Following the pandemic-induced lockdowns, the experiential economy is recovering fast. After two years of constant restrictions, people quickly returned to socializing once the distancing measures were lifted. Yet, some real estate investment trusts (“REITs”) with exposure to the experiential segment have not recovered to pre-pandemic levels. I believe this presents an opportunity.

One of the REITs that has been hit particularly hard is EPR Properties (NYSE:EPR). While its largest segment – movie theaters – was affected by the lockdowns in a major way, while streaming platforms present another threat, things are starting to recover and EPR should benefit from it. Looking at the current valuation of EPR, the company offers around 7.9% dividend yield, which looks well covered by adjusted funds from operations, or AFFO. In addition, trading at approximately 8.4x AFFO multiple, EPR appears to be at a considerable discount to peers in the experiential segment.

Company overview

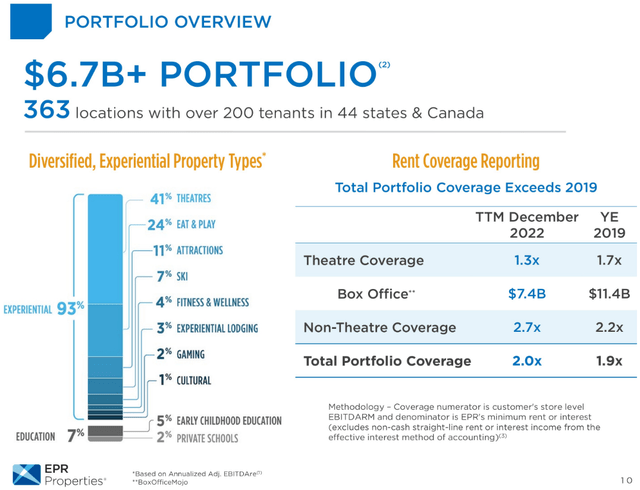

EPR Properties is a REIT with a primary focus (93% of EBITDAre) on the experiential segment in the U.S. The remaining 7% of EBITDAre comes from the educational segment. The biggest sub-segment in the total portfolio is movie theaters, holding a 41% share. The company aims to strategically reposition its assets by lowering the exposure to theaters and the educational segment while increasing its presence in the remaining sub-categories in the experiential area.

EPR’s portfolio (EPR Properties)

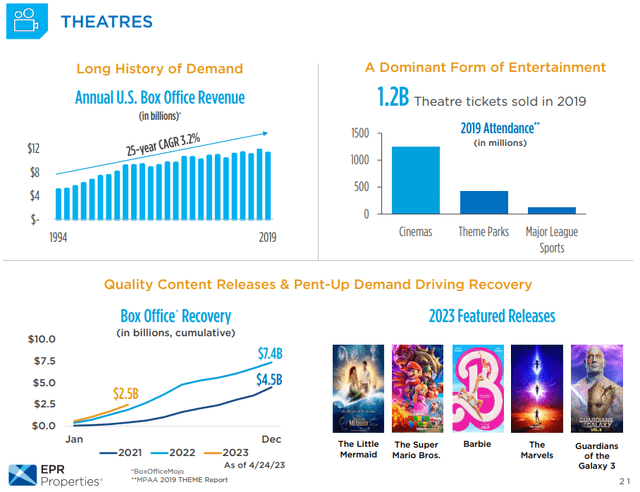

Theaters are recovering

While the remaining part of EPR’s portfolio has more than recovered from the lockdowns, achieving higher than pre-pandemic EBITDARM coverage, the theater segment is still struggling, as streaming platforms are exerting competitive pressures. However, streaming has its own issues, such as it’s vulnerable to piracy, which has been on the rise lately.

Theater sub-segment trends (EPR Properties)

At the same time, going to the cinema could be a socializing activity and bring better experience than watching a movie at home. This is understood by the film industry, as even big tech is trying to enter the space:

The biggest news in 2023 is the widely reported commitment from both Apple and Amazon to spend $1 billion to create content for theatrical release, reinforcing our long-held conviction that theatrical exhibition provides the best platform for studios to drive revenue, create buzz around a title and secure A-List talent.

– Greg Zimmerman, EPR’s CIO.

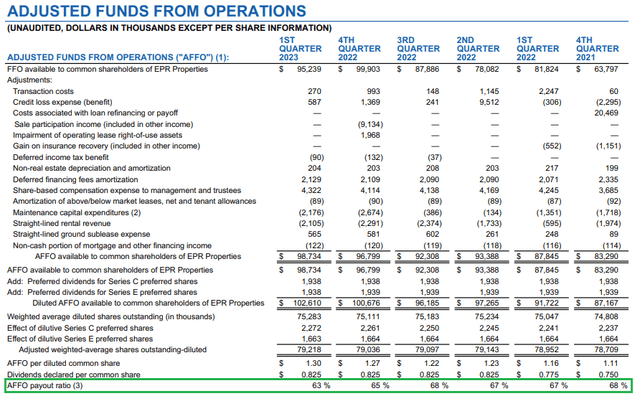

Sufficient AFFO dividend coverage

Looking at the AFFO dividend payout ratio, the metric has been in the range of 60-70% and improving during the last few quarters, trending towards the lower end of the range and at the same time maintaining or increasing the dividend amount.

