Thesis

The stock price of Ero Copper Corp. (NYSE:ERO) has risen 130% since I rated it a buy almost eleven months ago. Last September, Ero was trading at a mere 5.3x earnings, twice below the sector median, despite plans to more than double copper output by 2025, while bringing cash costs down by about 20%. However, after perhaps the hottest streak among pure-play copper miners, the stock is now trading at 25x earnings, 64% higher than the sector median. And, based on a discounted cash flow analysis, the stock looks overvalued. Although now is not ideal for new investors, I think it wise to hold onto the stock until more details emerge on the company’s exploration of a new nickel system.

Explosive Growth On The Way

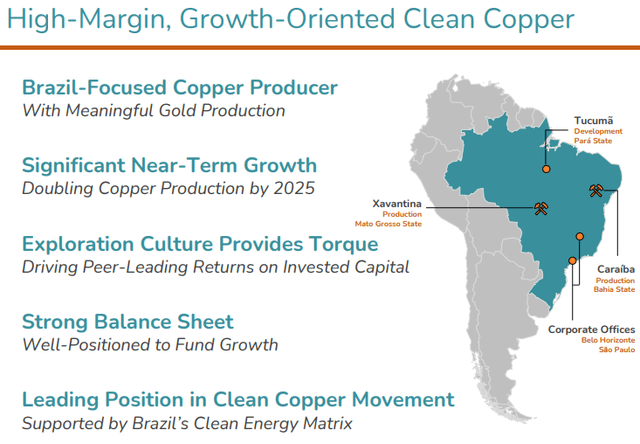

Ero Copper, headquartered in Vancouver, Canada with mining operations in Brazil, arrived on the proverbial scene with impeccable timing in 2016 amid ever increasing concerns over future copper shortages.

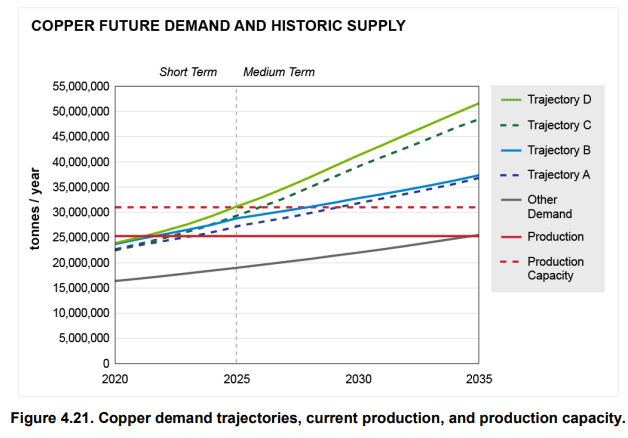

The U.S. Energy Department in an assessment released last week moved copper into the “near critical” category for the medium term (2025-2035), a rating driven by supply risks and importance to electrification. Moreover, the assessment also indicated that the supply gap could actually reach as much as 20mln tons by 2035. This is based on demand reaching over 50mln tons per year in a net zero emissions by 2050 scenario (Trajectory D), while assuming production capacity remains flat at just over 30mln tons.

Copper Demand Projections (U.S. Department of Energy, Critical Minerals Assessment, July 2023)

Ero’s flagship Caraiba operation currently produces around 50kt of copper annually, and the Xavantina operations 50koz of gold. And now, the company is looking to ramp up its Tucuma project, which is expected to add another 24kt of copper in 2024 and 57kt the following year. This would bring Ero’s total copper output in 2025 to more than 100kt.

Ero Overview (June Investor Presentation)

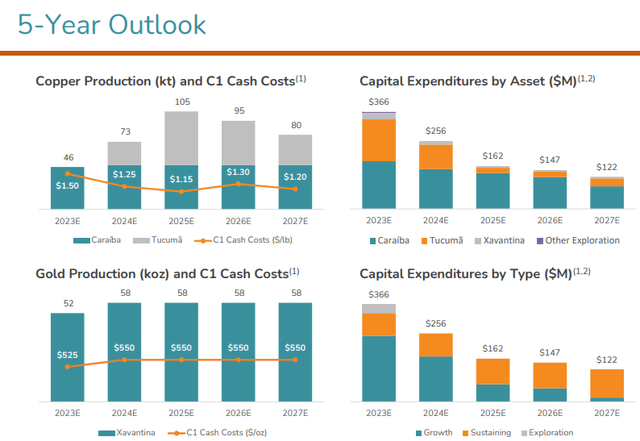

As copper production rises over 100kt by 2025, cash costs are expected to come down about 23% – from $1.50 to $1.15. But it is worth noting that the company is making significant investments along the way, with capex expected to reach $360mln to $409mln in 2023, roughly 90% of revenue.

