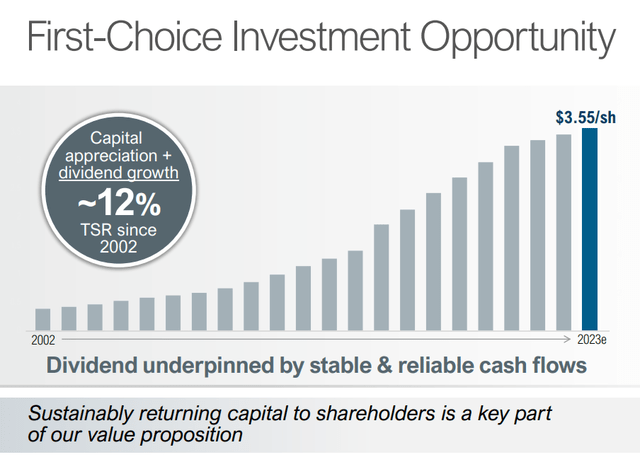

A very large chunk of these assets produce inflation protected cash flows. Enbridge has reached a settlement on its Mainline contracts and has been watching with glee as costs explode on the Trans Mountain expansion. The critical assets are now up for grabs at one of the lowest multiples we have seen in a long time. At 8.3X adjusted funds from operations (AFFO) the stock yields a solid 8%. The payout ratio also comes in 65%, so there is some buffer on that front. The company is one of the few that has delivered such spectacular growth over the long term and kept dividends steady through thick and thin.

Enbridge Q2-2023 Presentation

The key risk comes from the rating agencies and potentially a severe recession that changes the landscape further. On the first front, Fitch was unmoved with this purchase.

Fitch expects this transaction to modestly increase ENB’s leverage, as Fitch expects the company will be issuing incremental debt ahead of acquisition closing, primarily in the form of hybrid instruments, in addition to assuming approximately USD4.6 billion (CAD6.1 billion) of existing LDC debt. As such, Fitch expects leverage to be roughly 0.1x to 0.3x higher than previously targeted over the forecast period, based on the final financing mix and potential near-term rate case outcomes, but remain below Fitch’s negative leverage sensitivity of 5.5x. Fitch continues to expect ENB to manage to and remain within its previously stated leverage target range over the forecast period. Fitch considers the diversification benefits and higher contribution from low-risk utility businesses, as well as increased scale to be offset by higher expected leverage, which collectively lead to Fitch’s estimation that this transaction is neutral for ENB’s credit profile.

Source: Fitch

Moody’s and S&P were less sanguine both switched their outlooks to “negative”.

