I have called 2023 an inglorious year for equity CEFs as most of the 100-plus funds I follow lost valuation, even while the S&P 500 (SPY) has jumped 25.6%-plus so far this year through Dec. 22.

And in some cases, equity CEFs lost a lot of valuation, even if their NAVs performed well. Want an example? Take a look at the Nuveen S&P 500 Dynamic Overwrite fund (SPXX), $14.88 closing market price, a typical covered-call fund that uses the S&P 500 as a benchmark.

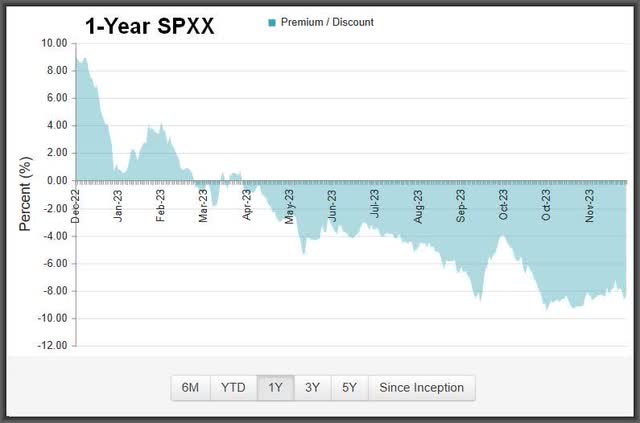

Here is SPXX’s 1-Year Premium/Discount chart, showing a precipitous valuation drop going back a year:

CEF Connect

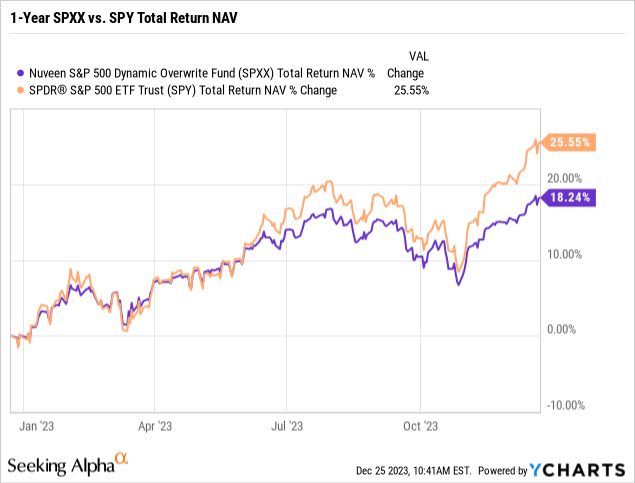

Now certainly, as an option-income CEF that writes options against roughly 50% of its portfolio value, you woundn’t expect SPXX’s NAV (which is the true apples-to-apples performance comparison) to outperform in a bull market and indeed, SPXX’s NAV total return trailed SPY’s by over 700 basis points:

Y-Charts

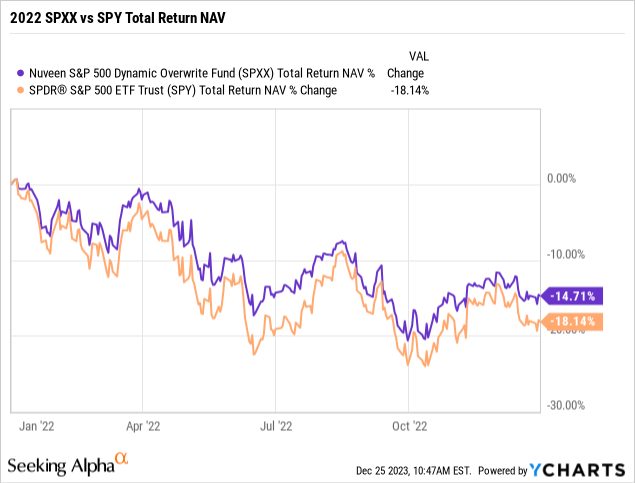

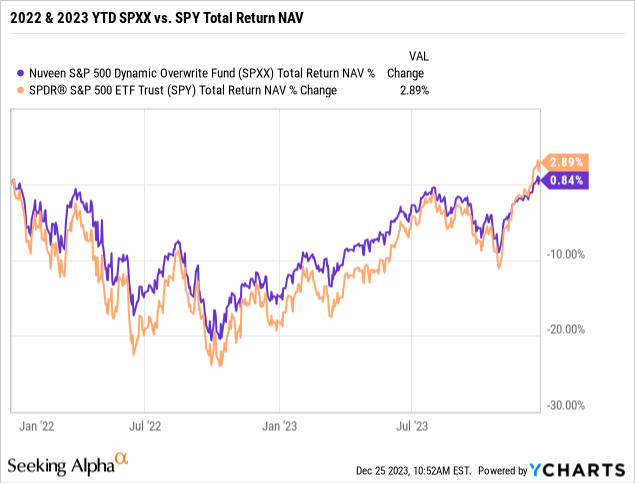

But go back to the bear market of 2022, and the more defensive SPXX held up significantly better than SPY:

Y-Charts

So can we agree that SPXX will lag in a bull market but can hold up better in a down or bear market?