Ero Outlook (June Investor Presentation)

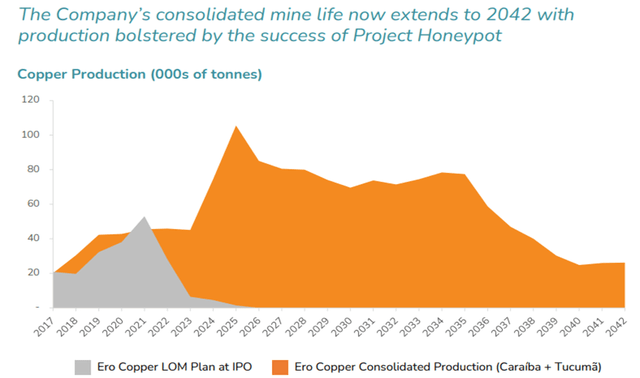

But also take note that 2025, when it surpasses the 100kt mark, represents the high-point of the copper mine plan, which extends through 2042.

Ero Copper Consolidated Life of Mine Plan (June Investor Presentation)

By 2027 total annual copper production is projected to fall to 80kt/year. Output will average about 75kt/year from 2028-2032. Meanwhile, the Xavantina gold operation is expected to wind down in 2028.

It is also worth mentioning that Ero is currently exploring a newly-discovered sulphide nickel system, more details of which the company said will be provided in November.

Q2 Earnings

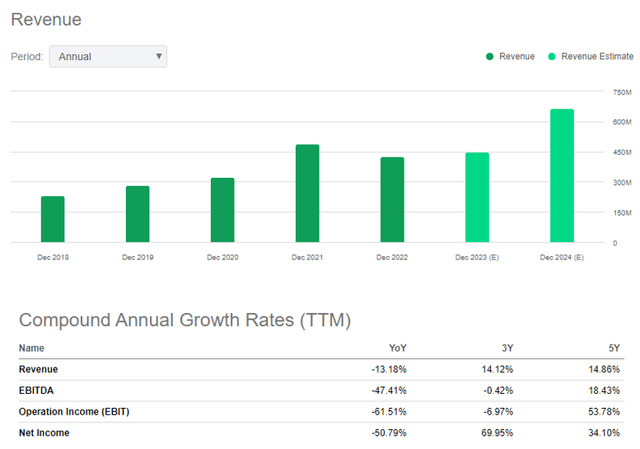

From 2017-2022, Ero’s revenue grew at a CAGR of 15% to $426mln, while, during the same period, EBITDA rose 18% and EBIT 50%. Analysts expect revenue to rise 5% to $447.2mln this year and another 48% in 2024 to $665.7mln.

Ero Sales & Profit Historical Growth (Seeking Alpha)

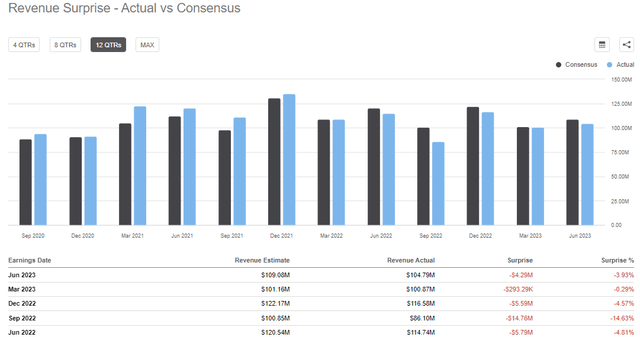

For Q2, analysts forecasted Ero to hit revenue of $109mln, but the company fell about 4% percent short, while EPS of $0.32 was in line with expectations. The $104.79mln in sales it recorded was down 8.7% YOY.

Ero Revenue Surprises (Seeking Alpha)

The company said meaningful quarter-on-quarter increase in copper production offset “lower realized copper prices” and a stronger Brazilian Real.

Key Financial Results:

- Revenue: $104.79mln (-8.68% YOY)

- EBIT: $20mln (-49.51% YOY)

- Capex: $127mln (+54% YOY)

- Levered FCF: -$76mln

- EBIT Margin: 19%

- Capex/Sales: 121%

Key Operational Results:

- Copper Production: 12kt

- Gold Production: 12.3koz

- Copper Cash Cost: $1.52/lb

- Gold AISC: $1,081/oz

Ero reaffirmed 2023 annual production guidance, with a mid-point of 46.5kt for copper and 51.5koz for gold. However, it raised the capex spending by $15 to $20 million to “reflect proactive investments at the Caraiba Operations.” Capex for FY 2023 should exceed $385mln.

One concerning issue was that Ero’s realized copper price in Q2 was $3.30/lb, which was about 16%-18% below the market price. The London Metal Exchange (LME) price for Q223 averaged around $3.85. Ero, during the Q2 earnings call, confirmed that going forward the company’s realized price will be 5-10% below the LME average.

Meanwhile, most of Ero peers were able to achieve realized prices closer to the market, based on their quarterly filings.