Verdict

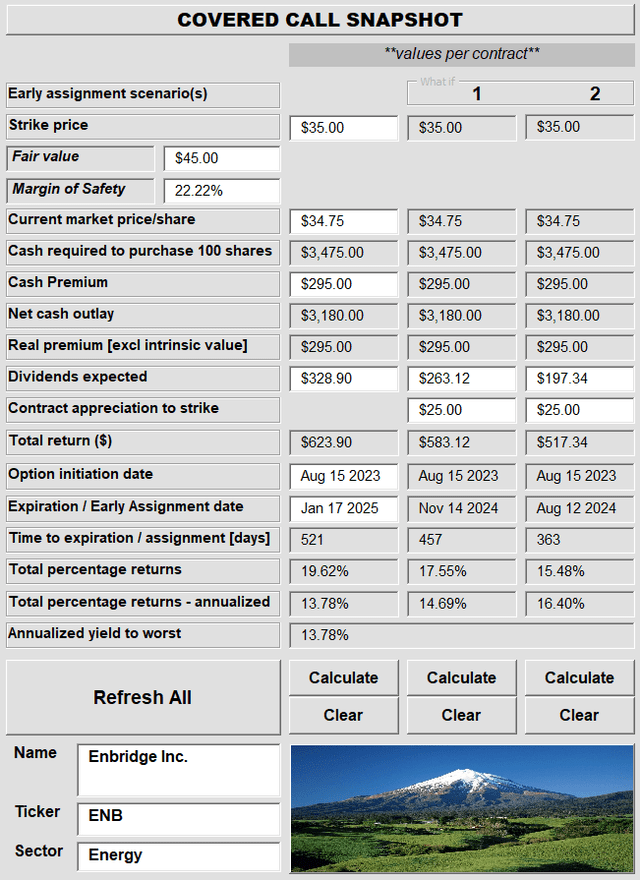

We would not amongst the most sanguine on Enbridge. In fact our first foray into the common shares of Enbridge occurred just two weeks back, after it had been beaten down to $34.75. We did some covered calls that we felt could provide a solid yield with low risk. In fact our net cash outlay was just $31.80.

Author’s App

As it stands today, we are a little disappointed and think fair value is probably closer to $42 rather than $45. We still think the stock is attractive but the company needs to make a beeline for the 4.5X leverage ratio over the next 3 years. We continue to rate the shares a Buy.

What About Dominion Energy?

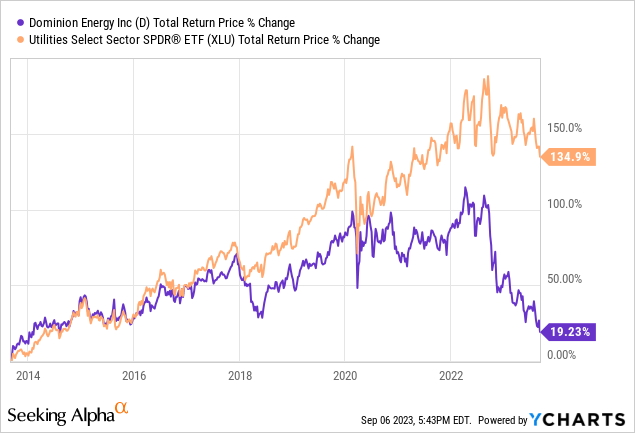

The story on Dominion is a bit different. Once one of the most hyped stocks in the utility sector, the company has produced a really poor return over the last decade.

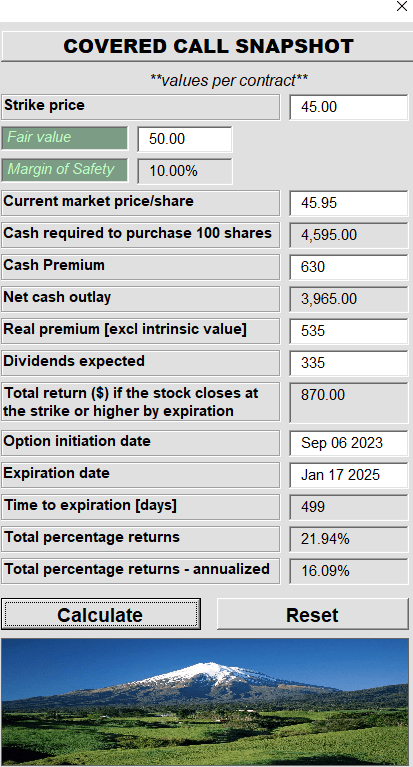

In fact Dominion Energy did the same empire building exercise. It was made worse by gangs of overenthusiastic investors rewarding the company with a 25X P/E ratio in the middle of the last decade. So Dominion Energy was to 2015 what NextEra Energy, Inc. (NEE) was to 2022. The valuation compression that followed was predictably painful. Dominion Energy has now sold assets at a premium multiple (16.5X earnings) to where it trades (13X earnings). This comes on the heels of the Cove Point asset sale. All after-tax sale proceeds will be used to pay-off debt. This essentially finishes the derisking of the business. We had a neutral rating on the stock and are upgrading this to a buy as well. As we expect utilities to remain under pressure from interest rate hikes, we would play this defensively using a longer dated covered call for the $45 strike.

Author’s App

That 16% yield for a flattish price is a good deal for this beaten down utility.

Read the full article here