And in fact, if you go back two years, which then includes the 2022 bear market and 2023 bull market, SPXX and SPY have performed roughly the same at NAV and in fact, SPXX’s NAV was ahead most of this time:

Y-Charts

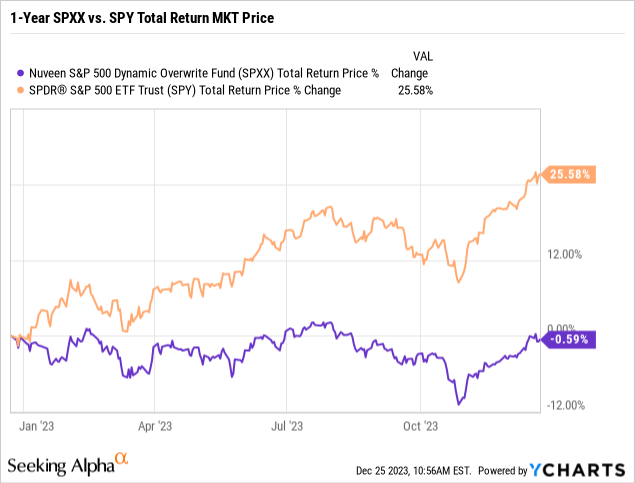

So why then does SPXX’s total return MKT price (not NAV price) graph look like this over the past year?

Y-Charts

That’s right. SPXX’s total return over the past one year is negative despite owning substantially the same stocks and in the same weightings as SPY. The only difference? SPXX writes options on its portfolio, which allows it to offer a much higher 7.9% current yield than SPY’s 1.4% yield.

Does this seem fair? Well, maybe SPXX should not have been as high as a 16%-plus premium a year ago when it was beating SPY at NAV, but when you take SPXX’s market price drop from a +16% premium in early December of last year to a -8.4% discount currently, that’s about a -25% valuation drop.

So if you were a shareholder of SPXX and see that your fund is actually down this year at market price total return, you’re probably not very happy.

Now I didn’t own SPXX, but I did own many of the Eaton Vance and BlackRock covered-call funds and for the most part, they also saw significant valuation compression over the past year too.

In fact, if you looked at how many equity CEFs were still at premium valuations as of last Friday, Dec. 22, they total only nine (shown in red below since the more a fund’s MKT price exceeds its NAV, the more over-priced it is):

Capital Income Management, LLC

That is the lowest number of funds I have ever seen. So you have to ask yourself, why is this happening when SPY is up +25.6% year-to-date and the Nasdaq-100 (QQQ), $408.38 closing market price, is up +54.2% YTD?

Note: You can also go to CEFConnect.com and screen for equity funds only and see that as of 12/22/23, there were only nine funds at a premium valuation.

What Rate Rises And Quantitative Tapering Have Done To CEFs

Now we all know that the mega-cap technology stocks, better known as the Magnificent 7, have helped spur SPY and QQQ to those outsized gains while most everything else has lagged (until recently).

But keep in mind, many equity CEFs also had heavy weightings in the Magnificent 7 stocks too but yet didn’t come close to +25% or +50% kinds of market price returns.

And herein lies one of, if not the most important criteria when it comes to CEF market price performances, i.e. liquidity.

When liquidity is plentiful, CEFs and indeed, all smaller-sized securities (defined as less than $2 billion in market capitalization) can keep up with larger cap securities, all else being equal.

But when liquidity is being withdrawn, the first to suffer are less liquid securities, and the vast majority of CEFs are less than $2 billion in market cap.

That’s the simple answer to what has happened though certainly, the Federal Reserve’s interest rate increases which began in March of 2022, have had an impact as well, since once yields of other security classes breached 5% or so, all of a sudden, there’s a lot more competition for high-yield oriented securities than just CEFs.