Ero vs. Peers Realized Copper Prices/Lb (Q223):

- Southern Copper – $3.85

- Freeport-McMoRan – $3.84

- Taseko Mines – $3.84

- First Quantum Minerals – $3.84

- Capstone Copper – $3.71

- Antofagasta – $3.49

- Ero Copper – $3.30

Valuation

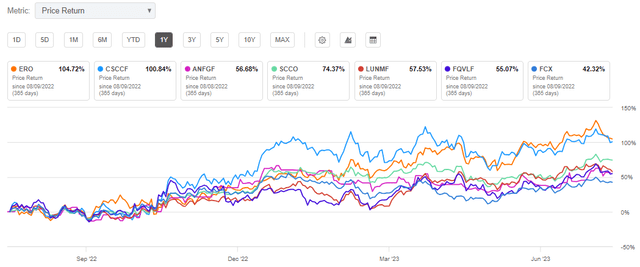

Ero’s 1-year stock price performance has pummeled the market, the sector, and the pure-play copper miner field – and the field, by the way, has collectively done pretty well. Consider that the top 9 copper stocks, including Ero, rose by almost 60% on average in the past twelve months.

Ero Stock Price vs. Peers (Seeking Alpha)

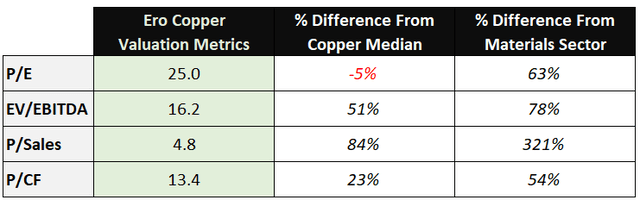

The median P/E of these eight rival stocks is 26.2, so Ero at 25 does not appear too overvalued. However, based on EV/EBITDA and price to sales and cash flow, Ero looks expensive relative to the other pure-play copper stocks and the materials sector, as illustrated below.

Ero Valuation vs. Peers (Data: Seeking Alpha)

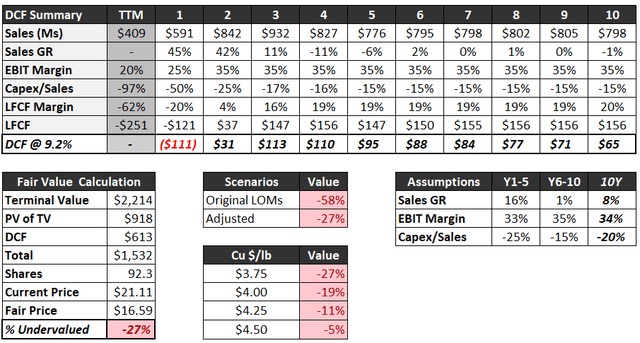

I found the stock overvalued intrinsically as well, based on a discounted cash flow (DCF) analysis. The first phase of the model was straightforward given the five year outlook provided by Ero. The challenge was years 6-10, which I initially based on the life of mine plans found in each operation’s most recent technical reports. The net result was a -4% decline in revenue on average for the back half of the DCF model. Instead, I assumed the company would develop and explore enough to at least keep volumes roughly flat.

For the EBIT assumption I looked at these data points and concluded based on expected growth that we could start at 25% and push the margin up to 35% based on the low expected cash costs.

Key EBIT Data Points

- 5Y average (2017-2022) = 37%

- TTM = 20%

- Metals & Mining Average = 23%

- Top 5 copper peers’ 3Y averages = 30%

- Highest (Southern Copper) = 42%

The below tables provide the summary and averages inputs like Sales growth, EBIT margin, and capex/sales. In the end I found the stock overvalued by 27% based on my adjusted scenario. Based on the original life of man (LOM) plans, the stock looked 58% overvalued. I also provided a copper price sensitivity table. The base assumption was $3.75/lb but even if you pushed it up to $4.50/lb, the stock still appeared about 5% overvalued.

Ero DCF Analysis (Seeking Alpha)

Risks

I see a few key risks that should be considered if one decides to hold onto the stock related to realized prices, taxes, and other assumptions.

Realized Copper Prices – The company risks not achieving minimum projections if the market price continues to hover around $3.80/lb and the company is able to realize market prices.

Effective Tax Rate – Ero has been able to achieve an effective tax rate of 20%, which is amazing considering all their revenue derives from Brazil, where the corporate tax rate is north of 30%. In the model I pushed the tax rate up to 28% as a hedge, but the tax rate is something to keep an eye on. In company filings, you may even notice Ero indicating that the tax system is byzantine and not easy to understand.

Growth Narrative – As much as I personally buy into the fact that copper demand is set to soar, there are some significant risks that threaten this bullish narrative. New EVs are being engineered to be more efficient in a way that cuts the amount of copper content, Reuters reported citing industry analysts, with one calling it “the first crack” in the copper demand story.

Conclusion

I gave Ero a buy rating nearly a year ago and the stock has risen over 100% since – it is definitely the hottest pure play copper stock out there. However, now it looks like it ran too hot, too fast – and potentially more than 25% overvalued based on a DCF analysis. It is a stock that is too expensive to buy, yet hard to sell with the potential upside in the nickel exploration – not to mention the company’s knack for boosting reserves continually – and a compelling growth narrative in both sales and profitability.

Read the full article here