AFFO coverage (EPR Properties)

I expect this trend to continue, as the theater segment recovers further. This could offer three possible scenarios for the remaining part of the AFFO – either hiking the dividend, expanding the portfolio, and deleveraging. The most likely scenario seems to be a combination of the three.

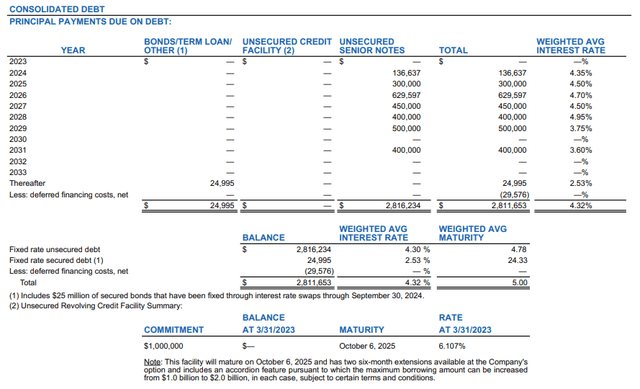

Manageable debt

EPR has a bit over US$2.8B of debt, with a favorable maturity schedule – no maturities in 2023, followed by approximately 4.9% and 10.7% due in 2024 and 2025 respectively. The first year with a significant amount of debt maturing is 2026 when close to 22.5% (US$629.5M) of total debt is maturing.

Debt profile (EPR Properties)

It’s important to note that the company has virtually all of its debt at a fixed rate, making the P&L statement insensitive to interest rate increases. By the time EPR has to roll its debt, I expect the current tightening monetary cycle to have ended.

Valuation

Comparing EPR’s Fwd P/AFFO multiple to other REITs with exposure to the experiential segment – Essential Properties Realty Trust, Inc. (EPRT), Simon Property Group, Inc. (SPG), Gaming and Leisure Properties, Inc. (GLPI), Four Corners Property Trust, Inc. (FCPT), VICI Properties Inc. (VICI), and NNN REIT, Inc (NNN) – the company looks to be trading at a steep discount. In order to catch up with the median multiple of the group, the shares of EPR have to appreciate more than 75%. While closing the full discount seems unlikely, at least before the improvement trend in the theater sub-segment fully plays out, I think that closing half of the discount seems realistic.

| Fwd P/AFFO | |

| Essential Properties Realty Trust | 15.00 |

| Simon Property Group | 9.74 |

| Gaming and Leisure Properties | 13.31 |

| Four Corners Property Trust | 15.36 |

| VICI Properties | 14.74 |

| NNN REIT | 13.27 |

| Realty Income Corporation | 15.05 |

| median | 14.74 |

| EPR Properties | 8.38 |

| Implied upside | 75.9% |

* Prepared by the author using data from Seeking Alpha.

Risks

While the fixed nature of the EPR’s debt makes the company less sensitive to increasing interest rates, recession seems to be the biggest risk. As the experiential sectors of the economy are somewhat sensitive to economic slowdown, a deep recession could hurt EPR’s tenants, and they may have trouble paying their rents.

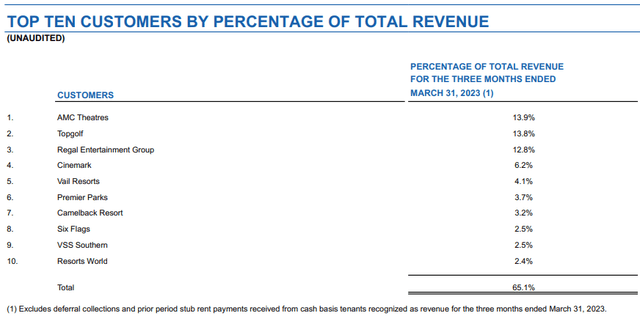

EPR’s top 10 tenants (EPR Properties)

Slower than expected recovery in the movie theater space could also be a threat, as EPR’s tenants from the sector are in trouble. For example, Regal Entertainment Group, to which EPR has 12.8% revenue exposure, is emerging out of bankruptcy. However, EPR’s management announced in the earnings call that rents are still being collected on time.

We have also collected all scheduled rent from Regal due in 2023 through April, as well as the scheduled deferral payments due from all customers for the same period. These results provide further evidence of our theme of recovery and highlight the resilience of our experiential investments.

– Greg Silvers, EPR’s Chairman and CEO.

Conclusion

EPR Properties is emerging out of the pandemic-related lockdowns as experiential activities are recovering. While the biggest sub-segment in EPR’s portfolio – theaters – is the slowest to recover, there are promising signs there. The debt of the company is manageable with fixed interest rates and no significant maturities up to 2026. The 7.9% dividend yield appears to be well covered by AFFO, as the AFFO payout ratio is only 63%. At the same time, EPR Properties is trading at a deep discount to its peers, which implies an upside of up to 75%.

Read the full article here