But by the end of 2022, when the Federal Reserve had raised interest rates seven times from effectively zero to 4.5% by Dec. 14, the major market indexes had certainly suffered with SPY down -18.1% while the QQQ’s were down a stunning -32.5%.

But comparatively speaking, equity CEFs were performing great!

Here’s what that looked like for equity CEFs on Dec. 30, 2022, when I couldn’t even fit the number of funds that were holding up better at market price total return performance than the S&P 500:

Capital Income Management, LLC

And here is how many funds were at premium market price valuations on Dec. 30, 2022:

Capital Income Management, LLC

So instead of nine we see today, if you go back one year, there were 27 funds at premium valuations (about one-fourth of the funds I follow) while over half the funds (56 total) were beating the S&P 500 at market price total return performance.

So clearly, either liquidity wasn’t as much of a factor in 2022 or shareholders were more likely to hold onto their equity CEFs despite the bear market.

The question now becomes, if the Federal Reserve continues with its balance sheet normalization (Quantitative Tightening) allowing up to $95 billion in government securities to mature and fall off their balance sheet each month even while the Fed considers rate cuts next year, how will that impact CEFs?

Well, if liquidity is the lifeblood of CEFs, then maybe the fact that liquidity will continue to be withdrawn for the foreseeable future, may just mean that we won’t see much valuation improvement in CEFs after all.

Note: The Federal Reserve can adjust the amount that is tapered each month as well as having liquidity injection programs running at the same time.

In fact, what if this liquidity depletion is the reason why the markets have been so narrow in terms of performance as investors big and small continue to plow assets into the mega-cap technology stocks and the major market indices?

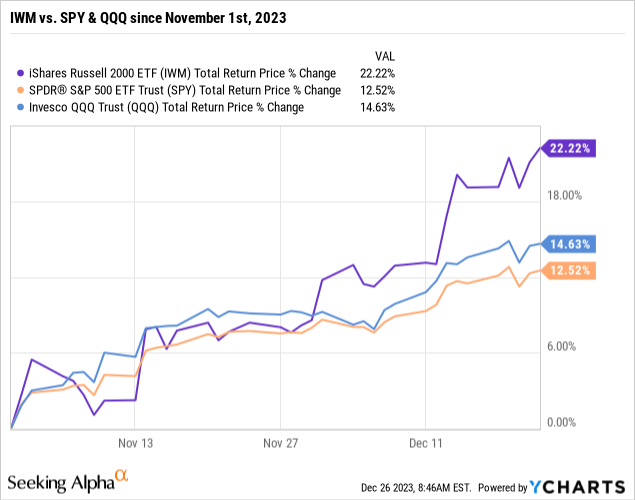

Certainly, we’ve seen the laggards finally start to catch up here at the end of the year as the Russell 2000 Small Cap ETF (IWM), $201.48 closing market price, has been far outperforming SPY and QQQ since November:

Y-Charts

But is this something that we can expect to continue heading into 2024? Well, let’s talk about that.

My Outlook For 2024

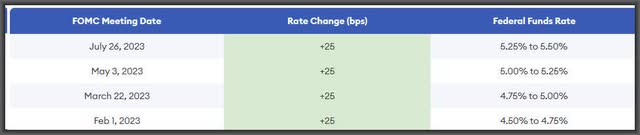

According to most prognosticators, 2023 was supposed to be a continuation of the bear market for the first half of the year while the Fed was still raising interest rates, though by the second half of the year, the Fed was supposed to be done and we’d see a recovery in the back half of the year.

Surprisingly, most prognosticators were right about the interest rate hikes in the first half of the year as the Fed hiked 25 bps in February, March, May and July:

Federal Reserve

But the equity markets didn’t really cooperate as cleanly as that. We first saw a strong beginning for the markets in 2023, a fall back in March during the regional bank crisis, another rally into June and July before succumbing once again in September and October. And then, of course, we’ve been straight up since November as the Fed signaled no more rate hikes while inflation kept coming down.

So with most prognosticators expecting the bull market to continue its run into 2024 with up to three rate cuts expected by the Fed sometime this year, what do you think will happen?

Well, if you’re a contrarian like me, then if everyone is bullish and fully invested, then just the opposite will happen and the markets will disappoint. I’m not saying we go into a bear market but I’m expecting a more up and down market in which no clear trend is established.

But again, we can’t expect it to be that clean and we’re going to have to take it week by week and month by month. But if there’s one thing I believe will continue into 2024, market liquidity will become an even more important factor, and not just in CEFs.

I’ll be back soon with a Top Picks For 2024 – Part II.

Read the full article here