Enerplus Corporation (NYSE:ERF) looks capable of generating over $250 million in free cash flow in 2H 2023 at current strip prices. Much of this free cash flow is expected to go towards share repurchases.

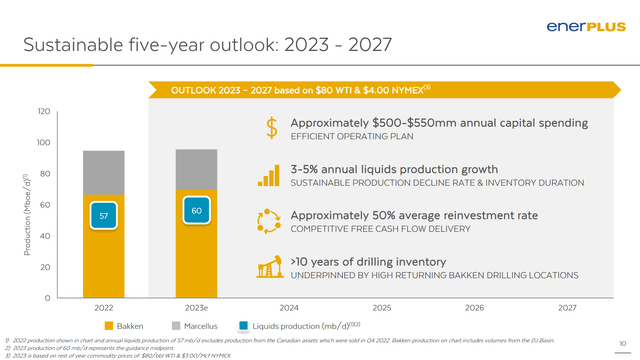

In the longer-term, Enerplus is focusing on driving 3% to 5% liquids growth per year with approximately $500 million to $550 million in capex. Based on projected 2024 production levels, Enerplus may be able to generate $450 million in free cash flow at $75 WTI oil.

I now estimate Enerplus’s value at approximately $17 per share at long-term $75 WTI oil and $3.75 NYMEX gas. I continue to believe that it is roughly fairly priced at the moment.

Guidance Updates

Enerplus slightly increased its 2023 production expectations, boosting the midpoint of its liquids production guidance by 2% and the midpoint of its total production guidance by 1%.

Enerplus now expects to average approximately 96,500 BOEPD in total production during 2023, including 60,000 barrels per day in liquids production.

Enerplus’s liquids production is expected to increase noticeably in 2H 2023, with liquids production potentially around 62,500 barrels per day, nearly 10% higher than 1H 2023 levels.

Meanwhile, Enerplus’s natural gas production is declining, due to limited investment in the Marcellus amidst weaker natural gas prices. Enerplus only put $15 million of its $510 million to $550 million capex budget for 2023 towards the Marcellus.

Thus Enerplus may have roughly flat average daily total production in 2H 2023 compared to 1H 2023, but its liquids percentage is projected to rise from 59% in 1H 2023 to 65% in 2H 2023.

2H 2023 Outlook

As noted above, Enerplus’s 2H 2023 production is expected to be near 96,500 BOEPD, with liquids making up 65% of that production. Based on recent results, the full breakdown may be approximately 53% oil, 12% NGLs and 35% natural gas.

At current strip prices for 2H 2023 (including high-$70s WTI oil), Enerplus is projected to generate $869 million in revenues, including $18 million in positive hedge value.

|

Units |

$ Per Unit |

$ Million USD |

|

|

Oil |

9,369,630 |

$78.50 |

$736 |

|

NGLs |

2,126,850 |

$18.00 |

$38 |

|

Natural Gas |

37,441,630 |

$2.05 |

$77 |

|

Hedge Value |

$18 |

||

|

Total |

$869 |

Due to the increased liquids-weighting and higher planned workover activity, Enerplus expects its operating expenses to be higher in the second half of 2023. It may average close to $12 per BOE in operating expenses in 2H 2023, compared to $10.40 per BOE in 1H 2023.

|

$ Million USD |

|

|

Production Taxes |

$70 |

|

Operating Expenses |

$210 |

|

Transportation |

$75 |

|

Cash General And Admin |

$24 |

|

Cash Interest |

$7 |

|

Capital Expenditures |

$210 |

|

Current Tax |

$17 |

|

Total Expenses |

$613 |

Enerplus is thus projected to generate $256 million in free cash flow in 2H 2023 at current strip prices. Enerplus’s capex budget was more heavily weighted to the first half of the year, with 60% of its full-year spending taking place in 1H 2023.

Debt And Share Repurchases

Enerplus is planning on returning 60+% of its 2H 2023 free cash flow to shareholders via dividends and share repurchases. Enerplus’s current quarterly dividend is $0.06 per share, which adds up to approximately $25 million over two quarters.

This would leave at least $129 million for share repurchases in 2H 2023, potentially enabling Enerplus to repurchase 7.7 million shares (at an average price equivalent to its current share price). Enerplus may end 2023 with around 204 million outstanding shares and net debt of under $100 million.

Future Outlook And Valuation

Enerplus is aiming to generate 3% to 5% liquids growth per year with a $500 million to $550 million capital expenditure budget. This would allow it to generate around $450 million in free cash flow (before income taxes) at my long-term commodity price estimates of $75 WTI oil and $3.75 NYMEX gas.

Enerplus’s Five Year Outlook (enerplus.com)

I estimate Enerplus’s value at approximately $17 per share at those long-term commodity prices. Enerplus’s free cash flow yield (while generating a modest amount of liquids production growth) would be around 13% before income taxes in that scenario.

Conclusion

Enerplus should be able to end 2023 with a minimal amount of net debt (under $100 million) if it puts 60% of its 2H 2023 free cash flow towards share repurchases and dividends. In that scenario, Enerplus may also be able to reduce its share count to around 204 million by the end of the year.

At long-term $75 WTI oil and $3.75 NYMEX gas commodity prices, Enerplus would be able to generate over $2.20 per share in free cash flow in 2024. This would continue to increase over time (at those fixed commodity prices) as Enerplus grows its liquids production and repurchases shares.

At the moment, I believe that Enerplus is close to fairly priced (with an estimated value of $17) for a long-term $75 oil and $3.75 gas scenario though.

Read the full article here